Anything can happen in life; often fate awaits a person at the most unexpected moment. It happens that an employee one day does not show up for work or does not return from sick leave, and only then it turns out that his vacation will now be eternal. What should an employer do to legally terminate an employment relationship? How to manage the money earned by a deceased employee? Who should I give the work book to, and what entry should I make in it?

How to formalize dismissal due to the death of an employee ?

Death does not depend on anyone's will

The legal grounds for dismissal due to death are clause 6.1. Article 83, “termination of an employment contract for reasons beyond the will of its parties.” The death or disappearance of an employee, followed by his recognition as dead or missing, naturally belongs to such reasons.

Question: The employment contract with an LLC employee states that in the event of the death of an employee, the LLC will reimburse his close relatives for funeral expenses. The employee died. Is the LLC obligated to reimburse his daughter for funeral expenses if the employment contract is terminated due to the death of the employee? View answer

Documentary evidence of the unfortunate fact will be a state document - a death certificate issued to relatives in the registry office. A medical certificate issued by a doctor is not suitable in this case: it is issued only for registering death in the registry office. The deceased's next of kin must bring a copy of this certificate to the employer.

FOR YOUR INFORMATION! If a person does not make himself known either at work or at home for a long time, more than six months, with the consent of relatives, the employer can initiate the establishment of his civil status. After going to court and the decision gaining legal force, the missing person is declared dead or missing. The court decision will become the documentary justification for the dismissal (clause 1 of Article 45 of the Civil Code).

Documentary support for “perpetual” dismissal

All civil processes in our lives are associated with a certain “paper” support. Any significant changes are recorded and documented. Therefore, it is important in all cases to comply with the formal side of the process, without neglecting the preparation of relevant documents.

What to do if an employee dies while on annual leave ?

What papers will be needed to dismiss an employee due to his death?

- Justification – death certificate (or a court decision on the status of the missing employee that has entered into legal force).

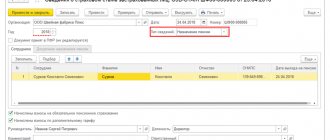

- An order for the dismissal of a deceased employee, issued in accordance with the established form No. T-8.

- personal file with appropriate notes.

- A work book with a correctly completed entry.

- Application from relatives to transfer payments due to the employee to them.

Algorithm for the employer

Having received news of the death of an employee, documented by a copy of the death certificate, the employer can begin the dismissal procedure.

How to enter a notice of dismissal due to the death of an employee in the work book?

If the information was received not by the employer himself, but by a lower-level manager who is the immediate superior of the deceased, he needs to submit a memorandum about this fact to management, indicating all the personal data of the retired employee and attaching a copy of the death document.

Further, the procedure is standard and clearly defined by labor legislation and personnel practices.

- Issuance of an order (form No. T-8) on dismissal under clause 6, part 1. Article 83 of the Labor Code of the Russian Federation. Naturally, the deceased employee will not be able to sign in the column “I have read the order,” and no one except him has the right to do this. So in this case the line remains empty.

- Registration of this order in the register of orders and orders relating to personnel.

- An entry is made in the employee’s personal card about the reason for termination of the employment contract with reference to the article of the Labor Code.

- Making an entry about dismissal in the work book: the wording is the same as in the personal card.

- The accounting department calculates the due payments and enters them into the settlement document T-61.

- The work book is given to the relatives of the deceased or, with their written consent, sent to them by mail. There should be a corresponding note about this in the book for recording the movement of work records. Relatives must present a document confirming their relationship. If relatives do not appear or do not express written consent to receive a work book, it must be kept in the archives of the enterprise for at least 3 years, and then destroyed in accordance with a special act.

- After signing the statement, relatives are given appropriate cash payments. This should happen no later than a week after the written request for payment accrual. In this case, the statement will be issued to the deceased employee (must contain information about his tariff rate, position, personnel number, etc.), and in the column “Money received” the person to whom it is given, that is, a relative, will sign.

Results

The death of a subordinate imposes certain obligations on his employer. The management of the enterprise must take the following organizational measures:

- Issue an order stating that the employment contract has terminated. One reason is given - the death of an employee, the basis is the provisions of paragraph 6 of Art. 83 TK. The date of termination of the relationship given in the order must fully correspond to the date of death.

- Draw up a work book by making the appropriate entry and hand over the document to the employee’s relatives or friends.

- Pay relatives or loved ones the money that is due to the employee for the period worked until death, as well as funeral benefits. Payment deadlines must be within the law.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to coordinate dates

There is no notice of resignation with a specific date and there cannot be, nor is there a two-week period of work required before dismissal. What is the date to terminate an employment contract? After all, these numbers depend on:

- calculation of due wages;

- calculation of unused vacation days;

- compensation for additional leave granted to employees with young children;

- transfer of contributions for the employee to the Pension, insurance and other funds;

- many nuances associated with the position, for example, driver's insurance, etc.

