Business division often leads to corporate conflicts and reputational losses. But there are several ways you can reduce the risks. The most common are prenuptial agreements and property division agreements.

In July 2021, the State Duma approved in the first reading a bill on the division of property in one court session (now different types of property are divided over several sessions). In this case, all income of spouses from work, entrepreneurship, social benefits and money, securities, shares in the authorized capital are considered common property, regardless of who paid for the property and in whose name it is registered. All debt obligations also become common.

A sudden division of shares in a business can lead to corporate conflicts and a drop in share prices, so the bill is designed to protect the business from fragmentation, bankruptcy and dismissal of employees and proposes to pay the second spouse the value of the share or compensation.

The bill also plans to consolidate the validity of the marriage contract and limit the possibility of its review by the court. Now the court can invalidate a marriage contract if its provisions seem unfair to it.

Although business assets cannot be divided and payment of compensation is implied instead, it can be deferred or secured by a pledge and a ban on the alienation of property until compensation is paid.

How the law regulates marital property right now

The property of spouses is regulated by the Family Code (Chapter 7): according to the law, property acquired during marriage is considered common. Including a business registered during a marriage, it is considered joint property, even if one of the partners does not participate in running the business.

Conventionally, when dividing an individual entrepreneur, both spouses receive 50% of the assets, when dividing an LLC - 50% of the share in the authorized capital, that is, half of the profit.

During a divorce, shares, assets of individual entrepreneurs and LLCs, investment accounts and shares in the business are divided.

Property will not be divided if a separate ownership regime is established for it. If the assets are registered in the name of third parties and formally one of the spouses does not own any business, it will not be possible to divide such property.

Case Study

In one of the court proceedings in 2021, the district court ordered the husband compensation for his share of his wife’s pharmacy kiosk - 2.6 million rubles. The husband achieved a review of the case by the Supreme Court of the Russian Federation, but the Supreme Court considered the “business” not property, but activity, and decided to divide not the enterprise itself, but the income from the operation of the pharmacy business and the rights to it.

Personal business that one spouse acquired before marriage is not divided upon divorce. Moreover, if some business property (for example, premises or equipment) was acquired during marriage or the second spouse invested his money in the business, such investments are considered common and will be divided equally.

In some cases, a business acquired during marriage is still considered personal. For example, if one of the spouses received a business or business equipment by inheritance or as a gift or as a result of another gratuitous transaction, he bought it with money earned before marriage (Article 36 of the RF IC). The same applies to securities received as a gift or inherited and shares in an LLC.

Such a transaction can be deliberately used to avoid dividing one’s share during a divorce - for example, you can register the property in the name of your partner and ask him to donate it to the entrepreneur himself, but the court will most likely recognize such a transaction as invalid during a divorce.

Case Study

In Tomsk, the wife asked to recognize the transaction for the alienation of 100% of her husband’s share in the authorized capital of Dentaliya LLC and its transfer to another person as invalid. The Arbitration Court of the Tomsk Region satisfied her claim in 2021. The court found that the spouse alienated joint property through a loss-making transaction with a deliberate understatement of the price - a share of 12.4 million rubles. was sold for 10,000 rubles. The deal was declared sham.

The appeal was rejected because the company was created in 2008, during the couple's marriage. The spouse was the only participant in the LLC and accepted a new participant only during the division of joint property in 2015, and later received compensation for the cost of the share in the amount of 7.15 million rubles. and in 2021 bought his share back for 20,000 rubles, hiding the fact of the transaction from his wife.

In 2021, the value of the net assets of Dentaliya LLC amounted to 24.9 million rubles, the same amount was the share of the spouse participating in the LLC.

If the spouses actually live separately and one of them has started a business, while they are not yet divorced by law, you can prove to the court that this business is the personal property of one of the spouses.

In addition, the results of intellectual activity - inventions and developments, blogs, musical works, films, books created by one of the spouses - are not shared. In this case, income from intellectual activity, for example, from the sale of a music album, earned during marriage, is considered joint property and must be divided in half. If the result of intellectual activity is transferred to the benefit of an LLC that was created during the marriage, the share in it will also be divided in half.

