Home / Complaints, courts, consumer rights / Services and consumer protection

Back

Published: 09/03/2018

Reading time: 10 min

6

734

Sberbank services are provided to individuals and legal entities on the basis of Article 30 of the Federal Law “On Banks and Banking Activities” (as amended by Federal Law No. 17-FZ of February 3, 1996, as amended on August 3, 2018). In case of inappropriate service and behavior of Sberbank employees, clients have the opportunity to write a complaint against unscrupulous employees. Based on the Federal Law of May 2, 2006 No. 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation,” you can complain in three ways: orally, in writing, or electronically.

- How to write a complaint on the Sberbank website? Contact via the official website: step-by-step instructions

- Checking the status of your application

- Application in writing

You can contact:

- to a bank branch;

- on the Sberbank website, section “Feedback”;

- send a letter by mail;

- send a message by email;

- write a review on the website regarding communication with clients;

- call the contact center numbers: 900 or 8-800-555-55-50;

- through authorities.

How to write a complaint on the Sberbank website?

You can protect your rights and complain about poor service on the official Sberbank website by writing a complaint. Based on clause 3 of Art. 7 Federal Law No. 59, an electronic document is registered and considered in the same way as on paper.

Contact via the official website: step-by-step instructions

Go to the official website of Sberbank and complete the following steps:

- in the search bar, type the address link sberbank.ru/ru/person;

- in the “Support” section, select “Feedback”;

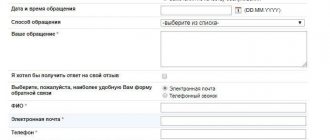

- fill out the feedback form . To do this, indicate the person: individual or legal entity; write the purpose and reason for the appeal; compose a text with a detailed description of the reason for the appeal;

- attach a file with additional document;

- select the form to receive a response: by email or SMS;

- click the "Submit" button.

Checking the status of your application

On the website, track the progress of the complaint using the link sberbank.ru/ru/feedback in the “Check the status of consideration of the complaint” section. Enter the case number and press the “Check” button.

The legislative framework

The procedure for filing claims and the timing of their consideration are regulated by the following legislative acts:

- Federal Law “On the Protection of Consumer Rights” dated 02/07/1992 N 2300-1 (as amended on 07/03/2016).

- Federal Law “On the Prosecutor's Office of the Russian Federation” dated January 17, 1992 N 2202-1-FZ.

- Federal Law “On the procedure for considering appeals from citizens of the Russian Federation” dated May 2, 2006 N 59-FZ.

- Federal Law “On Banks and Banking Activities” dated December 2, 1990 N 395-1.

- Federal Law “On the Central Bank of the Russian Federation” dated July 10, 2002. No. 86.

Applying via Internet banking: step-by-step instructions

To make a complaint via online banking, register on the Sberbank-online website:

- go to the website via the link https://online.sberbank.ru/;

- at the top of the page, next to the phone icon with the inscription “Contact Center”, numbers for contacting the bank are indicated;

- when you click on the envelope at the top of the page on the right, a window will open for a question in the bank’s Contact Center;

- press the "Create" button;

- on the page that opens, fill out the sections: message type, topic, method of receiving a response, etc.;

- write a message;

- click "Send".

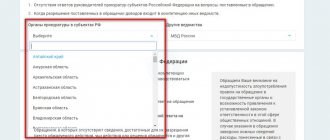

Central Bank

The Central Bank oversees the work of all credit institutions operating in the country. Fundamental issues related to violations of banking legislation can be resolved in this department.

Before complaining about Sberbank, you should study the functionality of the Central Bank website. It, like others, involves sending messages through a special request form. The problem is stated in the communication form or its description is attached along with other attachments confirming the applicant’s position.

There are representative offices of the Central Bank in each region; it is permissible to send a written message to them by mail or in person.

For a personal meeting with the head of the department

If the problematic issue is not resolved on the website, then you can complain about the illegal actions of Savings Bank employees to the head of the department where the conflict occurred. Oral complaints are expressed in any form during a personal appointment, which is pre-registered.

