Many issues have already been considered regarding the calculation of temporary disability certificates, pregnancy and childbirth, but over time they are not decreasing. Today we will talk about the recalculation of sick leave, namely: is it necessary to make an adjustment to the reporting if the temporary disability benefit or maternity benefit was recalculated in another reporting period?

So, the employee brought in sick leave, you processed it, sent the register to the Social Insurance Fund, submitted reports to the regulatory authorities, but after a while you discovered an error in calculating the amount of sick leave. What to do?

There are two situations with incorrect calculation of benefits for temporary disability, maternity and child care:

- there was an overstatement of the amount of benefits (overpayment) to the employee;

- there was an underestimation of the amount of benefits (underpayment) to the employee.

Let's talk about each of these cases.

Application for recalculation of sick leave after payment (sample)

According to clause 2.1 of Art.

15 of the Law “On Mandatory Social Insurance...” dated December 29, 2006 No. 255-FZ, the employer calculates the amount of sick leave benefits based on the documents that he has at his disposal on the day of calculation. But later, the employee can bring certificates of earnings from previous places of work, and on their basis the benefits are recalculated. You can recalculate only those sick leaves for which benefits were assigned no earlier than 3 years before the moment when the employee brought the certificate. IMPORTANT! Since 2021, the FSS pilot project has been operating throughout the Russian Federation. This means that the employer calculates benefits only for the first 3 days of illness of the employee. The remaining days are paid by the Social Insurance Fund directly to the employee’s card.

Read about the nuances of calculating sick leave in this material.

To recalculate benefits from an employee, you must receive an application in a form approved by the Social Insurance Fund. You can see a sample in ConsultantPlus by signing up for trial demo access to the system. It's free:

No later than five calendar days from the date of receipt of the application and certificate (certificates) about the amount of earnings, send them to the territorial body of the Federal Social Insurance Fund of the Russian Federation (clause 3 of the Regulations on the payment of benefits for VNiM in 2021). In addition, recalculate the benefit paid from the organization’s funds (for the first three days of illness).

ConsultantPlus experts explained how to correctly recalculate benefits if the employee brought a certificate from a previous employer. Get free trial access to the K+ system and proceed to the calculation example.

Basic Concepts

A sick leave certificate is a document issued by licensed medical institutions, which indicates the period of temporary incapacity for work of a person. The form has a unified form approved by the Ministry of Health and Social Development. In 2021, an electronic form of the document will also be acceptable. The grounds for issuing a sheet include:

- injury or illness of the employee himself;

- restorative procedures, aftercare;

- illness of one of the family members who requires care;

- pregnancy and childbirth.

Filling out the form is the responsibility of employees of medical institutions, and control over the correct formation of the document is exercised by the employer. His interest is based on the fact that management pays compensation from its own funds and then requests them from the Social Insurance Fund. Errors and inaccuracies in the form will lead to refusal from the fund.

The amount of payment is determined by several parameters:

- average salary;

- insurance experience;

- number of days of incapacity.

It is important to know! The employer calculates the payment based on the provided certificate, which indicates the third point and his information about salary and length of service. If an employee brings data from previous or other places of work about his earnings, then the accounting department must recalculate the amount.

Reimbursement of sick leave supplement from the Social Insurance Fund in connection with recalculation

Reimbursement of expenses for additional payment of benefits occurs in the same way as reimbursement of any other social security - by submitting the appropriate set of documents to social insurance, incl. application and certificate-calculation with a sick leave certificate attached, to which the employer first makes corrections, specifying the amount of average earnings and the amount of benefits.

You can find a sample statement of calculation for sick leave here.

In the information “Compulsory social insurance in case of temporary disability and in connection with maternity (question and answer),” social insurance explains that if an individual cannot obtain a certificate from a previous employer, then the current employer, at the request of the employee, can send a request to the Pension Fund of the Russian Federation to obtain information about past income. Based on information from the Pension Fund, you can calculate the benefit, and such benefit will be recalculated by the FSS.

Errors in sick leave and FSS claims

Sergey Slesarev,

private practicing lawyer, expert

Every year, courts consider thousands of disputes related to errors in sick leave certificates: errors in sick leave can cause claims from inspectors and the employer will be required to reimburse expenses incurred to pay for sick leave or be denied credit for insurance premiums. The tension is heightened by the fact that even the slightest blot, say, a missed birthday when filing sick leave, can lead to such consequences. In such cases, does the organization have any hope of defending “justice” in the courts? What do the courts think about errors in sick leave certificates and under what conditions should an organization not be afraid of claims from inspectors?

