An employment contract with an employee is a kind of agreement concluded by the parties to regulate working relations. It reflects all the points that relate to the work schedule, working conditions, duties and powers, responsibility and nature of the work. Please note that if at least one mandatory point is missing, this will lead to a violation of worker rights and legislation.

Required conditions.

According to Part 2 of Art. 57 of the Labor Code of the Russian Federation, the following conditions are required to be included in the contract.

Place of work

The place of work must be included in the contract, and if the employee is hired to work in a branch, representative office or other separate structural unit of the organization located in another area, the place of work indicating the separate structural unit and its location.

Place of work is the name of the employer, usually indicated in the preamble of the employment contract.

note

Do not confuse place of work and workplace. According to Art. 209 of the Labor Code of the Russian Federation, a workplace means a place where an employee must be or where he needs to arrive in connection with his work and which is directly or indirectly under the control of the employer.

An entry about the place of work in an employment contract may look like this:

The employee’s place of work is November LLC, located at Nizhny Novgorod, st. Direct, no. 29.

Changes initiated by the employee

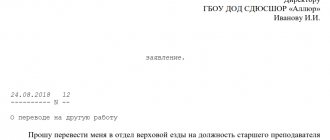

If the employee believes that changes need to be made to the contract, he should contact the employer. It is advisable to prepare a draft of a new contract or additional agreement to it: this will make it easier for the employer to make a decision on making changes.

The appeal itself is drawn up in a statement, which sets out the essence of the proposals, the motives that led to the need to make changes, as well as the expected time frame for making changes.

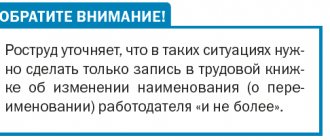

Important! If the employer agrees with the proposal, he puts a corresponding mark on the application and issues an order. If the employer agrees with only part of the changes being made, then he returns the application to the employee with a proposal to state the requirements differently. If the employer disagrees, the application with a note of refusal is returned to the employee.

The employee can demand changes by filing a lawsuit to force the employer to agree to the requirements and accept them. But positive law enforcement practice on this issue has not yet clearly emerged.

Labor function.

The Labor Code deciphers what it is: work in a position in accordance with the staffing table, profession, specialty, indicating qualifications; the specific type of work assigned to the employee.

In fact, no one prevents the employer from calling positions in the company as he likes. For example, an assistant manager with the same functionality in one company may be called a secretary, in another - office manager, in a third something else...

Not everything is so simple when it comes to performing work that involves the provision of compensation, benefits or the presence of some restrictions. In this case, the names of these positions, professions or specialties must correspond to the names and requirements specified:

- in qualification reference books - ETKS, EKS;

- in professional standards.

note

From 07/01/2016, the requirements of professional standards are mandatory for application if the names of positions, professions, specialties and qualification requirements for them must correspond to the names and requirements specified in qualification reference books or professional standards, if, according to the Labor Code of the Russian Federation or other federal laws, with the performance of work according to these positions, professions, specialties are associated with the provision of compensation and benefits or the presence of restrictions (Letter of the Ministry of Labor of the Russian Federation dated 04.04.2016 No. 14-0/10/B-2253).

Let us give examples of the wording of this condition of the employment contract.

If an employee is hired for a position, the wording may be as follows: The employee is assigned to perform work as a marketer.

If qualifications or professions are required, this could look like this:

An employee is hired as a cook.

(or)

The employee is hired as a 3rd category cupola worker.

The specific type of work is mainly specified in employment contracts with employers - individuals. For example, an employee is tasked with cleaning an apartment or ironing clothes.

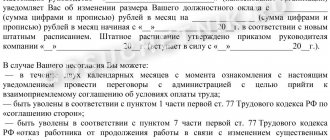

If the employee refuses to accept the changes being made

The employee’s refusal may not be motivated by him in any way. Its presence is enough. The employee either does not sign the notice of upcoming changes (a draft order or a draft of a new local act), about which a commission of three people draws up an act, or signs and accompanies it with the note “does not agree.”

If an employee expresses disagreement and refuses to work under the new conditions, the employer offers him to work in another position with a possible change in functionality, if these positions are not affected by the introduced innovations.

