Why are they selling an apartment that has a mortgage?

If the apartment was transferred to the bank through the court because the owner owed a loan, then the financial institution sells it through a public auction. When the owner himself decides to sell the property as collateral, potential buyers may be suspicious. Mortgages have a reputation for slavery, the shackles of which can only be thrown off with the final payment. If a person sells an apartment, something is wrong either with him or with the housing, some believe.

In fact, there could be a million reasons. The owner decided to move to another city for work or to a larger apartment due to an addition to the family. The couple is getting divorced, wants to pay off the debt and divide the money for the mortgaged apartment. The borrower’s financial circumstances have changed, he is unable to cope with the loan and wants to repay it before the situation becomes irreparable.

Of course, the reason could also be something unpleasant: the roof is leaking, there is a drug den in the entrance, and the management company collects so much money that it’s as if it were sprinkling the sidewalks with Swarovski crystals in winter. But you are not insured against such risks even when buying an apartment without a mortgage - you just need to check everything.

Now in Russia, almost half of the share of mortgage transactions with housing in Russia is named, transactions with real estate involve mortgages. So there will be more apartments encumbered with collateral on the market.

Is it possible to buy an apartment with a mortgage encumbrance?

Mortgage is one of the most common types of encumbrance. It is possible to purchase such an apartment. However, you need to understand that until the debt is fully repaid, the apartment will be pledged to the credit institution.

A note indicating that the apartment is encumbered is indicated in the extract from the Unified State Register of Real Estate (Article 11 of Federal Law No. 102).

A special feature of the transaction is that permission to sell the apartment can only be given by the bank in which the mortgage was issued (Article 37 of Federal Law No. 102).

There are some advantages to purchasing an apartment with an encumbrance (mortgage):

- the cost of the property will be cheaper compared to similar real estate on the market due to the presence of an encumbrance;

- the bank's participation in the transaction guarantees the absence of a fraudulent scheme.

However, there are certain risks when purchasing real estate with encumbrances.

How to buy an apartment encumbered with collateral

Depending on the conditions, you can buy an apartment in different ways.

With mortgage repayment during the transaction

Conditions: the transaction is carried out with the consent of the bank in which the current owner took out a mortgage; The buyer purchases the property for cash.

The safest scheme. It protects all parties to the transaction: the buyer, the seller, and the bank. Let's look at an example.

An apartment is put up for sale for 3 million rubles. The bank agrees to the transaction and determines the amount of the remaining debt - 500 thousand rubles. Two cells are used for calculations. Before signing the purchase and sale agreement, the buyer’s money is deposited in them: 500 thousand in one and 2.5 million in the other.

The documents for the boxes indicate who can pick up the bills and when. If the purchase and sale agreement is signed and the transfer of ownership is registered in Rosreestr, the bank will be able to withdraw its 500 thousand from one cell, the seller - 2.5 million from the second, and the buyer - the mortgage to remove the encumbrance. If the deal falls through, the buyer will return his funds, and nothing will change for the rest.

Sometimes funds for a loan may be deposited not through a cell, but directly to the bank, but the financial institution is in any case actively involved in the process.

With assignment of debt

Conditions: the transaction is carried out with the consent of the bank, the buyer purchases housing with a mortgage from the same bank.

The buyer submits a mortgage application to the bank, as if buying any apartment. The approval process will be similar and take about the same amount of time. Since he will be the borrower during the purchase, the financial institution will check his solvency and decide whether he is ready to see him as a client.

Here, in addition to the purchase and sale agreement, an agreement on the assignment of rights of claims under the old loan or a new loan agreement is concluded between the bank and the buyer. The encumbrance in Rosreestr is removed and a new one is imposed with the registration of the rights of the next owner.

Tatiana Trofimenko

Leading lawyer of the European Legal Service

This scheme is also quite safe.

With early repayment of the mortgage at the expense of the buyer

Conditions: the bank does not agree to sell the apartment, the buyer purchases the property for cash. Or the buyer gets a loan from another bank.

In this case, the loan is repaid by the buyer. Accordingly, he must have on hand an amount equal to the balance of the debt. The parties enter into a preliminary agreement for the purchase and sale of an apartment, under which money is transferred to the seller to close the mortgage. Then the encumbrance is removed from the apartment, and then the housing is sold as real estate without collateral.

This option is more risky for the buyer, since the money is transferred under an agreement that is not subject to registration with Rosreestr.

Tatiana Trofimenko

Leading lawyer of the European Legal Service

Theoretically, the seller may refuse to register the purchase and sale agreement with Rosreestr. The buyer will be able to get money from it, but only through the court.

Bad apartment: how to detect encumbrances on real estate

The Cadastral Chamber explained what types of encumbrances on apartments are and how to detect them

Most apartments have their own special “history”. For some it is clear, but there are “stories” with “aggravating circumstances” - encumbrances. This concept can equally be encountered both when purchasing an apartment in a new building and on the secondary market. What is an encumbrance? And is it worth buying an apartment with “load”? Experts from the Cadastral Chamber spoke.