Certificate of incapacity for work as confirmation of an insured event

Often, a sick leave is perceived simply as a kind of analogue of a sickness certificate to recognize a valid reason for absence from work.

And this is indeed true to a certain extent, primarily from the point of view of labor relations: for the employer, the only important thing is for what reason the employee was absent, and that he really had an objective reason to “miss” the performance of work duties.

But from the point of view of the compulsory social insurance system, the certificate of incapacity for work is a much more important document.

When we go on sick leave or maternity leave, the “gears” of the compulsory social insurance system are activated.

What sometimes seems to us to be just an ordinary social benefit is actually insurance coverage (insurance payment) in connection with the occurrence of an insured event under an insurance contract.

Moreover, the basis for the payment of such benefits is not the illness, injury or birth of a child per se, but a change in our situation as a result of the event.

This, in particular, is directly stated in Art. 1 of the Federal Law of July 16, 1999 No. 165-FZ “On the Basics of Compulsory Social Insurance” (hereinafter referred to as the Law on OSS): compulsory social insurance is part of the state system of social protection of the population, the specificity of which is the insurance of working citizens from possible change in financial and (or) social situation, including due to circumstances beyond their control.

Among the insurance risks are listed (Article 7 of the Law on OSS):

1) the need to receive medical care;

2) loss of earnings (payments, rewards in favor of the insured person) or other income by the insured person in connection with the occurrence of an insured event;

3) additional expenses of the insured person or his family members in connection with the occurrence of an insured event.

As we can see, the task of the OSS system is to support, first of all, the financial situation of a citizen, to help him in case of loss of earnings or the need for additional injuries.

Reaching retirement age, the birth of a child, illness, injury, etc. are only insured events that trigger the insurance risk and insurance protection.

They “signal” about the occurrence of an insurance risk (clause 1.1 of Article 7 of the Law on OSS, Article 9 of the Law of the Russian Federation of November 27, 1992 No. 4015-1 “On the organization of insurance business in the Russian Federation”).

Of course, after reading this, you can say: why this lecture about the OSS system and what do errors in sick leave and claims from inspectors have to do with it?

The fact is that a certificate of incapacity for work is not just a “certificate of illness”, but a document confirming the occurrence of an insured event and the “triggering” of the insurance risk.

A kind of analogue of the “Start” button for the OSS system, and if this button is defective, then questions arise about the correct operation of it.

And in case of disputes, the courts will look at whether the “button” was actually “working” and worked correctly; and the organization to which the claim is made must prepare to provide evidence of the occurrence of conditions for the “triggering” of insurance protection.

Let us turn to judicial practice for illustration and at the same time compile a small list of FSS claims for sick leave and the courts’ reactions to them.

Claim 1. Lost certificate of incapacity for work

The loss of a certificate of incapacity for work can happen for various reasons: from theft of documents to the negligence of employees and accidental damage to certificates.

In such a situation, the FSS considers the sick leave payments made to be unjustified, allegedly due to failure to confirm the fact of incapacity for work. But the courts look at the loss of sick leave differently.

Thus, the joint-stock company lost certificates of incapacity for work for 10 employees, which is why the Social Insurance Fund decided not to take into account the costs of paying benefits for temporary disability and in connection with maternity.

The joint-stock company challenged the decision in court, and all three authorities supported the company, pointing out that the mere fact of failure to submit certificates of incapacity for work in connection with their loss by the insured is not a sufficient basis for refusing to accept for offset the costs of paying insurance coverage in the presence of other documents confirming justification of the corresponding payments.

The basis for the appointment and payment of insurance coverage, in particular, maternity benefits or temporary disability, to the insured person is the occurrence of a documented insured event (Articles 8, 12 of the Law on OSS). Within the meaning of these norms, as well as Art. Art. 3, 2.3, 4.1, 13 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, the conditions necessary to reimburse the policyholder for the costs of compulsory social insurance are:

- the existence of an employment relationship between the policyholder and the insured person;

- documentary confirmation of the occurrence of an insured event and payment of benefits to the insured person, calculation and payment of insurance premiums.