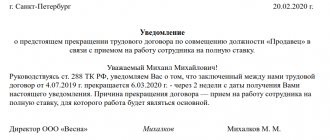

In case of automatic termination of employment relations, the day of dismissal is considered to be the last working day of the employee (Article 84.1 of the Labor Code of the Russian Federation). But since the manager does not immediately learn about the death of a subordinate, especially since it takes time to prepare supporting documents, the official date that will appear in all accompanying papers will be considered the one indicated in the certificate (or in the court decision).

Since the supporting document (certificate) reaches the enterprise later, the employer is forced to prepare the documents “retroactively”. In such a situation this is not a violation.

Payment of funeral benefits

When buried at the expense of a relative of the deceased or another citizen who took upon himself the funeral efforts, he is paid a social benefit for the funeral. The benefit is due if the above-mentioned citizens applied for it no later than 6 months from the date of death and is paid on the day of application for it on the basis of a package of documents: an application (in any form) and a death certificate from the registry office. Important! The original must be provided.

It is unlawful to demand any other documents from an individual.

To pay benefits you do not need to calculate average earnings. The benefit is assigned in a fixed amount , which is indexed annually. From 02/01/2020, the amount of the funeral benefit, taking into account indexation, is 6124.86 rubles. In regions where a regional coefficient is applied, the amount increases by the size of the coefficient.

Funeral benefits for individuals are provided from budget funds. This means that the employer reduces the calculated social insurance contributions by the specified costs (with the offset method) or receives a refund (with direct payments).

No death certificate? Need to find

It happens that the deceased employee does not have relatives or they do not contact the company, perhaps they live far away, and they do not want to send a notarized copy of the document. How to get a copy of the death certificate, because only on the basis of this document is it possible to begin the procedure for terminating the employment relationship?

The company has the right to obtain a copy of this certificate itself by sending a request to the authority where the death of their employee could have been registered. This could be the registry office:

- at the place of actual residence of the deceased;

- at the place of last registration;

- closest to the place where the death is recorded (for example, in a hospital) or the body is discovered;

- in the burial area.

When the question arises of searching for documentary evidence, but the employer does not have the exact facts, you can send a request to all possible registration authorities.

What is due to relatives?

For whatever reason, an employee is dismissed, including due to death, he is entitled to certain payments:

- wages for hours worked that have not yet been paid;

- compensation for “not taken” vacation;

- financial assistance to the family of the deceased is a gesture of goodwill on the part of the employer. This payment is not mandatory, but in practice the company usually supports relatives in memory of a good employee.

To receive this money, immediate relatives (spouse, children, including adopted children, parents, guardians or adoptive parents) must collect the following documents for the employer:

- application requesting payment;

- documentary evidence of relationship with the deceased;

- a copy of the death certificate of a relative;

- your passport or other identification document.

Relatives have 4 months to receive legal payments directly from the employer (clause 2 of Article 1183 of the Civil Code of the Russian Federation). If they did not come for the money with the appropriate documents, payments must be transferred to the account of the executor - any state notary (Article 327 of the Civil Code of the Russian Federation). They will be included in the total amount of money of the deceased's inheritance.

ATTENTION! The employer will not be able to ignore these payments, or information about the deposit account and hide them: the check should be presented either with a signature of relatives on the payroll, or information about the deposit account of a government lawyer.

If immediate relatives apply for payments independently of each other, for example, applications were submitted by both the wife and mother of a deceased employee, the employer is not authorized to decide which of them to give the due money. Relatives will be asked to reach an agreement among themselves or go to court.

Personal income tax and insurance premiums

In the final calculation for the release of funds due to the deceased employee, it is assumed that there is no need to pay income tax. This fact is reflected in Art. 217 tax code. According to the law, personal income tax is not deducted for earnings and other compensation (vacation pay, bonuses, allowances).

Relatives will receive the entire amount before taxes. The issue of paying contributions to the Pension Fund or Social Security is resolved in a similar way. In the event of a person’s death, the need for contributions to extra-budgetary funds disappears, and insurance premiums are not deducted from the last earnings.

What payments are due?

The issue of correct calculation of payments that are due to relatives for a deceased person deserves special attention. The Labor Code prescribes the payment of all funds due to the first person who applies from among:

- Parents.

- Children.

- Spouse.

- Dependents who were under the care of the deceased.

This norm is established by Art. 141 labor code. The period allotted for claiming rights to payments and benefits is set at 4 months from the date of dismissal (or death), according to Art. 1183 Civil Code of the Russian Federation. If no one requests payment during this period, the right to claim wages and other accruals for the deceased is lost, and the money may be included in the general inheritance or remain with the employer.

To receive money from work, you must submit to the administration of the enterprise a letter of application, a document certifying it, or any certificate establishing a close relationship.

After receiving the application, management is obliged to resolve the financial issue by paying all due charges within 1 week.

According to current legislation, compensation to relatives includes the following types of deductions:

- Covering part.

- Additional payments and allowances due to the deceased.

- Compensation for unused vacation upon death of an employee.

- Payment according to a certificate of incapacity for work.

- Premium part.

- If established by a collective agreement, financial assistance. In the absence of such provisions, the head of the enterprise has the right to formalize such payment through a separate internal act.

- Funeral benefit paid as part of Social Security assistance.

The company must pay the entire amount within 1 week after the relatives apply.