OSAGO is one of the most unprofitable types of insurance for insurers. This confirms the fact that money for repairs and health improvement after an accident is actually paid and insurance, which costs 4-10 thousand rubles per year, is not a fiction.

In addition, a motor vehicle license is also a mandatory policy: if you don’t have it, you have the right to be fined 500 rubles.

How to write an application for compensation for damage, where to go in case of an accident and other insurance cases, more about this in our article.

Who is eligible?

IC "Rosgosstrakh" offers drivers favorable terms of cooperation and the opportunity to receive money for repairs or treatment within the limit established by law.

In addition to traditional insurance compensation, there is also the concept of compensation payments, which, according to Article 18 of the Law “On Compulsory Motor Liability Insurance”, are paid in the event of bankruptcy of a company, revocation of its license, and also in the event that the culprit of the accident is unknown or does not have an insurance policy.

The following may apply for payment:

- drivers of other cars involved in an accident;

- pedestrians who were injured in an accident;

- passengers who were in the car and also suffered damage to their health or life.

Payments can be received not only by Russian citizens, but also by foreigners (including legal entities) and people who do not have any citizenship at all.

In other words: the law protects victims of road accidents from all sides. Even if there is no possibility of traditional compensation for losses, you can count on guarantee payments from the Russian Union of Auto Insurers or compensation payments.

The legislative framework

When filing a complaint against the RosGosStrakh company, you can be guided by the following legislative acts:

- Federal Law “On the Protection of Consumer Rights” dated 02/07/1992. N 2300-1 (as amended on July 3, 2016).

- Federal Law “On the procedure for considering appeals from citizens of the Russian Federation” dated May 2, 2006. N 59-FZ.

- Federal Law “On the organization of insurance business in the Russian Federation” dated November 27, 1992. N 4015-1 (as amended on May 23, 2016).

- Federal Law “On compulsory civil liability insurance of vehicle owners” dated April 25, 2002 N 40-FZ (as amended on May 23, 2016).

- Civil Code of the Russian Federation dated January 26, 1996. N 4-FZ (as amended on March 28, 2017).

Conditions of receipt

In order to receive payment for car repairs or health improvements, issuing money to the relatives of the deceased and covering funeral expenses, you need to be a participant in an accident, the culprit of which was the owner of the compulsory motor liability insurance policy.

In the event of an accident, an application for payment is prepared by the victim or his beneficiary. The money is transferred to the account of the service station or clinic, or (in very rare cases) – paid in person or to the bank account of an individual.

If harm to the health of a third victim is caused by not one, but two culprits of the accident, payments will be accrued in shares proportional to the culpability of each insurance company where compulsory motor liability insurance was issued.

Kinds

Payments under compulsory motor liability insurance are:

- straight;

- insurance;

- according to the European protocol;

- compensatory.

It all depends on the circumstances of the incident, the availability of insurance for drivers and the amount of damage.

Direct indemnity

According to Art. 14.1 of the Law “On Compulsory Motor Liability Insurance”, if no more than two cars were involved in the accident, and no one was personally injured, only there was damage to the car body, then you can count on direct compensation for damage.

But for this, both participants in the accident must have auto insurance policies. You can apply for payment directly to the company where the policy was purchased (that’s why payments are called direct), and only then the insurer itself will recover the money from the company that caused the accident.

According to the insurance rules, the exercise of the right to direct compensation for losses does not limit the right of the victim to contact the insurer who insured the culprit of the accident with a claim for compensation for harm caused to life or health that arose after the filing of a claim for direct compensation.

Indirect

This is not a completely correct definition, but it is used quite often. It means insurance payments under the MTPL contract, which compensate for the costs of car repairs, health restoration, and payments to heirs. According to the limits specified in the law, you can receive no more than 500 thousand rubles in case of compensation for damage to life and health and no more than 400 thousand rubles for car repairs or as compensation for its cost in the event of a complete loss.

The victim or his beneficiary receives money for restoration repairs or treatment, but not the policyholder himself, who spent the money on insurance.

According to the European protocol

It only applies in cases where there are two drivers in an accident and no one is seriously injured.

