If the insurance company refuses to pay, or you receive less than you should, go to court. But first, be sure to send a pre-trial claim to the insurer.

Important! When filing a pre-trial claim under MTPL, use additional leverage over the insurance company.

You can contact:

- to the Russian Union of Auto Insurers (file a complaint);

- to the Bank of Russia (file a complaint);

- to the territorial department of Rospotrebnadzor.

What do you need to know about the claim procedure in order to receive a decent insurance payment and additional monetary compensation?

Why write a pre-trial claim under OSAGO

Since 2014, compliance with the pre-trial procedure for resolving disputes under compulsory motor liability insurance is mandatory by force of law (Article 16.1 No. 40-FZ). If you go to court immediately, the claim will not be considered.

Therefore, we write a complaint on any controversial issue. In particular, when the insurance company:

- refuses to pay or reduces the amount of insurance payment;

- violates payment deadlines;

- performs poor-quality repairs;

- attracts “its” experts and appraisers, which influences the results of the examination;

- makes incorrect calculations (bonus-malus coefficient, insurance amount);

- imposes additional services, etc.

But: writing a claim does not mean simply observing a formality. If the insurer voluntarily does not comply with the requirements, then you, as a consumer, will be able to recover through the court a fine in the amount of 50% of the amount assigned for collection (clause 6, article 13 of the Law on the Protection of Consumer Rights No. 2300).

That is, if the court awards 100,000 rubles in your favor, you will receive 150,000 rubles. The only thing you will need is evidence that you submitted the claim correctly (more on this later).

What other compensation can you demand?

In a pre-trial claim to an insurance company under compulsory motor liability insurance, you can demand payment (compensation):

- vehicle repair costs;

- loss of market value;

- tow truck services;

- road workers services;

- storage services for damaged vehicles;

- the cost of repairing road signs and fences;

- transporting victims to hospital;

- cost of examination,

as well as other expenses that arose in connection with the occurrence of an insured event (clause 50 of the Resolution of the Plenum of the Supreme Court No. 58).

Delay in fulfilling obligations under the MTPL agreement by the insurance company is compensated by a penalty in the amount of:

- 1% of the due payment amount;

- 0.5% of the repair cost for each day of delay.

We begin to count the days of delay: in the first case, from the 21st day, in the second, from the 31st day from the date when the insurance company received your application for insurance payment (repairs).

Additionally, you can only demand monetary compensation for moral damage and a consumer fine of 50% in court.

Information on vehicle technical inspection.

When concluding an MTPL agreement, the policyholder is required to have a diagnostic card containing information on the vehicle’s compliance with mandatory vehicle safety requirements (except for cases where, in accordance with the legislation in the field of technical inspection of vehicles, the vehicle is not subject to technical inspection or its implementation is not required, or the procedure and frequency of technical inspection are established by the Government of the Russian Federation, or the frequency of technical inspection of such a vehicle is six months, as well as cases provided for in paragraph 3 of Article 10 of the Federal Law of April 25, 2002 No. 40-FZ “On compulsory insurance of civil liability of owners Vehicle").

Information about the validity of the diagnostic card (DC) and the timing of the technical inspection (TI), the next technical inspection is checked by the insurer automatically in the State Traffic Safety Inspectorate database.

You can find detailed information about the need to provide a DC, the timing of maintenance and the validity period of the DC in the table below.

ATTENTION!

- Passenger vehicles of categories “B”, “BE”, as well as motorcycles, mopeds and light quadricycles (vehicles of categories “A”, “M”) are exempt from mandatory maintenance in the first 4 years of operation, including the year of manufacture of the vehicle specified in the PTS , as a full year of operation, regardless of the date and year of issue of the PTS or the acquisition of such a vehicle by its first owner. Moreover, at the end of the 4-year period from the date of release of the vehicle, taking into account the year of manufacture, i.e. as early as January 1 of the next 5th year, using a vehicle without a valid diagnostic card is not allowed! Thus, the mandatory technical inspection must be carried out in the previous year, i.e. before the end of the 4-year period from the date of issue of the vehicle, taking into account the year of issue according to the title.

- Trucks of categories “C” and “CE” are exempt from undergoing maintenance only during the year specified in the PTS as the year the vehicle was produced, without taking into account the date of acquisition of the vehicle by its first owner.