The legislation does not provide for requirements for filing a complaint in writing. There are only recommendations. The personal and contact details of the applicant are indicated. A sample complaint can be downloaded from this link.

Based on paragraph 1 of Art. 11 of Law No. 59, officials are not required to respond to anonymous letters. Exceptions include statements indicating criminal or administrative offenses.

When contacting the manager, the situation is briefly described orally and in writing and evidence of what happened is presented. The application is registered.

Rospotrebnadzor

The state organization, which controls, in particular, the quality of banking services, has its own hotline: 8-800-100-00-04. It’s worth writing this number down in your address book, even if you’re reading the article out of idle curiosity.

Also, on the Rospotrebnadzor website there is an online form for citizens to apply:

In this form you will have to keep within 2000 characters, but you can attach a document or photo. Please indicate “Poor provision of banking services” in the subject and be sure to leave all possible contact information. The appeal is numbered and considered for 10-30 days, depending on the complexity.

Fans of queues can contact the regional office of Consumer Rights Protection in person. Do not forget to find out the reception hours for citizens in advance.

↑ to contents

Appeal to the Central Bank of the Russian Federation

If there are no other ways to resolve the conflict, the claim is sent to the Central Bank of the Russian Federation in written or electronic form. The letter is drawn up addressed to the head of the department indicating the address of the organization. The address is taken from the official website.

Application in writing

The letter states:

- personal and contact details of the person who wrote the complaint;

- address of the department (office, branch) where the incident occurred;

- detailed description of the conflict situation;

- facts or materials confirming the authenticity of the situation;

- requirements that do not contradict relevant legislation regarding punishment.

A sample complaint to the Central Bank of the Russian Federation can be downloaded from the link.

Electronic application

The complaint is submitted electronically through the online reception on the official website.

Terms of consideration

According to Art. 12 Federal Law No. 59 dated 02.05. 2006 a written appeal to state or local authorities and other authorities must be considered within 30 days from the date of registration. The measures taken to resolve the conflict will be indicated in the letter. The response is sent to the sender’s place of residence/registration or other contact address specified in the request.

In exceptional cases, the review period may be extended by another 30 working days.

Complaint to the prosecutor's office

Complaints are filed with the prosecutor's office if bank employees violate current legislative norms. For example, if an offense is committed involving personal insult, humiliation of honor and dignity. The prosecutor's office is contacted after filing an application with other government agencies. An application addressed to the prosecutor is drawn up according to the following rules:

- in the upper right corner the name of the organization , full name and place of residence of the applicant, contact details and full name of the responsible person are indicated;

- the statement indicates the place, time , and under what circumstances the personal insult occurred;

- participants and witnesses to the conflict are named;

- provides a detailed history of the conflict;

- evidence with video and audio recordings of insults is attached;

- called broken laws;

- request for administrative liability.

When to complain

First, let's define a list of reasons that give you the right to complain. Its size is very large, since you have the opportunity to complain about absolutely any violation: it can affect both customer service standards and your rights as a citizen. Let's highlight the most important ones:

- Violation of service quality standards, namely unreasonable refusal of service, unlawful refusal of service, rudeness, provision of false information;

- Violations when working with clients’ personal documents, namely disclosure of personal data, unlawful transfer of personal papers to third parties, loss of client’s personal papers;

- Violations in the provision of services: errors in money transfers and financial transactions, violations in the preparation of documents and contracts. Providing false or non-public information;

- Violations when signing contracts, imposing services, as well as deliberate non-compliance with or changes to the contract;

- Fraudulent actions, as well as other offenses committed by Sberbank employees.

Attention

At the same time, each type of complaint is responsible for its own service, and before writing a complaint, you need to think about what topic it will concern and where it will be best dealt with.

Going to court

If problems with the bank are not resolved peacefully, then a lawsuit is filed. To file a claim against Sberbank, a statement of claim is written in a short business style. The title of the application states:

- court name and address;

- personal information about the plaintiff (complaining party);

- information about Sberbank (legal address, full name of the manager, TIN, KPP, etc.).

