We tell you how to build processes in a company from the point of view of returning goods: how to instruct employees which goods can be returned and which cannot, whether the consumer needs a receipt and what to do in the case of online trading.

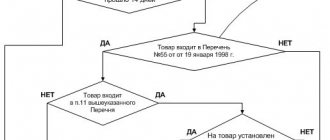

- Algorithm of actions of a store employee when returning goods

- Why is it necessary to respond to the buyer in any case?

- How to write a response to an application for the return of goods

- What to do if a consumer wants to return a defective product?

- What is a product shortage?

- How much time does the buyer have to make a claim?

- How to identify a deficiency

- How to exchange goods of inadequate quality

- How to make a discount on a product with a shortage

- How to repair a product

- How to get your money back for a product of poor quality

- What to do with returns at the request of the consumer

- When the seller is not obliged to return money for a quality product

- How to return and exchange technically complex products

- Errors in consumer refusals

- How to apply for a refund

Algorithm of actions of a store employee when returning goods

Returning goods to the buyer is not only a legal and accounting process, but also part of customer service. The task of a business manager is to write down instructions so that employees understand how to act according to the law, and even in emotional situations, they transfer everything into a positive, calm, but legal direction.

The main phrase of the seller - let's figure it out

Let's say you have a clothing store. The following situations are possible:

- The consumer emotionally demands a refund because he was sold a defective down jacket.

- The buyer asks for a refund because the style did not suit him, but according to the law he supposedly has the right to a refund.

- The consumer asks if he can return his down jacket. When he tried on the clothes, everything seemed to fit, but at home it turned out that the down jacket was too big.

To any of these situations, the store employee should respond the same way: “Okay, let's figure it out.” You cannot get into squabbles, argue, or refuse to return money or accept goods, even verbally.

If you do not turn the conversation into the right direction and argue with the consumer, then he may sue you. De jure, with his appeal, the consumer complies with the claims procedure - he came to you with a pre-trial claim, you did not agree to a peaceful resolution of the issue.

Therefore, in court, the store can be charged not only the cost of the goods, but also 50% of its price in the form of a fine, a penalty, which depends on the duration of the proceedings, compensation for moral damages, examination costs on the part of the buyer and legal costs.

Take a statement from the consumer

The store can avoid litigation if it complies with the requirements for handling citizen complaints.

Obtain a statement from the buyer in which he describes the problems and expresses his requirements. People often refuse to write something, demanding a return at the time of request. Therefore, it is important to instruct employees that in such situations customers cannot be refused in any way.

A refusal to issue money right now may ultimately be counted in court as a refusal to return the money in general. Therefore, the employee contacted by the consumer must explain to the buyer that making a return is not a problem, because the store has clearly written instructions in this regard in accordance with the law. But according to this instruction, the decision to return is made by an authorized person. For example, a director or lawyer of a company. Therefore, the buyer needs to leave a statement.

Usually two copies are made - one is kept for yourself, the other is given to the buyer with a note on the date of receipt.

If the buyer continues to argue and does not want to write anything, a store employee can accept an oral request from him. To do this, you need to record the requirements on paper yourself and register them in the request log.

The law does not regulate the sample journal of oral communications for business, so stores usually use a free form. For example, they create a table file for the secretary with the following columns:

- serial number of the complaint;

- date and time of request;

- Full name of the applicant;

- address or other contact details of the applicant to which the response can be sent;

- content of the appeal;

- the applicant’s signature (confirmation that he agrees with what was written);

- results of the appeal.

Another option to receive a consumer statement is to offer to write him an appeal in the book of complaints and suggestions. You need to record the date it was written.

What to do if the consumer refuses to fill out a statement

There are situations when the buyer refuses even to draw up an oral appeal. Perhaps due to emotions, later, having calmed down, the person will return again for a constructive conversation. But this could also be manipulation - after that he will go to court and demand compensation for moral damages and fines against the store, claiming that the store allegedly refused to accept his oral appeal.

Therefore, businesses should prepare: install cameras with audio recording in rooms where the consumer can make verbal demands. Keep the records for as long as possible to be able to prove that you are right and that the consumer is dishonest.

If there are no cameras, and you suspect the buyer of manipulation, look for witnesses to the dialogue - those who can confirm in court that you asked the consumer to leave contact information to respond to his verbal appeal and did not refuse him a refund.

What should be included in the return application?