Seeing an insignificant amount of damage, drivers may decide not to call the traffic police and limit themselves to filling out an accident report. Next, the victim submits a package of documents to the insurance company for payment without a certificate of the accident.

The maximum compensation under the European Protocol (when a traffic accident is registered without certificates) is no more than 100 thousand rubles.

Compensatory

As mentioned above, such compensation is paid from the money of the Russian Union of Auto Insurers and only in special cases provided for by law. For example, in the case:

- bankruptcy of the insurer;

- revocation of his license;

- if the culprit of the accident fled the scene of the accident;

- or he did not have an insurance policy.

Payments are made within the same limits (no more than 400-500 thousand rubles) as in the usual case. This is a kind of insurance in case of insolvency of the insurer or sudden revocation of its license, for which all participants in the MTPL market pay contributions to the RSA.

Required documents

To receive payment from Rosgosstrakh, you need to prepare a package of papers that confirm the fact of the incident, determine the nature, nuances of the damage and the applicant’s right to compensation. It includes:

- passport;

- power of attorney or documents on the death of the victim when the beneficiary applies;

- documents confirming ownership of the car;

- papers from the police, traffic service or medical institution - the package is determined by the type and nature of the incident;

- notification of an insured accident;

- bank details of the recipient of the funds.

If damage to health was caused as a result of an accident, then in order to receive compensation for treatment and the cost of medicines, you will need an extended certificate from the hospital, ambulance station and from a forensic expert. When bringing the culprit to administrative responsibility, a protocol must be attached to the set of papers.

Where to go in case of an insured event?

To receive money after an accident you need not only to have the right to it, i.e. receive damage due to the fault of the insurance owner, but also follow a certain procedure. What to do in the event of an accident is described in detail on the Rosgosstrakh website :

- You need to notify the insurer about the accident in a timely manner.

- Call the traffic police (if required), exchange contacts with other participants.

- Next, you need to write a written statement about the insurance event and provide the car for inspection.

- Collect a package of certificates and copies, and submit a package of documents to receive compensation within the time limits established by the insurance policy.

Application for MTPL payments Rosgosstrakh Online

Attention! Application cannot be made online. This is clearly stated in the penultimate paragraph of Part 1 of Art. 12 Federal Law No. 40. That is, the application and documents can still be submitted electronically, but solely for the purpose of checking the completeness (and not to receive a payment). But you can notify the RGS about an insured event under MTPL online (just notify, nothing more).

Thus, the application and documents are needed:

- or deliver in person;

- or send by mail.

There is confirmation of this in ab. 5 hours 1 tbsp. 12 Federal Law No. 40, which says about personal appeal and mail, but says nothing about the possibility of submitting documentation via the Internet.

What does the size depend on?

The amount of payment depends on the assessment of damage, the limit for a specific type of damage and wear and tear of the car. Payment under compulsory motor liability insurance, unlike CASCO insurance, is always paid taking into account such an indicator as wear and tear.

In the event of a complete loss of the car, its value on the day of the accident is compensated within the limit. In the event of damage requiring repair, the calculation of costs for restoration of the vehicle submitted to the insurer is paid. You can also contact Rosgosstrakh with a request to pay for the services of a tow truck, calling a taxi to deliver the wounded, and the cost of storing a car in the parking lot. It is not a fact that these expenses will be approved, but if it can be proven that they were necessary, then there will be no problems.

With compensation for health damage, everything is much more complicated. There is a detailed Table of standards for payments for personal injury, which indicates different options for calculating money depending on the injury or illness received in an accident. The procedure for calculating compensation is regulated by Government Decree No. 1164.

For example, only disabled people of the first group and children with disabilities receive a maximum payment of up to 500 thousand rubles, while owners of other groups can count on compensation of up to 250-350 thousand rubles. For an ordinary concussion and resulting bruises, they can pay up to 15 thousand rubles, and for a broken nose - up to 50 thousand rubles.

The victim is also compensated for his lost earnings on the day of the accident, expenses for staying in a hospital or care in a clinic, the cost of medicines, medical nutrition, and recovery in a sanatorium. The regulations need to be carefully studied in order to understand what payments you are entitled to claim in connection with health damage.

