To create the most comfortable living conditions for people with disabilities, the Russian government is implementing various social programs. One of the areas of such support is tax benefits for disabled people of group 1. Under this bill, citizens who have disabilities are partially or completely exempt from certain types of taxation. The goal of the program: to improve the well-being of the socially unprotected part of the population.

Let's consider what tax privileges citizens on disability can count on in 2021.

Definition of second group disability

Federal medical institutions, together with social protection authorities, examine the health of citizens and identify deviations in it that appear as a result of various external influences - injuries, diseases and birth defects.

The criteria defining the disability group include impairments of the patient’s capabilities that require the help of other persons and the use of auxiliary aids:

- self-service;

- movement;

- temporal and spatial orientation;

- adequate information communication;

- the ability to work, perhaps under facilitating conditions, and to absorb scientific knowledge at home or in special educational institutions;

- self-control and behavior in public places.

Limitation of at least one of the above criteria in combination with the following serious health disorders, according to Orders of the Ministry of Labor No. 664n dated September 29, 2014 and No. 1024n dated December 17, 2015, establishes disability of the second group:

- decrease in volitional and mental abilities (attention, memory, emotions, etc.);

- deterioration of hearing, vision, voice, ability to write;

- worsening sensation of pain, temperature, vibrations;

- impaired coordination and movement;

- diseases of vital organs and systems - cardiovascular, endocrine, urinary, blood, digestive, respiratory, as well as skin diseases.

Persons with physical disabilities also receive disability of the second group - abnormal physique, deformation of body parts, etc.

Social services establish tax benefits for disabled people of the 2nd group, closely monitor their health and life, offer free services in day care centers and technical means to make life easier.

Everyone should take care of their own health - healthy eating, as much physical exercise as possible, walks in the fresh air, physical and mental work - these are the components of a healthy lifestyle that make it interesting, useful for yourself and your loved ones, happy and long-lasting. Follow this advice and live happily!

General information

Persons with physical disabilities resulting from industrial or domestic injuries or at birth have the status “Disabled”.

Depending on the degree of existing injuries that prevent them from properly caring for themselves and working, they are assigned to the disabled group by a special medical commission on the following grounds:

- chronic disease of the digestive system;

- ailments associated with diseases of the circulatory system;

- the presence of constant symptoms (homeostasis) of elevated temperature, blood pressure, sugar, etc.;

- poor functioning of the respiratory tract;

- mild mental disorders that are not dangerous to others;

- underdevelopment of hearing, vision, smell, not amenable to surgical and other treatment;

- obvious physical defects of the physique: disproportion of the limbs, curvature of the spine, absence of phalanges of the fingers, etc.

Russian legislation recognizes group 2 disability as working, but in order to carry out full-fledged activities they still need outside help.

What taxes are a disabled person of group 2 exempt from?

The regional administration issues decisions on assistance to disabled people without the consent of the Government of the Russian Federation. The monetary expressions of benefits depend on the filling of the regional budget, so they may be different in each region. But tax benefits for disabled people of group 2 are the same everywhere. These include:

- reduction in the amount of utility bills;

- exemption or reduction of payment of property, land, transport taxes;

- free travel on public transport;

- reduction of fares in suburban railway transport.

A transport tax benefit may be provided in one city, but not in another, so you need to find out about the introduction of benefits by regional authorities in the social security authorities or in the “Property Taxes, Rates and Benefits” service on the Internet.

Citizens’ own property, subject to taxes, is listed in the “Taxpayer’s Personal Account for Individuals”

If the rights of beneficiaries are violated, you must immediately contact the prosecutor's office.

Vehicle tax

Vehicle tax is regional and is levied according to the rules established by the region.

Benefits for disabled people:

- free travel on municipal transport in the city, village and gardening. Private transport and taxis do not provide free transportation;

- free travel to and from the place of sanatorium-resort treatment;

- -for vehicles with engine power less than 100 hp. (in some regions and with higher power) payment of tax does not apply. Vehicles with special devices received from social security authorities are also exempt from tax;

- no tax is paid for passenger and freight transportation if such activity is the main activity of the disabled person.