The law does not establish any specific format for a refund application, so you must adhere to the general principles of civil law. You can draw up a template application and offer to fill it out, but the consumer has the right to refuse and write the application in free form.

If you are making a template, provide the following columns:

- Full name of the applicant;

- contact information for sending a response;

- the essence of the statement;

- reasons why the consumer wants to return the product;

- How the goods were paid for - in cash or by card.

There may be several templates, depending on the reason for the return. For example, to return a low-quality product or return simply at the request of the consumer. More on this in the following sections.

Find out the buyer's status

The Consumer Protection Act (CPLA) does not apply to everyone who buys something from you. A consumer is only considered to be someone who buys for personal needs and not for business purposes.

For whom ZPP does not work:

- An individual entrepreneur who makes payments through a bank account.

- The same individual entrepreneur who pays for goods for his business with a personal card or cash.

- Any individual who pays for goods by card or cash, if they are intended for business activities. For example, a wife buys goods for production for her husband, a businessman.

- If payment is made from a corporate card.

If the buyer is not a “consumer,” then the return of goods essentially turns into a dispute between economic entities. In this case, the buyer does not have the right, for example, to return the product simply because it did not fit him in style.

It is quite difficult to understand for what purpose a purchase was made. This can only be determined accurately if payment was made from a current account or corporate card, or if the person himself wrote about this in the return application. In other cases, refusal to return may result in legal action.

In your return application template, include several multiple choice questions to help you identify your business goals. For example, ask how the person paid for the goods: in cash, with a personal or corporate card.

2021 Tuition Tax Refund

You can get back part of the funds spent on training thanks to clause 2, part 1, art. 219 NK. As in the previous case, the opportunity is available to officially employed people who pay personal income tax. You can reduce costs by 13% both for your own education (in any form) and for the education of your children, brothers, sisters and even wards (but only full-time).

You can take advantage of the deduction when paying for services from licensed educational institutions (university, technical school, etc.). The factor of having a license is not taken into account in the direct implementation of educational activities by individual entrepreneurs.

What is the amount

The refund amount is calculated for the calendar year and cannot exceed the amount paid by personal income tax. The maximum amount that can be reduced by 13% is RUB 120,000. (for your training). Thus, the maximum return amount is 120,000 × 0.13 = 15,600 rubles.

To receive a deduction for the education of your children, the following conditions must be met:

- the offspring is a maximum of 24 years old;

- he is a full-time student in kindergarten, school, university, etc.;

- the agreement for payment of educational services was drawn up for one of the spouses;

- receipts and bills must be drawn up in the name of the personal income tax payer (or a power of attorney for the transfer of funds has been issued).

The maximum reduction amount is RUB 50,000. per child, i.e. the return will be 50,000 × 0.13 = 6,500 rubles.

Similar conditions are necessary to receive a deduction for brothers and sisters, with the only difference being that the maximum refund in the latter case can be equal to 15,600 rubles.

Tuition tax refund (2020): documents

To provide the deduction in question, you will need to submit the following documents to the Federal Tax Service:

- declaration in form 3-NDFL (original);

- passport (notarized or personally signed copy of each required page);

- original income certificate in form 2-NDFL, which is obtained from the employer. If in the year for which the benefit is received the place of work has changed, certificates are obtained from each employer;

- a tax refund application with account details where the tax office will send the money;

- a certified copy of the agreement with the educational institution, as in the case of a passport, indicating the cost of training. If it changed during the training process, then you need to provide a proper copy of the agreement about this;

- a certified copy of the educational institution's license. It is not necessary to provide it when the contract contains licensing details;

- certified copies of payment orders, receipts or cash receipts.

When returning children's tuition fees, they must additionally submit:

- a certified copy of their birth certificate;

- certificate from the educational institution about the form of study. Needed only if the contract does not specify the named form;

- a certified copy of the marriage certificate. It is necessary when the contract was drawn up for one spouse, and the other applied for a deduction.

Refund of personal income tax paid for the education of a brother or sister means additional provision of:

- copies of the birth certificate of the deduction recipient;

- copies of the birth certificate of the brother, sister;

- the original certificate of the form of study, if the relevant data is not in the contract.

The process of obtaining such a deduction is similar to the case of obtaining a deduction when purchasing an apartment; it takes up to four months.

How long does it take to get your money back?

You can only get a refund for years directly paid for. Moreover, this can only be done in the next 12 months following the payment year. Therefore, if the tuition was paid for in 2021, then you can receive a deduction only in 2021.

