In the modern world, transferring to one or another bank card or account is probably no longer difficult for anyone, being an established and familiar matter. However, even with all the care and responsible approach to such financial transactions, none of us is immune from mistakes: it is enough to enter just one character incorrectly and your transfer will go to someone else’s card. What can you do to ensure that the money returns, if not to you, then at least to the card owner to whom it was intended? And what should you do if the funds were transferred quite deliberately, but it later turned out that you were dealing with scammers? Together with FAN , lawyer Ekaterina Antonova (https://www.instagram.com/advokat_antonova_krd/), we’ll figure out how to behave in such situations.

Does it make sense to ask the cardholder to return funds accidentally transferred to him?

Trying to come to a humane agreement with someone who has the good fortune of suddenly receiving “material assistance” is, perhaps, the first thing that comes to mind for someone who has discovered a mistake and is wondering for the first time how to return money transferred to the wrong place . You can do the following: send, for example, 1 ruble to the same card (account or mobile phone number), and in the comments to the transfer briefly explain that you mixed up the account number, and also indicate your phone number so that the card holder I could call you back. Most often, this is exactly what people do, because a normal, adequate citizen, as they say, does not need someone else’s goods, therefore, having tried your situation on himself, he will most likely show up and return the transfer.

Contact the bank

We usually top up our mobile phone account through a banking application. If immediately after the transaction you notice that you made a mistake with the number and the money went to the wrong place, you need to immediately contact your bank - there is a chance that the funds have not yet been credited to someone else's phone, then the financial institution will cancel the transaction and return the money. You can contact the bank via the hotline (the toll-free number should be indicated on the inside of your card) or via chat - online banking.

“Inform the hotline operator about the need to suspend the transaction and return the payment. In the future, you can duplicate the message in writing. Your message will be checked and, if the money has not yet been credited to the recipient’s account, it will be returned,” says the expert.

What should you do if you have not received a response when you contact the cardholder?

How to return money transferred to a Sberbank or any other bank card if the recipient turned out to be dishonest - did not return the money transfer and did not even call back? In such a situation, you need to immediately personally contact the nearest branch of the bank of which you are a client and write a statement. This action, by the way, can be taken simultaneously with an attempt to negotiate with the subscriber directly.

“Even if a person transferred money to the wrong place, it will not be returned immediately. First, the bank will send an official notification to the citizen to whom the money transfer was made in error. It will contain a request to return the money to the rightful owner. The bank will not provide you with the personal data of this citizen, since this is a bank secret,” clarifies Ekaterina Antonova.

pixabay.com/

The application will have to be drawn up in two copies: the first of them with the bank’s mark will be given to you, and the second will remain in the bank. Be sure to make sure that the application reflects the date of its acceptance and also has the signature of a bank employee. The bank representative must then contact the owner of the account into which your funds were received and inform him that the transfer was made in error. Keep a copy of the application as the apple of your eye - in case the recipient of your money turns out to be fundamentally unscrupulous.

The sender became a victim of a fraudulent scheme

With cards, including credit cards, holders make several transactions a day: transfers, payments, purchases. A large number of fraudulent resources on the Internet are recognized as the reason that people become victims of illegal schemes.

Problems of this kind can be solved in a simpler manner: it is enough to contact the bank with a statement setting out all the details of what happened. If you act quickly, then after the investigation the bank can return the money. Otherwise, attempts should be made to resolve the issue through law enforcement agencies and the courts. In this case, the fraudulent scheme will first need to be uncovered and then proven - this is the direct responsibility of law enforcement officers.

In what cases should you contact the police?

It should be remembered that even a bank employee does not have the right to force the recipient to return funds to you if you discover that you transferred them to fraudsters. He can only ask the recipient about it. How can you return the money transferred to the card if the bank informed you that the account owner was found, but the funds never arrived? According to the law, such situations are regulated by Article 1102 of the Civil Code of the Russian Federation “Obligation to return unjust enrichment.” Or in some cases - an article about fraud. Therefore, in order to defend your rights, feel free to contact the police, and this is where a copy of the statement written at the bank will come in handy.

