Not long ago, domestic legislation underwent certain changes: now not only the child’s mother, but also her husband, grandmother and other close relatives have the right to issue a maternity leave. In addition, adoptive parents and legal guardians of a minor have the right to go on maternity leave. Let's look at the conditions under which maternity leave is granted, how to properly apply for maternity leave for a grandmother , how to draw up an application and what documents will need to be provided.

Maternity leave or leave to care for a baby

Article 256 of the Labor Code establishes the right of a mother to leave to care for a child up to 3 years old, or, in popular parlance, to maternity leave.

Situations in which a new mother is unable to care for her child are common. In this case, the maternity leave is issued to another family member, for example, parental leave is issued to a grandparent. Regardless of who filed maternity leave, he is entitled to benefits:

- A guaranteed amount of 40% of the applicant’s average salary is paid by the employer monthly until the child turns 1.5 years old. The benefit is transferred at the expense of the Social Insurance Fund; it is not subject to personal income tax.

- Abolished payment in the amount of 50 rubles from the employer. The monthly supplement has been canceled as of 01/01/2020. But if the payment was scheduled before this date, then social benefits continue to be paid. The amount increased by the regional coefficient is paid by the employer monthly for up to 3 years, at the expense of the organization, without withholding taxes.

IMPORTANT!

Additionally, the employee is entitled to financial assistance if this is provided for in the wage regulations or employment contract.

According to Article 256 of the Labor Code of the Russian Federation, a decree has the right to be issued by:

- dad;

- grandparents, both on the mother's and father's sides;

- other relatives who will actually care for the newborn;

- legal guardians and adoptive parents.

All of the above family members have the right to claim cash payments (child care benefits) established by Part 3.2 of Art. 14 of Law No. 255-FZ.

IMPORTANT!

Please note that only the mother of the child is entitled to maternity leave!

What is maternity leave

In accordance with the legislation of the Russian Federation, maternity leave is provided to all pregnant women, regardless of whether they are working or studying, looking for work or military personnel.

The type of such leave is divided into two categories:

- Leave related to pregnancy and the birth of a baby. Issued in the form of a sick leave certificate, which sets the gestational age at 30 weeks. In standard cases, 140 days of sick leave are given. The indicated amount may vary due to multiple difficult births.

- Leave to raise a child is issued for up to three years. At the same time, the length of service and place of the child are preserved. The first half of the vacation is paid, but the second is not.

The law allows you to split your parental leave days.

Thus, for the first 9 months the mother takes care of the children, and for the next months other relatives, for example, the grandmother. But this advantage applies only to paid maternity leave.

Design features

If your grandmother goes on maternity leave instead of your mother, the design is different. The main difference in situations in which a grandmother or other close relative goes on parental leave is the need to confirm that parents and other family members do not receive the benefits listed above.

For confirmation, you will need an official document (certificate, extract, information) from the relevant organization. For example, a certificate from the place of work of the mother or father, or an extract from the Employment Center stating that the parents do not receive the required benefits.

Can a non-working grandmother take a vacation?

Obviously, in many families where both parents work, their grandmothers can take care of the children. Moreover, among them there are quite a lot of unemployed people, including those who are retired.

The question of whether a grandmother who is not engaged in work can take a vacation is in itself incorrect. This is due to the fact that the procedure for their provision is regulated by the Labor Code, the norms of which regulate the relations existing between employers and their employees. A person who is not employed cannot take maternity leave in principle.

Thus, the supervision and care of children by non-working relatives is not regulated in any way by law.

However, it should be understood that being on maternity leave involves receiving certain benefits from employers and the state. For example, after the birth of a child, a non-working mother can count on payments due to her through social security. Despite the fact that their size is minimal, they often act as a serious help for a young family.

A non-working grandmother cannot claim social benefits while caring for a child, unless there are compelling reasons for doing so, including:

- death of parents;

- parents serving a sentence of imprisonment in a correctional institution;

- missing parents;

- parents have limitations due to poor health.

Reference! When supervising and caring for a child, a non-working relative can only count on a minimum cash benefit.

List of documents

To apply for maternity leave, the grandmother should prepare a package of documents:

- Free-form application for parental leave for a child up to 1.5 or 3 years old.

- A copy of the child's birth certificate.

- Documents confirming that the mother, father or other guardian is not on maternity leave and does not receive cash payments provided for in Part 2 of Art. 14 of Law No. 255-FZ.

The relative or guardian presents the completed package of documents at his place of work. The employer does not have the right to refuse the application, since this is a direct violation of labor legislation (Part 3 of Article 256 of the Labor Code of the Russian Federation), entailing administrative liability (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). In case of refusal, the employee has the right to file a complaint with the labor inspectorate or court. Also, the employer does not have the right to fire an employee who has applied for parental leave.

The work experience, as well as the insurance period, is not interrupted while the grandmother or other family member is on maternity leave. Explanations are given in FSS letters No. 02-09-14/17-04-31319 dated 01/16/2018, No. 02-13/07-7424 dated 08/09/2007.

IMPORTANT!

By taking maternity leave instead of the mother, the grandmother has the right to continue working, but there are restrictions. To maintain the required payments, you will have to work from home or on a flexible schedule, but not full time!

Package of documents for receiving benefits

To receive the appropriate benefits, the grandmother will need to submit the following documents:

- Baby's birth certificate.

- Passport.

- Employment history.

- A document confirming the absence of intentions on the part of the parents to go on vacation.

- A document indicating the presence of family ties.

- Certificate of grandmother's earnings.