This is especially reasonable when the employee does not agree with a reduction or new salary calculation or with a new schedule. By moving to a position with approximately the same previous pay, he loses nothing, except that he can perform a different job function within the framework of his qualifications.

Attention! If an employee opposes a job change, then he is offered available vacancies in his desired location or territory.

If the employee, in principle, does not agree with the changes being made, does not accept innovations and refuses to work in new organizational and/or production conditions, then in this case the employer has the right, in accordance with paragraph 7 of Article 77 of the Labor Code of the Russian Federation, to dismiss him.

Work start date.

It must be indicated in the employment contract and may differ from the date of its conclusion - for example, if the parties have entered into an agreement in advance, according to which the employee will begin performing duties in a month or two. And with actual permission to perform work, the date of concluding the employment contract will be slightly later than the start date of work.

For your information

Upon actual admission to work, the employer is obliged to draw up an employment contract with the employee in writing no later than three working days from the date of such admission, and if the relationship associated with the use of personal labor arose on the basis of a civil law contract, but was subsequently recognized as labor - no later than three working days from the date of recognition of these relations as labor, unless otherwise established by the court (Part 2 of Article 67 of the Labor Code of the Russian Federation).

If the employment contract does not specify the start date of work, the employee must begin work on the next working day after the contract enters into force[1].

Why is the start date so important? Because if a newcomer does not start working on the day specified in the employment contract (if it does not specify the start day of work, the employee must begin work on the next working day after the contract enters into force), the employer has the right to cancel the employment contract (Part 4 of Art. 61 Labor Code of the Russian Federation).

The employee is required to begin performing his job duties on December 6, 2021.

A canceled employment contract is considered unconcluded and does not entail any consequences for the employer, except for the payment of temporary disability benefits[2].

Agreement from RosCo - reliable protection against risks

RosCo experts will analyze your situation and professionally draw up an up-to-date civil law agreement. We guarantee high quality services. Our company has been providing legal support to transactions since 2004. Lawyers have extensive experience and high qualifications, perfectly know and competently apply the law.

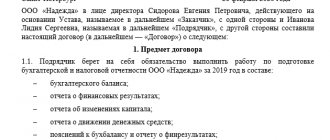

Contract time.

This condition is mandatory in case of concluding a fixed-term employment contract. Moreover, it is necessary to indicate not only the term of the contract, but also the reason that served as the basis for concluding a contract of this type.

Let us remind you that in accordance with Art. 58 of the Labor Code of the Russian Federation, a fixed-term employment contract is concluded when the employment relationship cannot be established for an indefinite period, taking into account the nature of the work to be performed or the conditions for its implementation. The reasons and circumstances giving rise to the establishment of urgency are specified in Art. 59 Labor Code of the Russian Federation.

The term of the contract can be formulated as follows:

2. Duration of the contract.

2.1. Start date: May 1, 2021.

2.2. The contract was concluded for five months for the period of operation of the amusement park from May 1 to September 30.

If it is difficult to determine the expiration date of the contract, for example, when it is concluded during the employee’s absence, the condition on the urgency of the employment relationship can be formulated as follows:

This agreement was concluded during the absence of Olga Ivanovna Ivanova’s secretary in connection with maternity leave for a child under three years of age.

Let us pay attention to one nuance: if it was assumed that the employment contract would be concluded for a specific period, but the term was not fixed in the contract itself, or the reasons for concluding a fixed-term contract did not comply with the provisions of labor legislation, there is a high probability of reclassifying such a contract as unlimited (see, for example, Appeal ruling of the Moscow Regional Court dated June 15, 2016 in case No. 33-15977/2016).

note

If for some reason, after the procedure for agreeing on the conditions, you change your mind about signing an employment contract with the applicant, be prepared to give a reasoned justification for your refusal. New amendment to Art. 64 of the Labor Code of the Russian Federation (as amended on July 11, 2015 by Federal Law No. 200-FZ of June 29, 2015) provides an unsuccessful employee with the right to request a written explanation within seven working days

If the signing of the employment contract was successful, do not forget to take a receipt from the employee indicating that he received the second copy of the contract. Changing the terms of the employment contract in the future is possible only as a result of signing an additional agreement to it.

