Explanatory letter – a document substantiating the reasons for the violation committed by one or another employee. It is usually written either voluntarily or at the request of the manager in cases where an employee of the enterprise has done something wrong (he was late or did not come to work at all, showed up drunk, did not fulfill the instructions given to him, etc.).

Examples of explanatory notes:

- about failure to fulfill official duties - about absence from work - about late provision of documents - about absence from the workplace - about failure to fulfill an order - about loss of documents - about an incorrectly punched check - about failure to fulfill the sales plan - due to being late for work

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Why do they write an explanatory note?

A person has to write an explanatory note not because the addressee is actively interested in the events taking place in the author’s life. Statement of the circumstances of the incident from the point of view of its participant is an opportunity to make a fair decision. The reason for writing an explanatory note is most often negative events: being late for work, missing school, an unfulfilled assignment, etc.

In cases where the culprit faces serious punishment - for example, dismissal or disciplinary action - an explanatory note can become a reason for lifting sanctions or, on the contrary, will be a supporting document.

Sometimes explanations become an argument of the parties in court; they can protect the employee or employer from liability or become evidence.

What happens if you don’t respond to the Federal Tax Service’s requirement?

No matter how much the inspectorate threatens punishment, tax officials cannot fine or issue an administrative penalty for the absence of an explanatory letter:

- Article 126 of the Tax Code of the Russian Federation is not a basis for punishment, since the provision of explanations does not apply to the provision of documents (93 of the Tax Code of the Russian Federation);

- Article 129.1 of the Tax Code of the Russian Federation is not applicable, since a request for written explanations is not a “counter check” (93.1 of the Tax Code of the Russian Federation);

- Article 19.4 of the Code of Administrative Offenses is not an argument; punishment is applicable only in case of failure to appear at the territorial inspection.

Similar explanations are given in paragraph 2.3 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837.

Where are explanatory notes written?

Explaining your own or someone else’s behavior is accepted in several areas:

At the place of work

A note is written by an employee if he violated labor discipline (was late for work, came drunk, did not submit a report on time, did not wear special clothing, etc.), caused material damage to his employer, is involved in a labor dispute, and in other similar situations. Explanatory notes for lateness and other incidents are usually submitted to the personnel department, the head of the department, or directly to the employer (if it is, say, an individual entrepreneur).

At the place of study

In this case, there may be two options. If we are talking about a school, the explanatory note is written by the parents or the student himself (depending on the age of the student). In higher and secondary educational institutions, notes are written by the student, and in some cases by his parents or legal representatives.

To a kindergarten

Explanatory notes are submitted to preschool institutions by parents, and they explain their actions (for example, the reasons for the child’s absence or late payment), and not the actions of the children.

Deadlines for writing explanatory notes

Labor legislation establishes a clear deadline for providing an explanatory note. Article 193 of the Labor Code of the Russian Federation obliges the employer not to impose a disciplinary sanction within two working days after the request for an explanation from the employee. If the employee does not write a note within these two days, the period is considered expired.

The administration of these organizations decides at what time to provide explanatory notes at the place of study, kindergarten and other institutions, and the period must be reasonable.

When to Provide Explanations

When conducting an inspection, the inspector has the right to request written explanations. Situations in which taxpayers are required to explain the result of control are spelled out in paragraph 3 of Art. 88 Tax Code of the Russian Federation:

- Errors in submitted reports. For example, inaccuracies or inconsistencies are identified in the declaration. In this case, tax authorities require you to provide justification for these discrepancies or send a corrective report.

- In the adjusting statements, the amounts payable to the budget are significantly lower than in the initial calculations. In such a situation, the inspector will suspect a deliberate understatement of the tax base and payments and will demand an explanation for the changes.

- The submitted income tax return reflects losses. In any case, you will have to justify unprofitable activities to the Federal Tax Service, so prepare a letter with explanations in advance.

The inspection request must be responded to within 5 working days from the date of official delivery of the request - such norms are enshrined in clause 3 of Art. 88, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation. In special cases, the Federal Tax Service will have to notify the receipt of a tax request (letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071).

IMPORTANT!

