○ Grounds for filing a complaint.

In practice, the following violations most often occur on the part of insurers:

- Refusal to pay insurance compensation on far-fetched grounds.

- Delaying payment deadlines.

- Unreasonable reduction of the amount paid.

- Refusal to conclude an agreement (they say the forms have run out, the computers don’t work, “we don’t serve your region,” etc., etc.).

- Imposing additional services.

- Requesting from the client additional documents that are not actually required in this case.

- Arbitrary increase in tariffs.

This list is indicative: many people also encounter other violations committed by insurance companies. However, it’s easy to see that insurers don’t like to work – but they don’t like paying out money to their clients even more.

That is why it is often necessary to file complaints with the authorities that control the activities of insurance companies.

Example of a complaint against KBM

A complaint against KBM if it was incorrectly calculated by the insurance company when issuing an MTPL policy is submitted on a unified form. Before filling it out, you need to familiarize yourself with all its points. An example of filling can be found on the website of the Russian Union of Insurers.

You can fill it out with a regular ballpoint pen on a printed form or electronically, and then print it out. It is imperative to indicate at the end of the complaint where to send the response to it, usually at the place of registration of the applicant.

○ Algorithm for filing a complaint.

If your rights are violated, it is best to act in the following order:

- File a complaint about the actions of employees to the company management. A significant part of violations occurs not because this is the internal policy of the organization, but because of the negligence or irresponsibility of specific company employees. It is possible that the problem will be resolved at this stage. If not, you need to move on.

- If no response was received within a reasonable time (that is, 10-14 days), or the problem was not resolved, you must already contact the supervisory authorities with a complaint against the insurance company. There is no single regulatory body for insurers, so it is necessary to choose the addressee based on the essence of the issue.

- If the problem is financial (the payment is underestimated or the insurance company refuses to pay at all), it makes sense to immediately go to court with a statement of claim. This can be done in parallel with filing a complaint with the supervisory authorities: if by the time the consideration of the case begins, an answer comes from there, it will serve as additional evidence in the court hearing. But before that, you need to stock up on evidence of your position: conduct an independent assessment of property damage, collect copies of telegrams or letters to the insurance company, etc. It is highly advisable at this stage to contact a lawyer who specializes in litigation with insurance companies: this is a very specific topic, and not every lawyer will undertake this.

○ Supervisory authorities regulating the activities of insurance companies.

There is no single organization monitoring insurers in Russia. However, this makes it possible for a person who has encountered violations of the law in this area to file complaints with several authorities at once.

You can contact the following organizations:

- The Bank of Russia (Central Bank of the Russian Federation), or more precisely, to the insurance market department, which took over the functions of the Federal Financial Markets Service, which was abolished in 2013. This division is responsible for monitoring the financial activities of insurers. Accordingly, you should contact them if the company refuses to make payments or significantly underestimates the amount.

- Federal Antimonopoly Service (FAS). It makes sense to file a complaint there in cases where a company tries to monopolize the provision of insurance services in the region, imposes additional services, or otherwise violates the Federal Law “On Protection of Competition”.

- Union of Automobile Insurers (RUA). This is not a government body, but a non-profit association of organizations involved in car insurance, but RCA can influence its members. It makes sense to complain there in case of incorrect application of the KBM and other issues related to compulsory motor liability insurance or the Green Card. You cannot contact RSA if violations are related to CASCO or other types of insurance - the complaint will not be considered.

- Rospotrebnadzor. A client who contacts an insurance company is a consumer of its services, which means that the actions of the insurer must comply with the requirements of the Law of the Russian Federation “On the Protection of Consumer Rights”. Private individuals can apply to this government agency. If the insurance was carried out as part of business activities, Rospotrebnadzor will not consider the complaint.

- Prosecutor's Office of the Russian Federation. This organization monitors compliance with all legislation - and therefore you can contact them if any violation is detected.

- Court. Through it, you can achieve, for example, the forced conclusion of a contract in the event of an unreasonable refusal by the insurance company, as well as recover losses incurred by a citizen.

Now let’s look at the functions and procedure for filing a complaint for each of these bodies in more detail.

In what cases would this not make sense?

- According to Article 56 of the Federal Law “On the Central Bank of the Russian Federation,” the Central Bank has no right to interfere in the operational activities of credit institutions.