The company applied to medical institutions with a request to confirm the issuance of certificates of incapacity for work to their employees, as well as to issue their duplicates. And to confirm the validity of the payments made, the JSC provided the Fund during the audit:

- pay slip for the disputed year;

- orders for hiring employees;

- calculations of temporary disability benefits for each employee;

- pay slips and other documents confirming the payment of benefits to employees;

- responses from medical institutions, which contain information about issued certificates of incapacity for work, indicating the series and numbers of certificates, surnames, first names and patronymics of employees and periods of their incapacity for work. The medical institution also provided copies of the spines of the leaflets.

The information contained in the submitted documents makes it possible to establish the existence of an employment relationship between the policyholder and the insured persons, the occurrence of insured events, periods of temporary disability of the insured persons and the incurrence of related expenses by the policyholder.

At the same time, the district court emphasized that the current legislation does not provide for the re-issuance of certificates of incapacity to replace lost ones, therefore the loss of sick leave is not a reason to “punish” the employer.

In the event of the loss of such certificates, the legality of the expenses incurred can be confirmed by other documents, including letters from medical institutions, which, together with the information contained therein, confirm that the lost certificates of incapacity for work were actually issued to the insured persons and presented for payment to the insured. (Resolution of the Arbitration Court of the North-Western District dated 06.06.2018 No. F07-5149/2018 in case No. A21-9220/2017).

The district court presented a similar position in another case, in which a college lost certificates of incapacity for work for 2021: the loss itself is not a reason for making decisions to refuse credit and additionally charge insurance premiums, penalties, and fines.

The occurrence of insured events and the issuance of certificates of incapacity for work were confirmed by medical organizations at the request of the court of first instance (Resolution of the Arbitration Court of the North-Western District of May 21, 2020 No. F07-2705/2020 in case No. A13-4806/2019).

Similar conclusions are found in another case: during the inspection, the LLC was unable to provide the original certificates of incapacity for work for one of the employees, which is why the Social Insurance Fund did not accept the corresponding expenses for offset.

The court rejected the Fund’s arguments, since the FSS did not deny the fact of the occurrence of insured events, and the absence of original certificates of incapacity for work in itself is not a basis for making a controversial decision (Resolution of the Arbitration Court of the East Siberian District dated August 13, 2019 No. F02-2281/2019 in case No. A19-20870/2018).

As we see from the examples, to remove the claims of the inspectors, it is enough to have evidence of the existence of an employment relationship and the fact of the occurrence of temporary disability.

The latter is confirmed by any evidence received from medical organizations, for example, upon request.

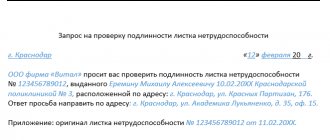

The request is written in free form, it indicates: the reason for the request (loss of certificates of incapacity for work and the need to confirm the occurrence of an insured event in order to pay benefits for temporary disability) and what information is needed (number, series, date of issue of the certificate of incapacity for work, full names of employees, periods of incapacity for work), the address where you want to send the response.

It is recommended, in order to reduce the risk of refusal on the grounds of maintaining “medical secrets,” to avoid formulations asking to confirm the fact of applying for medical care or receiving medical care, but only to ask to confirm the issuance of a certificate of incapacity for work.

If the medical organization for any reason refuses to do this, then copies of the correspondence are attached to the package of documents for the inspectors. You can also ask employees to obtain similar certificates from a medical organization themselves.

In the event of a trial, you can petition the court to send a judicial request to the medical organization.

The petition is formulated either in the text of the application itself to challenge the relevant decision of the inspectors or in the form of a separate document. In any case, a request and a “refusal” response from the medical organization are attached. (Part 4 of Article 66 of the Arbitration Procedure Code of the Russian Federation).

Claim 2. Errors in issuing and extending certificates of incapacity for work

Incorrect extension of the certificate of incapacity for work.

For example, medical organizations issued certificates of incapacity for work for additional days of maternity leave as primary, and not as an “extension”; because of this, the Social Insurance Fund refused to accept benefits paid to employees by PJSC.

Meanwhile, as the courts pointed out, the procedure for issuing sick leave certificates in force at the time of registration does not determine how sick leave for additional days should be issued - as a primary one or as a continuation, and does not establish that a sick leave certificate issued for an additional 16 days must necessarily be a continuation of the main one. maternity sick leave.

The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 10605/12 dated December 11, 2012, noted that the employer does not have the right to control the correctness of the sick leave certificate and compliance with the procedure for issuing it. Therefore, the Social Insurance Fund cannot refuse to offset (reimburse) the benefit amount to the employer if there are such violations in the sick leave certificate.

