According to official data, even before the onset of the coronavirus crisis, shadow employment in Russia accounted for over 20% of the working population, and according to Finance Minister Siluanov, the volume of the gray wage fund is at least 10 trillion rubles annually.

However, it should be noted here that labor activity without registration not only entails huge losses for the state, but also various negative consequences for both the employee and the unscrupulous employer, since it is illegal.

Why are employers in no hurry to register their employees?

The motives of an unscrupulous employer are absolutely banal:

1. Significant savings on “salary” taxes (no salary, no need to pay insurance premiums);

2. You can calmly deprive an employee of vacation or let him go for a few days at his own expense;

3. It is not necessary to pay sick leave;

4. If the employee is no longer needed, it is easy to get rid of him and, again, no severance pay, that is, the employer will not have to pay anything.

At the same time, during communication with a potential employee, an unscrupulous employer uses various manipulations. For example, an employer can argue its position by saying that the employee will not have to lose 13% of personal income tax from his salary every month. This is pure manipulation, for one simple reason: an officially employed employee has the right to paid leave and sick leave, which, based on the total amounts for the year, is almost equivalent to paying personal income tax.

In other words, if we consider the long-term period, the employee practically does not lose money on personal income tax.

How to prove that the contract must be an employment contract

In order for inspectors to recognize that the employer is violating labor laws and with workers, for example, under a contract, employment contracts must be concluded, it is necessary that the work they perform has the necessary characteristics.

Signs of an employment contract

Signs that make it possible to classify the work performed as an employment relationship include:

- Availability of a position or a specific job function.

- Remuneration is calculated not for the results of the work, but for its process.

- For the employee, a salary and other components of wages (and not the cost of work performed) are established: bonuses, additional payments, etc.

- Specific working conditions are established for employees and various benefits and compensation are guaranteed.

- The employee is subject to internal labor regulations, that is, the employer insists that the work must be performed on its territory, in a certain place.

If an inspector sees several signs from the above list in the relationship between a citizen and a company, they will be recognized as labor signs and the employer will be obliged to document them accordingly.

In this case, all doubts will be interpreted in favor of the employee.

Negative consequences of informal employment for a worker

Unfortunately, there are many such consequences. By renouncing his right to official employment, the employee, first of all, becomes completely dependent on the employer, namely:

● Loss of a job without explanation (in this case, the employer’s decision may be completely unexpected for the employee, for example, today he works, but tomorrow he no longer needs to come);

● Refusal to pay (very often unscrupulous employers use unregistered workers for a week or a month, and then fire them without paying a penny);

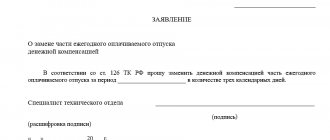

● There is no opportunity to go on vacation, since there are no guarantees that it will be possible to keep the job, and the employer will not pay vacation pay;

● You can easily lose your job due to illness; not every employer will want to wait for the employee to return; as you understand, you shouldn’t count on paid sick leave in this situation either.

In the current situation with the Covid-19 pandemic, many people have fully felt the consequences of being exposed to the arbitrariness of employers.

Thus, if in relation to officially employed citizens the state, at the very least, controlled the observance of their rights, then unregistered workers were literally left without a means of subsistence and out of sight of the state.

In addition to being dependent on an employer, there are other negative consequences. Work without registration does not form a length of service, and an unscrupulous employer does not make contributions to the pension fund and health insurance fund.

It means that:

● The employee may in the future lose his pension or a significant part of it;

● The employee will have to be content with the amount of social health insurance;

● If you lose your job when applying to the employment exchange, you can only count on a minimum unemployment benefit of 1,500 rubles, as a person who has never worked.

Civil contract

It happens that you need to hire employees for one-time work. For example, your office needs some cosmetic renovation. It is necessary to re-stick the wallpaper, paint the walls, replace the plumbing and tiles in the restroom. Don’t hire plumbers, plasterers and painters for this! This is where a civil contract comes to the rescue. Such an agreement is drawn up for one-time work. A classic example of a civil law contract is a work contract. You act as a customer, and the performer acts as a contractor. The document specifies the type and volume of work, the timing of its completion and payment terms. After completing the order, the parties sign the acceptance certificate for the work performed and financial documents, after which they part with the world.

What threatens an employer who does not register an employee?

In fact, as practice shows, the benefits and savings of the employer in this situation are not justified by high legal and other risks. The shadow economy is becoming a thing of the past. In recent years, state control over business has increased significantly. The gray turnover of remuneration is becoming more and more transparent, and the employer’s responsibility is only growing.

At the same time, for example, inspections by labor inspectorates since 2018 can be carried out without prior notification of an upcoming inspection by the State Labor Inspectorate.

For violation of labor laws, there are currently many penalties, and in some cases, employers may be held criminally liable.

So, let's look at what exactly threatens the employer if regulatory authorities reveal facts of unofficial employment.

What to do if workers are needed from time to time?