Attention. In the event of an illegally accrued fine or violation of contract clauses by the bank, a complaint to the Central Bank will be ineffective, since such controversial situations are resolved through judicial proceedings. - Also, the Central Bank cannot resolve all disputes between the policyholder and the insurance organization, since it does not have the authority to oblige insurers to pay insurance amounts if the policyholder does not agree with the amount of payments.

- The Central Bank does not determine the proportionality of the damage caused and the funds paid.

○ Complaint from the Central Bank of the Russian Federation.

✔ What kind of body is it and what issues does it regulate?

The “main caliber” for a person who wants to punish a violating insurer is to contact the insurance market department of the Central Bank of the Russian Federation. The fact is that in accordance with the decree of the President of the Russian Federation dated July 25, 2013 No. 645, the powers of the abolished FFMS, the Federal Financial Market Service, were transferred to this structure. And the powers of the Central Bank include both issuing and revoking licenses for insurance activities. As a result, if a company has committed serious violations, its activities may simply be forcibly terminated.

In addition, according to Art. 23.74 of the Code of Administrative Offenses of the Russian Federation, it is the Central Bank that considers many cases of administrative offenses committed by insurers. In particular, the imposition of additional services by the insurance company is a violation under Art. 13.34.1 Code of Administrative Offenses of the Russian Federation:

It is the Central Bank, represented by the head of the local division, that will consider cases under this article and impose fines on the insurance company.

✔ Reasons for appeal.

You can contact the Central Bank of the Russian Federation in the following cases:

- The insurance company imposes services on its clients that they did not order.

- The company refuses to enter into an agreement under a flimsy pretext or even without explanation at all.

- There is a violation of the deadlines within which compensation must be paid.

- The KBM is not applied or is applied incorrectly.

- The amount of compensation is underestimated or payment is refused under false pretexts.

- They do not accept or issue documents related to insurance or an insured event.

- The client does not agree with the quality or timing of the repairs required under CASCO.

✔ Filling out a complaint.

You can complain to the Central Bank of the Russian Federation as follows:

- By sending a paper appeal to the territorial division of the Central Bank of the region in which the violation occurred.

- Use the Internet reception on the official website of the organization.

There is no officially approved form for a complaint, so you can compose it however you like. It is only important to indicate what exactly the violation of the law or terms of the contract is, the insurance company’s data and your personal data. The complaint must be accompanied by copies of documents confirming the applicant’s position.

✔ Review deadlines.

It has been officially established that the Central Bank must consider complaints against the actions of insurers within 30 days from the date of receipt and registration of the document in the office of this organization. However, if additional verification is necessary, the review time may be extended to 2 months.

In practice, on average, citizens’ appeals in the Central Bank structures are considered within 10-15 days. An official authorized to act on behalf of the Central Bank then makes a decision.

✔ Decisions of the Central Bank of the Russian Federation and appeal.

Based on the results of consideration of the complaint, one of the following decisions may be made:

- Satisfying the citizen’s demands and ordering the insurance company to correct the violation (conclude an agreement, pay the amount, etc.).

- Initiation of a case of an administrative offense - in the event that an audit shows that it took place.

- Refusal to satisfy a complaint - in the event that it is either not within the competence of the Central Bank of the Russian Federation, or no signs of violation were found.

If the applicant does not agree with the actions of the Central Bank employees, he has the right to file a complaint against them - but to the court in the manner established by the CAS of the Russian Federation.

Association of Russian Banks and Financial Ombudsman

The Association of Russian Banks is a non-governmental non-profit organization founded in 1991. It consists of 522 members, including 350 credit organizations. The Association includes all the largest banks in Russia, 19 representative offices of foreign banks, 65 banks with foreign participation in the authorized capital, as well as the “Big Four” audit companies.

The Association not only protects the interests of credit institutions in legislative, executive and law enforcement agencies, but also strives to improve the work of banks. To do this, there is a section on the official website of the Association where anyone can file a complaint against any bank.

The complaint will be posted on the website of the Association of Russian Banks in public access.

Bank representatives can comment on complaints.

In 2010, the Federal Law “On an alternative procedure for resolving disputes with the participation of a mediator (mediation procedure)” was adopted and came into force on January 1, 2011. At the same time, on the initiative of the Association of Russian Banks, the institution of a financial ombudsman was established in 2010. This was the next step towards building a dialogue between banks and clients.

