Thus, 35% of married working men completely exclude the possibility of going on parental leave instead of their wife. 26% of men would rather not agree to such a vacation. Every seventh person (12%) allows the possibility of going on maternity leave instead of his wife. 27% of respondents claim that they are ready to babysit.

At the same time, according to the Social Insurance Fund, every year in Russia more than 13 thousand maternity leave are taken out by men. And for women, for comparison, almost 700 thousand vacations.

Work will wait

Parental leave can be used in full or in parts not only by the mother, but also by the child’s father, grandmother, grandfather, other relative or guardian who is actually caring for the child, the Ministry of Labor told Rossiyskaya Gazeta - Nedelya. Like women, they can also take such leave for three years.

During the period of parental leave, the employee retains his place of work (position). Parental leave is counted toward the length of service, as well as the length of service in the specialty (except for cases of early assignment of an old-age insurance pension).

Parental benefits will be paid until the child turns 1.5 years old. The minimum amount of benefits for child care up to 1.5 years is 6,752 rubles monthly. The maximum amount should not exceed 27,984 rubles (40% of salary).

Fathers, while on parental leave, like mothers, can work part-time, or part-time, or at home, while maintaining the right to receive benefits and receive wages for the time worked or for the amount of work performed (at home) . The employer is obliged to provide the employee who has a child with unpaid leave (leave at his own expense) for up to 5 calendar days.

What does a man get on maternity leave?

Cash payments when a man goes on maternity leave do not differ from similar rules for a woman. Here are the payments a family with a newborn child can expect for a man on maternity leave:

- until the child is 1.5 years old, a man will be able to receive up to 40% of average earnings at the employer’s expense;

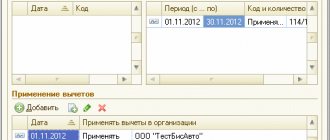

- for the calculation, all transfers to the employee over the last two years are taken into account, with the exception of financial assistance and a number of other compensatory additional payments;

- starting from the first day of going on leave until the age of three, an allowance is paid for each child in a fixed amount - 50 rubles. (the specified amount is paid until the child reaches the age of one and a half years, along with part of the average earnings).

When calculating 40% of the average earnings, the accounting department will have to take into account the legal limitation. Currently, the maximum monthly payment amount cannot exceed 23,120.66 rubles.

It is this amount that the employer can subsequently compensate from the social insurance fund. Exceeding the specified amount can only be at the expense of the employer’s own funds.

In order to protect families with children, the law also provides for minimum limiting amounts for maternity payments. If there is one child in the family, the amount cannot be less than 3,120 rubles, and for the second - 6,131.37 rubles. If, when calculating 40% of average earnings, it turns out that the payment does not exceed the legal minimum, the employer will take the specified amount as a basis. If several children under the age of one and a half years are cared for at the same time, the maximum amount of payments per family cannot exceed 46,240 rubles.

Vacation is not planned

Also, an employee who becomes a father has the right to take annual paid leave outside the vacation schedule. At the request of this employee, he is granted annual leave while his wife is on maternity leave, regardless of the time of his continuous work with this employer.

Along with maternity leave, mothers are also provided with “maternity leave” - leave in connection with pregnancy and childbirth. It lasts from 140 to 194 days, depending on the characteristics of pregnancy and childbirth. It is natural that only an expectant mother can take this leave.

When the FSS refuses to pay benefits

Sometimes the Social Insurance Fund has the right to refuse and not pay benefits for employees. This happens for several reasons:

- Errors in documents: certificate of earnings, certificate of incapacity for work, application for maternity leave.

- Fictitious labor relations. When an employee is hired in the late stages of pregnancy and immediately goes on maternity leave, this looks suspicious to the Social Insurance Fund.

- Inflated salary. If a woman lawyer receives a salary of 100,000 rubles, and her fellow lawyers receive 20,000 rubles, this is also suspicious.

- The employee receives benefits and works at the same time. The working day is full or reduced only formally, by less than an hour a day.

If fund employees find a violation, they will request explanations and documents.

The article is current as of 02/09/2021

How to apply for parental leave

To apply for parental leave, you must submit an appropriate application and the child’s birth certificate to the employer.

