To apply for a loan you need to bring:

- Russian passport with permanent or temporary registration;

- a certificate in form 2-NDFL or a certificate in the bank form confirming income;

- mortgage application form;

- a certified copy of the work book;

- insurance certificate of state pension insurance.

At the client’s request, Sovcombank can issue title insurance for real estate, as well as life and health insurance. Insurance is obtained from insurance companies that are partners of the bank.

Additionally, the bank may request documents for children if the apartment is taken under a mortgage program for families with children. If there is a co-borrower or guarantor, you must provide similar documents.

There are special requirements for individual entrepreneurs or pensioners. For example, an individual entrepreneur will have to bring a tax registration certificate, a declaration for the last tax period and a license for the chosen type of activity if he is running a business that requires its registration.

Review of documentation

If we talk about the timing of consideration, then a lot depends on how quickly a person responds to the bank’s requests for certificates or documents. Since the mortgage loan approval process consists of several steps, it also takes a lot of time.

Mortgage approval at Sberbank:

- At the first stage, a person goes to the nearest branch for advice.

- Then he selects an approximate property and receives an approximate cost of the mortgage loan.

- At the second stage, you should collect documents. The most important thing is certificates confirming the income level of a person and his co-borrowers.

- The final stage is characterized by waiting, which lasts 2-5 days.

If your mortgage is approved by Sberbank, here's what you need to do next:

- Search, select a property.

- Collect documents according to the list from the bank. They relate to mortgage housing.

- It is imperative to insure and evaluate the future property.

- Conclude an agreement for the purchase of an apartment (house).

- Make a down payment (using maternity capital is allowed).

- Draw up papers confirming the fact of transfer of mortgaged housing to the bank (as collateral).

- Receive an approved loan and transfer it to the seller of the apartment (house).

When clients ask how long to wait for mortgage approval at Sberbank, employees answer - about five days. This period is required by the bank in order to assess the readiness of documents and the solvency of the client. Next, a more detailed review of the transaction and related securities begins, which stretches for at least a month. This is a big disadvantage for the client, because often a purchase and sale transaction needs to be concluded very quickly.

What can and cannot be done?

Purchasing an apartment using a mortgage imposes some restrictions on new owners:

- The borrower can register himself and his immediate relatives in the apartment.

- The owner cannot completely dispose of the property, because it is pledged to Sberbank. You cannot bequeath or donate housing. You can even sell it only with the permission of the bank.

- The borrower has the right to make repairs of any kind. In addition to redevelopment. Any changes must be coordinated with Sberbank. Coordination of redevelopment takes place in 3 stages:

- preparing the project and obtaining consent from regulatory authorities;

- coordination of reconstruction with the insurance company;

- obtaining the bank's consent.

- The owner can, purely theoretically, re-mortgage his apartment. But again, the consent of Sberbank will be required. In such a situation, another bank is unlikely to agree to become the second lender in line if the borrower cannot pay the mortgage.

How many days does it take to approve a mortgage at Sberbank?

Several factors affect the review period. The first factor is the type of mortgage lending. The bank has a time limit for approving each type of mortgage. For example, if a loan is needed to purchase housing on the primary or secondary market, then the processing time for documents is 2-5 days. Only working days are counted, not calendar days. The period is increased by one day if housing is purchased using a military mortgage or through on-lending.

These steps are necessary for the banking institution to evaluate its future borrower. Bank employees are interested in whether the client has a stable income and what social category of citizens he belongs to. No one argues with the fact that banks, first of all, pay attention to the client’s employment and income. Managers must be confident that the future borrower will repay the loan regularly. If a person has a good credit history and has no current loans, this increases his chances of getting a mortgage loan.

The category of salary clients is a priority because their income level is stable and known to the bank. Accordingly, there is no need to make inquiries and once again prove your solvency. This has a significant impact on the deadlines, because they are reduced to one, maximum two days. As for the rest, they submit a list of papers in the prescribed manner.

An application for a mortgage loan is considered at several stages. Therefore, at any of them questions may arise that will lead to an increase in time:

- Credit scoring. This is an automatic check based on the information entered. Its main task is to assess a person’s solvency. The assessment is based on personal data on family composition, income level, work activity and other factors. This step is characterized by a credit history check.

- In order to evaluate documents for authenticity, they must be checked by the bank's security service. Bank representatives can call the specified place of work and talk with the manager. The underwriting department's job is to assess risks. Department employees conduct analytical work and, based on it, draw conclusions about the client’s solvency.

There are several ways to find out if a mortgage has been approved by Sberbank. In most cases, the credit manager calls the client, informing him of the decision, or receives an SMS message. Once the mortgage is approved, the most critical part of the process begins. You need to select and agree on real estate. At the next stage, the bank sets aside 10 days to review documents for future mortgage housing. If the client made errors in the certificates, this increases the consideration for some more time. And, most importantly, banks have certain requirements for real estate. Their compliance is mandatory.

List of documents for mortgage approval at Sberbank

Clients who take the collection of documents seriously can count on a quick positive decision. To speed up the procedure, when applying to Sberbank for the first time, you need to have the following documents on hand:

- Russian passport with permanent registration. If it is missing, a temporary one will do.

- A written application from a client to receive a mortgage loan.

- A document confirming the fact of marriage.

- If there are children, then their birth certificates are needed.