Terms of remuneration.

The employment contract must indicate the size of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments. Please note that Part 1 of Art. 135 of the Labor Code of the Russian Federation contains a similar requirement - it is necessary to establish the salary in the employment contract.

The salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and is not limited to the maximum amount, except for the cases provided for in Art. 145 of the Labor Code of the Russian Federation for managers, their deputies and chief accountants of individual organizations (Article 132 of the Labor Code of the Russian Federation).

The monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage (currently it is 7,500 rubles).

Some employers do not indicate a specific salary or tariff rate in the employment contract, but refer to the staffing table, for example: “The employee is paid a salary according to the staffing table.” The regulatory authorities will definitely not like this wording, because it violates the requirements of Part 2 of Art. 57 Labor Code of the Russian Federation. Let us note that the Labor Code of the Russian Federation does not require the specific amount of additional payments, allowances and incentive payments to be indicated in the employment contract. Therefore, as a general rule, it is enough to list in the employment contract the types of such additional payments, allowances and incentive payments (if they are established), and make reference to the provisions of the collective agreement, agreement or local regulation that determine the amount and procedure for payments. Moreover, the employee must be familiar with these documents.

The Labor Code of the Russian Federation also includes conditions regarding the place, method and timing of payment of earnings. However, it is not said that the listed conditions are necessarily fixed directly in the employment contract. Articles 131 and 136 of the Labor Code of the Russian Federation allow for the possibility of regulating these issues in a collective agreement or in internal labor regulations (for example, determining the days for payment of wages).

note

According to the new edition of Part 6 of Art. 136 of the Labor Code of the Russian Federation from October 3, 2016, wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.

The terms of remuneration can be formulated as follows:

5.1. The employee is given a salary of 15,000 (fifteen thousand) rubles and other incentive payments in accordance with the Regulations on Bonuses.

5.2. Salary payment deadlines are the 7th and 22nd of each month.

What documents are needed

To conclude an agreement, you will need the Labor Code of the Russian Federation, Article 65. Documents presented when concluding an employment contract:

- passport;

- SNILS;

- work book, if any (in the case of the first job, the company must create it independently);

- educational document - diploma or certificate;

- military registration documents.

If necessary, the employer may require a certificate of no criminal record, as well as a certificate of administrative liability for drug use. And that’s all; you cannot ask the average citizen for additional documents.

Applicants for civil service positions will have to obtain a certificate of income when filling which employees are required to provide information on income, expenses, property and property-related liabilities and the Procedure for submitting this information.

Working hours and rest hours.

This condition is included in the employment contract if the working hours for a particular employee differ from the general rules established by the employer. For example, if the entire organization, in accordance with internal labor regulations, works from 8.00 to 17.00 with a lunch break, and a specific employee is assigned a part-time work schedule. At the same time, employers almost always indicate the beginning and end of the working day (shifts), as well as the lunch break - this is not a mistake.

An entry in an employment contract may look like this:

3.1. The employee is given a shortened working day with a standard working time of 30 hours per week with a five-day working week with a daily work duration of 6 hours.

3.2. Work starts at 9.00, ends at 16.00. Break for rest and food - from 12.00 to 13.00.

Guarantees and compensation for work under harmful and (or) dangerous working conditions.

This condition becomes mandatory if a person is hired under appropriate conditions. In this case, it is additionally necessary to provide characteristics of working conditions in the workplace.

In cases where harmful and (or) dangerous factors of the production environment and the labor process at the workplace are determined as a result of a special assessment of working conditions in accordance with Federal Law dated December 28, 2013 No. 426-FZ “On special assessment of working conditions”, in the employment contract the corresponding class (subclass) of the degree of harmfulness and (or) danger of working conditions is indicated

Let us remind you that employees engaged in work with harmful and (or) dangerous conditions, based on the results of a special assessment of conditions, are provided with the following guarantees and compensation:

- reduced working hours;

- annual additional paid leave;

- increased wages.