Example. The year of manufacture of a category “C” cargo vehicle according to the PTS is 2021. The PTS was issued on December 12, 2020. The vehicle was purchased from the manufacturer or a car dealership in January 2021. A valid diagnostic card was not required until December 31, 2020 inclusive. However, the use of such a cargo vehicle is not permitted from January 1, 2021. Thus, when purchasing a cargo vehicle in 2021, the car owner is required to enter into a MTPL agreement for the period of travel to the place of technical inspection for 20 calendar days (a valid registration certificate is not required). After passing a technical inspection and issuing a registration certificate, the car owner is obliged to enter into a compulsory motor liability insurance contract with an insurance period of 1 year. It is allowed to register a vehicle with the traffic police (if other required documents are available) only if you have an annual MTPL policy.

How to correctly write a pre-trial claim under OSAGO

The requirements for a claim under compulsory motor liability insurance are described in detail in clause 5.1 of Chapter 5 of Bank of Russia Regulation No. 431-P.

A pre-trial claim to an insurance company under compulsory motor liability insurance must include:

- name and address of the insurer's company;

- Full name, address, bank account details of the victim (beneficiary);

- detailed requirements for the insurer with links to legislative norms and evidence from the list of appendices;

- Full name of the sender, position (if the claim is sent by a legal entity), signature;

- list of applications.

All your rights and claims must be supported by evidence. The claim must be accompanied by originals or certified copies of: the applicant’s passport, vehicle title document (PTS), MTPL policy. expert opinion, etc.

Important! The main thing is not to miss anything, otherwise the insurance company will ignore the claim, and the court will consider the pre-trial procedure not to be followed and refuse to collect a consumer fine of 50% of the amount assigned to be collected in your favor.

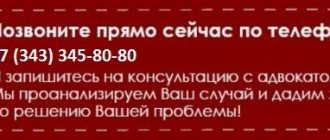

If you need help, we will help you correctly write a claim under MTPL and collect all the necessary documents (evidence).

What is an application for compulsory motor liability insurance?

OSAGO is a formal name; it is popularly referred to as “motor citizen”. Absolutely all vehicle drivers are required to have such an insurance policy, and the legislation of the Russian Federation also requires this.

The main object of compulsory motor liability insurance is the property interest of the car owner. This interest may be affected in situations where, with the help of a vehicle, the owner of the policy caused damage to the property or health of another participant in the accident. In this case, the driver is obliged to compensate for the damage caused. The amount of money for compensation is provided by OSAGO, since the driver who caused the damage regularly made monetary contributions to the insurance policy.

The MTPL policy is considered to provide certain protection for the victim in an accident and for the driver of the vehicle. This is the main reason that every car owner is required to have such a document, and driving onto the road without it is prohibited. If the driver is stopped by a traffic police inspector and determines that the owner of the car has not taken out an insurance policy, the inspector will fine the driver in accordance with the current law of the Russian Federation.

If the driver caused an accident and crashed another car, the insurance policy will not reimburse the costs, but if the car of a driver with an insurance policy is crashed, OSAGO will fully compensate for the damage.

How to direct?

You can submit a claim using any method as long as it allows you to confirm delivery. The most reliable option is by registered mail with a list of attachments and acknowledgment of delivery.

You can take it personally to the office of the insurance company.

It is not necessary to contact the exact branch where the contract was drawn up. Contact the closest one to you, but provide information about previous requests (clause 22 of PP No. 58).

Be sure to ensure that the acceptance mark is given by an authorized person. If this is not the director, ask to see a power of attorney for the right to receive incoming documents.

The claim can be sent by e-mail if such a possibility is specified in detail in the contract. For example, a claim to Rosgosstrakh can be sent by e-mail

Important! The sender must prove that the message was sent and delivered (clause 67 of the Resolution of the Plenum of the Supreme Court No. 25).

The Supreme Court in one of the cases on compulsory motor liability insurance found that the pre-trial procedure was not complied with, although the plaintiff sent the claim to the address indicated in the Unified State Register of Legal Entities. Russian Post sent the letter back to the sender 9 days from the date it arrived at the post office, even before the letter’s storage period expired (30 days). And a month later the plaintiff received it. The plaintiff did not provide evidence to the court that the insurance company avoided receiving correspondence.