If the benefit was not issued immediately, then this can only be done for the last three years. If your studies took place in 2013-2018, you will be able to return the tax in 2021 only for 2021, 2021 and 2021. You can receive such a deduction either through the tax authorities by transferring money to your account, or through your employer in a manner similar to receiving a deduction when purchasing an apartment. Moreover, receiving through an employer means that, unlike receiving a deduction through the tax authority, you do not have to wait until the end of the current year, however, the money can only be received for the current 12 months.

This measure of social support will not be available if tuition is paid for using maternity capital.

Why is it necessary to respond to the buyer in any case?

When a person contacts a store with a request for a return or another complaint, a legally correct procedure must be followed. Accepted the application, sorted out the essence of the complaint, satisfied or refused the consumer, and retained proof of the response.

The consumer can come to the store with an appeal, write a statement or complaint. From the point of view of the law, all this is pre-trial claims. You are obliged to answer it.

If the buyer files a claim in court and wins, then in addition to reimbursement of the cost of the goods and other expenses, the business will be fined 50% of the awarded amount (Article 13 of the PZPP).

It doesn’t matter what the consumer wrote in the appeal. Even if the content of the complaint seems absurd to you, it is necessary to give an answer to it.

The timing of the response, respectively, and the timing of the decision, depend on the essence of the application. There are several of these.

Seller's responsibility

An unmotivated refusal to exchange goods/return money is a violation of consumer rights, which entails:

- forced exchange of goods or refund of the paid price;

- compensation for losses caused by the seller’s actions, for example, the buyer purchased a down jacket and intended to go on a business trip to the northern part of the country. The down jacket did not fit, and the seller refused to exchange it. The buyer no longer had the money to buy another down jacket, and leaving without warm clothes was dangerous to his health. As a result, the employer recovered damages from the buyer for the missing tickets and deprived the buyer of bonuses due to improper performance of labor functions. The buyer can recover the specified amount of damages from the seller, since there is a connection between the unlawful refusal and the consequences);

- interest for the use of other people's money (if, due to the nature of the relationship, the seller had to return the money and not make an exchange). The amount of interest is determined by the amount of 1/300 of the refinancing rate (bank interest of the Central Bank of the Russian Federation) for each day;

- compensation for moral damage (the amount varies from 1,000 to 15,000 rubles, depending on the situation);

- other consequences are possible, which are provided for in sales contracts, promotions carried out by the merchant.

Bringing to responsibility is possible by filing a claim in court (magistrate, if the amount of claims is not more than 50,000 rubles, and in a district/city court - the cost of the claim is more than 50 thousand rubles).

If the lawsuit ends in favor of the consumer, the latter can still recover all of his legal costs.

How to write a response to an application for the return of goods

If you decide to satisfy the buyer’s requirement in full, then you need to write about this in the response and invite him to receive money. Usually a specific retail outlet or office is indicated if the company has several stores. You can also include time, but in general, the consumer has the right to come for money at any store opening hours.

It is not necessary to invite the consumer to a meeting if he has chosen a transfer to a card as a method of receiving money. But it’s still worth sending a response - this way you will eliminate situations where the consumer tries to go to court with a claim not for the return of the goods, but for the lack of a response.

If you decide to refuse the buyer or satisfy his demands only partially, it is better to motivate the answer. That is, refer to regulations or indicate other reasons, for example, the result of an independent examination.

You need to keep evidence that the answer was given. Therefore, either provide a written response with the buyer’s signature on your copy, or send it by letter with an inventory, and keep the receipt with the date of dispatch in your archive along with the consumer’s statement.

Submitting other claims

You should send your requirements that are not related to the return of goods of proper or inadequate quality to the address: 420101, Tatarstan rep., Kazan, st. Kh. Mavlyutova 17B-50, for IP Sboeva A.N.

You must attach documents to your claim on which you base your claims.

These rules, as well as the law “On the Protection of Consumer Rights,” do not apply to legal entities and individual entrepreneurs, since it regulates the relationship between the seller and the buyer as an individual. Contractual relations between the seller and the buyer are a legal entity regulated by the norms of the Civil Code of the Russian Federation.

What to do if a consumer wants to return a defective product?

The consumer has the right to a quality product. If the buyer finds a defect in the product, he has the right to demand:

- exchange the product for the same one - the same brand, model or article;

- exchange the product for a similar one with recalculation of the purchase price - if the product has fallen in price, the buyer has the right to demand the return of part of the money;

- reduce the cost of the product in proportion to the shortage;

- repair the product or compensate for repair costs;

- return the money.

