Legislative norms determine the need to pay state fees when filing various types of claims, complaints, petitions, etc. An appeal is no exception.

State fee for appeal

You are invited to learn further about the collection procedure, the nuances of calculation, transfer and preferential treatment in relation to the payment in question.

Who should pay the fee?

Section 333.36.

Benefits when applying to the Supreme Court of the Russian Federation, courts of general jurisdiction, magistrates In accordance with current legislative requirements, a payment document indicating the fact of transfer of the fee must be attached to the statement of claim, complaint, petition, etc. Consequently, the obligation to pay the deduction in question falls on the shoulders of the citizen filing an appeal against the decision made by the court of the previous instance.

However, based on the results of the appeal proceedings, the payment procedure may be reviewed by the court. The options are as follows:

- the court regards the appeal as legitimate and satisfies the demands of its author - the other party to the proceedings is obliged to compensate the costs;

- the court does not satisfy the appeal requirements - the money is not returned to the applicant;

- The appeal is partially granted by the court - the fee is distributed among the participants in the proceedings. The calculation is carried out in accordance with the percentage of the appeal granted. For example, if the applicant put forward 3 demands and 2 of them were satisfied, the second party to the proceedings will recover 2/3 of the amount of the state encumbrance. Section 333.36. Benefits when appealing to the Supreme Court of the Russian Federation, courts of general jurisdiction, and magistrates

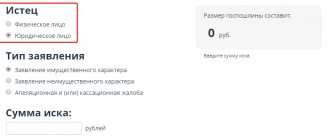

When to use the 2021 state duty calculator

The presented calculator is used to calculate:

- fees for consideration of cases considered by district (city) courts

- fees for cases considered by magistrates

- state fees to regional, regional, republican courts, to the Supreme Court of the Russian Federation

In 2021, the amount of the state fee to the court has not changed. When filing claims, starting from January 1, 2021, the state duty must be paid at the specified rates.

In the event of a positive decision in the case, the plaintiff may recover the state fee from the defendant, as well as other legal expenses.

Amount and procedure for payment of duties

Legislative standards regarding state duties are determined by the provisions of Chapter 25.3. the current Tax Code. When considering property claims, the amount of recovery is determined taking into account the cost of the proceedings. In this case, the applicant must pay at least 50% of the calculated amount. The procedure for collecting the remaining funds will be determined based on the results of the proceedings.

State duty (Chapter 25.3 of the Tax Code of the Russian Federation), Art. 1

The maximum fee is 4%. Relevant for claims worth no more than 100,000 rubles. In case of filing a non-material claim, the full amount for individuals. individuals and organizations will be 6,000 rubles. For a number of cases you will have to pay only 300 rubles. These points need to be clarified on an individual basis. In general, the law obliges applicants to pay at least half the fee, even if, in the opinion of the applicant, the disputed case is clearly biased and in any circumstances the appeal will be allowed.

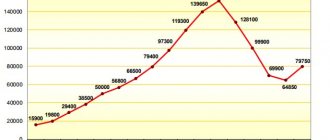

The fee in relation to claims of a property nature, as noted, is determined by the cost of the disputed proceedings. Information on this matter is given in the following table.

Table. Calculation of fees for property claims

| Condition | Duty amount |

| 1) when filing a claim of a property nature, subject to assessment, at the cost of the claim | up to 20,000 rubles - 4 percent of the claim price, but not less than 400 rubles; |

| from 20,001 rubles to 100,000 rubles - 800 rubles plus 3 percent of the amount exceeding 20,000 rubles; | |

| from 100,001 rubles to 200,000 rubles - 3,200 rubles plus 2 percent of the amount exceeding 100,000 rubles; | |

| from 200,001 rubles to 1,000,000 rubles - 5,200 rubles plus 1 percent of the amount exceeding 200,000 rubles; | |

| over 1,000,000 rubles - 13,200 rubles plus 0.5 percent of the amount exceeding 1,000,000 rubles, but not more than 60,000 rubles; | |

| 2) when filing an application for a court order | 50 percent of the amount of the state duty collected when filing a claim of a property nature; |