- The client's profitability is confirmed in two ways. Providing a 2-NDFL certificate; if it is missing, a completed document based on the model of a banking institution will do. People of retirement age provide identification. If the client has an additional source of profit, this must be confirmed.

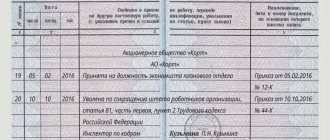

- A prerequisite is having a permanent job. A photocopy of the work book with a stamp and signature is suitable for proof.

When co-borrowers help to obtain a mortgage loan, the bank requires from them the same number of documents as from the main persons. It will be a positive fact if the husband and wife have jobs.

How to take out a mortgage loan without being rejected: approval conditions

Mandatory conditions for issuing a mortgage are:

- working age (21-75 years);

- having a work experience of at least 6 months and a total work experience of at least 1 year.

The property in question must have all required registration documents. If this is an apartment in a new building, it is necessary that the development company be accredited by Sberbank. This and other large banks compare favorably with small competitors in that it is easier for them to pay off large obligations and they are insured against a situation where the bank cannot provide the amount required for the loan.

If you are applying for one of the state programs, take into account the special conditions (described in detail on the website). For example, to apply for a loan under the program to support young families, it is necessary that the second or third child was born no earlier than January 1, 2018.

If the client does not have a permanent residence permit, the loan can be issued for the period of validity of the temporary residence permit.

Why does a mortgage application take so long to process?

There can be many factors, and in most cases, they come from the client. For example, if he filled out the papers incorrectly or made mistakes. Main reasons:

- The fact that there is not one co-borrower, but several, leads to an increase in the consideration period. After all, each of them is carefully checked.

- Incomplete set of documents.

- The inability to find an apartment that the client likes and would be approved by the bank.

- The underwriting department may not meet the allotted deadline for verifying documents. This leads to the fact that certificates received before everyone else lose their relevance.

- Human factor. It manifests itself both on the part of borrowers and on the part of bank employees.

Speeding up the mortgage application process

Sberbank has created a service that allows you to quickly find suitable housing in new buildings. This is DomClick. What is important is that all real estate objects meet the bank's requirements. If you apply for a mortgage loan from this service, it will be included in the priority queue. For example, the processing time for an application is reduced to several days. This is also convenient for the client because there is no need to visit a bank branch. You can find out about the decision by email.

It is worth noting the fact that in order to reduce the time it takes to consider an application, you need to take care of choosing real estate in advance. This will help eliminate those options that do not meet the bank’s requirements. Having received approval, the client will begin to collect the necessary certificates, and not look for an apartment. It is also important for a person to know how long mortgage approval at Sberbank is valid. Because sometimes the allotted time is not enough to prepare documents.

Coordination of housing option

If the bank approves the client's initial mortgage application, from that moment on, 90 days are provided to find housing and complete documentation.

If housing is found, you need to contact Sberbank to schedule an appraisal. The timing of the assessment depends on the type and condition of the residential property.

Apartments in new buildings accredited by Sberbank are approved the fastest. The developers of residential complexes and the bank have partnerships - this simplifies the appraisal and conclusion of the transaction.

If the new building is completed and has passed all commissions, there will be no problems with the lender. And if the house is under construction, additional security will be required.

The developer prepares the documents for the house in which the apartment is being booked with a mortgage. Among them are the following papers:

- agreement with information on the property;

- permission to erect a building and information about security;

- act on redistribution of housing stock;

- certificate of partial ownership of the plot where the house is being built;

- permission to sell the apartment.

Features of mortgage approval for secondary housing

Buying a home with a mortgage on the secondary market in 2021 causes more difficulties, and, therefore, slightly delays the process of approving a home loan.

The bank has a number of requirements for such housing:

- the house should not be in disrepair and not be unfit for habitation;

- the object must comply with the established technical characteristics;

- special attention is paid to legal subtleties - the absence of arrest, redevelopment, encumbrances, consent to the sale of all owners.

If the housing does not meet the requirements of Sberbank, the application can be submitted again if the allotted 90 days have not expired.

Procedure after approval of the application

After the bank has approved the application and the client has found a suitable property, the most crucial moment comes. It consists of signing a mortgage agreement. The client’s task is to study the provided document in detail. This is especially true for those points where the loan amount, monthly payment, and obligations of the parties are written. The debt repayment schedule is formed separately, it is also worth checking.

Simultaneously with the mortgage agreement, an additional agreement on home insurance is signed. You cannot refuse this, otherwise the bank simply will not approve the mortgage. In addition, it is advisable to insure your life. The bank cannot oblige the client to do this, but the interest rate depends on the fulfillment of this condition. By insuring life, a person can count on reducing the interest rate by 1%. It seems like a small privilege, but if the loan is issued for years, it is very noticeable.

At the final stage, having concluded a deal, the client needs to enter his home into electronic registers.

You can ask a bank employee for help or contact the MFC. After preparing the documents, the banking institution transfers the entire loan amount to the account of the person who sold the property. After this, we can say with confidence that the transaction is completed. The client becomes the owner paying off the mortgage. Mortgage in Sberbank. This is why most mortgages are taken out from Sberbank. Mortgage conditions in 2021

![How to get a mortgage for new buildings in Sberbank in [year]](https://notarius-nn.ru/wp-content/uploads/kak-poluchit-ipoteku-na-novostrojki-v-sberbanke-v-year-godu-330x140.jpg)