Moreover, the buyer chooses what to demand. The store cannot decide for itself whether to exchange the product or return the money. This right is enshrined in Art. 18 ZPPP.

If the product is large or weighs more than 5 kg, the buyer is not required to bring it to the store himself. According to paragraph 7 of Art. 18 ZPPP business is obliged to do this. If you refuse, the consumer can deliver the goods himself, but if it turns out that there is indeed a defect in it, then he will have to reimburse the costs of transportation. You determine the amount of compensation by agreement or through court.

Automate the accounting of goods from delivery to sale, keep track of balances

When you pick up the goods, draw up an acceptance certificate. Indicate information about the product, its serial number, and any visible defects, such as abrasions and scratches. Give a copy to the buyer.

What is a product shortage?

A defect is understood as the non-compliance of a product with its intended use, description or mandatory requirements. For example, if the coffee machine does not turn on, this is an inability to use, a disadvantage. If the description states that the coffee machine has a function for making cappuccino, but in reality it does not work, this is also a drawback.

If the seller warns about defects before the transaction, then this property actually ceases to be a defect. For example, if the description of a coffee machine says that it cannot make cappuccino, this will not be considered a disadvantage. This is exactly how discounted goods are sold: the seller gives a discount and immediately says what’s wrong with the product.

A defect is a problem with a product that the consumer was unaware of and that was not his fault. If the product is broken or damaged by the consumer himself, the store is not obliged to return the money.

Types of property deductions

Property deductions applied to income taxed at a rate of 13% are discussed in Art. 220 Tax Code of the Russian Federation. It talks about 4 types of deductions:

- arising in the event of the sale of property (subclause 1 clause 1);

- equal compensation for the value of property sold by the taxpayer (subclause 2, clause 1);

- in relation to the costs of purchasing housing (subclause 3, clause 1);

- on interest for a loan taken for the purpose of purchasing a home (subclause 4, clause 1).

The question of applying for a deduction arises in relation to the last 2 types.

How much time does the buyer have to make a claim?

The buyer may make claims due to defects in the product during the warranty period or expiration date. If such are not established, then in Art. 19 of the Law of the Russian Federation states that the period is considered to be 2 years.

The shelf life begins from the day the goods are transferred to the buyer, unless otherwise provided by the contract. For seasonal goods, this period is shifted until the beginning of the season.

The date of the onset of climatic seasons is fixed by regional legislation where the store operates. For example, in Moscow the winter season lasts from November 1 to March 1, and the summer season from May 1 to September 1.

If the buyer has left you a claim related to a defect in the product, you must respond within 10 days - this period is specified in Art. 22 ZPPP.

Processing and storage times

The Civil Code provides for specific deadlines for completing the procedure (Article 477 of the Civil Code of the Russian Federation):

- for products without an expiration date - no later than two years from the date of delivery;

- for goods with a specified expiration date - no later than the expiration of the stated period.

You will have to store documents confirming that the products were returned for at least 5 years. Based on Federal Law No. 402 of December 6, 2011, the organization must approve the procedure for storing accounting documents. Familiarize the person in charge with the approved procedure and sign it.

How to identify a deficiency

A product shortage may occur due to a manufacturing error, damage during delivery, or improper storage. Then the business must issue a return and return the money to the buyer. But if the defect appeared due to the actions of the buyer, you have the right not to make a return.

Example

You sold a smartphone, and the consumer returned it with a complaint that it does not work.

If this is a manufacturing defect, then you need to return the money and take the phone back. If the consumer floods the phone with water, then he himself is to blame for the breakdown, so the claim can be refused. They find out who is to blame for the defect using quality control. As a rule, a full-time company specialist can conduct the inspection. But if a dispute arises with the buyer, an independent expert will have to be involved.

The seller must carry out the examination - according to clause 5 of Art. 18 ZPPP. The buyer has the right to attend the quality control of the goods and the examination.

You can choose any company. Experts in it must have certificates giving them the right to conduct research. The cost depends on the type of product and the company’s pricing policy. There are two types of independent expert opinions.

Official . It is printed on the company’s letterhead, contains expert data and a reasoned opinion - the result of the test and compares it with the indicators from the mandatory requirements for the product.