A financial ombudsman is an impartial, unbiased and at the same time influential person who can help negotiate with the bank.

It doesn't punish banks or tell customers what to do. He acts as a mediator between the first and second and helps to reach a compromise. For example, the financial ombudsman can offer mutually beneficial conditions for loan restructuring for the bank and the client.

You can contact a public mediator in the financial market here.

○ Complaint to the Federal Antimonopoly Service.

✔ What kind of body is it and what issues does it regulate?

FAS is a federal service that ensures that legislation protecting free competition in various markets in Russia is observed, and specifically the Federal Law “On the Protection of Competition”. Its jurisdiction also includes the insurance market.

In its activities, FAS is called upon to ensure that insurance companies:

- They did not enter into secret agreements dividing the service markets.

- They did not abuse the existing dominance (in particular, they did not impose additional services, taking advantage of the fact that there are no competitors in the region).

- They did not refuse to conclude contracts under compulsory motor liability insurance.

✔ Reasons for appeal.

You can contact the FAS with a complaint against an insurance company in the following cases:

- Refusal to sell an MTPL policy without an additional contract (CASCO, life insurance, apartments, etc.). The complaint will be especially effective if such services are offered by several companies that have entered into a secret conspiracy among themselves.

- Refusal to conclude a contract or extend it.

- Monopolization of the market by one of the companies.

- Misleading advertising.

✔ Filling out a complaint.

As with the Central Bank of the Russian Federation, you can contact the FAS in two ways:

- By mail, sending a registered letter to the regional office.

- Through the official website or the State Services portal.

Applications submitted by fax or email are also acceptable, but in practice such methods are less common. However, if the applicant has a certified electronic signature, their email will be equivalent to a paper document.

✔ Review deadlines.

Like the Central Bank, the FAS considers complaints within no more than 2 months. Moreover, if established by Art. 12 of the Federal Law “On the procedure for considering citizens’ appeals”, a 30-day period is not enough, and the consideration is extended for another month, the citizen must be informed about this in writing.

✔ FAS decisions and appeal.

Based on the results of the review, the service can satisfy the requirements stated by the citizen. In this case, a fine will be imposed on the insurer, and an order will be issued to ensure that the violations are eliminated. Typically, insurance companies appeal such decisions of the FAS to the court, but, as a rule, the court takes the side of the antimonopoly service.

In the same case, if in response to a complaint from the FAS there was a refusal to consider, the citizen also has the right to go to court with a complaint against this federal service. However, the likelihood that the decision will be reversed is extremely low.

Banki.ru and other popular ratings

Let us repeat, banks value their reputation and do not like public proceedings.

Many financial institutions have special employees who monitor reviews and are responsible for feedback. If such an employee sees a complaint on the Internet about the bank he represents, he will try to respond as quickly as possible. Your message will be passed on to the responsible persons or they will tell you the algorithm of actions.

One of the most authoritative resources in this regard is the information portal Banki.ru. It was launched in 2005 and today is one of the most cited financial media resources on the Runet.

The name speaks for itself: on the site you will find ratings of Russian banks by level of service and quality of services, ratings of the most profitable deposits and ratings of loans with the lowest rates.

You can leave a complaint about a particular bank in the “People’s Rating” section or on the forum in the “Conflict Situations” topic. Representatives of more than 220 Russian banks respond to customer reviews.

The problem should be presented briefly, unemotionally and to the point, as is the case with written appeals. The moderator will not allow messages containing insults or obscene language.

In the popular rating "Banki.ru" you can complain about a bank employee, erroneous debiting of funds, incorrect operation of an ATM and other problems that concern you personally. There is no point in being outraged by legal, but, in your opinion, unfair actions (“Arbitrariness: my sister has nothing to pay her loan, the bank has seized the property!”).

○ Russian Union of Auto Insurers (RUA).

✔ What kind of body is it and what issues does it regulate?

RSA is a non-profit organization that unites all insurance companies that provide services under MTPL or CASCO. The main thing you should pay attention to is that membership in the RSA is mandatory for companies working in this area. That is why the union has certain levers in its hands, thanks to which the RSA can influence the actions of its members.

✔ Reasons for appeal.

It makes sense to complain to RSA if the insurance company:

- Does not apply KBM.

- I lost my license and therefore cannot compensate for damages under compulsory motor liability insurance.

- The order of direct regulation (DRP) has been violated.

- There are violations related to the European Protocol.