Some requests from the Federal Tax Service do not have a stamp. You will still have to respond to such demands - such instructions are given in the letter of the Federal Tax Service of the Russian Federation dated July 15, 2015 No. ED-3-2 / [email protected]

Legal meaning of explanatory notes

Such notes have significant legal significance, especially when it comes to labor relations. According to the Labor Code of the Russian Federation, employee explanations are a mandatory part of the procedure for bringing to disciplinary liability. Until the explanatory note is received (if the deadline for its provision specified in the previous chapter has not expired), no measures can be taken against the employee.

It is not only the fact of providing an explanation that is important, but also its content. Based on the note, the employer can either apply the maximum possible penalty or cancel the employee’s punishment completely. In other words, if you were late for work or did not complete any assignment for a good reason, then an explanatory note can save you from punishment from the employer.

At the same time, writing an explanatory note is not mandatory for the employee; he can refuse to do so without any legal consequences (except that the employer will make a decision based either only on his own assessment of the situation, or on the assessment of witnesses and other participants in the event ).

Refusal to provide written explanations

The individual providing the work requests an explanation from the employee in order to explain certain actions and behaviors. The employee has the right to refuse to write this document, but this fact will not work in his favor.

By refusing to write a document, the employee is at greater risk of receiving the following penalties:

- Notes,

- reprimand,

- Penalties,

- Layoffs,

- Other types of punishments that are appropriate in the opinion of the employer.

By competently writing a note and clearly explaining all the facts, the employee significantly increases his chances of mitigating his guilt or being completely acquitted in the eyes of the employer.

Method of writing an explanatory note

Legislation and everyday customs provide for two ways of writing explanatory notes:

- Writing by hand is the preferred method because it allows identification of the author and also makes it possible to avoid forgery. But even if the note is not written by the author himself, it must contain his own signature.

- Writing on a computer is more often used in organizations where a clear form of such documents has been established. Whatever the text, the signature must be handwritten.

How exactly to write an explanatory note is the personal choice of its author.

How to increase the uniqueness of coursework and dissertation work

You will not have to write an explanatory note if you submit your coursework and dissertation on time. Even if you have any difficulties in writing, it is better to use the Internet and do not put off your work. If you are afraid of anti-plagiarism, then our site was created to pass a plagiarism check.

The Killer-antiplagiat.ru service will help you go through checking the originality of the text easily and simply. You need to order an increase in uniqueness - and in just 1 minute you will receive a processed document. Moreover, there will be no changes in the text. After all, the special Anti-Plagiarism Killer program will recode your file and hide all borrowings. The percentage will increase to 80-90%. Want to check it out? Order a free increase in text independence.

Thus, you will definitely be able to through the plagiarism check at the university.

In this article, we looked at how to write an explanatory note at a university. Now you know that the best thing is to correctly express your point of view and not make a mistake when writing the name of the rector or dean.

How to write an explanatory note

Despite the different requirements for the form and type of explanatory note in different organizations, there are also general requirements.

Addressee of the explanatory note

Depends on the size of the organization, as well as the reason for writing the note. If the enterprise or institution is small, an explanatory note is written to the manager. In organizations with a complex structure, the addressee may be the head of a department (head of a workshop, department, department, section, etc.).

If we are talking about explanatory notes at the place of study, they are usually submitted to the rector or head of the academic department, or the school director. In kindergarten - addressed to the head.

Samples of explanatory notes

Despite the fact that the text of the note can be invented from scratch, there is no point in reinventing the wheel. We offer you examples of explanatory notes that you can successfully use in your life situations.

Explanatory note at the place of work

There may be several reasons for drawing up such documents.

About failure to fulfill official duties - the watchman did not walk around the territory, as a result of which theft occurred, the accountant did not send a report, because of which the company suffered losses, etc. In this case, you need to find compelling explanations for your actions (or inaction). It is highly undesirable to blame colleagues or management for what happened; the note should explain your behavior.

Sample explanatory note for work

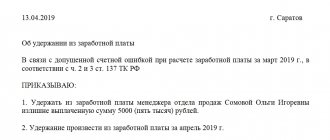

2 About errors in work - we mean unintentional errors in calculations, in the actions of the employee, etc. The best strategy here is to admit the mistake and promise not to do it again. An attempt to blame another person for an error is permissible only if there is documentary evidence.

Sample explanatory note for work about errors

about violations of labor discipline - absenteeism, tardiness, absence during working hours, violation of instructions and regulations, etc. Since most of these violations attract at least disciplinary action, the reason must be described very convincingly.

