Is study included in the total length of service? According to current legislation, no. If the training took place before 2002, yes, because this was established by the law in force before 2002.

The insurance period (production) is the time when pension contributions were made for a citizen. Its main significance is that it influences the formation of pension contributions (currently the minimum for assigning a pension is 15 years).

Pension legislation is constantly changing, but a new law cannot worsen a citizen’s situation. According to the previous law, the time of study was taken into account when assigning pension benefits, but according to the current law, it is not. Therefore, whether studying at an institute is included in the length of service depends on the period during which it occurred.

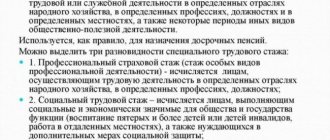

Is study included in the total work experience?

Until 1992, pensions were assigned on the basis of Resolution of the Council of Ministers of the USSR No. 590 of 08/03/1972, from 1992 to 2002 - according to the law on pensions No. 340-I of November 20, 1990. In accordance with these legislative acts, years of study are included in the total work experience if a citizen received education in higher and secondary specialized educational institutions.

Since 2002, Federal Law No. 173 of December 17, 2001 on pensions has been enacted in Russia. In accordance with Art. 10-11 of this law, the period of study is not taken into account when assigning a pension. The very concept of “work experience” has been replaced by “insurance”.

In 2015, the legislation changed again. Federal Law No. 400 came into force, adopted on December 28, 2013 and still in force to this day. He increased the number of periods counted in labor output, but the period of education was not included in it.

In accordance with Art. 11 of the new 400-FZ, insurance coverage includes the following periods:

- military service;

- receiving unemployment or disability benefits;

- caring for a young child under one and a half years old;

- caring for a disabled person, an elderly citizen over 80 years old, a disabled child;

- unjustified detention;

- living together with a military spouse (or military spouse) in an area where there was no opportunity to carry out work activities;

- living with a spouse abroad.

According to the law, it turns out, and this is indicated in paragraph 8 of Art. 13 400-FZ, that study is included in the length of service for a pension if it was carried out before 2002. This term refers to the acquisition of knowledge in secondary and higher educational institutions.

When can I consider studying at the institute in 2021?

Thus, until 2002, when different legislation was in force, the calculation of pensions was carried out according to completely different principles and, in particular, depended to a large extent on the total length of service. Over time, to adjust pension rights earned before 2002, a formula was developed for calculating the accumulated pension capital, depending on the estimated pension size. And the calculation of the pension includes a coefficient that takes into account length of service. However, when determining the estimated amount of a pension, two formulas are used, and the set of periods that form the length of service for calculation is taken differently for them. And only one of the calculations takes into account periods of professional preparation for further work (training in the educational institutions listed above).

How to calculate the insurance period for a pension? How to calculate length of service for early retirement? Sign up for a free trial access to ConsultantPlus and get an expert answer to these questions. In the expert consultation, you will also find a list of documents that can be used to confirm your experience.

The right to choose the method of calculation, and therefore whether to take into account (or not take into account) the length of service of the period of study, is left to the future pensioner. But in reality, such a choice is made by the Pension Fund of the Russian Federation, which is legally enshrined in the obligation to select the most beneficial option for calculating the pension for the pensioner (paragraphs 48–58 of the Resolution of the Government of the Russian Federation of October 2, 2014 No. 1015). At the same time, the option of taking into account length of service with the inclusion of periods of training, as a rule, turns out to be less profitable for calculating pensions.

On March 18, 2021, the Pension Fund of the Russian Federation dated March 4, 2021 No. 322 came into force. This legal act introduced changes to the procedure for assigning early pension provision (PFR dated July 16, 2014 No. 665). Now, when calculating periods for establishing an early preferential pension, the time of vocational training, as well as receiving additional vocational education, is taken into account.

This article will help you try to calculate your pension yourself, as well as the pension calculator on the Gosuslugi portal.

When will training time be counted?

University, technical school, and graduate school are taken into account when assigning a pension; college is included in the length of service for a pension, but not school years; studying at a comprehensive school has never been included in the calculation. And they count only when completing training before 2002.

The exception is cases when the student carried out labor activities in his free time from classes.

According to Soviet legislation, vocational education was equal to these types of education, so the answer to the question of whether courses are included in the pension experience is positive if they were completed before 2002 and related to vocational training (advanced training, etc.).

Experience for retirement

Since 2002, the entire period of work of a Russian citizen is officially considered guaranteed length of service. Upon its expiration, the amount of insurance premiums timely transferred to the account of a citizen of the Russian Federation in the Pension Fund is taken into account. Attention is drawn to certain periods when the taxpayer was involved in labor activity.

It is permissible to include in length of service all the time when a person, although considered unemployed, contributed money to non-budget funds.

What is included

Absolutely all years of legal employment are included if contributions were made to the Pension Fund during it. The list of other periods includes:

- caring for a minor child;

- providing care for a citizen with a diagnosed disability or a child with a disability;

- caring for a ward who is over 80 years old;

- Military service;

- receiving benefits due to disability or unemployment;

- living with a military partner in a location where he was required to perform work duties.