Land use tax

Land tax is also regional. There are two options for tax rates determined by Article 391 of the Tax Code of the Russian Federation:

- 0.3% of the cadastral value of a plot of agricultural land and individual construction;

- 1.5% - other types of land ownership.

Two tax reduction options:

- the citizen is completely exempt from payment;

- the benefit is assigned by regional administrations.

Disabled people—indigenous residents of the Far East and North—are completely exempt from land use taxes.

The benefit is determined as follows. The amount established by the regional administration is deducted from the cadastral value of the land plot. The remaining amount will be considered the base amount for calculating tax.

In 2021, a rule was established - from a plot of up to 600 sq. m. meters, no tax is paid, and the basic tax amount is calculated on the balance after deducting 600 square meters from the area of the plot. meters.

Only one of several plots of a disabled person, if he has them, is subject to preferential treatment.

Only regional authorities can indicate the exact amount of annually adjusted taxes and benefits.

Working on your own plot of land is a great pleasure for several reasons. This is work that bears fruit, pleasant and necessary for all family members. Working in the fresh air is beneficial for everyone, even the disabled. You can work on your own plot of land without regulations. If you want, work, if you want, sleep, if you want, barbecue. Be sure to purchase a plot of land if you don’t have one yet. Pleasant care will prolong your fruitful life.

Property tax

Article 407 of the Tax Code of the Russian Federation defines benefits of 50% for payment for residential premises, garages and outbuildings with an area of up to 50 square meters. meters, built on an individual plot.

Creative workers are exempt from paying taxes on workshops, ateliers, studios, as well as museums, galleries, and libraries.

Local authorities can waive the full payment for real estate for people with disabilities.

The citizen submits to the tax department by November 1 an application and documents justifying the right to receive the benefit. From this date its action begins.

The application form and completion rules are approved by the federal tax authority.

Carefully study and check the permits of the tax authorities. Experience shows that often unqualified personnel are found there and they get confused in the preparation of documents.

Utility tax

Utility bills are reduced by 50%.

The cost of fuel is compensated by a 50% discount if it is purchased for residential buildings for disabled people. The standards are set by the local administration.

Exceeding the area of housing established by law does not remove the benefit for additional area.

Citizens who are absent from a communal apartment and living in gardens from May 15 to October 31 are exempt from utility bills, as are those who are absent for more than a month for other reasons.

Telephone and heating are not exempt from payment.

Radio points with a power not exceeding 0.5 W are not paid for by visually impaired people.

Housing conditions can be improved if:

- a disabled person was registered before 01/01/2005;

- housing supply standards are lower than those established by the constituent entity of the Russian Federation;

- the dwelling does not comply with sanitary, fire, construction and technical standards;

- some neighbors of the communal apartment are severely chronically ill;

- proximity to non-relatives in adjacent rooms;

- a disabled person lives in a hostel or rents housing.

Additional comfortable living space is provided for the following diseases:

- active form of tuberculosis;

- psychoneurological diseases;

- tracheostomy, nephrostomy, urinary, respiratory systems, etc., skin lesions with secretions;

- leprosy;

- diseases requiring the mobility of a disabled person in a wheelchair;

- kidney disease with complications of 2-3 degrees.

If a disabled person is absent from hospital treatment for six months, ownership of the living space remains with him. If a citizen is absent for a longer period of time, he or she must be placed in line for housing on the same basis as for disabled people.

Disabled people of the 2nd group are provided with 50% compensation for contributions for major home repairs.

Plus and minus

Payments will increase for those whose seven-year tax holiday period has ended. Owners of apartments in buildings younger than 2013, for example, did not pay property taxes - the inventory value of the housing was not determined.

Payments will not have to be made to owners of houses with an area of less than 50 square meters, since it is subject to deduction from the total tax amount. For a room, the cost of 10 “squares” is deducted, for apartments - 20.

Parents with many children have an additional deduction for footage. For an apartment it is five square meters, for a house - seven. Applies only to one apartment or house. Deductions for 50 and 20 meters are given for each property.

Procedure for applying for benefits

Tax benefits for disabled people of the 2nd group are issued at social protection institutions and are implemented by tax, utility, judicial and other authorities.