For example, when checking shoes for leaks, the expert writes that he performed the examination under such and such conditions and found out that the shoes were leaking. Although according to GOST such and such it must maintain water pressure to a specific level. Or, conversely, that the shoes fully comply with GOST, and according to the results of such and such an examination, no shortcomings were found.

The expert's opinion can be used in court as evidence of your position and justification for refusing to return the consumer.

Unofficial . Such a conclusion is possible by agreement with the expert. Literally, this can be perceived as a way to save money - the expert will not issue an opinion, but will conduct an examination and say whether there is a defect in the product or not. And if there is, is it a manufacturing defect or a violation of the operating conditions by the consumer.

An informal response cannot be used in court or in response to a complaint. But this is a saving: as a rule, expert advice costs 5-10 times less than an official opinion. And you find out cheaply who is right. If it's a consumer, then it's worth returning the money.

If the examination shows that the defect arose due to the buyer, then he can be required to reimburse the cost of the official examination. But they usually don’t do this - most likely, the buyer will refuse, then the only option left is compensation through the court. This takes a long time and requires resources for lawyers, which are more expensive than the cost of an examination.

Usually they do this. Having received a complaint from a consumer, they check the quality with the help of a full-time employee. If in doubt, seek an informal opinion from trusted experts. Further depending on the situation - they refuse to return the consumer or satisfy the requirements.

Even if you are sure that the defect was caused by the consumer, he can bring you the result of an independent examination in his favor. Then you will have to either satisfy his demands plus reimburse the costs of the examination, or go to court.

How to exchange goods of inadequate quality

If the consumer requires replacement of a defective product, one must rely on Art. 21 ZPPP.

You have 7 days to pick up the defective product and replace it with the same one. If the goods were sent for examination, the period increases to 20 days. If you have to wait for the goods to be delivered from the supplier to the store, then you have a month.

If the replacement took more than a week, then within three days the buyer must be provided with a similar product for temporary use. There is an exception to this rule, for example, there is no need to provide temporary hair dryers, kettles, or furniture. The full list is given in Decree of the Government of the Russian Federation dated December 31, 2020 No. 2463.

If you are exchanging for the same product, then there is no need to recalculate. If it is similar, but of a different brand, you need to recalculate the cost. It’s cheaper to pay the difference from the cash register; it’s more expensive to take an additional payment from the buyer.

Please process the exchange of goods as a return of goods and a new sale. Accordingly, you first need to issue a return receipt for the old receipt, and then issue a receipt for the new product.

How to make a discount on a product with a shortage

The amount of the discount for defects is determined by agreement with the buyer. For example, you sold him a refrigerator, but the movers damaged it during delivery. The scratch does not affect the operation of the refrigerator, but the buyer may oblige you to replace the damaged panel. In such a situation, it is easier to negotiate a discount and return part of the money.

A discount is issued, as is the replacement of goods, return receipts and a new purchase for a lesser amount. Return period is 10 days.

In the same way and within the same period, compensation for the costs of repairing the goods occurs. The buyer must bring you a receipt from the organization that corrected the defect. Please note: the consumer is not required to agree with you on the organization to carry out the repair. If you think the price for repairs is too high, you can refuse to pay - usually “high” is considered more than two-thirds of the cost of a new product. In this case, the buyer has the right to go to court.

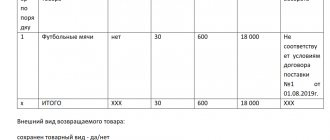

How to draw up a return certificate

The organization has approved its own form.

Step 1. We indicate the date and place of preparation, indicate the name and responsible persons of each party. We write down the document on the basis of which the return procedure is carried out. In our case, agreement No. 1 dated 08/01/2019.

Step 2. We indicate the item (cargo, item, product) that is to be shipped to the seller, and the basis. In our example, there is a contract for the supply of basketballs.

Step 3. We indicate the reason for the return and the results of the examination, if required (defects, low quality, defects).

Step 4. Now we write down the buyer’s conditions. In our case, the organization requires replacing soccer balls with basketballs.

Step 5. Then we write down the details of the parties, sign the act and certify with seals.

How to repair a product

If the buyer requires the product to be repaired, you have a maximum of 45 days to complete all work. If the repair lasts longer than 7 days, then within three days the buyer must be provided with a similar product as a temporary replacement - this is documented in a separate act. Exceptions are listed in Decree of the Government of the Russian Federation dated December 31, 2020 No. 2463.