| 3) when filing a claim of a property nature that is not subject to assessment, as well as a claim of a non-property nature | for individuals - 300 rubles; |

| for organizations - 6,000 rubles; | |

| 4) when filing a supervisory complaint | in the amount of the state duty paid when filing a claim of a non-property nature; |

| 5) when filing a claim for divorce | 600 rubles; |

| 6) when filing an application to challenge (in whole or in part) regulatory legal acts (regulatory acts) of state bodies, the Central Bank of the Russian Federation, state extra-budgetary funds, local governments, state corporations, officials, as well as applications to challenge non-regulatory legal acts of the President Russian Federation, Federation Council of the Federal Assembly of the Russian Federation, State Duma of the Federal Assembly of the Russian Federation, Government of the Russian Federation, Government Commission for Control of Foreign Investments in the Russian Federation: | for individuals - 300 rubles; |

| for organizations - 4,500 rubles; | |

| 7) when filing an application to recognize a non-normative legal act as invalid and to recognize decisions and actions (inaction) of state bodies, local governments, other bodies, officials as illegal: | for individuals - 300 rubles; |

| for organizations - 2,000 rubles; | |

| when filing an application for special proceedings | 300 rubles; |

| 9) when filing an appeal and (or) cassation complaint | 50 percent of the state fee payable when filing a claim of a non-property nature; |

| 11) when submitting an application for the issuance of writs of execution for the forced execution of arbitration court decisions | 2250 rubles; |

| 12) when filing an application to secure a claim being considered in an arbitration court | 300 rubles; |

| 13) when filing an application to cancel the arbitration decision | 2,250 rubles; |

| 14) when filing an application in cases of alimony collection | 150 rubles. If the court makes a decision to collect alimony both for the maintenance of children and for the maintenance of the plaintiff, the amount of the state duty is doubled; |

| 15) when filing an application for an award of compensation for violation of the right to legal proceedings within a reasonable time or the right to execution of a judicial act within a reasonable time: | for individuals - 300 rubles; |

| for organizations - 6,000 rubles. |

Payment order form

Citizens often encounter difficulties in determining the recipient of the payment. Options 2: court of first instance and appellate instance. Legislative norms establish the following payment procedure: the fee is transferred in favor of the authority that received a similar deduction when filing the original disputed claim. The exact details for the transfer, as well as the amount of payment, must be clarified locally, in the court office or at a stand with important information.

What is the state duty to court?

State duty (state duty) to court is a fee established by law that the payer must pay when going to court.

State duty refers to legal expenses, which is enshrined in Articles 88 of the Code of Civil Procedure of the Russian Federation, 103 of the Code of Arbitration Procedures of the Russian Federation. The Code of Civil Procedure and the CAS establish the procedure for determining the price of a claim and cases of additional payment of state duty. The provisions of the procedural codes establish the procedure for the collection and distribution of legal costs, including the state fee paid when filing a claim.

The amount of the state duty, the procedure for its payment, cases of granting benefits, the possibility of deferment, installments and refund of the state duty are established by Chapter 25.3 of Part 2 of the Tax Code of the Russian Federation. The state fee calculator does not take into account these individual privileges.

State duty benefits

Legislative norms determine the following procedure for benefits. Representatives of the following categories of citizens are exempt from paying the fee :

- persons awarded the title of Hero of the Russian Federation or the USSR;

- citizens who are full holders of the Order of Glory;

- persons who took part in the Great Patriotic War, as well as those who became disabled as a result of those events.

To receive the benefit, the applicant must present the appropriate identification. State duty benefits

The following categories of claims are exempt from collection:

- drawn up in relation to labor disputes, benefits;

- alimony;

- submitted for the purpose of claiming compensation for harm resulting from injury and other injuries to the breadwinner, as well as upon his death;

- drawn up with a claim for compensation for moral/property damage that arose as a result of the crime;

- complaints affecting aspects of the divorce process.