In such cases, the Fund has the right to demand reimbursement of expenses for payment of benefits from a medical institution that incorrectly filled out the form (Clause 6, Part 1, Article 4.2 of Law No. 255-FZ). (Resolution of the Arbitration Court of the Moscow District dated June 25, 2020 No. F05-7340/2020 in case No. A40-158982/2019).

In another case, a worker’s sick leave was extended, but, contrary to the rules for issuing sick leave, the first was “closed”, and the second was issued as a continuation of the first.

The FSS considered that in this case the payment of temporary disability benefits was unjustified and demanded that the company reimburse the expenses incurred by the FSS for the payment of benefits, since the payment of benefits was made within the framework of a pilot project directly by the Fund. The company challenged the decision in court.

The court came to the conclusion that the shortcomings made by the medical institution when issuing a certificate of incapacity for work cannot serve as a basis for reimbursement of expenses incurred excessively by the FSS by the applicant.

The institution did not provide evidence of the issuance of certificates of incapacity for work by medical institutions in the absence of medical indications.

The institution’s reference to the fact that the medical organization issued an incorrectly executed certificate of incapacity for work, where the section “to be filled out by a doctor of the medical organization” is drawn up using printing devices, and the controversial entries about the number of the “certificate of incapacity for work continued”, entries in the line “Other” code “31” and the line “a certificate of incapacity for work has been issued (continued)” is entered in black ink with a gel (or capillary) pen, does not indicate the unreliability of the information provided by the policyholder; The Foundation’s arguments that the certificate of incapacity for work was damaged by the applicant are based on assumptions and are neither documented nor refuted.

To recognize a payment made as unjustified, it is required that the Fund establish circumstances indicating that the policyholder’s actions were aimed at illegally receiving funds from the Social Insurance Fund, but such evidence was not provided to the court (Resolution of the Arbitration Court of the West Siberian District dated November 7, 2018 No. F04-4525/2018 on case No. A45-2304/2018, by Decision of the Supreme Court of the Russian Federation dated February 27, 2019 No. 304-ES19-275, the transfer of the case for review was refused).

Incorrect dates on sick leave or errors in dates.

Thus, the medical organization made a mistake in terms of entering the period of incapacity for work into the hospital: in two lines instead of one and indicating all periods of extension instead of the start and end dates of the period of incapacity for work.

And again the FSS refused to offset the contributions. The court recognized the Fund's position as unfounded: errors in the preparation of a duplicate sheet in themselves are not an unconditional basis for recognizing the resulting disability as a non-insurable event, excluding the payment of insurance coverage.

By virtue of clause 6, part 1, art. 4.2 of Law No. 255-FZ The Fund has the right to bring claims directly against medical organizations for reimbursement of the amount of expenses for insurance coverage for unreasonably issued or incorrectly executed certificates of incapacity for work, i.e. the negative consequences of medical institutions’ failure to comply with the requirements of the current legislation are assigned directly to them, and not on the policyholder, who is not entitled to control the correctness of registration and compliance with the procedure for issuing certificates of incapacity for work by medical organizations.

Since the Fund did not challenge the fact of incapacity for work and did not prove the direction of the institution’s actions as an insurer to create an artificial situation to receive funds from the Fund, its decision is illegal (Resolution of the Arbitration Court of the North Caucasus District dated August 10, 2017 No. F08-5574/2017 in case No. A63-8397 /2016).

Moreover, the courts in this case also referred to the position of the Supreme Arbitration Court of the Russian Federation that it is the medical organization that bears the risks for violating the rules for processing and issuing certificates of incapacity for work, for example, if it does not have a license to carry out medical activities (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 11, 2012 No. 10605/12 in case No. A33-11561/2011).

Adheres to the same position on the responsibility of medical organizations and the Armed Forces of the Russian Federation (see, for example, Ruling of the Supreme Court of the Russian Federation dated February 13, 2018 No. 306-KG17-22369 in case No. A12-3283/2017).

In another dispute, employees of a medical organization incorrectly filled out the details of the sheets regarding the end dates of the period of incapacity for work, in particular, in one of the sheets the date of issue did not correspond to the date of discharge after hospital treatment, in the other the line “start to work...” was filled in incorrectly, etc.

All this served as the basis for the FSS’s refusal to accept expenses incurred for offset.