The court can also leave property to only one of the spouses if the second did not work without a good reason or spent all the money to the detriment of the family - for example, he lost money on bets. But the fact of such destructive behavior will need to be proven.

The court may increase the share of one of the spouses if minor children remain living with him.

Donated meters are not divided

There were two options - equally as jointly acquired property or not to divide, but to give it to the one with whose inheritance it was purchased. Similar questions often arise before those who divide jointly acquired property. Therefore, the explanations of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation may be useful not only to the judges for whom they were given, but also to ordinary citizens.

Local courts disagreed, but the Supreme Court put an end to it. He stated that real estate that was purchased with the funds of one of the spouses cannot be divided. This story began almost 15 years ago in the Rostov region. There, two years after the wedding, the young husband received an inheritance from his grandmother. These were shares in a private house and land. The husband decided to sell the inheritance and use the proceeds to buy an apartment for his family. So all the money received was spent entirely on the purchase of housing. The new apartment was registered in the name of my wife.

A few more years passed, and the family fell apart. That’s when the question of dividing the acquired property arose. And first of all - apartments. The man went to court, demanding that the apartment be recognized not as joint marital property, but only as his personal property.

In court, the plaintiff explained that the apartment was purchased entirely with his money, which he received from the sale of his inheritance. Showed the documents. True, the ex-wife did not deny this.

The trial court carefully calculated everything. He saw that the amount that was received for the inheritance, literally a month later, in its entirety, penny for penny, went to pay for the apartment.

The Volgodonsk District Court of the Rostov Region decided that the spouses bought the apartment with the husband’s personal money, so it cannot be considered joint property of the spouses. The court granted the ex-husband's claim and left the housing to him.

The appeal was not satisfied with this decision. The court agreed that the husband bought the property at his own expense. But at the same time, the regional court said that the husband “actually contributed money to the family budget, since he bought a joint living space.” The regional court noted that the husband agreed to register the apartment in his wife’s name. And this once again confirms that there is no reason to consider property as personal property.

So the appeal overturned the decision of the district judges and made its own decision - it divided the apartment in half.

That's when the ex-husband went to the Supreme Court.

The board pointed out the mistakes of the lower authorities. According to the Supreme Court, in order to correctly determine the status of property (common or personal), you need to understand with what funds it was purchased and under what transactions. According to paragraph 1 of Art. 36 SK (“Property of each of the spouses”), what one of the partners received free of charge (including inherited) is not common. It will remain personal if the partner sells it and buys another house or apartment in return.

Property purchased during marriage with the money of one of the spouses excludes it from the regime of joint property, even if it is registered in the name of the other spouse, the Supreme Court said.

He recalled his resolution of the Plenum (dated November 5, 1998) “On the application of legislation by courts when considering cases of divorce.”

Property purchased with the personal funds of one of the spouses is not community property

It clearly states that property purchased during marriage is not community property, but with personal funds. Therefore, the Judicial Collegium for Civil Cases of the Supreme Court stated that the first instance took the correct position during the consideration. That is, the district court.

In disputes, if a spouse wants to recognize the property as personal, he must prove to the court that the funds used to buy the disputed object were not shared. You can prove it in different ways. It can be shown that the funds were earned before marriage. Or indicate receipt of an inheritance or gift. In such cases, the court must evaluate the value of the acquired property, the amount of personal funds and the time between receipt of income and acquisition of real estate. In our case, very little time has passed since the sale of one object and the purchase of another. So the Supreme Court upheld the decision of the district court, according to which the apartment was not divided.

What risks does the business bear?

Divorce and division of assets can greatly impact a business. Various types of risks arise:

- reputational due to conflicts between owners or sudden changes in ownership;

- possible conflicts with partners;

- possible conflicts with counterparties;

- depreciation of assets - one of the spouses can artificially reduce the value of the company or encumber their share with collateral.

One of the spouses can re-register the business to third parties, sell or donate it partially or completely without an agreement on the division of property.

