Unfortunately, the constituent documents of an enterprise are often lost or, due to various external factors, become unusable. Moreover, this usually happens suddenly and at the wrong time. However, it is impossible for a legal entity to continue operating without constituent documentation, and it is simply impossible, because without them not a single legally significant action can be carried out. Thus, there is an urgent need to restore lost documents as quickly as possible.

We offer our services in obtaining duplicates of any company registration documents! The period for receiving duplicates is 10 days, and when ordering you will receive documents within 3-5 days.

General Basics

As you know, in Russia there are several types of legal entities. These include LLCs, OJSCs, various unions and associations and many others. Each of these companies uses its own list of constituent documents, which are required by law. In fact, this list is constantly changing, and therefore it is quite difficult to understand what exactly is included in it at the moment.

So, as of the current time, all legal entities, with the exception of state corporations and business partnerships, as stated in Article 52 of the Civil Code of the Russian Federation, act only on the basis of the Charter. These enterprises need another legal entity document, namely a memorandum of association or other documents. Now let's talk in more detail about what they mean.

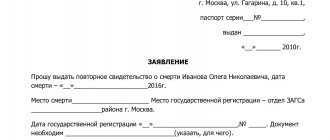

Application for issuance of a duplicate of the charter to the tax office 2021

The service itself will calculate taxes and contributions payable, taking into account changes in legislation.

The likelihood of human errors is excluded, since the calculation is automated. Thanks to this, you don’t have to worry about fines and penalties.

Tax calculation

The service calculates:

- Advance payments under the simplified tax system and tax for the year

- Patent payments

- Trade fee amounts

- Income tax

- Value added tax

Any payment is calculated in a special wizard. You will see step by step how your tax is calculated.

Calculation of contributions

The service calculates:

- Fixed payments for individual entrepreneurs

- Additional entrepreneur contribution

- Contributions to funds from employee salaries

Fixed contributions of individual entrepreneurs are calculated taking into account the date of registration. You won't have to overpay them for less than a year of work. When calculating contributions for employees, the service takes into account regression - a decrease in contribution rates when accrued salaries reach threshold values.

Additional features

The service generates a payment document. LLCs can generate a payment order.

There are more options for individual entrepreneurs. They can generate a payment slip for the bank or a receipt for paying the tax in cash. In addition, individual entrepreneurs will be able to pay tax with a bank card or electronic money directly from their personal account.

The tax payment order can be uploaded directly to your online bank. “My Business” automatically exchanges data with leading banks. All you have to do is confirm the payment, and the tax is paid.

We know how important it is not to overpay, so the service will offer safe ways to reduce taxes. Will take into account your taxation system and business ownership form. Each method is legal and will not cause claims from the tax authorities.

You can draw up almost any agreement without the help of lawyers in the Agreement Creation Wizard.

You will find 19 ready-made contract templates for various transactions.

You don’t need to compose anything from scratch; use time-tested and lawyer-tested templates.

And so you can upload your own contract template, into which all the data about each client will be inserted. Thus, a new agreement can be created with one click.

There is nothing complicated about this, but there are some nuances that are very important to know. When writing an application for a copy of the charter, the organization must also indicate all changes in the charter, including their numbers.

In accordance with paragraph 1 of Art. 6 Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs” dated 08.08.2021 No. 129-FZ (hereinafter referred to as the Federal Law on State Registration), information and documents contained in state registers are open and publicly available , with the exception of some information ( passport data of individuals).

Charter

The charter is the only one from the list of constituent documents that are required for the activities of OJSC, LLC, unitary enterprises, cooperatives, funds, additional liability companies and a number of other organizations. Even though its concept has not been established at the level of the legislative system, the term itself is now widely used. A correctly created and registered Charter can only be approved by the founders of the organization themselves, who carry out their further activities based on it. Its main difference from the constituent agreement is that it cannot be concluded, but only approved, which in legal science are different actions.

Why a Charter may be required

Let's move on to the issue of providing the tax service with a certified copy of the Charter.

The charter of an enterprise is one of the main constituent documents of an LLC, which incorporates the procedure for the activities of the organization and its members. The charter is drawn up by the founders, and registered by the Federal Tax Service. After registration, the original is left in the tax archive, and the only certified copy is transferred to the LLC.