In general, it should be noted that the RSA has less powers than the Central Bank of the Russian Federation or the FAS, therefore, in the event of gross violations, the measures taken by the union are not very effective.

In addition, we must remember: if you have problems with CASCO, you cannot contact RSA, this is not its competence!

✔ Filling out a complaint.

You can complain in the following ways:

- On a personal visit to the management department located in Moscow.

- By sending a complaint with attached documents by mail.

- By email - but in this case the applicant may be required to provide paper copies of documents or other confirmation. At the same time, you need to ensure that the complaint itself and the attached scans of documents “weigh” no more than 3 MB. If the volume is larger, you need to use an archiver program and split the archive into volumes of the specified size, sending them as separate emails.

✔ Review deadlines.

The period during which citizens' appeals must be considered is regulated by the Rules for the protection of the rights of policyholders and victims, approved by the Presidium of the RSA in 2004. In general, the one-month rule also applies here, however, according to clause 3.9 of the Rules, the period can be extended if a more thorough check is required or additional documents are requested. In the latter case, the consideration is extended for the time required to receive these documents.

✔ RCA decisions and appeals.

Based on the results of consideration of the complaint, the RSA makes a decision. He can:

- Obtain from the insurer a change in the terms of the contract or compensation for damage.

- Refuse the complaint.

In the latter case, the citizen has the right to appeal the response through the court in accordance with the CAS RF procedure.

File a complaint against KBM under OSAGO

The KBM has been installed and used since 2003. The mechanism for its use is prescribed in the law on compulsory motor liability insurance. To calculate what size of the motor vehicle insurance policy a particular driver is entitled to, you need to use the database maintained by the Russian Union of Auto Insurers - RSA. All information on this indicator enters the database automatically.

When calculating the cost of an insurance policy, OSAGO KBM is not applied if:

- the policyholder takes out transit insurance;

- the car is registered in another country;

- The policy is issued by a newcomer without driving experience (by coefficient 1).

○ Rospotrebnadzor.

✔ What kind of body is it and what issues does it regulate?

Rospotrebnadzor is a government body that is obliged to protect consumer rights. A citizen who wishes to conclude an agreement under compulsory motor liability insurance acts as a consumer - and therefore, in the event of an unreasonable refusal on the part of the insurance company, as well as some other violations, Rospotrebnadzor is obliged to take measures against the guilty company.

This is due to the fact that, by virtue of the Federal Law “On Compulsory Civil Liability Insurance of Vehicle Owners,” compulsory motor liability insurance is a public contract, the terms of which must be the same for all persons applying to a specific insurer. But we must remember: Rospotrebnadzor is concerned with protecting consumers. If the complaint is related to business activities or the work of organizations, they may immediately refuse to consider the appeal.

✔ Reasons for appeal.

It makes sense to contact Rospotrebnadzor in the following cases:

- The insurance company refuses to enter into a contract.

- There is no payment under the contract, or the compensation is underestimated.

- Imposing additional services under MTPL or CASCO.

✔ Filling out a complaint.

The complaint must be addressed either to the regional office of Rospotrebnadzor or to the central office. However, in the latter case, it must be taken into account that the complaint will still be forwarded for consideration at the place of the violation.

Complaints can be submitted either in paper or electronic form through the official website of the organization, or through State Services.

✔ Review deadlines.

Complaints received by Rospotrebnadzor must be accepted for consideration no later than within three days from the receipt of a paper or email letter to the organization. From this moment the standard monthly period begins to count.

If additional verification is necessary, the period is extended to two months. The applicant must be notified in writing of the extension.

✔ Rospotrebnadzor decisions and appeals.

If Rospotrebnadzor considers that there is a violation of the law, it issues an order to the company to eliminate it. The applicant is notified of this in writing.

If the complaint is unfounded or is beyond the competence of the government body, the citizen will receive an official response with a refusal. It can only be appealed in court.

Reasons for appeals and complaints

When any violations are identified, citizens have the right to seek justice. The basis for considering a case of non-compliance of the MSC with the real value is a complaint. In the field of automobile insurance, cases of violations are quite common. Errors in the calculation of compulsory motor liability insurance may be associated with incorrect definition of the indicators used in the formula.

A complaint is a written statement sent to a competent organization that has the ability to review the terms and conditions of insurance. The main reasons for filing a complaint are a gross violation of the rules for calculating the cost of the policy and an incorrectly determined bonus-malus coefficient.