The application contains the following information:

- under what circumstances did the conflict arise?;

- essence of the conflict;

- in monetary disputes the price of the claim is indicated;

- request to resolve the situation;

- justification of requirements based on legislation.

Attached is a list of documents related to the case: checks, receipts, extracts. The application is submitted to an authorized bank employee or sent by registered mail.

Hotline

A complaint against Sberbank can be voiced to the operator by calling the hotline. The likelihood that the conflict will be resolved is quite small; telephone conversations are usually not assigned a number and they are not forwarded for further consideration. If the operator was unable to answer the client’s question, you will have to choose a different form of contact.

It happens that complaints are actually sent to regional offices. But such cases are rare.

Sample

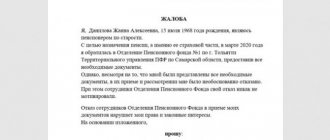

The complaint to Sberbank must reflect all the details of the issue. There is no established sample application, but, like all documents of this kind, the application must meet certain requirements.

The document includes:

- Addressee's name. It depends on where you intend to file your complaint;

- Applicant details (full name, address and telephone number);

- In the middle you need to write the word “Complaint” or “Claim”;

- The essence of the complaint (who and in which branch of the bank violated your rights);

- Applicant's requirements;

- List of documents. The applicant can attach a past response from the bank, a contract, a photo, a witness statement;

- The date, as well as the signature and its decoding.

If you send a complaint by mail to the main office, it can be drawn up on a regular A4 sheet. The letter should not contain threats, insults or excessive emotionality. The document must contain the applicant’s coordinates, email address, and telephone number. Usually requests are processed within 10-15 days.

You can download the application form here.

Appearance

First, you will have to understand where the claims come from and how to correctly write a claim to Sberbank. This is an important point. The basis for cooperation between a citizen and a bank is the concluded agreement. It describes all the features of providing certain services.

Most often in practice, complaints arise regarding:

- lending;

- providing mortgages;

- on cash and settlement issues.

Complaints are prompted by the emergence of controversial situations or direct violation of the concluded agreement by the bank. But how to write a claim to Sberbank? What information should all clients be aware of?

Illegal blocking

Most often, a current account or bank card is blocked when using a plastic card abroad. A little less often, but quite often, the reason for blocking is a strange, from the point of view of Sberbank, transaction within the Russian Federation.

In fact, blocking in some cases is pure arbitrariness of Sberbank, contrary to current legislation.

Yes, Art. 858 of the Civil Code of the Russian Federation states that restriction of the right of a bank client to dispose of their own funds is possible only on the basis of seizure of funds.

Paragraph 2 of Federal Law No. 115 dated August 17, 2001, on the basis of which Sberbank carries out blocking, states that control of client funds can only be carried out in the event of suspicions confirmed by law enforcement agencies about the client’s involvement in extremist or terrorist activities.

Moreover, even if a certain transaction seems suspicious to the bank, due to the requirements of Federal Law-115, it only has the right to refuse to carry out this separate suspicious transaction, but it does not have the right to block the account, since blocking is a restriction of the client’s right to use his own money.

This means that unjustified blockings fall under Art. 10 of the Civil Code of the Russian Federation (abuse of rights) and Art. 285, 330 of the Criminal Code of the Russian Federation.

Reasons for filing a complaint

The reasons for filing a claim with the bank may be different. For example, rude staff service or technical failures in the operation of ATMs and terminals, as well as more serious violations of Federal laws.

In most cases, clients demand the return of illegal commission fees under loan agreements that were canceled by a ruling of the Arbitration Court. Well, who wants to voluntarily part with money?

Quite often, outrage is caused by illegal debiting of funds for services that the client did not order. Among the dissatisfaction is the incompetence of bank employees and tellers who provide inaccurate information on certain financial products and services. Also, irritation is caused by the imposition by bank employees of services unnecessary to the client, and annoying advertising SMS mailings from banks. More and more claims are coming from customers who have suffered as a result of fraudulent activities of third parties.