Encumbrance

- This is a type of restriction of ownership rights to a real estate property. In other words, the owner of the apartment cannot sell it without the consent of third parties or the state. Encumbrances on real estate can cause problems for both the buyer and the seller. When buying an apartment, it is important to understand: if there are any prohibitions - encumbrances - other persons who are not the registered owners of the property may lay claim to it.

What are the types of encumbrances?

Today the most popular encumbrance is a mortgage. The owner of the property cannot put the apartment up for sale and carry out the transaction without the permission of the bank. In fact, until the end of the mortgage payment, the property is pledged to the bank. In other words, the bank is the owner of the property.

The second most popular encumbrance is registered minor children. If citizens under 18 years of age are registered in the apartment, at the time of purchase you should check whether the purchase and sale transaction violates the rights of the child. Especially if the apartment was purchased with maternity capital. When using a government subsidy to purchase real estate, each family member receives a share of the property, including children. If the transaction is incorrectly executed, adult citizens subsequently have the right to claim a share in the apartment.

Arrest is no less common encumbrance. There are many reasons for the seizure of real estate: debt obligations to a bank or private lender, division of property during a divorce, delays in housing and communal services. In these cases, the apartment may be seized by a bailiff by court decision.

An infrequent encumbrance for our country is rent. There have been situations where an apartment was sold when tenants lived in it and had officially entered into an agreement with the owner of the property. Basically, this is a common practice in European countries when a person buys a home for investment purposes. In addition to the apartment, the new owner gets tenants who continue to pay for housing, only to the new owner.

Another rare type of encumbrance on the Russian real estate market is rent. Often, older people sell their apartments with the condition of living in them for life. If ownership is transferred to the new owner of the property, the rent recipient cannot be evicted.

One of the critical situations that may arise when purchasing an apartment is finding tenants with the right to use it free of charge. Most of the real estate built in the 90s was state or municipal property. In the process of selling and transferring real estate into private hands, a citizen could refuse privatization in favor of another person, thereby retaining the right to use the living space indefinitely. The problem is that such a tenant cannot be evicted from the apartment and deprived of his right to live in it. A testamentary refusal - the last will of the deceased - can also become a stumbling block when buying and selling an apartment. According to the will of the home owner, expressed in notarial form, the citizen receives the right to live in the apartment. Even if the owner of real estate changes, a person does not lose his rights (Article 1137 of the Civil Code of the Russian Federation).

How to find out about encumbrances on an apartment?

The main thing is to carefully check all real estate documents. The attached certificates or notarial certificates will be the first “bell”. It wouldn’t hurt to ask the seller the “history” of the apartment: did he buy it, take it on a mortgage, or inherit it. From the story it is easy to understand whether the package of documents for the transaction is correctly formed, and to request the missing papers, if necessary.

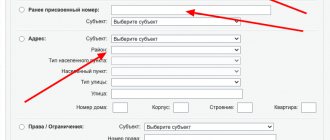

Not all apartment sellers are respectable citizens. The buyer can protect himself from the actions of intruders by ordering an extract from the Unified State Register of Real Estate on the official website of the Cadastral Chamber. In the extract, which any citizen can receive, you need to pay attention to paragraph No. 4 “Limitation of rights and encumbrances of the property,” which indicates whether third parties have any rights to the purchased housing. If not, this section of the statement will indicate “not registered.”

“Encumbrances on real estate are rare, but they can cause the purchase and sale transaction to be abandoned, lengthy litigation, or, in the worst case, the loss of the buyer’s home and money. Therefore, any purchased object must be checked for legal purity. Today, an extract from the Unified State Register of Real Estate is the only title document with which you can understand what was the basis for the emergence of ownership rights, whether the seller is the legal owner of the property and, of course, find out about the presence of encumbrances on the apartment being purchased.”

,” noted

Oksana Stein, director of the Cadastral Chamber for the Nizhny Novgorod region.

The real estate market is always full of colorful offers for the sale of living space. Some people manage to find a clean apartment, but often they have to choose from apartments with “history”. Encumbrance is not a vice, considering that some types of encumbrances are temporary and are removed immediately after the cause of the imposition is eliminated. The price of the burden is, indeed, very attractive for buyers, and the sellers of such apartments are very compliant for the sake of the deal. The main thing is to carefully study all the documents when buying or selling an apartment. And in order to save time and nerves, the buyer should take care of the security of the transaction and order an extract from the Unified State Register in advance. We recommend ordering an extract as close to the planned date as possible, since the data contained in the Unified State Register is constantly updated.

Methods for purchasing an apartment with encumbrances

Let's consider how you can purchase real estate encumbered with collateral from a bank.

For cash

The seller pays off the remaining debt with the buyer's money. The apartment is freed from encumbrance and a regular apartment purchase transaction is completed. This option is suitable for cases where the amount of debt to the bank is not too large.

For a mortgage

The seller is reimbursed the money paid under the loan agreement (except for interest), and then the mortgage is reissued to the buyer at the mortgage bank. It is also possible to conclude a cession agreement (assignment of the right of claim).

Via bank

It is also possible to purchase a mortgaged apartment through a bank. It is used when the seller has a significant debt for the apartment and it is not practical to arrange it with a deposit.

All stages of the transaction are controlled by the mortgage bank, which is a guarantee for the buyer of a successful outcome of the transaction.