Next, we again have two options for the development of events, the expert explains. In the first of them, the police refuse to initiate criminal proceedings. You will receive an official notification of refusal by mail at your place of actual residence (or the place where you contacted the police).

pixabay.com/

The second option is to initiate a criminal case. In practice, this happens very rarely and, as a rule, under special circumstances - for example, when there are several victims. Or if the person appearing in your application has been transferred money by mistake more than once and he never returned it. In this case, the recipient's actions may be regarded as fraudulent.

Accounting and tax accounting

Entries are entered into accounting that are completely opposite to those that were used when accepting money for accounting. In particular, these wirings are needed:

- DT51 KT62. Arrival of money.

- DT62 KT51. Refund.

- DT76 KT51. Write-off for refund of erroneous payment.

Let's consider tax accounting for refunds on payment orders:

- USN. The transfer of money is recorded in taxable income. The payment must be reflected on the date of receipt of money on the account. When funds are returned by payment, it is necessary to reverse the income, which is taxed. The reversal is issued on the date of refund.

- BASIC. The crediting and return of money transferred by mistake is an operation that is not recorded in the OSNO.

Important! When accounting and tax accounting, it is important to pay attention to the dates of return/crediting of money. Each operation must be confirmed by the appropriate document.

Is it possible to return the transferred money if the police did not help?

The initiation of a criminal case is the basis for going to court. However, even if a refusal is received, you also have the right to turn to Themis for help.

“If all of the above actions do not bring results and the citizen ignores the return of funds, then you can go to court with a claim for unjust enrichment. In such a situation, you will also need a copy of the application from the bank, as well as a copy of the police refusal to open a criminal case. In addition, you can obtain an official confirmation of the money transfer from the bank and attach it to the case materials,” says Ekaterina Antonova.

It may also be useful to file a claim. It should be sent to the defaulter's postal address in the form of a letter with acknowledgment of receipt. When both of you are invited for interrogation, there is a high probability that the unscrupulous recipient will return the money to you at this stage, because this procedure is not a pleasant one. If it was not possible to reach an agreement even now, then you will have to, as they say, “go to the end” - file a lawsuit and wait for the court hearing.

It is important to know that through the court it is also possible to recover from the defaulter interest for the use of funds that do not belong to him and the amount of the state fee for filing an application, and even receive compensation for legal costs and moral damages.

How to return money from your phone to your card

Each mobile operator has its own conditions for transferring money from the balance of your number to a bank card. In most cases, we are not talking about returning funds that were over-credited to your number, but rather about transferring them to a bank card. The only exception is Yota - they return funds only to the subscriber’s card.

Let's consider the conditions of such a transfer for each mobile operator that provides such services in more detail.

MTS

You can withdraw money from an MTS number to a bank card on the company’s website under the following conditions:

- transfer amount - from 10 to 15,000 rubles at a time;

- commission - 0.9% of the transfer amount to an MTS Bank card and 1.99–4% to a card of another Russian bank, but not less than 60 rubles;

- up to 5 transfers totaling 75,000 rubles per day;

- The maximum commission amount is 3,000 rubles per day.

On the MTS website, money from your phone can be transferred to a card of not only a Russian, but also a foreign bank.

A similar operation can also be carried out in the MTS Money mobile application.

How to transfer money from MTS to a card using USSD code (video)

Beeline

In Beeline you can transfer money from the balance of a mobile number to a card under the following conditions:

- from 50 to 14,000 rubles at a time;

- up to 14,000 rubles or 10 transactions per week;

- up to 40,000 rubles or 20 transactions per week;

- up to 40,000 rubles or 50 transactions per month.

- commission - 60 rubles for a transfer amount up to 60 rubles, from 60 to 14,000 rubles. — 10% of the transfer amount.

You can withdraw money to your account if the bank where it is opened has a partnership agreement with the operator. Commission - 2.99%. The restrictions have one difference from withdrawal to a card - the minimum transfer amount is 500 rubles.

You can transfer money on the website or via SMS.

To transfer money from your phone to a card on the Beeline website, you need to enter the 16-digit card number, your Beeline phone number, email address for sending a check, the transfer amount, enter a captcha and tick your agreement with the terms.

To transfer via SMS, you need to send a message to the short number 7878 with a text containing, separated by spaces, the name of the card’s payment system, its 16-digit number and the transfer amount. For example, to transfer 5 thousand rubles to a Visa card: “Visa 0000 1111 2222 3333 5000”.