The Federal Tax Service takes into account several cases in which an additional copy of the Charter may be required:

- for registration of real estate transactions;

- when performing any notarial acts;

- for submission to judicial authorities;

- during licensing;

- in order to restore a damaged or lost document;

- to open a bank account;

- to third parties - to obtain information about the counterparty for the purpose of concluding cooperation or to confirm his good faith.

Sometimes an organization seeks to save time by independently certifying a photocopy of the Charter for use in the listed situations. In this regard, the question arises - how to properly certify a copy of the Charter, and whether a special template has been adopted for such actions.

In fact, an organization has the right to copy only the originals of its own constituent papers. But the registered original of the Charter remains with the Federal Tax Service, while only a copy is transferred to the company.

This means that creating copies from already reproduced documents without the individual consent of the Federal Tax Service is an illegal action.

The Federal Tax Service may restrict access to minutes of meetings or some statements

Memorandum of association

Another one of the list of constituent documents is the constituent agreement itself. Based on it, business partnerships can continue to operate, since in terms of their legal force the Charter and the agreement are of equal importance. It is concluded directly at the moment of creation of the legal entity. persons between its founders, and also determines the procedure for their activities and the distribution of income and losses. Such an agreement is a kind of agreement between the founders, which expresses the will of each of them. That is why each of the participants must sign it, because only after this they acquire rights and obligations.

Other constituent documents

In addition to the Charter and the constituent agreement, the list of constituent documents can also include a number of other documents that have similar force.

- State corporations and federal funds can carry out their activities without a Charter or agreement. For them, the main thing should be the presence of a special Federal law, with the help of which the state regulates the procedure for their activities.

- Unions of non-profit organizations must simultaneously have both an agreement and a Charter as part of their constituent documents, otherwise their activities are illegal.

- A number of non-profit organizations can continue to operate on the basis of the general provisions for legal entities of this type.

- In addition, a number of lawyers also classify as constituent documents a certificate of registration with the tax authorities, orders for the appointment of managers and a number of others, since they are also mandatory for the organization’s activities. However, one should take into account the fact that they are not included in the list at all by law.

Obtaining a duplicate of the charter

A copy of the charter of a legal entity is issued by the territorial inspectorate of the Federal Tax Service. To obtain this document, you must also provide an application for a copy of the charter and a receipt for payment of the state fee. A copy of the charter in this case will cost 200 rubles (and 400 rubles urgently). The receipt indicates the details of your tax office, where you will need to receive a copy of the charter. For Moscow, these are invariably the details of MIFTS No. 46. At the same time, you can find out the address and all payment details of any territorial Federal Tax Service on the official website of the tax department.

Required information

The standard Charter, which is adopted by a legal entity, must contain the following information:

- Full name of the organization and its legal form.

- Legal address where it is located.

- Regulations on the basis of which activities are managed.

- Other data that are provided for inclusion in it depending on the organizational and legal form. The Civil Code of the Russian Federation clearly states what exactly should be reflected in the constituent documents.

In addition to the above conditions, other information may be included in the Charter that does not contradict the law. The goals and subject of the company’s activities can be entered depending on desire, since now this is not a mandatory condition.

Issuance of duplicate certificates

On the one hand, it is easier to obtain duplicates of lost certificates, but on the other, it is more difficult. It’s simpler because many of them are not issued by the Federal Tax Service, but by completely different authorities. For example, a certificate for the right to conduct collection activities is obtained from the FSSP, and a certificate for conducting banking activities is obtained from the Central Bank of the Russian Federation. To do this, you just need to fill out an application and pay the fee.

But it may be difficult to obtain copies of certificates of assignment of OGRN and TIN. Thus, since 2013, legal entities registered before July 1, 2002, upon loss of the certificate of assignment of the OGRN, received not a duplicate of it, but a Unified State Register of Legal Entities (USRLE) entry sheet. (Decision of the Moscow Arbitration Court in case No. A40-41955/15 dated June 29, 2015).