Such periods are called non-insurance periods.

You must have at least 9 years of compulsory insurance coverage to be eligible for state old-age pension benefits. In order for the accrual of pension payments due to disability or loss of a breadwinner to begin, you need at least one day at official work.

Does schooling count?

Study cannot be included in the nine-year work experience assigned to citizens in old age. An exception will be if the student was studying before the law of 2002 came into effect, which allows the time of study to be included in the length of service.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Usually, a request is made to include study time in the work experience when there are not enough working years to form the minimum work experience. If it is, then even after including the period of study, the pension will not increase.

When does training time count?

Before January 1, 2002, work experience unconditionally counted study time if the student studied in secondary specialized and vocational educational institutions. If during the specified period the citizen studied at a higher educational institution, study time can be accrued on the condition that he had a job before January 1, 1992. Moreover, labor activity had to be carried out under an employment contract. Service in the army or other branches of the armed forces can also be counted as work.

As of January 1, 1992, the employment requirement was abolished, so it does not apply after that date.

The training took place at a departmental university

In accordance with Law No. 4468-1 of February 12, 1993 and Government Decree No. 941 of September 22, 1993, training is included in the length of service for receiving a pension in the internal affairs bodies within 5 years. This rule applies to employees who entered the service before 01/01/2012, subject to graduation from an educational institution (Part 2, Article 17, Article 22 of the Federal Law of November 30, 2011 No. 342-FZ “On service in the internal affairs bodies of the Russian Federation and making amendments to certain legislative acts of the Russian Federation", clause 2 of article 35 of the Federal Law of March 28, 1998 No. 53-FZ "On military duty and military service", order of the Minister of Defense of the Russian Federation of April 7, 2015 No. 185).

Based on 342-FZ dated November 30. 2011, 53-FZ dated 03/28/1998, order of the Ministry of Defense of the Russian Federation No. 185 dated 04/07/2015, enrollment in universities of the Ministry of Internal Affairs or the Ministry of Defense is actually entry into service with the signing of contracts.

Results

According to the current legislation on pensions, periods of study are not taken into account in the length of service for calculating a pension. But they can be taken into account in the length of service if the training was completed before 2002, according to one of the existing calculation options. Periods of vocational training and additional vocational education are now included in the length of service when establishing early retirement.

Sources:

- Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”

- Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”

- Decree of the Government of the Russian Federation dated October 2, 2014 N 1015

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The serviceman studied at a civilian university

The type of educational institution does not matter, but accounting is done according to the following principle: two months of study are equivalent to one month of service.

The answer to the question of what kind of study is included in the total work experience is as follows: until 2002, if the study took place at a university, academy, higher education institution, college, technical school, graduate school, doctoral program, or advanced training courses.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

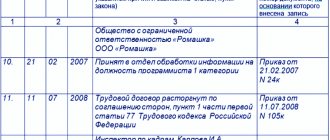

Study while working - but what about the experience?

It is not uncommon for working citizens to undergo on-the-job training. Naturally, studying employees have a question: how does the time spent on studying compare with their work experience, since they are not working during this time?

Art. 173 of the Labor Code of the Russian Federation guarantees employees sent for training by the employer or enrolled independently, additional study leaves, for which payment continues to be in the amount of average earnings. Since wages have been maintained, required Pension Fund contributions are also made on time. Thus, the educational leave on which the employee goes, like all types of paid leaves, will be counted towards the insurance period.

Study and special work experience

When a person works in difficult conditions and/or in harsh territories, such as the Far North, his work experience is calculated according to a special, preferential scheme - with a special coefficient. Therefore, the employee gets the opportunity to take a well-deserved rest before the usual deadline.

If, during study and work, an employee performed his job duties in dangerous and harmful conditions or in specified territories, the procedure for calculating special preferential length of service is applicable to him. These conditions can be confirmed by the presence of a corresponding entry in the work book.

Training in military schools and universities

Although cadets and cadets are recognized as military personnel, military training, according to the law on pensions, is not included in the insurance period. The pension reform has led to the fact that only those who can prove the receipt of contributions to the Pension Fund from their income for 5 years (in total) can count on a pension.

Duration of paid leave according to the Labor Code of the Russian Federation - find out more! Got sick on vacation? Do you want to apply for sick leave? Read here how to do it correctly.

You can find out the competent advice and information you need on calculating maternity benefits in our article.

Rules for calculating teaching experience

In addition to the list of organizations and positions in which work is a necessary condition for preferential retirement for teachers, Resolution No. 781 also contains a set of rules for calculating preferential length of service for teachers. According to these rules, various positions may have restrictions or advantages when calculating teaching experience.

Let's look at the main ones of these rules.

- Since September 1, 2000, only full-time work is counted toward teaching experience. In this case, it is possible to combine several positions in one period of time, and if the work on them totals a full-time salary, this period is counted as special length of service. The work of a teacher before September 1, 2000 is counted regardless of the development of the norm.