The condition in question in an employment contract may look like this:

For work in hazardous working conditions of the 2nd degree, the employee is provided with additional paid leave of 8 calendar days.

Please note that the absence of conditions on guarantees and compensation for work under harmful and (or) dangerous working conditions (if any) is regarded as a violation of labor legislation. Thus, by Resolution of the Supreme Court of the Republic of Sakha (Yakutia) dated July 22, 2016 No. 4a-281/2016, the decision to bring an official K. organization to administrative liability in the form of a fine was upheld. K. believed that the absence of mandatory conditions on guarantees and compensation in the employment contract does not constitute an administrative offense under Part 3 of Art. 5.27 Code of Administrative Offenses of the Russian Federation. However, the court expressed a different position: since these conditions are mandatory by virtue of Art. 57 of the Labor Code of the Russian Federation, they must be included in the employment contract.

Article 57 of the Labor Code of the Russian Federation. Contents of the employment contract (current version)

The law obliges the position name to be indicated in the employment contract in accordance with the organization’s staffing table.

The staffing table is an organizational and administrative document that sets out the official and numerical composition of the organization, and also indicates the wage fund. It is drawn up in the form established by the State Statistics Committee of Russia and includes a list of positions, information on the number of staff positions, official salaries, allowances, and monthly payroll. The staffing table is signed by the chief accountant of the organization and endorsed by the heads of structural divisions. The staffing table is approved by order of the head of the organization. The staffing table is a long-term document. However, if necessary, changes, additions or other adjustments may be made to it.

A profession is understood as a type of labor activity or occupation of a person who possesses a complex of special knowledge, skills, and abilities acquired through education.

A specialty is a type of professional activity improved through special training (for example, a personnel manager, a surgeon, a tool maker); a certain area of work, knowledge.

Employee qualifications - the level of knowledge, skills, professional skills and experience of the employee.

The indicator that determines the level of qualification of an employee is the qualification category. The qualification category is established taking into account the complexity, responsibility and working conditions on the basis of the tariff and qualification reference book.

If the performance of work in certain positions, professions and specialties in accordance with federal laws is associated with the provision of compensation and benefits to employees or the establishment of restrictions, then the names of these positions, professions or specialties and the qualification requirements for them are indicated in the employment contract with the employee in accordance with qualification reference books , approved in the manner established by the Government of the Russian Federation, or corresponding to the provisions of professional standards.

The Government of the Russian Federation, by Decree of October 31, 2002 N 787 “On the procedure for approving the Unified Tariff and Qualification Directory of Work and Professions of Workers, the Unified Qualification Directory of Positions of Managers, Specialists and Employees,” entrusted the Ministry of Labor of Russia with the organization of the development of these directories together with the federal executive authorities responsible for management, regulation and coordination of activities in the relevant sector (sub-sector) of the economy. According to paragraph 1 of the said Resolution, the Unified Tariff and Qualification Directory of Works and Professions and the Unified Qualification Directory of Positions of Managers, Specialists and Employees must contain qualification characteristics of the main types of work depending on their complexity, as well as the requirements for the professional knowledge and skills of workers. Currently, until the new ones are approved, the following are in effect: Qualification reference book for positions of managers, specialists and other employees, approved. Resolution of the Ministry of Labor of Russia dated August 21, 1998 N 37, Unified Tariff and Qualification Directory of Work and Professions of Workers (UTKS). Individual issues of ETKS were approved at different times by the Resolutions of the USSR State Committee for Labor and the Secretariat of the All-Union Central Council of Trade Unions. The general provisions of the ETKS were approved by the joint Resolution of the State Committee of Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated January 31, 1985 N 31/3-30. The list of ETKS issues operating on the territory of the Russian Federation was approved by Resolution of the Ministry of Labor of Russia dated May 12, 1992 N 15a. The section “Qualification characteristics of positions of employees of standardization, metrology and certification centers authorized to carry out state control and supervision” of the Unified Qualification Directory of Positions of Managers, Specialists and Employees was approved by Resolution of the Ministry of Labor of Russia dated January 29, 2004 N 5. Resolution of the Ministry of Labor of Russia dated 02/09/2004 N 9 was approved The procedure for applying the Unified Qualification Directory for positions of managers, specialists and employees.