Errors when filling out an application for compulsory motor liability insurance

Before you put your signature on the MTPL policy. It should be double-checked carefully, as attentiveness will protect the owner. The list of acceptable mistakes and possible deception is quite long:

- the insurer may enter incorrect vehicle data;

- incorrect term and period of insurance;

- in the list of those allowed to drive a vehicle, the initials of the owner must be indicated, because if this is not done, in the event of an accident, the insurance company will not compensate for the damage;

- If inaccurate data was entered when filling out the policy, quite serious consequences may arise. In this case, the owner will have to independently correct the mistakes made and prove that the mistake was made by an agent of the insurance company; otherwise, the insurance company will refuse to pay damages after an accident. The insurance company may also bring charges of fraud;

- One of the most common mistakes an owner makes is purchasing a fake insurance policy. This can lead to quite lengthy discussions with the traffic police officer. To prevent this, you need to carefully study the policy to ensure that there are all the necessary degrees of protection, stamps, signs;

- No corrections are allowed in the application for compulsory motor liability insurance. You should not believe the statements of some agents who assure that changes are permissible - no, it is absolutely impossible to correct the document. If an IC employee makes a mistake, he is obliged to issue a new document.

How long should I wait for an answer?

If within 10 days from the receipt of the claim by the insurer, payments have not been received into your account, you can go to court.

But in general, it’s better to wait a month: until the letter arrives, until it is received (up to 30 days correspondence is stored - track the movement of the letter on the Russian Post website using the track number), then 10 days for a response and 3-5 (sometimes more) days for delivery of a letter from the insurance company.

If you take it personally, then wait 10 days, and you can go for an answer.

A written refusal, partial payment, ignoring a claim - all this is a reason to go to court to protect your rights and recover all due monetary compensation.

"Theft, theft"

If there has been a theft of a vehicle, its individual parts, components, assemblies, assemblies or additional equipment (qualified in accordance with the legislation of the Russian Federation)

What to do?

- If individual parts are stolen, try to ensure the continued safety of the car, do not leave it unattended, and do not destroy possible evidence of malicious actions.

- Call the police: 020 – for Megafon, Tele2, Rostelecom subscribers; 102 – MTS; 002 - Beeline. The single emergency number is 112 (for all operators). The call is possible with a zero balance.

- Write a statement to the police department at the place of the theft.

- Call the 24-hour SOGAZ contact center at 8 (800) 333-0-888 to register the event and coordinate further actions. If it is more convenient for you to use the Internet, fill out the insurance event notification form on the website.

- If the insured event occurred far from the place where the insurance contract was concluded, record the damaged property in photographs, contact authorized expert organizations for an inspection and calculation of damage.

The notification period for theft (theft) is 2 business days from the moment of discovery (unless otherwise provided by the insurance contract).

Documents required to receive insurance payment:

- An identification document of the insured, or a notarized power of attorney for his representative;

- A set of documents issued upon concluding a comprehensive insurance agreement: application for insurance;

- insurance policy or insurance contract;

- additional agreement to the policy or insurance contract (if drawn up);

- receipt for payment of insurance premium;

- certificate of inspection of the vehicle when it was accepted for insurance (if an inspection was carried out).

- PTS;

- in case of theft (hijacking): a certificate from the Department of Internal Affairs confirming the fact of the complaint regarding the loss of the vehicle, indicating the date and time of the complaint;

- a certificate from the Department of Internal Affairs in form No. 3, confirming the fact of the complaint regarding illegal actions of third parties, indicating the stolen and/or damaged parts, components, units, assemblies, additional equipment of the vehicle, the perpetrators, if identified, and/or a copy of the decision on initiation of a criminal case (or refusal to initiate) indicating an article of the Criminal Code of the Russian Federation.

It is necessary to submit to SOGAZ standard sets of keys and key fobs for the vehicle, as well as keys and key fobs for additionally installed anti-theft devices and search systems in the quantity specified in the insurance contract or application for insurance.

If documents for the car, keys and key fobs are seized for inclusion in the criminal case materials, attach a supporting document from the police department.