And from 01/01/2017, the Federal Tax Service of the Russian Federation completely stopped issuing certificates of assignment of OGRN, of amendments to the Charter and the Unified State Register of Legal Entities, as well as of assignment of TIN on secure forms. They are not printed at all today. Therefore, instead of lost OGRN certificates and changes to the constituent document or register, the applicant will receive Record Sheets, and instead of a certificate of TIN assignment on a secure form - a duplicate on a regular A4 sheet with the seal of the registration authority. However, such changes did not in any way affect the legal validity of these documents.

State registration

Constituent documents must undergo a registration procedure before entering into legal force. This is done directly at the Federal Tax Service of the Russian Federation. All necessary papers will need to be submitted to the government agency, including copies of constituent documents, certified in advance by a notary, in order for the legal entity to be registered.

Any changes that will be made to the Charter are also subject to state registration, so it should be taken into account that they will not come into force immediately, but only after its passage.

LLC Charter

According to Article 12 of the Law “On LLC”, the charter is the only constituent document of the company. It contains the identification characteristics of the organization:

- the name of the LLC (full and abbreviated) in Russian; in addition, you can also indicate the name in the language of the peoples of the Russian Federation or in a foreign language;

- location (location where the organization is registered);

- the size of the initial authorized capital.

In addition, the charter must include the procedure for the company’s activities, the rights and obligations of participants, the procedure for transferring a share in the management company to another person and other mandatory information.

Create documents for LLC registration for free

Since 2014, Article 52 of the Civil Code of the Russian Federation allows the creation of an organization on the basis of a standard charter. True, the federal tax service has not yet completed the development of standard samples. The standard charter does not need to be printed and submitted for registration to the inspectorate; it is enough to note in form P11001 that the company operates on the basis of one of the approved options. But even after their approval, the founders have the right to develop not a standard, but an individual version of the charter.

In our service you can prepare the charter and other documents for registering an LLC for free and in a few minutes.

Our sample charter includes the provisions necessary for the operation of the enterprise; you can take it as a basis and adjust it as desired. If in the future you need to change the text, you must notify the registering tax office about changes to the charter using form P13014.

For registration of changes, a state fee of 800 rubles is paid. In the article “Amendments to the charter of LLC 2021: step-by-step instructions” you will find a description of all situations requiring the submission of form P13014, and the application form itself.

Essential conditions

Since the constituent documents are basically a transaction, it must contain essential terms that reflect the essence. They can be divided according to the following classification:

- Imperative, that is, those that are mandatory.

- Dispositive - if desired, the founders can make changes to them.

- Initiatives introduced in order - their presence in the documents depends solely on the wishes of the participants.

- The most important conditions are prescribed, that is, those that must be included in the content by decision of the legislator.

Topic: Involvement of the founder under the Code of Administrative Offenses for providing false information

First, let's determine why they arrived there. If, on behalf of the registration authority that is verifying the accuracy of information already included in the Unified State Register of Legal Entities, then yes, an inspection protocol is drawn up. Sequence: 1) receipt by the registrar of information about unreliability 2) sending by the registrar of an order to the territorial inspection 3) inspection of the property by the territorial inspectorate and drawing up a protocol 4) sending the inspection protocol to the registrar 5) adoption by the registrar of the measures provided for in paragraph 6 of Article 11 (direction “ taxpayer" notice of unreliability)

In the second case, we are talking about a continuing violation of the rule on the reliability of address information available in the Unified State Register of Legal Entities. For this violation, it does not matter when the documents about this address were presented, whether they were reliable or unreliable at the time of presentation, and when they ceased to be reliable. Today they revealed that they are unreliable - and that’s enough. But there is no such composition of the APN in the Code of Administrative Offenses. And this is precisely the violation that the author has.

It is recommended to put the seal of the organization submitting an application for a copy of the charter or an application for issuing amendments to the charter on the signature. A request for a copy of the charter in the form of a paper document is submitted (sent) to the authorized territorial body of the Federal Tax Service of Russia at the location of the legal entity in respect of which copies of documents are requested.

You might be interested ==> Pension for widows of Chernobyl victims in what age?