In accordance with current legislation, parties to proceedings may be released from the encumbrance in question in the following situations:

- when requesting a deferment of execution of court orders;

- in case of filing an application to change the procedure/method of execution of decisions made as a result of the trial;

- when requesting an extension of the missed deadline; Article 333.18. Procedure and deadlines for paying state duty

- in case of filing a petition for review of a default judgment, decisions and rulings, final decisions;

- when filing complaints regarding the performance or non-performance of their duties by bailiffs;

- in case of submission of private complaints against judicial rulings for consideration. The situation is clarified on an individual basis.

In addition, citizens of the following categories may be exempt from the state penalty in question:

- applicants submitting complaints for judicial consideration regarding compensation for any kind of harm caused during criminal prosecution;

- citizens who were unjustifiably subjected to political repression and rehabilitated in accordance with established legislative provisions;

- persons belonging to the category of refugees and forced migrants in the event of an appeal challenging the refusal to recognize them as such, registration and other provisions provided for by legislative standards;

- citizens appealing to the court in cases related to adoption;

- applicants filing appeals in cases of protection of children, their legitimate interests and established rights;

- citizens appealing proceedings in cases of a non-property nature affecting the rights of people with disabilities;

- applicants filing appeals in relation to cases of compulsory psychiatric treatment/examination of citizens;

- prison inmates if they submit a request for the re-issuance of various types of documents drawn up during judicial proceedings, if they have the right to familiarize themselves with them; Article 333.41 of the Tax Code of the Russian Federation

- appeals from citizens positioned as authors of the results of various types of intellectual activity. Such applicants are exempt from the burden of state fees in the event of appealing claims for their admission to work with intellectual property owned by other persons.

When challenging a claim worth up to 1 million rubles , the burden in the form of state duty can be lifted from representatives of the following categories of citizens/organizations:

- organizations of disabled people;

- citizens who are disabled I-II groups;

- veterans of various military operations and services;

- citizens resorting to appeal against decisions regarding violation of consumer rights;

- pensioners in the event of claims being brought against state and non-state pension funds, as well as against executive bodies whose powers include pension provision for former military personnel. Application for refund of state duty

If the value of the claim is more than 1 million rubles , representatives of the above categories will be required to pay a penalty in the amount of 0.5% of the amount over 1 million rubles. The maximum value of the duty cannot exceed 60 thousand rubles.

How can I pay, methods

You can pay the state duty in Russia in completely different ways, choosing the closest option for yourself. For example, it is convenient for someone to contact the bank’s cash desk with their details, but for those who live remotely, an option would be an i-box or a terminal or an ATM.

Payment through a bank cash desk

One of the options that is relevant for the majority is the cash desk of Sberbank of Russia. It is always available and there are numerous branches throughout the country, even in sparsely populated villages. Sberbank terminals are no less in demand than cash registers, especially among those who can handle the automated system quite independently and can enter details on the screen. This is in part more suitable for young people and the middle generation, who are more likely to encounter computers.

This is important to know: Special limitation periods in civil law

Whatever option the payer chooses, the main and mandatory rule is to correctly enter the details for making the payment. If you make a mistake, the money to pay the state fee may go in the wrong place, or it may get stuck in the system, and it may be difficult to get it back. In this case, you will have to write a statement to the bank about incorrectly providing payment details and wait for a refund.

You can always file a claim in court, but it will not be accepted without paying a state fee. This is a prerequisite in most legal proceedings. However, there are situations where the party filing the complaint or claim is exempt from paying the fee. You can also later return the money spent on state duty.

Expert opinion

Zakharov Viktor Yurievich

Practicing lawyer with 8 years of experience. Specialization: family law. Recognized legal expert.

Grounds for duty refund

Grounds for refund of duties

Legislative regulations provide grounds for refund of duties to the payer. This is possible in the following cases:

- if a citizen changes his mind about filing an appeal after paying the fee;

- if the amount of payment exceeds the deduction amount established by law.

To return the duty, the payer must submit a corresponding application to the tax office at the location of the court. Along with the application, it is necessary to submit a court decision on the return of the duty, as well as a document confirming the fact of its transfer.