Let's imagine the situation. You have a small online store and use a single tax on imputed income - UTII. The tax return in this mode is submitted once a quarter. But you don’t want to fill it out yourself and don’t know how – it’s better to hire a qualified accountant for these purposes.

As in the case of office renovation, it is not profitable to hire a specialist to fill out one single piece of paper every 3 months and take it to the tax office. Therefore, the best option in this situation is an outsourcing or agency labor agreement . It looks like this. A certain organization employs a full-time accountant. You agree with its manager that once a quarter he provides you with an accountant to prepare and submit reports. And you enter into an appropriate agreement. This will be the outsourcing agreement.

Personal income tax

Tax officials have promised to collect the full amount of unpaid personal income tax from “salaries in envelopes” from 2021, not from the employee’s salary, but at the expense of the employer.

Thus, offended workers, who were previously afraid to complain about an unscrupulous employer for fear that they would have to pay the entire personal income tax, will now be active, turning to the court, prosecutors and labor inspectors.

They may do this not only out of a desire for revenge, but also in the hope that they will be able to restore their seniority, replenish their pension points, and at the same time recover vacation and sick pay from the employer.

Administrative responsibility

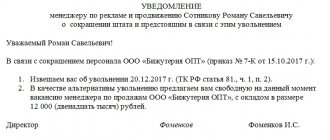

Parts 4 and 5 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation provide for a system of imposing penalties on employers for evading the execution of an employment contract.

So, if the offense was committed for the first time, then

● The guilty official will pay from ten to twenty thousand rubles;

● The individual entrepreneur will pay from five to ten thousand rubles;

● The legal entity will pay from fifty thousand to one hundred thousand rubles.

The amount within the specified penalties will be determined by the inspector, taking into account all the circumstances of the offense.

If the offense is repeated, the fines will increase:

● For individual entrepreneurs – from thirty to forty thousand rubles;

● For legal entities – from one hundred to two hundred thousand rubles. In addition, officials may be subject to disqualification for a period of one to three years.

What does it mean?

Informal employment is a type of relationship between an employee and an employer, which represents labor activity without a formal contract . There is no such concept in the Labor Code of the Russian Federation. According to the law, during hiring, the employer is required to draw up an employment contract describing all the conditions for future activities.

During unofficial reception, the worker does not sign any documents, is not included in the payroll of the enterprise, and no entry is made in the work book. That is, the period of such work is not counted towards the length of service.

Criminal liability

In cases where the volume of evasion from paying “salary taxes” (personal income tax and insurance contributions to extra-budgetary funds) over the past three years reaches a large or especially large amount, the employer may be brought to criminal liability simultaneously under several articles of the Criminal Code:

● 199 CC – evasion of taxes and insurance premiums;

● 199.1 of the Criminal Code – failure to fulfill the duties of a tax agent (we are talking about non-payment of personal income tax from an employee’s salary);

● 199.2 of the Criminal Code – concealment of funds or property of an organization from which taxes and insurance contributions should be collected;

● 199.4 of the Criminal Code – evasion of the employer from paying “accident contributions” (we are talking about insurance of accidents, industrial injuries and the prevention of occupational diseases).

● 159 of the Criminal Code - Fraud, which, as a rule, always goes in conjunction with the “tax articles” of the code itself.

Please note that large and especially large amounts, depending on the specific criminal offense, may be different amounts, directly indicated in the notes to the relevant articles of the Criminal Code.

Other employer risks

One should not discount the fact that an employee without registration can also greatly “annoy” an unscrupulous employer. Since he is not officially employed, he may also not show up for work any day, sell the company’s trade secrets, leak the customer base, etc. and so on.

At the same time, it will no longer be possible to hold such an employee accountable. Thus, it is obvious that the legal consequences of refusing official employment can be very painful for both the employer and the employee. Every decision of the employer and employee related to employment must be balanced and take into account all the advantages and disadvantages.

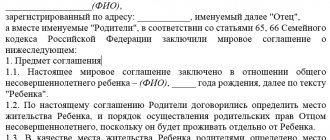

The employee asked not to draw up an employment contract

The employer does not have the right not to draw up an employment contract, even when the employee himself requests it. From this point of view, it is interesting to note the Appeal Ruling of the Supreme Court of the Republic of Bashkortostan dated 08/20/2019 in case No. 33-16172/2019.

The employee, wishing to avoid payments under the writ of execution, upon hiring, asked not to draw up an employment contract with him. The employer agreed and thereby “exposed” himself.

In what cases can an employment contract be changed at the initiative of the employer?

After his dismissal, the employee filed a lawsuit against his employer demanding additional payment of his salary and compensation for moral damages.

As a result of the consideration of the case in court, the organization was obliged to pay compensation for moral damage and issue the employee an employment contract, copies of orders for hiring and dismissal.

And that is not all. It is clear from the case that the employee asked not to draw up an employment contract in order to avoid payments under the writ of execution, namely the payment of alimony. After the employer complies with the court decision and issues the employee a work permit, a bailiff may appear in the organization.