A professional standard is a characteristic of the qualifications required for an employee to carry out a certain type of professional activity.

The procedure for the development, approval and application of professional standards, as well as establishing the identity of the names of positions, professions and specialties contained in the Unified Tariff and Qualification Directory of Work and Professions of Workers, the Unified Qualification Directory of Positions of Managers, Specialists and Employees, the names of positions, professions and specialties contained in professional standards, established by the Government of the Russian Federation taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations.

Currently, such Rules are approved by Decree of the Government of the Russian Federation dated January 22, 2013 N 23 (see commentary to Article 195.1);

3) start date of work, i.e. the date, month and year from which the employee is obliged to begin performing his work duties. The start date of work may coincide with the date of conclusion of the employment contract, if the parties have agreed on this, or the parties may agree that the employee will begin work later. In any case, the employment contract specifies the exact start date of work (see also commentary to Article 61). If a fixed-term employment contract is concluded, then it indicates the period of its validity and the circumstances (reasons) that served as the basis for concluding a fixed-term employment contract in accordance with the Labor Code or other federal law (see commentary to Article 59);

4) terms of remuneration, incl. the size of the employee's tariff rate or salary (official salary), additional payments, allowances and incentive payments. They are determined in accordance with the profession, position, qualification category and qualification category of the employee (see commentary to Articles 132, 135). The specific size of the tariff rate or official salary is indicated directly in the employment contract. As for additional payments, allowances and incentive payments due to the employee (for example, for high qualifications, long work experience in the specialty, deviations from normal working conditions), they can be directly indicated in the employment contract or there can be a reference to the relevant regulatory legal act or collective agreement providing the grounds and conditions for their payment. In the latter case, the employee must be familiarized with the content of these regulatory legal acts and the collective agreement against signature;

5) the regime of working time and rest time, if in relation to the employee with whom the employment contract is concluded, it does not coincide with the general regime of work and rest in force for this employer, for example: part-time or part-time work week, working only one shift with a multi-shift operating mode of the organization; dividing the working day into parts, establishing flexible working hours; provision of an additional break during the working day or a day off from work during the week, provision of additional leave, in addition to that provided for by law or other regulatory legal acts, collective agreement (agreement);

6) guarantees and compensation for work under harmful and (or) dangerous working conditions, as well as characteristics of working conditions in the workplace, if the employee, in accordance with the employment contract, is hired under appropriate conditions. In cases where harmful and (or) dangerous factors of the production environment and the labor process at the workplace are determined as a result of a special assessment of working conditions in accordance with Federal Law of December 28, 2013 N 426-FZ “On special assessment of working conditions”, in the labor the contract specifies the corresponding class (subclass) of the degree of harmfulness and (or) danger of working conditions at a given workplace;

7) conditions that, if necessary, determine the nature of the work (mobile, traveling, on the road, etc.). It should be noted that although Art. 57 does not directly provide for such a condition as the payment of compensation related to the performance of such work; it should have been provided for in the employment contract. This also corresponds to the provisions of Art. 168.1, which provides that the amount and procedure for reimbursement of expenses associated with business trips of employees whose permanent work is carried out on the road or has a traveling nature are established by a collective agreement, agreements, local regulations, and can also be established by an employment contract (see commentary to Article 168.1);

working conditions in the workplace, including the presence of harmful and (or) hazardous production factors, means of protection against their effects, incl. sanitary and hygienic, treatment and prophylactic, rehabilitation and others (see commentary to Articles 209, 212);

working conditions in the workplace, including the presence of harmful and (or) hazardous production factors, means of protection against their effects, incl. sanitary and hygienic, treatment and prophylactic, rehabilitation and others (see commentary to Articles 209, 212);

9) the condition of compulsory social insurance, to which the employee is entitled in accordance with the Labor Code and other federal laws.

List of mandatory conditions of the employment contract provided for in Part 2 of Art. 57 is not exhaustive. Legislation and other regulatory legal acts containing labor law norms may provide for other conditions as mandatory conditions of an employment contract.