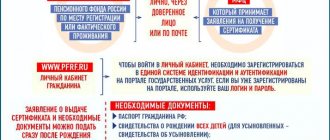

To apply for benefits for land use through social protection, the following documents are submitted to the tax authorities:

- passport;

- document confirming disability;

- documents for the site;

- health insurance;

- pensioner's certificate.

Some other documents may be required by social security.

An application for tax relief is submitted along with these documents.

Tax must be calculated and paid by October 1st.

If it is impossible to submit documents to the tax service yourself, you can use the help of an intermediary, providing him with a power of attorney, or send certified copies of documents by registered mail with notification.

The rules for filling out and the written application form, as well as its electronic format, are approved by the tax service.

Benefits for paying for utility services are issued by housing maintenance and utility companies on the basis of a certificate from the social security department, drawn up upon submission of:

- passports;

- disability certificates;

- certificates of family composition;

- registration certificates for housing;

- house book.

To receive a transport benefit, you must submit documents for a car and a disability certificate along with your application.

If a disabled person decides to use the right to a transport benefit late, then the recalculation is made for the last 3 years.

Preferences for payment of state duty

State duty is also a tax payment. Most applications to government services are impossible without payment. Thus, when turning to a notary , a citizen with a second disability group has the right to demand a 50% discount on the payment of the fee. An exception is transactions with real estate and other property (drawing up a purchase and sale agreement, donation, inheritance, etc.). When filing a claim in a magistrate or district court , a group 2 disabled person has the right to take advantage of a 100% discount on state fees. However, there is also an exception here. It is expressed in a limitation on the amount of the claim. If it is more than one million rubles, you will still have to pay a fee. At the same time, its size will be incomplete, which is also a unique form of providing benefits.

Deduction methods

Disabled people can be divided into two groups – those able to work and those unable to work. Able to work, in accordance with Art. 217 of the Tax Code of the Russian Federation, have benefits related to personal income tax. The tax deduction is 3,000 rubles from the monthly salary if the cause of disability was wounds, concussions or injuries received during military operations to defend the state. Other cases provide for 500 rubles.

Tax deductions are provided regardless of the citizen’s income and return part of the personal income tax if the disabled person spent money on purchasing:

- vouchers to health-improving and sanatorium-resort institutions;

- technical means;

- medications prescribed by a doctor, with the provision of payment documents up to 4,000 rubles.

Financial assistance to disabled people up to 4,000 rubles is also not subject to personal income tax.

To apply for a personal income tax deduction, a disabled person must submit:

- application for benefits;

- passport;

- disability certificate;

- income certificate in form 2-NDFL or 3-NDFL.

If a disabled person is registered as unemployed and receives benefits or his income is not subject to 13% tax, he is not entitled to this benefit.

The tax deduction can be issued by the employer, then fewer documents are required from the applicant and his use of the benefit is not interrupted.

Disabled people receive the right to personal income tax benefits from social protection organizations.

How to get tax breaks

To receive the required payments or discounts, you first need to clarify all the conditions with local governments. Then prepare and provide all the necessary papers to prove your status and legal right to a particular tax break.

The state provides a fairly wide range of benefits for disabled taxpayers. This was done for the social and financial protection of this category of citizens. The main thing is to know your rights and the possibility of receiving a discount on a particular tax.

Preferential incentives for disabled people of group 2

General provisions

The state constantly takes care of its citizens with limited legal capacity. Disabled people have the right to receive benefits and cash payments at the federal and regional levels.

Note for disabled people:

- social pension - 4959.85 rubles, for disabled people since childhood - 9919.73 rubles;

- The labor pension depends on length of service, so it is different for different citizens; its basic size depends on the presence of dependents. If they are not there - 4982.90 rubles; one dependent – 6643.87 rubles; two – 8304.84 rubles; three – 9965.81 rubles;

- Monthly cash payment (MCB) is paid. Its size is indexed annually on February 1. In 2021 – 2678.31 rubles.

- disabled people of all groups are paid a social package, indexed annually. It provides:

- provision of medicines;

- payment for sanatorium treatment;

- travel to the place of treatment.

