When the case of overdue debts comes to the bailiffs, it is clear that since a person did not pay the debt before, then now there is nothing special to pay it with. Therefore, many debtors are interested in whether it is possible to agree with the bailiffs on an installment plan based on the writ of execution.

Installment is the distribution of the debt amount into equal payments. This repayment option is beneficial to the debtor, especially if the monthly payment amount is small and, most importantly, corresponds to earnings. To extend the payment of debt in installments, you need to justify such a request, prove a difficult life situation, or provide other valid reasons.

But the essence of the installment plan for the debtor is that the creditor gives him the opportunity to make payments that are feasible for his budget for quite a long time. Of course, any lender - be it a bank, microfinance organization or an individual - would choose the option for the debtor to return the funds in full and in a single payment. Just to get your money back and forget about the unpleasant situation.

But the debtor is in a difficult situation and cannot return all the money “en masse.” His task is to stretch out the repayment of the debt and protect himself so as not to die of hunger.

Therefore, installment payments are always a search for a compromise between the “want” of the creditor and the “can” of the debtor.

What is installment execution of a decision?

Installment of execution of a court decision means that the requirements contained in the writ of execution will be fulfilled in parts, step by step, within the time limits established by the court. To provide an installment plan under a judicial act, you must submit a petition according to our sample. And precisely to the court, and not to the bailiff. If we are not talking about a judicial act, the interested person submits a petition to the body (official) that adopted the relevant act.

The court may grant an installment plan due to the difficult financial situation of the defendant, which does not allow him to pay the entire amount awarded by the court in a lump sum. But there must be conditions when the debtor can pay the amount in equal parts, for example, monthly.

When applying for an installment plan, it is necessary to take into account that the court will strive to maintain a balance of interests of the creditor and the debtor. In any case, the decision must be executed within a reasonable time. Therefore, installment plans for more than 1-1.5 years are practically not used. Therefore, the maximum period for granting an installment plan for the execution of a court decision is 1.5 years. This should be taken into account when drawing up an application, because it must be justified. We advise you to write a maximum period of 1.5 years, and count on a period of no more than 1 year.

It is necessary to distinguish between requirements for granting installment plans and deferment of execution of a court decision. These actions have similar beginnings, but have different consequences.

Evidence of the difficulty of executing a judicial act.

The debtor must prove to the court that it is difficult or impossible to comply with the court decision. The main criterion, of course, is a difficult financial situation. You can provide the court with a salary certificate or income statement, which will clearly show your low earnings. You should also provide the court with documents confirming the absence of movable and immovable property that can be seized for the sale and repayment of debt.

Thus, one of the court decisions denied the applicant an installment plan due to the fact that he did not provide the court with evidence of the absence of property in his ownership, which, according to the Federal Law “On Enforcement Proceedings” dated 02.10.2007 N 229-FZ, can be recovered for his subsequent sale or transferred to the claimant.

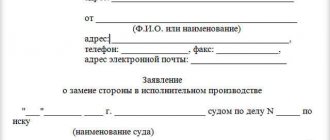

How to draw up an application for installment execution of a court decision

The application for installment plan is drawn up in free form according to the sample below. The document must contain information about the applicant, the court decision, and the grounds for granting installment plans. As grounds, you need to indicate your financial situation, that is, indicate your average monthly income and expenses. To calculate income, it is better to take average income for 1 year. If income has decreased recently, you need to indicate the amount taking into account the reduced income. To justify expenses, the cost of living and the presence of dependents (minor children, elderly parents) should be taken into account.

You should not base the deferment requirement on the presence of a large number of credit obligations or debts under other executive documents. In this case, the court will not give preference to some creditors over others.

Is it possible to influence the method and procedure for collection?

In some cases, this is indeed allowed, although the bailiff has the right to determine the list of enforcement actions and interim measures.

In addition to installments and deferment of payments, the debtor can:

- submit documents about your place of work or other source of income so that the bailiff begins withholding in the amount of 50% or 70%;

- submit an application to change the list of seized property (for example, you can ask to transfer jewelry to seizure in order to lift the ban on registration of a car);

- petition for the independent sale of property in order to pay off the claimant.

An installment plan under a writ of execution is a period when you can legally avoid paying debts.

Installment plans can only be obtained through the court. The bailiff has the right to postpone enforcement actions for 10 days. Also, executive holidays are issued through the FSSP, which can only be used by debtor-pensioners.