Having established that the terms of the employment contract listed in Part 2 of Art. 57 are mandatory, the legislator, however, in Part 3 of the same article provides that the absence of any of these conditions in the employment contract is not grounds for terminating the employment contract or declaring it not concluded. If, when concluding an employment contract, certain mandatory conditions were not included in it, then it must be supplemented with the missing conditions. In this case, the missing conditions are determined by an annex to the employment contract or a separate agreement of the parties, concluded in writing, which are an integral part of the employment contract.

4. Part 4 art. 57 provides for the possibility of including additional conditions in an employment contract along with mandatory conditions. This norm does not establish an exhaustive list of additional conditions of the employment contract and indicates only some possible conditions. At the same time, it establishes a general rule according to which additional terms of the employment contract cannot worsen the employee’s position in comparison with established labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, and local regulations.

Among the additional conditions that the parties may include in the employment contract at their discretion are Part 4 of Art. 57 refers to the following:

1) about clarification of the place of work (for example, about a specific structural unit of the organization and its location) or about a specific workplace (for example, about a specific mechanism, unit);

2) about the test, indicating the specific period of the test (see commentary to Article 70);

3) on non-disclosure of secrets protected by law (state, official, commercial and other). When including such a condition in an employment contract, the following must be taken into account.

State secrets consist of the most important information provided for in special lists, the disclosure of which could cause significant harm to the interests of Russia. According to Part 4 of Art. 29 of the Constitution of the Russian Federation, the list of information constituting state secrets is determined by federal law. Currently, such a list is provided for in Art. 5 of the Law on State Secrets. In development of the said Law, Decree of the President of the Russian Federation dated November 30, 1995 N 1203 “On approval of the List of information classified as state secrets” approved the List of information classified as state secrets.

An employment contract with persons who, due to the nature of the work performed, will have access to state secrets, is concluded only after registration of access in the appropriate form in the prescribed manner.

Access of citizens to state secrets is carried out on a voluntary basis and provides for some restrictions and additional obligations for them, including:

— accepting obligations to the state to not disseminate information entrusted to them that constitutes a state secret;

— consent to partial temporary restrictions of their rights in accordance with Art. 24 of the Law on State Secrets;

— written consent for inspection activities to be carried out in relation to them by the authorized bodies;

— familiarization with the norms of the legislation of the Russian Federation on state secrets, providing for liability for its violation.

The obligations of citizens to the state to comply with the requirements of the legislation of the Russian Federation on state secrets, with whom an employment contract is concluded, are reflected in the employment contract (see paragraphs 6, 7, 10 of the Instruction on the procedure for accessing officials and citizens of the Russian Federation to state secrets, approved Resolution of the Government of the Russian Federation dated February 6, 2010 N 63 “On approval of the Instructions on the procedure for accessing state secrets to officials and citizens of the Russian Federation.”

Official secrets are information, access to which is limited by government bodies in accordance with the Civil Code of the Russian Federation and federal laws (see Decree of the President of the Russian Federation of March 6, 1997 N 188 “On approval of the List of confidential information”).

The concept of a trade secret and the legal means of its protection are provided for by the Law on Trade Secrets.

In accordance with it, a trade secret is a regime of confidentiality of information that allows its owner, under existing or possible circumstances, to increase income, avoid unjustified expenses, maintain a position in the market for goods, works, services, or obtain other commercial benefits. Information constituting a trade secret (production secret) is information of any nature (production, technical, economic, organizational, etc.), incl. about the results of intellectual activity in the scientific and technical field, as well as information about methods of carrying out professional activities that have actual or potential commercial value due to their unknown to third parties, to which third parties do not have free access legally and in respect of which the owner of such information, a trade secret regime was introduced (Article 3 of this Law).

According to Art. 4 of the Law on Trade Secrets, the right to classify information as information constituting a trade secret and to determine the list and composition of such information belongs to the owner of such information, taking into account the provisions of the said Law. The list of information constituting a trade secret of an organization is determined by the head of that organization. However, when determining such a list, he is obliged to take into account the provisions of laws or other regulatory legal acts that provide for information that cannot constitute an official or commercial secret.