However, the court recognized that the FSS did not have legal grounds for making such a decision, since violations of the requirements for the procedure for filling out certificates of incapacity for work were committed directly by medical institutions, and the facts of incapacity for work themselves were not disputed by the persons participating in the case.

The Fund’s refusal to accept for offset the costs of paying insurance coverage does not change the legal nature of the benefits paid, since errors in the preparation of documents cannot be an absolute reason for recognizing the resulting disability as a non-insurance event, that is, not obliging to pay insurance coverage.

Such errors do not actually entail refusal to pay benefits for temporary disability (Decision of the Supreme Court of the Russian Federation dated December 16, 2014 No. 309-KG14-2606). (Resolution of the Arbitration Court of the North Caucasus District dated January 28, 2019 No. F08-11199/2018 in case No. A63-5252/2018).0-36992/2019).

A similar conclusion is found in other disputes:

- The medical organization incorrectly indicated the date of closure of the sick leave: the mere fact of issuing certificates of incapacity for work in violation of Procedure No. 624n, if there are conditions for the citizen to receive benefits for temporary disability, is not a basis for refusing to accept these expenses for offset (Resolution of the Arbitration Court of the Ural District dated 19.08 .2020 No. F09-4818/20 in case No. A50-36992/2019);

- in the continuation of the certificate of incapacity for work, the employees of the medical institution incorrectly indicated the start date of the period of incapacity for work. The court explained that not any violation of the procedure for issuing temporary disability certificates indicates the illegality of making social insurance payments.

The Fund did not dispute the fact of the occurrence of the insured event and did not provide evidence of the unreliability of the disputed certificate of incapacity for work (Resolution of the Arbitration Court of the East Siberian District dated February 20, 2019 No. F02-81/2019 in case No. A19-11796/2018).

There is no seal/stamp of the medical organization.

For example, temporary disability benefits were assigned on the basis of a certificate of incapacity for work without the seals of a medical organization.

The courts found that the violation committed by the company is remediable and does not indicate the illegality of the accrual and payment of benefits; the circumstances of the occurrence of an insured event in relation to employees by the Fund are not disputed.

The occurrence of insured events, the period of incapacity for work of the insured persons, and the incurrence of corresponding expenses by the insured are confirmed.

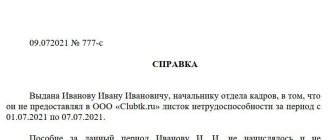

At the same time, the court imposed on the FSS the obligation to pay the state duty, and rejected the argument to exempt the Fund from this, since the LLC addressed the Fund with a statement, attaching the necessary documents, in which it asked to reconsider the Fund’s decision.

Meanwhile, the Fund has not considered this application on its merits; the society has not been informed of anything about the procedure for subsequent actions after receiving the necessary documents. Thus, the Foundation had the opportunity to resolve the current situation out of court, but did not take any measures in response to the company’s actions and did not respond to the submitted application.

The legislation does not provide for the exemption of state and municipal bodies from reimbursement of legal costs if the decision is not made in their favor (Resolution of the Arbitration Court of the East Siberian District dated October 4, 2018 No. F02-4308/2018 in case No. A19-22723/2017).

Putty corrections.

Thus, the following mistake was made on the certificate of incapacity for work: a new entry was made on the entry erased with “putty” in the “insurance period” field, instead of the required crossing out and making the correct entry on the reverse side of the certificate of incapacity for work.

Because of this, the FSS demanded that the institute (the employer) reimburse the excessively incurred expenses for paying sick leave.

Meanwhile, as the courts indicated, the Foundation did not provide evidence of the issuance of a certificate of incapacity for work by a medical institution in the absence of medical indications.

The Fund does not dispute the fact of the employee’s illness and the validity of issuing sick leave.

The targeted nature of spending the Fund's funds has not been violated.

Violation by the insured of the procedure for filling out a certificate of incapacity for work in the field “insurance period” does not indicate the absence of grounds for payment of benefits for temporary disability to the insured person (Resolution of the Arbitration Court of the Volga District of September 26, 2018 No. F06-37202/2018 in case No. A06-10422/2017) .

What can an employer do?

The certificate of incapacity for work provided by the employee obliges the employer not only to take into account the validity of the reason for the employee’s absence from the workplace, but also to provide benefits.

Abuse by an employee of his right to insurance coverage and absence from work creates significant difficulties for the employer, who is forced to look for internal resources to complete the work and bear an additional financial burden. In such a situation, suspicions arise about the existence of a conspiracy between the employee and a representative of the medical organization, but it is quite difficult to prove this.