The listed options can be used as an alternative to deferment or installment plans, or simultaneously. We recommend that you consult with an attorney before taking any action. In the most difficult situations, you can give a lawyer a power of attorney to conduct business.

What documents are needed for installment plan

To the application for granting an installment plan for the execution of a court decision, the applicant must attach documents that confirm their financial situation. And evidence that the obligation can be fulfilled in parts. Such evidence includes certificates of the amount of earnings or other income that is paid in periodic payments.

You can attach the children's birth certificate or a guardianship order as proof of expenses. You can attach receipts for expensive treatment and other documents.

In general, the list of documents for installment payment is not established anywhere. Considering the arguments presented in the application, attach supporting documents. That is, each justification for the installment plan must be documented. Talk about income - attach a certificate confirming it. Talk about expenses - attach the relevant documents. It is clear that there is no point in confirming, for example, expenses for food, clothing and other daily needs. These expenses are covered by the concept of a living wage. It is necessary to confirm the individual expenses that are unique to you personally.

Submission deadlines

The debtor's petition must be sent within 10 days after the court decision is made. The authority can review the document within 30 days from the date of application.

In the Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 17, 2015 N 50, the maximum and minimum installment periods are not specified. The resolution speaks of a reasonable time frame for the execution of a judicial act, but, as judicial practice shows, you should not count on more than a year. The defendant himself or his lawyer or representative can apply.

Consideration by the court of the issue of installment decision

The debtor's lack of funds to execute the court decision is not a basis for granting an installment plan. In this case, the bailiff has the right to foreclose on the defendant’s property. After all, execution of a court decision is possible through the sale of this property.

An application for an installment plan is considered by the court that made the decision in the case. An application for installment plan is not paid with state duty. As a general rule, the court considers the application without a court hearing or summoning the parties. However, the court has the right to schedule a meeting and notify the participants (this most often happens). But the appearance of the parties at the consideration of the application in such cases is not obligatory. All persons who took part in the case are indicated as interested parties. In addition, a bailiff.

An application for installment payment is submitted to the court in free form; there are no special requirements for its content. However, when submitting an application, we recommend that you adhere to the template posted on the website.

How to negotiate with bailiffs: what is possible and what is not

It all depends on what you mean by “agree.” The bailiff does not receive any personal benefit from the collection and cannot be interested in the outcome of the case. If you try to “solve the issue” with money or by promising benefits in favor of the bailiff, you may be prosecuted for giving a bribe.

Pressing for pity is also useless. Each FSSP specialist simultaneously has dozens and hundreds of collection cases in progress. For each of them, it is necessary to carry out painstaking work to find the defaulters and their property, and force the debtors to pay the collector. Instead of useless persuasion or deliberately illegal actions, it is better to use the provisions of Law No. 229-FZ. Read more about this below.

Deferment of execution

Deferment is a period of time during which the debtor may not pay the debtor.

The bailiff can only delay enforcement actions for up to 10 days if such a request is submitted by the debtor. But the FSSP specialist is not obliged to give such a deferment.

For example, during an urgent business trip, the debtor cannot be personally present during the inspection and seizure of property, therefore he has the right to request a postponement of this procedure.

Officially deferring debt payments can only be done through the court that made the decision. When submitting an application, you must indicate valid reasons for postponing the deadline. For example, you can ask for a deferment while you are in hospital if the debtor is undergoing a complex operation. The judge will determine the exact period of deferment based on the evidence presented. In practice, courts rarely grant more than 4-6 months of deferment.

How to get an installment plan for a writ of execution from bailiffs

There is no way to get an installment plan for a writ of execution from the bailiff service.

FSSP specialists simply do not have the right to provide installment plans. All they can do is determine the percentage of withholding when sending documents to the debtor's place of work or to the bank. Therefore, it makes no sense to submit an application and try to pay off the debt through the bailiff.

Installment payment through the court

In any enforcement proceeding there is a very good chance to settle debts through the court. The fact is that the creditor can also receive certain benefits from the installment plan. When considering the application, the judge will check whether the debtor has a real chance of paying certain amounts each month. If there is such an opportunity, the claimant is guaranteed to receive his money, even if not in a lump sum.

We would like to repeat once again - you need to ask the court (and seek to make such a decision) to order payments to pay off the debt in an amount that will be feasible for the debtor. So that with the funds remaining to him he could support his life - and his family.