After repair, you need to give the goods and a copy of the report with information about the date of application, the date the goods were transferred for repair, a description of the work performed and parts replaced, and the date the goods were issued. Make sure that the consumer has checked the functionality of the product and confirmed by signing the document that he has no complaints about the quality of the repair. Keep a copy of the deed and the buyer’s statement for yourself.

How to get your money back for a product of poor quality

If the product is not included in the list of exceptions, then you have 10 days to return the money. During this time, you need to conduct a quality check or examination, make a decision and give the money.

Control your business remotely: check how much money is in the cash register and in the current account, set up notifications about cash register operation.

Try it

There are nuances:

- The amount must be returned in full. Even if the product has lost its presentation during use.

- If the goods were purchased on credit, the store returns the amount for the goods and the interest paid, that is, the losses incurred by the buyer.

- If the price of a product has increased since the date of its purchase, then at the buyer’s request, the price must be returned to the day of the refund. The rule does not work in the opposite direction: if the product has become cheaper, this does not affect the cost of return.

Find out more about how to process a return at the online checkout.

Non-refundable

- medical and pharmaceutical products;

- personal hygiene products;

- cosmetics, perfumes, household chemicals;

- vehicles and trailers for them, motorcycles, scooters, bicycles, motor boats, boats, etc.;

- technically complex household goods (TVs, microwave ovens, vacuum cleaners, etc.) for which the warranty period is more than 1 year;

- electrical cables and wires;

- home furniture;

- Jewelry;

- printed publications;

- weapons and ammunition;

- food products and utensils made of polymeric materials;

- pets and plants;

- textiles, knitwear and other sewing goods (this does not apply to leather and fur products);

- finishing and construction materials

As you can see, the list is large. Accordingly, the list of goods subject to return is not so long.

What to do with returns at the request of the consumer

The buyer can contact the store to return a quality product without defects. There are several situations where you should take it back and give the money back.

In a regular store

The seller is obliged to exchange a non-food product if it does not suit the buyer. In practice, this means that the buyer can return the product without giving any reason. You can always say that the color or style didn’t suit you.

The buyer may also not agree to an exchange due to “there is no suitable product,” because the term “suitable” can be interpreted in any way. For example, the exchanged item again does not match the color. Therefore, de facto, this rule means that the store is obliged to return the money. The buyer has 14 days from the date of purchase to request an exchange or return of the quality product. Afterwards the store has 3 days to return the money or exchange.

An exception is the list of non-returnable goods listed in Decree of the Government of the Russian Federation dated December 31, 2020 No. 2463.

In the online store

The rules for distance selling are different. The buyer has the right to refuse any purchase without giving reasons at any time before the order is delivered to him and within 7 days after. If the website does not contain any legally compliant return instructions, the return period is extended to three months.

When returning, the store is not required to pay for shipping; shipping costs can be deducted from the refund amount. But only if the delivery price was clearly indicated. If it was said that delivery is free, the buyer can challenge your deduction in court.

The store has 10 days to return money from the date of application.

How to find out about an overpayment

Most often, the reason for overpayment is errors in the payment order or declaration, double write-off of tax at the request of the Federal Tax Service, previously paid advance payments exceeding the total tax amount for the year.

In 2021, an additional reason may be exemption from paying taxes and fees for the second quarter on the basis of Federal Law No. 172-FZ dated 06/08/2020. Previously, it was possible to find out about an overpayment only after reconciliation with the tax office or from a certificate in the KND form 1160081. Starting from October 1, 2021, the Federal Tax Service is obliged to always notify the taxpayer that there is an overpaid amount of tax on his personal account within 10 days period from the moment of its detection (clause 3 of Art. Tax Code of the Russian Federation).

When the seller is not obliged to return money for a quality product

- The purchase is made for business purposes, that is, the buyer is not a consumer.

- The presentation is lost. For example, there are scuffs on the equipment or the clothes have been used and are frayed.

- Manufacturer's labels have been torn off the product.

- The item was not sold by you. If you are sure that this particular product was purchased at another store, you can refuse a return. But if you are wrong, the buyer can go to court.

- The deadline has passed. You have 14 days from the next day after purchase to return goods of good quality.

- The product was purchased in a regular store, not in an online store, and is included in the non-returnable list.

The seller is not obliged to return money for food products of proper quality. But if the product has defects or is sold past its expiration date, then this will be considered a sale of defective goods. That is, at the buyer’s request, it is necessary to either return the money or replace it with a similar product.