Sample explanatory note for work about being late for work

Sample explanatory note about absence from work

Explanatory note at the place of study

The text depends on the place where the note is submitted, and on whether the student himself explains his action or his parents do it:

1 To school - most often parents explain the reason for their son or daughter’s absence from classes. This could be illness, participation in competitions or other events, or family circumstances. If in the lower grades the class teacher most often does not require documentary evidence of explanations, then in the upper grades, if there is no certificate from a doctor, convincing arguments are required in the explanatory note to the school.

Sample explanatory note to school

2 To a university or secondary specialized educational institution - parents or the student himself explains the reason for absence from lectures, seminars or exams. Poor health or undocumented illnesses will not go away more than once.

Sample explanatory note to the university

Explanatory note in kindergarten

This is a document on the basis of which parents can, for example, return the amount paid for the child’s food on the day he missed. But valid reasons for absence are required.

Sample explanatory note to kindergarten

Errors and discrepancies regarding VAT

Value added tax is the fiscal liability where accountants make the most mistakes. As a result, discrepancies and inaccuracies in reporting are inevitable.

The most common mistakes are when the amount of tax accrued is less than the amount of the tax deduction claimed for reimbursement. In fact, the reason for this discrepancy is the inattention of the person responsible for issuing invoices or a technical error when uploading data.

In the explanatory note, please include the following information: “We inform you that there are no errors in the purchase book, the data was entered correctly, timely and in full. This discrepancy occurred due to a technical error when generating invoice No.____ dated “___”______ 20___. Tax reporting has been adjusted (indicate the date the adjustments were sent).”

FAQ

– What will happen if I refuse to write an explanatory note?

– As mentioned above, there is no liability for refusal to write an explanatory note. However, if the employee does not want to explain his actions, the employer must draw up a report on this (the same applies to the situation when the employee did not submit the note within two days). The “Act of Refusal to Write an Explanatory Note” must indicate:

- information about the employee (full name, position, department name);

- information about witnesses to the refusal and/or drawing up the act (there must be at least three people);

- date of drawing up the act of refusal;

- reference to the rules requiring the employee to write an explanatory note;

- description of the situation according to the employee (if he agrees to explain or “without explanation”);

- an indication that the act was drawn up in two copies, and the employee has read it or refused to read it;

- list of witnesses and their signatures;

- signature of the document originator and the employee (if he agrees to sign).

After drawing up the report, the employer will interpret the situation and make a decision on disciplinary action without taking into account your opinion.

Act on refusal to write an explanatory note sample:

Sample act of refusal to write an explanatory note

– The employer does not want to accept the explanatory note. What to do?

– If you do not serve the document within two days, it will be tantamount to refusal to provide explanations. Since the employer avoids receiving the note in person, notify the labor commission that oversees your locality, as well as the trade union of your organization (if you have one). Send the note by courier or Russian Post by registered mail with notification (receipt stamp required). There is no need to worry about the letter taking a long time: the filing date is considered the day the letter was sent, so be sure to save the receipts that you will be given at the post office, as the date will be indicated there.

Reducing the tax burden

This issue is of particular interest to tax authorities. Thus, representatives of the Federal Tax Service constantly monitor the volume of revenues to the state budget. If they decrease, the reaction is immediate: demands with explanations, an invitation from the manager to a personal meeting with a representative of the Federal Tax Service, or an on-site desk audit (a last resort).

In such a situation, you cannot hesitate; you must immediately provide explanations to the Federal Tax Service. In your response letter, describe all the circumstances and facts that influenced the reduction in tax payments. Confirm the facts with documents or provide economic justification. Otherwise, the Federal Tax Service will initiate an on-site inspection, which will take several months.

What to write in an explanatory note:

- Reduction of salary taxes. Reasons: staff reduction, enterprise restructuring, reduction in wages.

- A decrease in profits usually occurs due to the termination of contracts with customers. A copy of the additional agreement on termination of the contract should be attached to the written explanations.

- Increased costs as a result of decreased profits. Justification: expansion of activities (increase in production volumes, opening of a new branch, division, outlet), change of suppliers or increase in prices for inventories and raw materials (attach copies of contracts).

There are many reasons for reducing the tax burden. It is necessary to understand each specific case in detail.