- A document from the social security service confirming the absence of payments for the child.

- Statement.

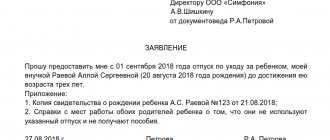

The application must include the following information:

- Addressee (organization in which the applicant works).

- Grandmother's name.

- Application for leave until the child is one and a half years old or up to 3 years old.

- Information about the child.

- List of papers attached to the application.

- Date, signature.

How to apply

Follow the instructions on how to apply for maternity leave for your grandmother in 2020:

Step 1. Obtain the necessary documents.

The required form is a written confirmation that the baby’s parents did not go on maternity leave. Get confirmation from both mom and dad's place of work. There is no established form of the document; the employers of the child’s parents draw up a certificate in any form.

A copy of the birth certificate does not need to be certified. It is enough to get the original and a well-readable copy to verify the data.

Step 2. Receive a statement from the employee.

There is no single application form for maternity leave. Most employers have developed and approved their own forms.

Step 3. Issue a maternity order.

A regular leave order is drawn up on Form T-6.

Let's sum it up

Today, not only mothers, but also other close relatives, such as grandmothers, can go on maternity leave. An officially employed grandmother has the right to go on maternity leave if the baby’s parents did not take advantage of this opportunity.

When an elderly woman is already a pensioner or unemployed, she will be able to go on maternity leave only in exceptional situations - for example, parents do not have the opportunity to provide for and care for the child and are deprived of parental rights. If the mother does not work due to serious health problems, then this is also sufficient grounds for applying for maternity leave for the grandmother.

In addition, the time spent by the grandmother on maternity leave will be counted as work experience. As a result, she will not have to worry about setting up a pension in the future.

Benefits and payments during maternity leave

The mother of the child is entitled to monthly cash benefits for care (up to the age of 1.5 years and 3 years). If you take leave for your grandmother, the employer pays her social benefits for up to 1.5 years. Social benefits are calculated at 40% of the average salary of an employee who submitted a child care application. The procedure for calculating average earnings is determined by government decree No. 922 of December 24, 2007 (as amended on December 10, 2016).

The current legislation provides for situations in which it is permissible to issue a maternity leave not in full, but in parts (paragraph 2 of Article 256 of the Labor Code of the Russian Federation). So, for example, a mother arranges maternity leave for a newborn until he reaches the age of 6 months, and then starts working. And the grandmother (grandfather, father, guardian) takes care of the baby until 1.5 or 3 years old and receives established monthly benefits.

Is maternity benefit available for up to 1.5 years?

If the grandmother is working, then she can receive maternity benefits at her place of work. The calculation of benefits is defined in Law 255-FZ.

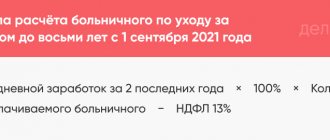

The calculation period is taken to be the two-year period preceding the year of maternity leave. Sick days can be excluded from this period.

Earnings for calculating benefits include all income from which contributions are deducted - wages, annual leave, compensation for it, bonuses.

First, the average earnings for one day are calculated - the total income for 2 years is divided by the days worked. Next, the resulting value is compared with the established restrictions - it must be between the minimum and maximum earnings for the current moment.

To calculate benefits, average daily earnings are multiplied by 30.4 and 40%.

Maternity benefits are paid to the grandmother at work on a monthly basis - transferred to the details specified in the application, or issued in cash at the company's cash desk.

If the grandmother is not working, then there are certain restrictions on receiving a minimum benefit of up to 1.5 years in social security. If the parents cannot arrange the payment themselves at their place of work or in social security, then the grandmother can do this.

The inability of parents to obtain maternity leave must be documented (by court decisions). Valid reasons are considered cases when:

- parents died;

- missing;

- they were deprived of their rights to a child;

- are serving time in prison.

In these cases, the mother and father cannot apply for leave for the child and receive maternity benefits, so a non-working grandmother has the right to apply to social security for financial support.

Maximum and minimum values of maternity benefits

When calculating social benefits, a limit was set; for 2021 it amounted to 27,984.66 rubles. The maximum benefit amount is limited to the maximum average daily earnings. It is calculated from the maximum base for contributions to VNiM for the two years preceding the year of the start of parental leave. For vacations starting in 2021, the limit is RUB 2,301.37. per day ((RUB 865,000 + RUB 815,000) / 730). The benefit limit is calculated as follows: RUB 2,301.37. per day x 30.4 days x 40% = 27,984.66 rubles.

The minimum amount of benefit for caring for the first child from 02/01/2020 is 3,375.77 rubles.

The benefit, calculated from the minimum wage, for vacation starting in 2020 is 4,852 rubles.

The minimum allowance for caring for the second and subsequent children from 02/01/2020 is 6,751.54 rubles (RF RF No. 61 of 01/29/2020).

If in the region of residence there is an increasing regional coefficient for wages, then the amounts of social benefits are recalculated taking it into account.

Amount of benefit transferred to grandmother

If the grandmother works in several places, the amount of benefits will be calculated based on the average income from each employer. Payments are made at the main place of business.

Grandmother has the right to receive the following benefits:

- 40% of income monthly until the child is one and a half years old.

- Depending on the number of children born, the allowance can vary from 16.4 thousand rubles to 23.1 thousand rubles for one child or several, respectively.

- Monthly payments for a child who has reached the age of one and a half years are 613 rubles.

Important! Based on the reduction in the amount of payments for a child in the period from 1.5 to 3 years, it is better for someone who earns less to sit with him.