In accordance with Art. 5 of the Law on Trade Secrets, such information includes information:

a) contained in the constituent documents of a legal entity, documents confirming the fact of making entries about legal entities and individual entrepreneurs in the relevant state registers;

b) contained in documents giving the right to carry out entrepreneurial activities;

c) on the composition of the property of a state or municipal unitary enterprise, state institution and on their use of funds from the relevant budgets;

d) about environmental pollution, the state of fire safety, the sanitary-epidemiological and radiation situation, food safety and other factors that have a negative impact on ensuring the safe operation of production facilities, the safety of each citizen and the safety of the population as a whole;

e) on the number and composition of employees, the remuneration system, working conditions, incl. on labor protection, on indicators of occupational injuries and occupational morbidity, and the availability of vacancies;

f) about the debt of employers in payment of wages and other social benefits;

g) about violations of the legislation of the Russian Federation and facts of prosecution for committing these violations;

h) on the conditions of competitions or auctions for the privatization of state or municipal property;

i) on the size and structure of income of non-profit organizations, on the size and composition of their property, on their expenses, on the number and remuneration of their employees, on the use of gratuitous labor of citizens in the activities of a non-profit organization;

j) on the list of persons who have the right to act without a power of attorney on behalf of a legal entity;

k) the mandatory disclosure of which or the inadmissibility of restricting access to which is established by other federal laws.

In accordance with Art. 19 of the Federal Law of August 11, 1995 N 135-FZ “On Charitable Activities and Charitable Organizations” information about the size and structure of income of a charitable organization, as well as information about the size of its property, its expenses, the number of employees, and their payment cannot constitute a commercial secret. labor and attracting volunteers.

According to Art. 32 of the Law on Non-Profit Organizations, information about the size and structure of income of a non-profit organization, the composition of the property of a non-profit organization, its expenses, the number and composition of employees, their remuneration, and the use of gratuitous labor of citizens in the activities of a non-profit organization cannot be the subject of a trade secret.

Other secrets protected by law include information:

- about facts, events and circumstances of a citizen’s private life that allow his personality to be identified (personal data), with the exception of information that is subject to dissemination in the media in cases established by federal laws;

- confidential investigations and legal proceedings, as well as information about protected persons and measures of state protection carried out in accordance with Federal Law of August 20, 2004 N 119-FZ “On state protection of victims, witnesses and other participants in criminal proceedings” and other regulatory legal acts RF;

- related to professional activities, access to which is limited in accordance with the Constitution of the Russian Federation and federal laws (medical, notarial, attorney-client confidentiality, confidentiality of correspondence, telephone conversations, postal items, telegraphic or other messages, etc.);

— on the essence of an invention, utility model or industrial design before the official publication of information about them (Decree of the President of the Russian Federation of March 6, 1997 N 188 “On approval of the List of confidential information”).

The condition of non-disclosure of state, official, commercial and other secrets protected by law may be provided for in an employment contract only with such an employee to whom information constituting such a secret will become known in connection with the performance of his labor functions.

In this regard, the employment contract or annex to it must indicate exactly what specific information containing state, official, commercial or other secrets protected by law is entrusted to this employee;

4) on the employee’s obligation to work after training for at least the period established by the contract.

This condition can be included in an employment contract only if the same contract, an appendix to it, or a separate special contract contains a condition on the employer’s obligation to pay for the employee’s training. It does not matter where the employee will be trained - in a special educational institution, in another organization or directly in the organization with which the employment contract was concluded;

5) among the possible additional conditions of the employment contract, the commented norm also names such conditions as additional non-state pension provision for the employee, additional insurance for the employee and improvement of the social and living conditions of the employee and his family members. Such conditions, in particular, may be: voluntary medical or pension insurance, provision of an apartment, a summer house; providing vouchers to holiday homes and sanatoriums; provision of living quarters; payment to the employee of the amount for the purchase of residential premises, etc.