○ Prosecutor's office.

✔ What kind of body is it and what issues does it regulate?

The prosecutor's office is the main supervisory authority in Russia. In accordance with the Federal Law “On the Prosecutor’s Office of the Russian Federation”, its competence includes:

- Supervision of compliance with Russian laws.

- Supervision to ensure that there are no violations of human rights.

- Supervision of law enforcement agencies and the execution of punishments.

Prosecutor's office employees have the right to monitor the activities of both government agencies and commercial or non-profit organizations - and, accordingly, they have the right to take action against insurance companies if they violate the law.

However, we must remember: the prosecutor’s office does not resolve financial disputes. If, for example, the company made a payment, but the amount of compensation is underestimated, there is no point in contacting the prosecutor’s office. In this case, its employees may refuse to consider the complaint and recommend going to court.

✔ Reasons for appeal.

By virtue of the Federal Law “On the Prosecutor's Office of the Russian Federation”, employees of this law enforcement agency are obliged to check any violation of the law. Although the prosecutor's office does not replace other regulatory authorities, it is obliged to respond to any statements that indicate signs that the law is not being observed.

Accordingly, a complaint can be filed with the prosecutor in any case if the applicant believes that his rights have been violated. Moreover: if several people have suffered, they can file a collective complaint, and then the prosecutor’s office will act on behalf of all applicants.

✔ Filling out a complaint.

You can submit a complaint to the prosecutor's office in the following ways:

- At a personal reception. Every day in any prosecutor's office, an employee on duty receives complaints and applications from citizens. As a last resort, you can appear without a written complaint - the assistant or deputy prosecutor on duty at the reception will help you draw up the document correctly and accept explanations from the visitor.

- By mail. This is convenient if you don’t have time to appear in person, but it will take time to deliver the correspondence. You can contact any of the prosecutor's offices: if the sender made a mistake, the complaint will be forwarded to its destination.

- By email or via a website on the Internet. This significantly speeds up the review process - but you must remember that only letters signed with a qualified electronic signature are considered equivalent to paper documents. Without this, the applicant will still need to either appear in person and bring the missing documents - or send them by mail.

✔ Review deadlines.

According to the Instruction approved by order of the Prosecutor General's Office of the Russian Federation dated January 30, 2013 No. 45, the prosecutor's office considers complaints within:

- 15 days – if there is no need for additional verification.

- 30 days – if verification is carried out.

In exceptional cases, the period may be extended by an additional 30 days. After this, additional extensions can only be made by the Prosecutor General himself.

All deadlines are counted from the moment the letter was received and registered in the prosecutor's office.

✔ Decisions of the prosecutor's office and appeal.

If prosecutors consider that the complaint is justified, they may take one of the following response measures:

- Make a presentation. This document indicates what specific violation the insurance company committed, and also indicates what measures need to be taken to correct the situation. The offender is given 30 days to correct the violation.

- Make a decision. In this case, a case is initiated under the Code of Administrative Offenses of the Russian Federation - but only in cases where the violation is not related to administrative articles, which must be dealt with by the Central Bank of the Russian Federation.

- Give a warning. This is essentially a “final warning.” If the insurance company violates the law again, it will be held accountable according to the law.

In the same case, if the prosecutor’s office considers that there are no grounds for a response, the applicant will be sent a refusal, which can be appealed to the court or to a higher prosecutor.

Correct drafting of document text

For those wishing to reconsider the meaning of the MSC, the procedure for filing a complaint has been significantly simplified, thanks to the possibility of using a unified form. You can find sample documents below. The policyholder can fill out an electronic form on a computer or enter information by hand using a gel pen with black ink.

The following information must be included in the text of the appeal due to incorrect calculation of the KBM:

- Personal information about the applicant (full name, exact address, including postal code) and his contact information.

- Information about the driver's document (series/number/date of receipt).

- Passport details.

- Details of the insurance policy and contract with the insurance company.

The main part of the document must describe the reason for the application, indicating the circumstances of the case. An important condition is the date on the document and the signature of the applicant. Without them, the document loses its legal significance and is not accepted for consideration.

Another mandatory requirement is written confirmation by the applicant of the accuracy of the information reflected on paper with reference to Federal Law No. 152 of July 27, 2006 and consent to data processing.