The second spouse may try to protect the disputed property, ask the court to seize the property and prohibit the sale of shares and assets (Articles 139-140 of the Civil Procedure Code of the Russian Federation) or recognize the transaction as imaginary and invalid (Article 170 of the Civil Code of the Russian Federation). The applicant spouse must prove the sham of the transaction.

An LLC can be protected by including in the articles of association a provision that a new member cannot acquire a share without the consent of the other members.

Case Study

The ex-wife of Norilsk Nickel co-owner Vladimir Potanin could not receive half of his share in Norilsk Nickel and Interros International Investments Limited in 2014 during a divorce. The court did not recognize the company's shares as the property of the businessman and distributed only real estate and financial assets between the spouses, since beneficial ownership is not regulated by family law.

If one spouse owns a share or all of the assets of the LLC and divides them equally with their partner, this can lead to conflicts in the management of the business, damage the reputation and reduce the value of the business. A conflict between spouses can escalate into a corporate conflict and lead to the dismissal of the team, loss of clients and profits.

It would be appropriate for the contract to stipulate that one of the spouses pays the partner compensation for the market value of assets in exchange for giving up his or her share of the business.

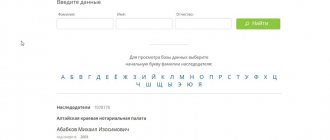

The usual order of inheritance after the death of relatives

Upon the death of a husband, wife, sons, daughters, distant and close relatives, there are options for registering an inheritance: notarially or in court. with a notary yourself if all the documents are in order.

It's not difficult, although it does take a lot of time. Then you can contact us for help. Read more about inheritance on the site pages (right menu). In court it is difficult. And it’s difficult because you can’t submit the same request to court twice. If the claim is immediately drawn up incorrectly and the court decides to deny the inheritance, there may not be a second chance. Therefore, it is important to correctly draft a statement of claim. And in difficult cases, be sure to hire a lawyer in court.

Inheritance of apartments in non-standard cases

Here are a number of questions from citizens that we have encountered in practice, and small comments on them.

- My husband died and a loan was taken from him to buy our apartment. So what's now? Usually, when a bank issues a loan, a mandatory condition is life and health insurance. If the terms of the insurance contract were met on time, and after death, the insurance company was notified of the insured event within the period established by the contract, the balance of the loan will be repaid by the insurance company. And all you have to do is inherit an apartment that is not encumbered by the rights of the bank.

- My wife died. Is it possible to ask the bank to change the payment terms of the loan and reduce monthly payments? You need to consult a lawyer. Perhaps in your case you will not have to pay the loan at all if the death of your wife is regarded as an insured event.

- A neighbor died. There are no heirs. Is it possible to rent an apartment for yourself? Of course not. Taking something that does not belong to you is a criminal matter. But you can look for heirs of other lines and receive a reward or options for further re-registration of the apartment in your name.

- The owner of an apartment in a housing cooperative building has died. Unknown people moved in. They don't have documents for the apartment. Is it possible to find heirs? Yes, if they exist, heirs can be found.

- I found out from the Internet that my father died. We didn't live together after his divorce from his mother. Where he lives, whether he has an apartment and what kind of property he has in general is unknown. Is it possible to recognize and enter into his inheritance? Yes, a lot can be done based on notary and lawyer requests. In addition, there are other technologies for searching for inherited property. Since you learned about his death on the Internet, the owner of the resource on which this publication was posted can also provide information known to them. For this you need your birth certificate. And a specialist who will help you in registering an inheritance will tell you about further actions.

- A great aunt died. She had no other heirs except me. But the relationship cannot be established. During my lifetime, I took out a loan for her treatment. Can I get my money back from her estate? In most cases, you can not only return the money, but also prove your relationship. This is done in court.

Here is a small part of the mass of issues that are encountered in judicial practice. Our specialists are ready to help in various situations. Our work experience is serious. You can get acquainted with court decisions on issues of inheritance of apartments at an appointment with specialists.

Make an appointment at your convenient office