If grandparents work, the same rules apply to them as to the mother of the baby. During the period of leave, any of them for one and a half years will be entitled to a benefit in the amount of 40 percent of the average income for the two years preceding the year before the leave. To apply for benefits at the place of work, you need to provide the following package of documents: application for leave, child’s birth certificate.

If the grandmother or grandfather worked in another place during the two years preceding the vacation, then you will need to provide a certificate of income received there.

The nuances of maternity leave for men

If a man does not work under an employment contract, calculating maternity benefits based on average earnings is not possible. In this case, the calculation will be based on the minimum wage in effect at the time of filing the application. This calculation procedure applies to an unemployed man working as an individual entrepreneur, lawyer or notary.

Payments for these categories of citizens are made to the Social Insurance Fund account, and the application is submitted to the social protection authorities. In this case, the set of documents will be similar to the situation with going on maternity leave from your main job. Additional documents will be a certificate from the Social Insurance Fund and a TIN certificate. Accordingly, the amount of payments in this case will be no less than 3,120 rubles. for the first baby, and for the second – no more than 6,131.37 rubles.

You also need to know that during the period of maternity leave, your work and insurance experience is not interrupted. Upon subsequent retirement, maternity periods will be included in the total length of service, which gives the right to social benefits. An entry in the work book about going on maternity leave is not made, and the order for the enterprise is reflected only in personnel records.

Leave for a military father

When a soldier’s father has a child, the latter is also entitled to leave on an equal basis with other citizens of the Russian Federation. To determine how many days are given when replenishing the family of a man in military service, we proceed from the following parameters:

- whether the spouse or the child’s mother plans to go back to work;

- what are the reasons for the absence - short-term assistance in connection with the birth, or the organization of full care for the newborn until he reaches a certain age.

A serviceman is entitled to extraordinary leave if his service is under a contract. To coordinate the absence, the serviceman must submit to the commander of the military unit

- An extract that will be issued in the parental home upon birth, or a completed certificate of the newborn from the registry office.

- A report indicating the name of the serviceman, his commander, the reason for filing the report, date and signature.

Employer Responsibilities

According to Art. 22 of the Labor Code of the Russian Federation, the employer is obliged to strictly follow laws and legal acts, internal regulations, and also provide maternity leave for the father upon his request. This possibility should be reflected in collective agreements and agreements.

Keep in mind: any refusal by the employer to provide leave is unlawful. The father has the right to appeal to the labor inspectorate, and, as a last resort, to demand it in court.

Often, in order to avoid aggravation of the situation at work, the father prefers to come to an agreement with his superiors. He may ask to work remotely or on a part-time, part-time basis.

Will the father be given maternity capital?

The spouse has the right to apply for maternity capital, but under special conditions:

- If he is the only adoptive parent and has not previously applied for state social benefits. A mandatory requirement in this case is Russian citizenship.

- If he is the only parent, and the mother has lost her rights to receive maternity capital due to deprivation of parental rights or for other reasons. In this case, the recipient does not need to have Russian citizenship.

Submit an application for registration of maternity capital to the territorial branch of the Pension Fund of Russia. Attach legal documents to your application: birth certificates of children and reasons for the father to receive maternity capital.

Fathers will help mothers

–

An interesting innovation is the so-called paternity leave.

What problems are being solved here? – Leave for the birth of a child in the family will be granted upon application by the father within six months after the birth of the child. Providing it will be mandatory for the employer. The leave will be limited in duration – no more than 14 calendar days. A different duration, as well as its payment, may be provided for by a collective agreement or by the employer himself.

Of course, the birth of a child is not only a great joy, but also a test for a family that changes its usual way of life. It is especially difficult for a mother to adapt in the first months after childbirth; the main burden falls on her. In such a situation, both moral and physical help from the spouse is important. Such mutual support strengthens the family during a very crucial period of its life.