If an interested person requires another copy of the constituent document, he must contact the tax authority and declare the need for an additional copy. How to order a copy of the Charter from the tax office? To do this, the applicant will need to follow the following procedure.

We kindly ask you to provide us with a duly certified copy of our articles of association. Zamoskvorechye LLC is registered under registration number 5000629841, the certificate was issued on August 8, 2002. As well as changes made to the above charter, registered under No.

This service is paid, and before ordering an application for a copy of the charter, you need to take payment details and go pay the state fee. Details can be obtained from the tax office. And if you register on the site in your personal account, you can perform all these actions online.

Features of the procedure for making changes

If it is necessary to make changes to the content of the Charter, which are aimed at changing the legal status of a legal entity or regulating relations between participants, then within 5 days after the decision is made, the registration authority must be notified about this. To do this, a statement is sent stating that it was decided to make changes, as well as the list of changes itself. After this, the Federal Tax Service informs you within the prescribed period that the data has been entered. Registration authorities may also refuse registration, but this only happens in cases where not all papers were submitted for verification or they were executed improperly.

Application for issuance of a copy of the charter to the Federal Tax Service

Lost documents related to the organization (TIN, OGRN, registration sheet)? This is not a reason to worry, our lawyers will quickly restore duplicates of constituent documents and other documents through the tax inspectorates, since a legal entity or individual entrepreneur will not be able to work without documents. information about the Company (name of LLC, INN, OGRN);

It happens that companies, for one reason or another, lose their constituent documents: they fall into disrepair, disappear during natural disasters, as happened in the Krasnodar Territory and Transbaikalia, or are simply lost by irresponsible employees.

A copy of the company's charter, certified by the tax authorities, may be needed when opening a bank account, performing notarial acts and when working with counterparties. A copy of the charter is issued at the registration or territorial tax authority at the place where the organization is registered as a taxpayer.

If you have chosen delivery, then expect a call from the courier the next day.

Application form Duplicate from MIFTS or certified by a notary office? When it becomes necessary to obtain a certified copy of the charter, a dilemma usually arises: to certify yours with a notary or to obtain a duplicate certified by the registration authority? Often the choice is made in favor of a duplicate from the Federal Tax Service for several reasons:

Priority of payment in a payment order in 2021 Queue number Payments that are included in queue 1 (first priority) According to executive documents for the transfer or issuance of funds from the account to satisfy claims for compensation for harm to life and health, as well as claims for the collection of alimony 2 (second queue) According to executive documents for the transfer or issuance of funds from the account for severance pay and wages to persons working or who worked under an employment contract, as well as for the payment of remuneration to the authors of the results of intellectual activity 3 (third priority) According to payment documents for:

V. Petrov June 30, 2021 The amount of the fee for issuing documents contained in the Unified State Register of Legal Entities is established by the Decree of the Government of the Russian Federation dated May 19.

2014 N 462 On the amount of payment for the provision of information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs and the recognition as invalid of certain acts of the Government of the Russian Federation” and amounts to 200 rubles. for each document and 400 rubles.

› It happens that companies, for one reason or another, lose their constituent documents: they fall into disrepair, disappear during natural disasters (as happened in the Krasnodar Territory and Transbaikalia), or are simply lost by irresponsible employees. Our new article will tell readers how managers and owners of a company can restore and obtain copies of lost documents.

/ / In accordance with paragraphs 35-36 of the Regulations, the state fee for the provision of public services related to the provision of information and documents from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs is not charged, but a fee is charged, the amount of which is established by Decree of the Government of the Russian Federation dated May 19, 2014 N 462. However, Clause 1 of Art. 7 of the Law on State Registration establishes that the provision of information and documents contained in state registers is carried out for a fee, and provision in the form of an electronic document is free of charge.

Documents about a specific legal entity are provided upon request, which must contain the full or abbreviated name of the legal entity about which documents are requested, as well as its main state registration number (OGRN) or taxpayer identification number (TIN).

In addition, when obtaining a particular license, you cannot do this without presenting the charter. If you participate in any competition, these papers may also be needed. Also, in addition to the charter, you may need to urgently obtain other constituent documents. For example, a copy of the memorandum of association is required in matters of real estate plots.