You can ask the court to install the debt at any stage of the proceedings. The algorithm of actions is as follows:

- you need to prepare evidence confirming the grounds for the installment plan;

- it is necessary to fill out an application, make correct references to evidence and legal norms;

- you need to submit documents to the court that made the decision to collect the debt.

It is advisable to personally take part in the consideration of the application, justify your request and convince that the evidence in your case is extremely serious. The claimant has the right to present his objections, which may influence the court's decision.

If the court agrees with your arguments, it will issue a ruling to grant an installment plan. The document will indicate the period of time during which you can avoid paying your debts. Please note that you can apply for installments several times. At the same time, for each new application you need to re-prove the validity of the reasons why you cannot pay the debtor at once. Automatic extension of the installment plan is not allowed.

What to indicate in an application for installment plan

It depends on the application and the evidence provided whether you will be able to pay off your debts in installments.

The application must indicate:

- your data, information about the claimant;

- details of the FSSP proceedings (number, date of initiation);

- basic information about the court decision and the writ of execution for debt collection;

- a reference to the valid circumstances for which you are asking to install the debt;

- the period of time you request for installments;

- asking the court to release you from payments;

- signature, date.

An application for an installment plan can also be submitted by the bailiff leading the case. In practice, this is extremely rare, since only the debtor is directly interested in changing the terms of collection.

The application must indicate and justify the exact reasons why you are asking for an installment plan. Such circumstances may be:

- severe and/or long-term illness, including hospitalization;

- dismissal from work (for example, due to reduction, liquidation);

- reduction in earnings, if this is not related to your guilty actions;

- disability or temporary incapacity for work;

- the appearance of new dependents in the family (for example, the birth of a child);

- other circumstances confirming the deterioration of the financial situation and the temporary inability to pay debts.

For example, you lived an ordinary life, rented an apartment, but did not have your own corner. A relative of yours died and left you his apartment in his will. This apartment may become your only home.But the inheritance is burdened with debts - for example, before his death the person took out a loan, and also did not pay for utilities - well, he did not have the funds for this. It happens.

And now you enter into an inheritance, and creditors come to you. And they demand to sell the apartment to pay off the debt. Don't agree right away! Ask the court for an installment plan and to establish payments that are feasible for your financial situation.

All of the above circumstances must be supported by documents. For example, this could be the conclusion of a medical and social examination (MSE) or extracts from the register of disability, a certificate from the employment center (CPE) about registration for unemployment, a child’s birth certificate, and other documents.

Settlement agreement with the claimant

This option is allowed by Law No. 229-FZ, but is extremely rare. The claimant is unlikely to agree to formalize a settlement agreement and withdraw documents from the FSSP, even if the debtor guarantees voluntary payments. If you manage to reach an agreement, the settlement agreement must be submitted to the court for approval. And you must not violate its terms.

The bailiff does not have the right to make decisions on such issues himself. If the agreement is approved, the FSSP specialist will complete the case, return the documents to the claimant, and stop enforcement actions.

Executive holidays

This is a special installment option that can be provided by the bailiff himself. Executive holidays were introduced in 2021 as a support measure due to the coronavirus pandemic. Only debtor pensioners can receive an installment plan if their income does not exceed two subsistence minimums.

General conditions for granting holidays:

- Installment plans are provided only for credit debts in the amount of up to 1 million rubles;

- the maximum duration of the vacation is 24 months;

- the debtor-pensioner is obliged to submit an application and payment schedule to the FSSP.

The entire amount of debt in the schedule is divided by the number of months of installments. In most cases, this is less profitable than monthly deductions of 50% from the pension.

For example, with a debt amount of 1 million rubles. and a vacation period of 24 months, the debtor will have to pay more than 41 thousand rubles monthly. Agree that the amount of deductions from your pension will always be much less. Therefore, only a few debtors took advantage of executive holidays.

Sample application for installment execution of a court decision

In ____________________________ (name of court) Claimant: ___________________________ (full name, address)

Debtor: __________________

(full name, address) Interested parties: ___________ (full name, address)

Bailiff: _________________

(full name, address of the bailiff department) in civil case No. __________

Application for installment plan for execution of a court decision

“___”_________ ____ a court decision (ruling) was made on the claim of _____________ (full name of the plaintiff) to _____________ (full name of the defendant) about _____________________ (essence of the decision). Based on the writ of execution, bailiff _________ (full name) initiated enforcement proceedings No. __________ dated “___” ________ _____.