Russian Union of Auto Insurers

If the claim concerns insurance under the international Green Card or OSAGO system, then you can use the help and support of RAS. You can file a complaint with the Union:

- To the Central Office by sending a letter to the address: 115093, Moscow, st. Lyusinovskaya, 27, building 3. To contact the regional division, you should be guided by the information www.autoins.ru/elektronnaya-priemnaya/. If the consumer forgets to submit one or more required documents, he should not count on RAS assistance.

- By email using the “Feedback” button. If possible, additional materials (photocopies, documents, calculations) that the client managed to collect should be attached to the document. They may be useful for RSA to study the circumstances and analyze the situation.

You can familiarize yourself with the procedure for submitting applications, the list of required documents and download the standard form on the Union website www.autoins.ru/ob-rsa/obratitsya-v-rsa/napravit-zhalobu-v-rsa/. But if the consumer submits an application in free form, he is unlikely to be denied assistance, especially if he can document the fact of serious violations on the part of the insurer.

Algorithm of actions

After an accident occurs, you need to immediately call the traffic police (if the accident is serious) and Rosgosstrakh. You can report an insured event not only by phone, but also by going to the insurer’s website in the “Notify about an insured event” section. The insurer offers a unique opportunity to report an accident online.

An application for an insurance event is written within five days. Another 15 days are given to collect papers and submit them to the company. Without documents confirming the fact of the accident and the damage caused, payment cannot be made. These deadlines are mandatory not only for Rosgosstrakh clients, but also for everyone else, since they are provided for by the relevant law.

A car that has been in an accident must be provided for inspection and examination. The results are documented in writing and signed by the insurer, the expert technician and the owner of the vehicle.

The insurer refuses to pay or part of it if the repair of the damaged property was carried out before the inspection and examination and does not allow reliably to establish the existence of an insured event and the amount of losses to be settled. Therefore, there is no need to rush to start repairs. It is better to coordinate your actions with the company as much as possible.

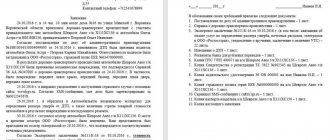

Refund Application

This is the first thing that is filled out after you arrive at the insurance company. There is a pre-approved form that you only need to fill out, indicating: contacts of the victim, date, place of the accident, cause, policy number (yours and someone else’s), bank details for the transfer. The application is signed personally by the victim or his beneficiary. A description of the circumstances of the accident, as well as the desired method of receiving compensation (for example, paying for repairs at a service station) must also be indicated.

You can find out more about the instructions for filling out an application for compulsory motor liability insurance at Rosgosstrakh insurance here.

Required documents

A package of documents is attached to the application. Their list depends on the type of damage caused. If after the accident there are no persons who have health problems, then, of course, there is no need to provide certificates from the clinic. And vice versa - if the victim received abrasions or bruises, but the car was not damaged, then calculating the costs of its repair and examination of the damage is not necessary.

The victim will be required to:

- Statement.

- Certificate of registration, VU.

- OSAGO policy.

- Certificate of road accident in the established form, notification of road accident (if required).

- Copy of the passport.

- A copy of the administrative violation protocol.

- Certificates from the clinic (if someone was injured), death certificate (in the event of the death of the victim).

- Certificate of income from work to determine compensation for temporary disability.

- Bank details.

All documents are compiled into a package and given to the insurer against signature. The insurer prepares an insured event report based on available documents, where it calculates the insurance payment.

If a decision is made to refuse, the victim is also informed about this within the prescribed time frame.

The insurance company is considered the largest in its segment in Russia. Today, its product list includes more than fifty items. Among them are the most popular insurance programs, and highly individualized ones, for the smallest but most demanding client.

In 2013, Rosgosstrakh once again confirmed its well-deserved place in the reliability rating of insurance companies. Currently they have A++ status, which means “exceptionally high level of reliability.” Credo. In each office, they will transparently tell you about the features of insurance products and select for you an individual option that is suitable only for you.