Section 333.40. Grounds and procedure for refund or offset of state duty

Section 333.40. Grounds and procedure for refund or offset of state duty

The money will be returned to the payer a maximum of one month after submitting the said application. The statute of limitations for this point is 3 years. After the expiration of the designated period, the request for a refund will not be considered, except in situations provided for by current legislative regulations.

| Conditions for refund of state duty (partially or in full) | When the state duty is not refunded |

| payment of state duty in a larger amount | when the defendant voluntarily satisfies the plaintiff’s demands after the latter applies to the arbitration court and a ruling is made to accept the statement of claim for proceedings, as well as when a settlement agreement is approved by a court of general jurisdiction for a significant action |

| termination of proceedings in a case or leaving a statement of claim without consideration by a court of general jurisdiction or an arbitration court | |

| refusal of persons who have paid the state duty to perform an action before contacting the authorized body performing this legally significant action | |

| If a settlement agreement is concluded before the arbitration court makes a decision, 50 percent of the amount of the state duty paid by him shall be returned to the plaintiff. This provision does not apply if the settlement agreement is concluded in the process of executing a judicial act of the arbitration court | |

| return of an application, complaint or other appeal or refusal to accept it by the courts. If the state duty is not returned, its amount is counted towards payment of the state duty when filing a claim again, unless the three-year period has expired from the date of the previous decision and the original document on payment of the state duty is attached to the repeated claim |

Application for refund of state duty. Form

Application for refund of state duty

Sample application for refund of state duty to the tax authority. Form

Sample application for refund of state duty to the tax authority

Appeal against a district court decision: prices and sample

Free online legal advice on all legal issues

Appeal

Immediately at the preliminary hearing, the judge openly sided with the defendant. Turning half a turn away from me, he said quite clearly: “I’ll show you how to file a lawsuit.

You will pay me and pay me." At the end of the preliminary hearing, I told the defendant that he (the judge) would tell him how the defendant could deal with me and those who agree with me. My claim was rejected.

Is it necessary to somehow write in the complaint about the actions of the judge and what laws should be referred to?

The commission department sold my things for 100,000 rubles, deceiving another 30 people and did not give the money

What articles can be applied to my case?

Good afternoon In order to give you recommendations with references to the rule of law, it is necessary to have an idea of the court’s decision and in what part you do not agree with it.

The commission department sold my things, but did not return the money in the amount of 100,000 rubles. The court decided to punish in the form of compulsory labor. He deceived more than 30 people. Thus. How to file an appeal?

How to file an appeal?

Good afternoon In accordance with the Code of Civil Procedure of the Russian Federation, an appeal or presentation is filed through the court that made the decision. An appeal or presentation received directly by the appellate instance is subject to forwarding to the court that made the decision for further action in accordance with the requirements of Article 325 of the Code of Civil Procedure of the Russian Federation.

An appeal or presentation may be filed within a month from the date the court decision is made in final form, unless other deadlines are established by this Code.

An appeal or presentation must contain:

1) the name of the court to which the appeal or presentation is filed;

2) the name of the person filing the complaint, presentation, his place of residence or location;

3) an indication of the court decision that is being appealed;

4) the demands of the person filing the complaint or the demands of the prosecutor making the presentation, as well as the grounds on which they consider the court decision to be incorrect;

5) a list of documents attached to the complaint or submission.

An appeal or presentation cannot contain demands that were not stated during the consideration of the case in the court of first instance.

A reference by the person filing the appeal or the prosecutor bringing the appeal to new evidence that was not presented to the court of first instance is allowed only if it is justified in the said complaint or presentation that this evidence could not be presented to the court of first instance.

The appeal is signed by the person filing the complaint or his representative. The complaint filed by the representative must be accompanied by a power of attorney or other document certifying the authority of the representative, if there is no such authority in the case.

The appeal submission is signed by the prosecutor.

The appeal is accompanied by a document confirming payment of the state fee, if the complaint is subject to payment.

The appeal, presentation and documents attached to them are submitted with copies, the number of which corresponds to the number of persons participating in the case (Article 322 of the Code of Civil Procedure of the Russian Federation).