Considering that a certificate of incapacity for work is issued by an authorized organization on the basis of a valid license for medical activities, including work (services) for the examination of temporary disability, the threat of losing this license obliges the head of a medical institution to respond to any information preventing the revocation of the license.

Accordingly, clarification by the employer of the fact of multiple issuance of sick leave will not violate the requirements for information protection, but will draw the attention of the head of the medical organization to a possible violation.

The employer’s next opportunity to stop the employee’s abuse of the right is the authority assigned to the Social Insurance Fund of the Russian Federation (Clause 7, Article 59 of the Federal Law of November 21, 2011 N 323-FZ “On the Fundamentals of Protecting the Health of Citizens in the Russian Federation”) to verify compliance with the established procedure for issuing, compliance with the deadlines for issuance and extension, registration of certificates of incapacity for work, as well as checking the maintenance of documents confirming the issuance, extension and registration of certificates of incapacity for work (clause 5 of the Order of the Ministry of Health of Russia dated December 21, 2012 N 1345n “On approval of the Procedure for the implementation by the Social Insurance Fund of the Russian Federation of checking compliance with the procedure issuance, extension and registration of certificates of incapacity for work").

Inspections can be carried out on the basis of an appeal (complaint) from legal entities and individual entrepreneurs about the actions (inaction) of persons issuing certificates of incapacity for work related to violation of the procedure for issuing, extending and processing certificates of incapacity for work (clause 8 of the above-mentioned Order).

An appeal to the FSS not only initiates an unscheduled inspection, but also obliges the FSS to provide the policyholder with information on the merits of the appeal (complaint), thereby practically stopping the flow of certificates of incapacity for work for a certain citizen.

Sample

Manager Semenov S.S. has been working at Clubtk.ru LLC (St. Petersburg) since February 10, 2021. In July, he handed over a certificate of incapacity for work from July 6 to July 10. The calculation period for calculating benefits is 2021 and 2021. During this period, the employee did not provide income certificates, so the accountant calculated and made accruals based on the minimum wage:

August 10 Semenov S.S. brought a certificate of income in accordance with the form of order of the Ministry of Labor dated April 30, 2013 No. 182n and wrote an application for recalculation of the certificate of incapacity for work.

Payments to be included in the calculation amounted to RUB 500,000 for 2021. for 2019 - 600,000 rubles. How to recalculate sick leave:

The difference between the new calculation and the previously paid amount is subject to transfer to S.S. Semenov. on the next payday:

More information about the rules for calculating a certificate of incapacity for work

How to compose correctly

A request to change years is written in a free style; there is no single template. It is compiled in handwritten or printed form according to the standard scheme:

- to whom (full name of the manager and company name) and from whom (full name and position);

- Title of the document;

- main part;

- signature and date.

In the content part, list the following data:

- request for recalculation of sick leave;

- article FZ-255, regulating its implementation;

- the period for which a new calculation should be made;

- number, date of issue of the certificate of temporary incapacity for work;

- details of a certificate confirming the possibility of correcting the amount of compensation.

If it is necessary to make adjustments to the benefit based on a certificate of average earnings of 182n, the employee fills out a specialized form established by order of the Social Insurance Fund dated November 24, 2017 No. 578.

To correctly enter information into a specialized form, employees often turn to an accountant. And they have a question: an application for payment and recalculation of sick leave benefits can be signed by an accountant or other company specialist who assisted in filling it out? No, the law does not provide for such an option. The applicant personally signs the request and attaches certificate 182n to it.

ConsultantPlus experts examined in what cases an employee needs to file an application for payment of temporary disability benefits. Use these instructions for free.

Sample

To write a request in free form, stick to a business format. If you need to decide how to write an application for recalculation of sick leave after maternity leave, follow the sample below.

| to CEO LLC "PPT.ru" Petrov P. P. from the secretary Solntseva S. S. STATEMENT I ask in accordance with paragraph 1 of Art. 14 of Federal Law No. 255-FZ of December 29, 2006, recalculate the temporary disability benefit from March 17, 2021 to March 24, 2021 on sick leave No. 645739208, which was issued on March 17, 2021, based on the billing period 2017–2018, since in 2019– 2020 I was on maternity leave. Solntseva Solntseva S. S. 07.04.2021 |

And this is what a completed example of an application for adjustment of compensation based on a salary certificate looks like (unified form):