Megaphone

Funds can be transferred from the Megafon number balance both by card number and account details. To do this, you need to use the MegafonMoney service.

You can transfer from 1 to 15,000 rubles at a time, and no more than 40,000 rubles per day. The limit on transfers per month is also 40,000 rubles.

Tariffs for transfers to a card are:

- 7.35% of the transfer amount + 95 rubles - for transfers from 50 to 4,999 rubles;

- 7.35% of the transfer amount +259 rubles - for amounts from 5,000 to 15,000 rubles.

Money can be withdrawn by number to Visa and MasterCard, Maestro and Mir cards.

Transfer using account details is also possible. The tariff for transferring from a phone to an account is 8% of the amount + 40 rubles.

The term for crediting funds depends on the recipient’s bank - from two minutes to five days.

You can withdraw from 1 to 15,000 rubles at a time from Megafon’s number, but not more than 40,000 per day or month

Tele 2

To withdraw money from your Tele2 balance, you just need to indicate your phone number, the recipient’s card number and the payment amount.

In Tele2 you can transfer money from your mobile balance not only to your own, but also to someone else’s card

You can transfer from 50 to 15,000 rubles at a time, but after the transfer, at least 10 rubles must remain on the balance of the mobile number. Up to 50 transfers are allowed per day, up to 1,000 per month. The commission depends on the amount and on average ranges from 50 to 400 rubles. Transfers are made to cards with 16-digit numbers. You cannot transfer money to Maestro, where there are more digits in the number.

Iota

The operator returns money from the balance of the mobile number only to the bank card. To begin this procedure, you need to visit the operator’s point of sale with your passport and a receipt or other proof of payment. You can find the nearest one here using the “Accepting applications” filter. You can fill out an application for refund of the advance payment () in advance or on the spot.

The application must include the following information about the card:

- card type (Visa, MasterCard, Maestro, Mir or other);

- number on the front of the card;

- the owner’s first and last name in Latin letters - as on the front side of the card;

- card expiry date;

- Bank's name;

- current account number;

- bank correspondent account;

- BIC.

Yota considers such applications within 30 days. Depending on the bank, it will take up to five days for the money to be credited to the card.

What if money was transferred to you by mistake and they ask you to return it?

“If an unfamiliar person transferred funds to you by accident, immediately transfer them back,” says Ekaterina Antonova. “After all, the article on unjust enrichment can be applied to any citizen, which means that a lawsuit can also be filed against you with a requirement not only to pay the entire amount in full, but also to compensate the victim for moral damage and financial costs for legal support.”

pexels.com/

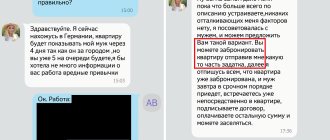

Sometimes cardholders receive messages asking them to return erroneously transferred money to such and such a card or mobile phone number, while no funds were received on their card.

“If you suspect fraudulent activity, do not make any money transfers under any circumstances,” warns Ekaterina Antonova. - And of course, do not tell anyone the three-digit code indicated on the back of the card. Even bank employees do not have the right to request such information over the phone. In any other case, you need to immediately call the bank’s hotline and block the card. This can be done over the phone."

Contact the operator

But if the money has already been transferred to the cellular operator, then the bank is already powerless here - you will have to contact the operator.

Large players have special functionality that allows them to automatically transfer erroneously paid funds to the correct number. To do this, you should go to the website of the operator (servicing the phone to which you accidentally sent money), find a special section and read the information about the procedure for returning a payment.

“By dialing the short number indicated on the website, you must follow the instructions of the automatic informant. But these services operate under certain conditions set by each operator independently. These may include, for example, the number of incorrectly dialed digits, the deadline for applying for a refund, the maximum amount of the transferred amount,” explains Tanina.

Russian legislation does not provide for universal rules for refunds and their conditions, designed for all telecom operators without exception.

How to find out why money is being withdrawn from your phone? More details

How to protect yourself from making erroneous money transfers?

And finally, some advice for those who are tired of double-checking the numbers of bank accounts or cards during financial transactions. Firstly, to optimize money transfers, you can create special templates in mobile banking. In addition, you can use a text editor, saving the numbers of frequently used accounts in it, and then copying and pasting them in the desired column during the translation. And of course, you can easily and securely transfer funds using the contact list in your mobile phone.