- For employees of a number of institutions (social services, for children in need of special assistance), as well as for music directors, it is mandatory to develop standard working hours, regardless of the period of work.

- The work of primary school teachers and teachers of rural schools is counted towards teaching experience regardless of the fulfillment of working hours.

- Work in the position of director of an educational institution since September 1, 2000 is counted only if teaching activities are carried out for at least 240 hours per year for general education institutions and 360 hours per year for secondary special education. Until 2000, such work was included in the teaching experience regardless of teaching.

- Work in listed positions in institutions of secondary specialized and primary vocational education, evening schools is counted towards teaching experience, provided that at least 50% of children under 18 years of age were studying at the institution during the specified period.

Accounting for training for some professions

Sometimes employees can count the time they received specialized education into the length of service that counts towards their pension.

In general, studies are not taken into account when calculating pension payments. However, doctors, for example, need to obtain residency and internship training. Interns study without interrupting their main activities - they work in a medical institution to which they are assigned for a certain period of time.

During the internship:

- the intern is on the staff of the clinic;

- the intern receives a salary;

- An employment contract has been concluded with the intern.

If a person is studying in an internship, during this time the insurance period is accrued to him

Consequently, completing an internship can be considered a work activity - a person receives work experience that is taken into account when calculating a pension.

Important ! For some groups of doctors, internships are added to the preferential length of service, which allows them to retire earlier than expected.

Training and title of labor veteran

Article 7 of the law on veterans specifies the grounds for conferring the title of labor veteran. Thus, a citizen is recognized as a labor veteran if:

- have a “Veteran of Labor” certificate or awards in the labor field (including Soviet-style ones);

- the man has 40 years of insurance experience, and the woman 35.

Again, periods of training are not included in the length of service. However, there is a caveat: the procedure for assigning such a title can be changed by the laws of regional authorities (regional, regional, city halls of Moscow and St. Petersburg).

According to the norms of regional laws, periods of training may well be counted towards length of service.

Does the experience include distance learning?

Often, part-time work is the choice of citizens who work full time. Consequently, throughout this entire time period, management must transfer money for the employee to the Pension Fund.

Naturally, receiving education via correspondence is associated with study and examination sessions.

The management of the enterprise must provide the employee with study leave so that he can take tests and exams in an educational institution for a period of 40 (50) days annually, in an average special institution 30 (40), in graduate school - 30 days, based on what course of study the person is taking .

If a person studies part-time and works at the same time, he has the right to study leave to take the exam

When the deadlines for passing tests and exams last longer than the above-mentioned framework, the employee has the right to take advantage of a share of the next vacation or request several days off without saving earnings.

Important ! Note that the employee retains his average salary, while taxes and various contributions are paid.

In order for a person to be granted study leave, he must ask the educational institution for a certificate calling him to the next session.

However, life is not so smooth. Typically, employees take advantage of their work leave to attend a session, and when they do not have time to meet this deadline, they ask for days off without pay. This does not violate the laws, but if a person is studying at his own expense, then this does not have any weight for the insurance period.

If a person goes on vacation “at his own expense”, during this time contributions to the Pension Fund are paid for him

It is important to remember that management is obliged to provide the employee with leave for the time required to pass final exams or final papers. The average salary in this case remains.

A person also has the right to request paid leave to write and submit a candidate’s or doctoral research paper. The duration of such leave is 3 months or six months, the salary remains with the employee.

Important ! If there are reasons for granting a pension on a preferential basis, academic years are relevant for length of service while simultaneously working at the same time.

For example, this applies to people working in difficult or dangerous conditions. They can take a well-deserved vacation early if they have worked for a certain amount of time in such an environment. So if the employer pays for study holidays, they do not have any significance for the preferential pension.

In some cases, citizens have the right to retire early

How is the length of service of military personnel and those who are considered military personnel calculated?

Security forces with special ranks have the right to include training time in the length of service taken into account when calculating pension benefits for length of service. The type of university in which the future retiree was trained is of decisive importance.

If a cadet is enrolled in an educational institution of any level subordinate to the Ministry of Defense, then special service (military service or equivalent) is accrued from the moment he begins his studies. This is due to the fact that the cadets of these schools and universities have a status equal to that of regular security forces.

They receive an assigned financial allowance and after graduation must acquire professional experience in their specialty for at least 5 years.

If the training of the future security officer took place in educational institutions at the general civilian level, and upon completion the graduate entered service in the armed forces, departmental units, internal affairs bodies or other security forces, then the period of training will be taken into account in the length of service according to a reduction factor.

After completion of training, the graduate must be awarded a rank in the reserve category. If there was a military department in a civilian educational institution, and after graduation a rank was awarded, then the security officer has the right to include this period of training at a reduction factor of 1:2.

That is, after graduating from a medical school, where training lasted 3 years, and having received a specialty and rank, the future security officer will have 1.5 years of military experience included.

In the same way, length of service is taken into account when transferring in the middle of training from a civilian university to one subordinate to the Ministry of Defense in the same specialty.

In the same way, studying at a civilian university will be taken into account for half the period.