○ Consideration of a complaint in court.

The last resort where you can turn if you have problems with insurance companies is the court. You can go there at any time, but it is best to resort to the help of a judge in the following cases:

- When it comes to collecting unpaid amounts. If there is a financial dispute, it is usually easier to file a claim than to waste time complaining to supervisory authorities.

- If a claim has already been sent to the insurer, but it was ignored.

- If the supervisory authorities have already refused the applicant for one reason or another.

A judicial act is the last chance to restore justice and bring the unscrupulous insurer to justice.

✔ Procedure for filing a complaint in court.

When going to court, you must be guided by the following regulations:

- Code of Civil Procedure of the Russian Federation - when filing a claim.

- CAS RF - if the actions of the insurance company are appealed.

Both codes describe in detail how, where and in what order the appeal should be sent, which court should hear the case, etc.

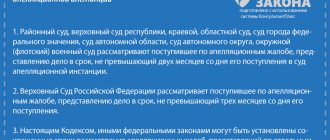

✔ Court decisions and appeals.

Based on the results of the consideration, the court may:

- Satisfy the application.

- Refuse satisfaction.

In the latter case, one should be guided by procedural norms and appeal the adopted act to a higher authority, up to the Supreme Court of the Russian Federation.

Completing a complaint correctly

In this case, there is no unified form of the document. Claims can be presented arbitrarily: if you place the details not on the right, but on the left, or instead of the word “complaint” you write “application”, this will not be an error. However, it is better to be guided by the general requirements for written statements.

- A cap. In the upper right corner you must indicate who the complaint is coming from (your personal information, including address and contact phone number) and to whom the complaint is addressed. If you do not know the name of the required official, write simply “Head of <name of financial and credit organization>.”

- Title. Write the word “complaint” in large letters in the middle of the line.

- Factual circumstances of the case. State what rights you think have been violated by what actions or inactions of the bank. Give reasons. Describe when, at what time and under what circumstances the incident occurred, or when you discovered the fact of the offense. Is anyone specific to blame for what happened? If yes, please provide the person's first and last name.

- Applications. Back up your indignation with written evidence. Attach to your complaint a copy of the loan agreement, a receipt for payment for a particular service, an account statement, and so on.

- Requirements. Formulate what specific decision you expect regarding your complaint: “I ask you to eliminate the consequences...”, “give a legal assessment...”, “punish the perpetrators...” and so on.

- Date and signature. Don't forget to indicate when the complaint was filed and also endorse it.

When making a complaint, you should not curse or swear. Extra epithets and details only complicate understanding and, therefore, delay the proceedings.

Follow the rule: less emotions - more facts.

Any more or less large credit institution has a department for handling claims, where, as a rule, they try to solve problems without washing dirty linen in public.

Research shows that a customer who complains and is heard becomes a regular and loyal customer. Banks value their reputation and know that if a dissatisfied customer is simply brushed aside, he will tell his friends about it, and they will tell theirs.

The Lifehacker Telegram channel contains only the best texts about technology, relationships, sports, cinema and much more. Subscribe!

Our Pinterest contains only the best texts about relationships, sports, cinema, health and much more. Subscribe!

Therefore, the first thing to do when a conflict situation arises is to contact the bank itself.

The processing time for written complaints by credit institutions is usually seven to ten banking days.

During this time, the bank will conduct an internal investigation, develop solutions to the problem and offer them to you orally (by phone) or in writing.

As practice shows, the fastest response is to complaints received through Internet resources and hotline numbers. They are usually processed the same day.

| Bank | Phones | Online reception |

| Sberbank | 8-800-555-55-50; +7-495-500-55-50; 900 (available in Russia for subscribers of MTS, Megafon, Beeline and Tele2) | sberbank.ru |

| VTB 24 | +7-495-777-24-24 (for Moscow); 8-800-100-24-24 (for regions) | — |

| Rosselkhozbank | 8-800-200-02-90; +7-495-787-7-787; +7-495-777-11-00 | rshb.ru |

| Alfa Bank | +7-495-78-888-78 (for Moscow and the Moscow region); 8-800-2000-000 (for regions). | alfabank.ru |

| Tinkoff Bank | 8-800-333-777-3 | tinkoff.ru |

If the bank did not satisfy your complaint or you are dissatisfied with the decision, you can write a negative review on a thematic website or forum, or contact one of the supervisory authorities.