Currently, executing a decision at a time is difficult for the debtor because: _________ (give existing circumstances that make it difficult to execute a court decision at a time). I consider it reasonable and in the interests of the parties to execute the decision in parts, in installments, according to the following schedule: _________ (give a payment schedule, indicating dates and amounts, you can indicate monthly payments). _________ (give reasons to establish an installment plan).

Based on the above, guided by Articles 203, 434 of the Civil Procedure Code of the Russian Federation,

Ask:

- Provide an installment plan for the execution of a court decision on the claim of ________ (full name of the plaintiff) to ________ (full name of the defendant) about ________ (essence of the decision) in the following order: ________ (indicate when, what amounts will be paid).

List of documents attached to the application:

- Notification of sending (delivery) a copy of the application to the participants in the case

- Evidence of the existence of grounds for installment plan

Date of application “___”_________ ____ Signature _______

applications: Application for installment execution of a court decision

Debt repayment schedule.

It is worth noting that the courts are more willing to decide to grant an installment plan if the applicant - the debtor attaches an adequate debt repayment schedule to the application. It is not enough to simply express to the court your willingness and ability to pay in equal parts in a certain amount until full repayment. A specific payment schedule should be drawn up with payments to be made over a reasonable period .

Example.

The debtor is obliged to pay 76 thousand rubles (debt for housing and communal services). He doesn’t have that kind of money, there’s no one to borrow from. When applying to the court for an installment plan, the debtor attaches a detailed debt repayment schedule in the following order.

From February 2021 to November 2021 in the amount of 6920 rubles, and in December 2021 - 6800 rubles. Payment will be made before the 15th of the current month.

For how long can I ask for an installment plan?

Consideration of the feasibility of granting installment plans is the prerogative of the court. It takes into account not only the interest of the debtor, but also maintains a balance of interests with the claimant, who often does not want to wait a long time until the funds awarded to him are paid in installments. Therefore, the installment period rarely exceeds 1 year, although in practice it can reach up to one and a half years.

Lawyers advise in the claim to indicate the maximum possible installment period - one and a half years. If there is a successful combination of circumstances and a reasoned statement confirming the impossibility of repaying the debt at once, the court may grant the petition and postpone it for the required period. In most cases, the period is significantly reduced, to 3–12 months. Such a reduction stimulates the debtor to search for additional sources of income and does not put the claimant at a disadvantage, who is forced to wait for the return of money after a successful trial.

This you need to know: Reducing enforcement fees from bailiffs

Applications for deferment and installment payment of a court decision - what is the difference

Consonant procedural actions are not equivalent in content.

Installment plan does not suspend the order of execution of the decision, it only changes the amount of payments and the time during which the debtor must repay the debt.

Postponement – completely suspends the execution of the decision, but does not change the amount of the debt. Upon expiration of the deferment period, the debtor is obliged to pay off the debt in full, and not in parts, as in the first case.

Hotline for citizen consultations: 8-804-333-70-30

Related documents

- Application form to the Pension Fund for choosing a pension delivery method

- Complaint to the prosecutor's office about mandatory fees at school

- Application for provision of materials of enforcement proceedings for review to the bailiff department of the FSSP

- Sample application for holding a public event (rally)

- Supervisory appeal against a federal court decision (provided by Krasnova’s lawyer)

- Statement by a citizen of intention to become a member of a housing association of owners

- Application for the appointment of a guardian over the person and property of an incapacitated citizen

- Application for change of surname, name, patronymic

- Statement of confirmation of fact

- Statement of confirmation of fact

- Application for leaving a collective farm (state farm) to organize a peasant farm, a private individual enterprise (appendix to the regulations on the commission for the privatization of land and reorganization of a collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Application for provision of land

- Application for withdrawal from members of a collective farm (state farm) in connection with the organization of a peasant (farm) enterprise

- Sample. Application for renaming a phone number in connection with the exchange (purchase, receipt) of an apartment

- Sample. Application for installation, renaming, temporary renaming for the duration of the apartment rental, telephone relocation

- Sample. Application for amendments to the civil status record

- Sample. Application to include information about the father in the birth record

- Sample. Application for marriage

- Sample. Application for marriage

- Sample. Application for voluntary recognition of paternity (at the request of the child’s father)

- Sample. Application for voluntary recognition of paternity (on a joint application of the parents)

- Sample. Application for the appointment of a guardian over the person and property of an incapacitated citizen