The form of support measures with a social package (cash or in kind) is chosen by the citizen himself.

Indexation of labor (insurance) and social pensions is carried out annually from January 1 and April 1, respectively.

Disabled people can receive free of charge:

- rehabilitation means that ensure active life;

- assistance from social workers in cleaning the house and surrounding area if the disabled person lives in a private house;

- prosthetic and orthopedic services;

- dental prosthetics.

They have the right to enter colleges, universities, and academies without competition and receive a scholarship.

Disabled people, in accordance with Article 333 of the Tax Code of the Russian Federation, do not pay fees in courts of general jurisdiction and magistrates' courts if they participate as plaintiffs, organizations of disabled people also as defendants. The cost of the claim should not exceed 1,000,000 rubles.

For all types of notarial activities, the cost of state fees is reduced by 50%.

Benefits during employment

Disabled people can work if the following conditions are met:

- observe a seven-hour working day while maintaining full salary;

- regular annual leave should be 30 calendar days;

- the opportunity to take 60 days of leave without pay should be provided;

- It is prohibited to work overtime, on weekends and holidays.

Labor benefits are issued at the place of work.

A disabled person cannot be refused employment, because refusal is classified as discrimination with subsequent action against the employer.

Violation of the rights of a disabled person is considered by the labor inspectorate or the prosecutor's office.

Benefits when applying for compulsory motor liability insurance

Disabled people can receive a 50% discount when applying for compulsory motor liability insurance. Under the following conditions:

- - the car owner must equip his vehicle in accordance with the requirements established by the medical institution;

- a disabled driver and two of his representatives must have the right to drive a vehicle;

- The car owner must provide a certificate of disability.

The motorist must arrange and purchase insurance independently from the insurance company. He receives compensation from the social security authorities. The rules for issuing compensation are stipulated by Federal Law No. 40-FZ of April 25, 2002 “On compulsory insurance of civil liability of vehicle owners.”

Benefits for medicines

Disabled people can receive free medications in accordance with federal and regional laws. The full list contains more than 400 items, and you can get acquainted with it from your attending physician.

To receive medications according to a special prescription issued by a doctor, the following documents are required:

- passport;

- medical report;

- certificate from social security;

- SNILS;

- medical insurance;

- statement.

Permission to receive benefits is issued by a medical and social examination commission based on the recommendation of the attending physician.

Funeral benefit

Disabled people have the right to receive funeral benefits in the event of their death. Relatives receive benefits upon presentation of:

- documents on kinship,

- certificates of disability,

- death certificates,

- statements.

Funeral organizers can also receive benefits upon presentation of payment documents.

The amount of the benefit is determined by the federal authorities and is equal to 5562.25 rubles. Keep an eye on its indexing. The last one was in 2021. In some regions, the amount of benefits is increased by law.

The amount prescribed by federal law is issued from the Pension Fund, and regional allowances are issued by regional social protection authorities. To apply for benefits, you must contact the Pension Fund and the social security service.

Pension

A pension for a disabled person is assigned if the citizen has no reason to receive a labor or state pension.

The size of the pension for different categories of disabled people of the 2nd group as of 01/01/2019 is:

- 2nd disability group – 5240.76 rubles.

- 2nd group of disability since childhood – 10,737.59 rubles.

This pension is granted to men from the age of 60, and to women from the age of 55.

Insurance pension

The insurance pension is assigned by the Pension Fund of the Russian Federation.

A disabled person has the right to receive this pension as additional income.

The reasons for the disability of a disabled person, his work experience, and the duration of his work activity are not taken into account when establishing it.

Its size depends on the salary previously received and consists of the insurance and fixed parts. Disabled people with disabilities receive a fixed portion of 4,758.98 rubles.

Labor pension

The assignment of a labor pension is determined by two conditions:

- recognition of disability and limited opportunities for work;

- conclusion of a medical and social examination on disability.

The labor pension is paid regardless of the continuation of work.

The amount of payments of the fixed part of this pension for a disabled person of the 2nd group who does not have a dependent is 2,771 rubles.