List of goods subject to return

- leather and fur products;

- shoes;

- simple household appliances (kettles, hair dryers, irons, etc.);

- complex household appliances with a warranty of up to 1 year;

- stationery;

- goods for fishing, tourism, active recreation;

- gardening tools;

- sport equipment;

- kitchen utensils (metal, glass, porcelain dishes, bread bins, cutting boards, bottle openers, etc.);

- other.

But you should know that these things must be serial. If an item was made to individual order, according to specific measurements, then a return is acceptable if the manufacturer/buyer deviates from the order parameters. That is, in fact, he sold an improper product (with inappropriate information about it).

How to return and exchange technically complex products

The law has an exception to the return rules - these are technically complex goods, for example, laptops, vacuum cleaners, phones. The full list is in Decree of the Government of the Russian Federation dated November 10, 2011 No. 924.

- If the product has no defects, the store is not obliged to return it in the first 14 days after purchase.

- If the product has any defect, then you are obliged to return the money only in the first 15 days after the transaction. After that - only repairs. If the repair takes more than 45 days or the consumer comes back with a similar defect, then the money will have to be returned.

- If there is a significant defect in the product, that is, the product cannot be repaired or the repair will be disproportionate to the cost of the product, then the consumer has the right to demand money immediately.

How can you manage your money?

You can dispose of the overpayment in three ways (clause 5, clause 1, article 1 of the Tax Code of the Russian Federation):

- return to your current account;

- offset against future payments;

- pay off debts on other taxes, pay penalties or fines.

Until October 1, 2021, overpayments of taxes can only be offset against taxes of the same level. Thus, by overpaying federal income tax, you can cover arrears and upcoming payments from federal taxes: VAT, income tax, mineral extraction tax.

Another rule that will soon be changed: money is returned to the account for those taxpayers who do not have debts to the budget for taxes of the same type.

From October 1, 2021, the provisions of Federal Law dated September 29, 2019 No. 325-FZ will come into force, and the rules will change:

- You can offset the overpayment against future payments or pay off the debt for various taxes. Regardless of which budget of the Russian Federation they are credited to. For example, due to overpaid income tax (federal budget), you can pay off arrears or a fine on property or transport taxes (regional budget).

- If you have tax debts of any type (federal, regional or local), you cannot return the overpayment of taxes in cash. Debtors, due to overpayment, are obliged to first pay off their obligations for taxes, fines and penalties (Clause 6 of Article 78 of the Tax Code of the Russian Federation).

Errors in consumer refusals

Businesses have several popular reasons for failure that are actually illegal.

1. No receipt. The buyer has the right to demand the return of goods without a receipt. This is stated in paragraph 5 of Art. 18 ZPPP.

2. No packaging. The law states that a store must refund money for goods without defects if the consumer has retained the presentation and manufacturer’s seals. Returns cannot be refused due to torn packaging or missing store tags.

You can justify the refusal by the unpreserved presentation, but then you will have to prove it. Therefore, if the product is not damaged and can be put up for sale again, it is better to return it.

3. Send it to the manufacturer for repairs. This type of refusal to return is practiced in hardware and electronics stores. The company does not take back the goods and the claim, but refers the buyer to an authorized service center (ASC). It is illegal.

The store may recommend that the buyer contact the ASC. But if he does not want to do this, he is obliged to accept the claim and the goods.

How to apply for a refund

Save the buyer's refund application for the tax authorities - this way you can explain the fact that the funds were written off. When receiving the goods, fill out the invoice in free form - it is enough to indicate in it the full name and passport details of the buyer, as well as all information about the product: its name, model, serial number or article, quantity, cost.

If you make a return on the day of purchase , you can issue cash from the cash register. When paying by card, the refund is also made to the card - you cancel the payment transaction. You also need to punch a check at the cash register with the calculation sign “return of receipt”.

If you make a return on a different day , then the procedure is different.

To give cash, the LLC needs to issue a cash settlement order in Form N KO-2. In it, indicate the reason for the return and the passport details of the recipient. If the organization has several cash desks, then money must be issued from the main one. An individual entrepreneur may not issue cash settlements, since he is not obliged to observe cash discipline.

The buyer may refuse to disclose his passport information. Indeed, nowhere in the legislation is there any direct indication that he is obliged to provide them to the store in order to return them. But at the same time, the store cannot issue cash without registering a cash settlement with this data, otherwise it will be a violation. Therefore, such a requirement is legal and established in the Resolution of the Supreme Court of the Russian Federation dated June 15, 2015 No. 25-AD15-3. In a conflict situation, the buyer can be offered to return the money to the card - in this case, passport data is not needed.