- Sample. Application for change of surname, name, patronymic

- Sample. Application for adoption

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Application for installment execution of a court decision”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Found documents on the topic “reasons for installment plans according to the 2018 writ of execution”

- Application for an installment plan for the execution of a court decision Statements from citizens → Application for an installment plan for the execution of a court decision

the reason at the same time and within the established period . based on the above and in accordance with Art. 37 of the Federal Law “On Enforcement Proceedings”... - Sample. The act of declaring a severe reprimand for absenteeism without excuse reasons

Employment agreement, contract → Sample. The act of declaring a severe reprimand for absenteeism without good reason...om director of Elekkom LLC dated December 26, 1997 on the announcement of no. K. Poluyarov received a severe reprimand for absenteeism without good reason on December 25, 1997. K. Poluyarov refused to give a receipt indicating that he had read the order. Master of Klyuev N. And. driver jan...

- Car purchase and sale agreement with installments payment (between individuals)

Property purchase and sale agreement → Car purchase and sale agreement with installment payment (between individuals)... to the buyer the losses incurred by him. 3.2. The seller is responsible for defects in the goods that arose before its transfer to the buyer or for reasons that arose before that moment. 3.3. in case of delay in the next payment under the contract, the buyer pays a penalty to the seller...

- Agreement for the sale of goods with installments payment

Property purchase and sale agreement → Goods purchase and sale agreement with installment paymentcontract for the purchase and sale of goods (with installment payment) "" 20, hereinafter referred to as the “seller”, represented by the acting…

- Agreement for the purchase and sale of goods with the condition of payment in installments

Agreement for the purchase and sale of property → Agreement for the purchase and sale of goods with the condition of payment in installmentsagreement for the purchase and sale of goods with the condition of payment in installments “” 20 (locality), hereinafter referred to as the “seller”, represented by the acting…

- Packing list

Contract for the carriage of goods and passengers → Packing listPACKING LIST No. PORT Name of the ship B/L No Designation +-+ PackingQuantity NAME OF GO

- Agreement for the sale and purchase of an apartment with installments payment

Real estate purchase and sale agreement → Apartment purchase and sale agreement with installment paymentagreement for the sale and purchase of an apartment with installment payment "" 20 we, gr. , (full full name) residing at the address:, passport...

- Sample. Loose sheet 2 to statement No. 7

Accounting statements, accounting → Sample. Loose sheet 2 to statement No. 7Loose sheet 2 to statement No. 7 Analytical data on accounts No. 06, No. 58 +-+ Financial object Type Term Amounts

- Book of registration of personal accounts of shareholders. Sheet 1

Documents of the enterprise's office work → Book of registration of personal accounts of shareholders. Sheet 1BOOK OF REGISTRATION OF PERSONAL ACCOUNTS OF SHAREHOLDERS sheet 1. +-+ number Full name. (name-series, number issued by Address Where Payments Dr.

- Transfer Deed to the Apartment Sale and Purchase Agreement (with installments payment)

Real estate purchase and sale agreement → Transfer Deed to the apartment purchase and sale agreement (with installment payment)agreement for the purchase and sale of an apartment with installment payment (name of locality) (day, month, year in words) we, gr. , residing by (full name, gender...

- Book of registration of personal accounts of shareholders. Sheet 3

Documents of the enterprise's office work → Book of registration of personal accounts of shareholders. Sheet 3REGISTRATION BOOK OF SHAREHOLDERS' PERSONAL ACCOUNTS sheet 3. +-+ number encumbered quantity number date size of the personal obligation

- Sample. Loose sheet 3 to statement No. 7

Accounting statements, accounting → Sample. Loose sheet 3 to statement No. 7Loose sheet 3 to statement No. 7 Analytical data on accounts No. 09, No. 97 +-+ Lease agreement and name

- Order - selection sheet (Unified form N TORG-8)

Enterprise records management documents → Order - selection sheet (Unified form N TORG-8)The document “Order - selection sheet (Unified form N TORG-8)” in Excel format can be obtained from the link &q

- Bus waybill (Standard intersectoral form N 6)

Enterprise records management documents → Bus waybill (Standard interindustry form N 6)The document “Bus Waybill (Standard Interindustry Form N 6)” in Excel format can be obtained from the link &qu

- Inspection sheet for construction readiness of residential premises

Construction contract, construction contract → Inspection sheet for construction readiness of residential premisesINSPECTION SHEET for the construction readiness of the residential premises "" 20 I, , dolshi