When studying this issue, we actively studied international experience. Currently, more than 20 countries around the world have already introduced paternity leave by law. This is mainly short-term leave for working fathers (from several days to several weeks), which is provided in the first weeks after the birth of the child. Patterns of paternity leave vary widely. In some places it is fully paid for by the employer, in others it is paid equally by trade unions, and there is also unpaid leave. In the process of studying the issue, we also studied public opinion. The Center for Sociological and Political Research of BSU, commissioned by the Ministry of Labor and Social Protection, conducted a sociological survey in 2021. The survey involved a thousand respondents and covered 78 settlements - from regional cities to villages. To the question “How do you feel about the possibility of introducing paternity leave at the birth of a child?”

more than 66 percent of respondents responded that they supported its introduction (more than 61 percent of men responded positively, and more than 70 percent of women responded positively). In addition, a sociological survey showed that more than 56 percent of respondents believe that fathers in our country do not devote enough time to the upbringing and development of their children. Therefore, it is natural that when asked whether it is necessary to take measures at the state level to involve fathers in the process of caring for children, in their upbringing and development, more than 52 percent of respondents answered affirmatively. This suggests that our society is interested in increasing the role of the father in the family and responsible fatherhood. We can say that the inclusion of provisions on paternity leave in the Labor Code is a concrete step in this direction.

Federal benefits

Federal benefits:

- Early registration at the antenatal clinic - 708.23 rubles.

- Payments for a child under 3 years of age (for children born before 01/01/2020) – 50 rubles. per month.

- Maternity capital – 483,882.0 rub. for 1 child and 639,432.0 rub. for 2 or 3 kids.

Note. Monthly payments for children under 3 years of age are provided to non-working parents who care for children. Payments are made at the expense of the employer.

Unemployed women are entitled to all types of financial assistance, except for maternity benefits and payments for children under 3 years of age.

Features of calculating benefits

Previously, we indicated that the calculation of benefits for a child under 1.5 years of age is made in the amount of 40% of the father’s average salary. There are some exceptions to this rule. Let’s say if the father’s average earnings are less than the established minimum wage. In this case, the calculation is carried out based on the minimum wage.

There is a small exception to the above rule. The amount of maternity benefits for employees of law enforcement agencies, the correctional service or bodies providing fire safety is 100% of the average monthly salary.

The assigned monthly benefit cannot be less than 1,500 rubles per person. A father with many children cannot receive less than 3,000 for each subsequent child. Benefit amounts are subject to indexation annually.

The opposite situation also exists. The maximum possible benefit amount has been established for those fathers who have high earnings. In 2021 it is 26,152.27 rubles.

Additional leave for the father at the birth of a child

If a working father does not need a long vacation, there are other options:

- vacation at your own expense;

- the right to annual leave for a certain period;

- time off for the birth of a child.

If you take leave at your own expense for a period of time, it is important to remember that your job is not retained. This means that your superiors have the right to give your position to another employee, and offer you another upon your return. But you can choose the timing yourself.

Any annual leave that you decide to take prematurely on this occasion will be calculated in the standard manner provided for in the terms of your employment contract.

Regarding the last option for time off, it is important to consider the following features:

- Time off is included in the length of service.

- The maximum period of such leave is five days. In law. However, the employer has the right to give the father ten or even two weeks if, for example, he wants to congratulate the man on a wonderful event. The maximum duration of such a mini-vacation is two weeks.

- The father must write an application to get time off.

- The employer is required by law to give time off the very next day after receiving the application.

Despite existing regulations, the employer can meet you halfway in each case. For example, agree with you on a specific period of vacation at your expense and promise that he will hold a job for you if the period suits him.

In each case, the issue must be resolved with management, and based on the official terms of employment.

- Employment contract consultations

Can a father claim child benefits and what benefits will he be paid?

Russian laws specifically indicate whether it is possible to obtain child benefits for the father: yes, it is possible. Each social benefit is regulated by a separate regulatory act, and the recipients are also indicated there - parents, adoptive parents or guardians. The key condition is that one of the spouses has the right to receive any subsidy from the state. This means that the father has the opportunity to receive the following benefits for his children:

- at birth;

- care for up to one and a half years;

- for coronavirus;

- “Putin” from birth to 3 years and up to 7 years;

- maternity capital (under special conditions).

The only payment that cannot be issued to a spouse is maternity benefits. Only the mother receives sick leave and all accruals for it.

Useful: all payments for children due to coronavirus quarantine