Communication with such a company is a pleasure, as it does not require much effort or sacrifice. Numerous offices allow you to avoid waiting in line among many similar clients. Registration occurs quickly and efficiently.

How to find out the amount?

Each insurer is guided by the uniform principles for calculating insurance compensation provided for by law and insurance rules. After submitting documents to Rosgosstrakh, you need to wait for an examination of the damage and the decision of the company, which will announce the final amount of payment, taking into account the amount of damage and existing limits.

A copy of the insured event report, which will indicate the amount of compensation for damage in the event of an accident, is given to the victim upon his written request within three days from the date of application. If you do not agree with the proposed amount, you have the right to appeal it in court.

Maximum indicator

The maximum limit in case of compensation for damage to life and health is half a million rubles.

No more than 400 thousand rubles can be returned to restore the car. If the accident was registered only with a notification (Euro protocol), then you will not be able to receive more than 100 thousand rubles.

Reviews about

The company rightfully occupies the highest positions in the ranking of the most reliable insurers in Russia. All paperwork is carried out in accordance with the laws of the country, the registration is quite transparent for clients, but there are still some technical difficulties in the work. reviews are very different. Payment cases without the burden of various additional details are quite easy and quick. Within twenty working days, insurance payments are credited to the account of the insured persons. The result leaves no one in doubt or controversial. But many people don’t like the registration process itself. The company should have opened more claims centers to reduce queues, wait times and customer inconvenience. Rosgosstrakh also received negative reviews for the number of documents that need to be provided. But here the legislation is most likely to blame, requiring so many confirmations from various authorities, and a huge number of scammers speculating on insurance payments.

Repair

According to the Insurance Rules of Rosgosstrakh, restoration costs for repairs are paid based on the average prices prevailing in the region, with the exception of cases where the victim receives compensation for the damage caused in kind (for example, providing him with a similar used car to replace the lost one).

When determining the amount of restoration costs, wear and tear of parts, assemblies and assemblies are taken into account, but not more than 50% of the cost.

Repair costs include:

- costs of materials and spare parts;

- to pay for the work of repairmen;

- costs of delivering materials and spare parts to the repair site (if we are talking about other property rather than a car).

The insurer does not pay additional costs for improving and modernizing the car. The choice of service station is made from among the stations offered by the insurer.

The deadline for completing repair work is determined by the service station itself in agreement with the victim.

What to prefer?

Recently, due to the increase in losses under compulsory motor liability insurance, insurers pay out money in hand extremely rarely. Basically, bills issued by a friendly service station where the victim's car is being repaired are paid.

If you were given a choice, then monetary compensation may be beneficial if:

- the amount of damage is minimal and everything was processed without involving the traffic police;

- You have an excellent service station in mind, where you have been doing repairs for several years.

If the damage is significant, and you don’t have time to communicate with the service station, then shifting all worries onto the shoulders of the insurer is more profitable. Usually in this case, repairs are carried out in a short time - up to a month (the service station does not have the right to delay) and without the need for control by the victim.

Which companies can I do this with?

A list of about three hundred service stations with which Rosgosstrakh cooperates is available on the company’s website in the “Questions and Answers” section. There is a table showing the name of the station, the region and the exact address where it is located, the maximum period of work, the brands of cars being repaired and the status of the organization (dealer or not).

For example, in the Moscow region you can get a referral for refurbishment at PeGas-Motors+, STC TechStar and many others.

Cost of restoration work

The cost is calculated based on the results of an examination of damage received in an accident and the Unified Methodology for Determining the Cost of Restoration Repairs, approved by the Regulations of the Central Bank. There is a specific formula for calculating costs, determining the value of the usable remains of the car, and the value of the car before the accident.

The price is determined on the date of the accident, taking into account the region of the Russian Federation and wear and tear of vehicle parts. It is quite difficult to make such calculations on your own, but if you wish, you can always do this by studying the formulas of the Unified Methodology.

The driver must read other information about the MTPL policy at Rosgosstrakh:

- the cost of an electronic car policy;

- insurance problems;

- OSAGO renewal online;

- checking the authenticity of the policy;

- how to correctly include a driver in your policy.