For disabled people of the 2nd group with limited physical and mental abilities, having one dependent - 3512 rubles, two dependents - 4313 rubles, three - 5237 rubles.

Disabled people with a total experience of at least 25 years, including those who worked in the harsh Arctic climate for at least 15 years, receive 3,671 rubles, and a dependent disabled person receives 5,321 rubles.

List of required documents

The benefit is of a declarative nature. That is, it is accrued only after the taxpayer submits a written application to the employer and provides a package of documents.

The main supporting document is a certificate of disability issued by the ITU institution. Its form is established by Order of the Ministry of Health and Social Development dated November 24, 2010 No. 1031n. The certificate must indicate the group and reason for recognizing the citizen as disabled.

To receive a deduction of 3,000 rubles. Additional certificates will be required:

- Chernobyl;

- liquidator of the accident at Mayak;

- combat veteran.

State assistance in running individual entrepreneurship in the presence of disability

Russian legislation has developed a number of laws and regulations granting people with disabilities the right to run their own businesses. The number of benefits and preferences received in this case depends on the disability group and region of residence.

Regulatory legal acts (LLA) to help individual entrepreneurs with disabilities

| Name, date of acceptance and assigned number | Basic provisions |

| Presidential Decree “On additional measures of social protection of people with disabilities” dated October 2, 1992 No. 1157 | The government’s obligation to provide comprehensive assistance to people with disabilities in official organization and gaining maximum access to the functions of government institutions is noted. |

| Federal Law “On Social Protection of Disabled Persons in the Russian Federation” dated November 24, 1995 N 181-FZ | Establishes a list of benefits and preferences available to citizens of the Russian Federation with diseases of varying severity. |

| “Tax Code of the Russian Federation (Part One)” dated July 31, 1998 N 146-FZ | The main document in relation to which taxation of workers is controlled and tax benefits are provided. |

| Federal Law of December 29, 2014 N 477-FZ “On Amendments to Part Two of the Tax Code of the Russian Federation” | Preferences in the field of taxation have been recorded for representatives of small businesses and individual entrepreneurs with disabilities. |

| Federal Law of May 3, 2012 N 46-FZ “On Ratification of the Convention on the Rights of Persons with Disabilities” | It is reported that the international bill of rights of persons with disabilities has come into effect in the Russian Federation. |

| Federal Law “On Insurance Pensions” dated December 28, 2013 N 400-FZ | Displays the grounds for canceling payments by entrepreneurs of contributions to compulsory medical and pension insurance funds. |

| Letter of the Federal Tax Service of Russia dated April 26, 2017 N BS-4-11/7990 “On exemption from payment of insurance premiums” | Fixes the grounds for exempting individual entrepreneurs from paying insurance premiums |

| Letter of the Ministry of Finance dated May 25, 2017 No. 32244 | Determines the specifics of collecting insurance contributions to pension and health insurance funds. |

Invaworld

- 25.12.2018

- Legislation

- benefits for disabled people

- tax benefits

The state, as part of supporting people with health problems, has established a number of tax breaks for them. The main goal of these benefits is to make life easier for citizens. So, tax benefits for disabled people: what can be used and in what amounts they are calculated. About all this - in Invaworld.ru.

- Tax benefits for individuals

- What income can be completely exempt from taxes?

- Tax deductions for disabled people

- Land tax benefits for disabled people

- Property tax benefits for disabled people

- State duty: who doesn’t pay

- Transport tax incentives for disabled people

Indefinite status

Disabled people of the second group can receive a category without mandatory re-examination. To do this, you must have a diagnosed disease included in the list of Government Decree No. 247 of 04/07. 2008. It consists of 23 titles, the main ones being:

- Problems of an oncological nature. Citizens with the presence of a tumor, metastases and relapses after completion of treatment have the right.

- Formations in the cerebral cortex that are not subject to surgical removal and are recognized as benign. Provided that they caused dysfunction of the body systems.

- Complete deafness, as well as blindness or a combination of both disorders.

- Deformation of any limb.

The Decree also specifies the time frame within which a permanent category can be obtained.

Important! You can obtain a permanent category within the time limits specified in the Resolution.