If the buyer paid by card, then, according to the tax office, the money should be returned to the same card - this is set out in the Letter of the Federal Tax Service of Russia for Moscow dated September 15, 2008 No. 22-12/087134.

If such a card is no longer available or the consumer is against returning to it, the store must still return the money - in cash or to another card. To exclude tax claims, take a statement from the buyer, where he clearly states the return method and details if we are talking about a card.

Briefly about what to do if the buyer wants to return the goods

- The main rule is to invite the buyer to understand the situation. Ask him for an application drawn up according to your template or in free form. If the buyer does not want to write himself, write down the requirements for him.

- If the claim is due to a product of poor quality, make sure that the defect was not the fault of the buyer. For example, find an independent expert or use an in-house specialist.

- If the defect actually appeared through no fault of the buyer, you must replace the product with the same or a similar one with a recalculation of the price, have it repaired at the store’s expense, or return the money. The choice is up to the buyer.

- For technically complex products there is an exception - the buyer can demand a replacement or refund within the first 15 days. Then only repairs. The buyer can withdraw money or demand a replacement only if the product cannot be repaired, the repair will be too expensive or take a long time, if the defects recur.

- Without defects, you need to return money or exchange goods only within 14 days after purchase, while maintaining their presentation and with manufacturer's tags. There are exceptions that are listed in Decree of the Government of the Russian Federation dated December 31, 2020 No. 2463.

- If the consumer's legal requirements are not met, the consumer may go to court. According to a court decision, the store usually pays the cost of the goods, a fine for refusing to resolve the issue voluntarily, compensation for moral damages, the cost of an independent examination, and legal costs.

- After returning goods of inadequate quality and fulfilling the requirements of the Health Protection Regulations, the store can make claims to suppliers - for example, demand that they compensate for all expenses. If an agreement is not reached through peaceful negotiations, you can go to court.

Instructions for the buyer on returning a defective product

Step 1. It is better to visit the seller in the company of someone you know who can act as a witness in the event of an unresolvable dispute. It’s a good idea to record the entire conversation on a voice recorder. The seller must be notified of this in advance. Say that you need the dictaphone recording in case of misunderstanding and, except in a legal dispute, you will not use it anywhere. At the same time, maintain a friendly but formal tone.

Step 2. The conversation must begin by presenting the seller with an application for the return of the goods. Such an application is drawn up in advance (sample application) and a copy of the sales document (receipt, check, contract, etc.) is attached to it. Calmly and peacefully explain your situation, offer to understand your situation and politely demand to sign and date the second copy of the application, which remains with you. From this moment you recorded the date of contacting the seller. He will not be able to refer in the future that you missed this deadline.

Step 3. Show the returned item to the seller to check for signs of use and the safety of factory labels, seals and packaging. And if there are no complaints, then ask to make a note about this in your copy of the application. In case of disputes, decisively prove that you are right. It is best to ask for a detailed explanation of the reason for the non-conformity of the returned product and other objections from the seller.

Step 4. Invite the seller to present you with an item he has for sale for exchange. Select a suitable purchase and offer to make an exchange. Upon the fact of the exchange, you require the preparation of a transfer document (deed, invoice, etc.) with the date of the actual exchange. Thus, you will retain the right to a 14-day return period for the goods received in exchange. The number of subsequent exchanges of the relevant product is not limited. Don't forget to get a receipt from the seller stating that you returned the original item to them.

Step 5. If the items offered to you are not suitable or are out of stock, please make a note about this in your copy of the return application. There you can stipulate in writing the date of arrival of the new batch.

If you do not want to wait, you have the right to receive the amount paid for the goods. In this case, present to the seller a previously prepared application for a refund (sample application). The seller must sign and date this application.

Step 6. Leave the seller your contact phone number to notify you of your readiness to return the money, in case the money is not returned at the time of the initial request.

Step 7. After 3 days, come to the seller for money. If he refuses to return them, then such a dispute will need to be resolved in court. In this case, demand a written refusal from the seller and notify him of going to court (submit a written claim for failure to comply with the requirement to return the goods of proper quality), threatening reimbursement of legal costs, penalties and compensation for moral damage. Often, seeing the consumer's aspirations, merchants retreat and comply with legal requirements voluntarily.