At the same time, when providing for such conditions in an employment contract, it should be taken into account that they are of a civil law nature, and if a dispute arises regarding non-fulfillment or improper fulfillment of these conditions of the employment contract, then, despite the fact that they are included in the content of the employment contract, by their nature, they are civil obligations of the employer and, therefore, the jurisdiction of such a dispute (district court or magistrate) should be determined based on the general rules for determining the jurisdiction of cases established by Art. Art. 23, 24 Code of Civil Procedure of the Russian Federation (clause 1 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2);

6) in the employment contract the rights and obligations of the employee and the employer established by labor legislation and other regulatory legal acts containing labor law norms may be specified in relation to the working conditions of the given employee. When agreeing on such conditions, it is necessary to take into account the general rule formulated in Part 2 of Art. 9 of the Labor Code: “Collective agreements, agreements, employment contracts cannot contain conditions that limit the rights or reduce the level of guarantees of employees in comparison with those established by labor legislation and other regulatory legal acts containing labor law norms. If such conditions are included in a collective agreement, agreement or employment contract, then they are not subject to application.”

5. Part 5 of the commented article allows for the possibility, by agreement of the parties, to include in the content of the employment contract those rights and obligations of the employee and the employer that are established by labor legislation and other regulatory legal acts containing labor law norms, local regulations, as well as the rights and obligations of the employee and employer, arising from the terms of the collective agreement, agreements. Obviously, in this case we are talking about those rights and obligations that are the most fundamental and important for the parties, and the parties would like to pay special attention to them. It hardly makes sense to rewrite into the employment contract all the rights and obligations of the employee and the employer provided for by the above-mentioned regulations. This will make the text of the employment contract too voluminous and difficult to understand, especially since the failure to include in the employment contract any of the specified rights and (or) obligations of the employee and the employer, as provided for in the commented norm, cannot be considered as a refusal to exercise these rights or fulfill these responsibilities.

Working conditions in the workplace.

They are indicated in the employment contract based on the results of a special assessment of workplaces based on working conditions. Moreover, working conditions must be prescribed even if they are considered optimal.

If the organization has not yet carried out a special assessment, this can be done until December 31, 2018 in stages (Part 6 of Article 27 of the Law on Special Assessment), and working conditions can be indicated on the basis of workplace certification carried out before the said law came into force. If the certification was not carried out, until the results of the special assessment are received, the working conditions at the workplace will not be recorded in the employment contract.

Working conditions at the employee's workplace are harmful: class 3, subclass 3.2.

Compulsory social insurance.

The social insurance provision implies several types of insurance:

- compulsory medical care (Federal Law of November 29, 2010 No. 326-FZ);

- social in case of temporary disability and in connection with maternity (Federal Law of December 29, 2006 No. 255-FZ);

- social from accidents at work and occupational diseases (Federal Law of July 24, 1998 No. 125-FZ);

- compulsory pension (Federal Law of December 15, 2001 No. 167-FZ).

We believe that it is not at all necessary to list all types of social insurance in the employment contract in accordance with Federal Law No. 165-FZ of July 16, 1999 “On the Basics of Compulsory Social Insurance.” But it will be enough, for example, like this:

The employer guarantees the provision of insurance to the employee in the compulsory social insurance system in accordance with the norms of the Labor Code of the Russian Federation and other federal laws.

let's get acquainted

A complete list of information about the employee and employer that is required to be included in the employment contract is regulated by Art.

57 Labor Code of the Russian Federation. For an employee who is a citizen of Russia, it is enough to indicate the last name, first name, patronymic and details of an identity document. For the employer - name and TIN (for the employer - individual entrepreneur - last name, first name, patronymic and TIN). If the hiring party is an individual, only the last name, first name and patronymic are indicated in the contract. An employment contract with an employee can be concluded by an official authorized by order or power of attorney. In this case, the document must indicate the details of the order or power of attorney. And, of course, the place where the contract is concluded is indicated.

Temporarily staying foreign citizens or stateless persons additionally provide a work permit or patent, as well as a voluntary health insurance policy; temporarily residing foreign citizens or stateless persons - a temporary residence permit, permanently residing foreign citizens or stateless persons - a residence permit (Article 327.3 of the Labor Code of the Russian Federation).

Automate personnel records. Draw up employment contracts, effective contracts and additional agreements in the Kontur-Personnel program

To learn more