Liquidator is a person who is entrusted with the responsibility for regulating the process of liquidation of the company.

The liquidator is responsible for “reconciliation” with creditors (within the framework of the debt), the sale of the assets of the liquidated company, and filing a claim against the debtors. The appointed liquidator assumes control of the company, pays debts, distributes profits or reserve capital among the members of the company according to their rights.

The liquidator has a direct connection with the bankrupt and can control the latter, that is, he is the person controlling the debtor. And, according to paragraph 4 of Article 10 of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”, controlling persons can be held vicariously liable.

The main task of the filers of lawsuits is to prove the cause-and-effect relationship between the actions of the liquidator and the resulting consequences.

Case No. 1. If you falsify documents on the liquidation of a company, you will not be able to avoid liability

The tax authority made changes to the Unified State Register of Legal Entities on the liquidation of the company on the basis of a forged application, which did not contain reliable information about the debt to the counterparty.

The trial began with the fact that a certain company owed its counterparty about 200,000 rubles. The company did not want to pay off the debt voluntarily, and then the buyer filed a lawsuit. The court issued a writ of execution for forced collection of the debt.

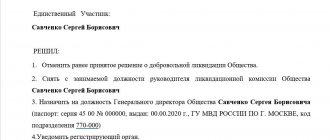

Time passed, but the debtor society never repaid the debt. The sole founder of the company decided to voluntarily liquidate the company. The tax authority received a statement signed by the liquidator of the company in form P16001, which contained confirmation of the completion of settlements with creditors and compliance with the liquidation procedure. Based on the decision of the interdistrict Federal Tax Service, information about the termination of the company’s activities was entered into the Unified State Register of Legal Entities.

Having learned about the liquidation of the debtor company, the buyer applied to the arbitration court with a demand to recover damages from both the founder of the company and his liquidator in a joint and several share.

The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 7075/11 dated October 13, 2011, indicated that the procedure for liquidation of a legal entity established by the Civil Code cannot be considered legal in the case where the liquidator knew for certain about the existence of unfulfilled obligations to the creditor who demanded payment of debt.

During the consideration of the case, the judges found that the liquidation balance sheet of the company was drawn up without taking into account obligations to the buyer. This was, of course, known to both the sole founder of the company and its liquidator.

It has been proven that a notice of liquidation of a legal entity was submitted to the tax authority on July 24, 2013, and on November 27, 2013, a decision was made to approve the interim liquidation balance sheet, which indicated zero accounts payable. At the same time, the court decision to recover funds in favor of the buyer was made on September 19, 2013.

In this case, the founder of the company and its liquidator acted in concert, pursuing the goal of evading the company from paying the debt and compensating the buyer for losses.

The court pointed out an abuse of law, which is contrary to Article 10 of the Civil Code. And persons who jointly caused harm are jointly liable to the victim (Article 1080 of the Civil Code of the Russian Federation).

By a court decision, the buyer’s demand was satisfied (Resolution of the Arbitration Court of the Central District dated December 8, 2015 No. F10-3811/2015 in case No. A68-2408/2014).

Case No. 2. Illegal actions of the creditor’s liquidator must be proven

The creditor filed a lawsuit demanding that the debtor’s liquidator be held vicariously liable for the fact that he “forgot” to indicate the debt when drawing up the liquidation balance sheet.

In this court case, events took a different turn.

At an extraordinary meeting of shareholders, a decision was made to liquidate the company. The tax authority made a decision on a previously accepted application to amend the Unified State Register of Legal Entities. Later, the liquidator of the company presented financial statements and an interim liquidation balance sheet. According to these documents, the company had no debt.

Having learned about the liquidation of the company, the creditor filed an application to the court to hold the liquidator accountable. The basis for filing such an application was the conclusion that the liquidator, knowing that the company had a debt on mandatory payments in the amount of more than 30 million rubles, submitted documents to the tax authority according to which the company had no debt.

The creditor also pointed out the fact that due to the termination of the debtor’s activities, all documents on the financial and economic activities of the company were destroyed. Therefore, it was impossible to check whether funds were transferred to current accounts from the debtor, and the procedure for the formation and sale of the bankruptcy estate was also complicated.

The arbitrators found that the liquidator, as required under the bankruptcy procedure, presented the necessary documents of the debtor: financial statements; sheets of records and extracts from the Unified State Register of Legal Entities, tax returns, bank certificates on the closure of current accounts; documentation on termination of lease agreements; judicial acts; calculations for paid insurance premiums. In accordance with the submitted certificate from the tax inspectorate on the status of settlements for taxes, fees, penalties and fines, the company had no debt to pay mandatory payments.

Thus, the liquidator verified that there was no debt to the budget and to other creditors, which means that her actions during the liquidation procedure were carried out with due diligence, in full compliance with the law.

In addition, the good faith of the liquidator’s actions is confirmed by the fact that not a single legal entity or individual from among the creditors submitted an application to include the debt in the interim liquidation balance sheet.

The court pointed out the right of the debtor's creditor to independently request from the tax authority the financial statements of the liquidated company and statements of cash flows on current accounts.

If the debtor is declared insolvent (bankrupt) due to the actions and (or) inaction of the persons controlling the debtor, such persons, in the event of insufficiency of the debtor’s property, bear subsidiary liability for his obligations (clause 4 of article 10 of the Federal Law of October 2, 2002 No. 127-FZ “On insolvency (bankruptcy)”).

Having established that the creditor did not provide sufficient evidence of the liquidator’s guilt that the destruction of documentation led to the impossibility of satisfying all the creditor’s claims, the arbitrators rejected the lawsuit. The basis for the refusal was the conclusion that there were no conditions necessary to bring the liquidator to subsidiary liability for the debtor’s obligations (Resolution of the Moscow District Arbitration Court of December 17, 2015 No. F05-4387/2015 in case No. A41-45286/2014).

Help your business grow

Invaluable experience in solving current problems, answers to complex questions, specially selected latest information in the press for accountants and managers. Choose from our catalog >>

What are the consequences of liquidation of a legal entity?

Lawyer Antonov A.P.

Liquidation is a fairly lengthy process that ends with making an entry in the Unified State Register of Legal Entities about the termination of the legal entity’s activities. From this moment on, the legal entity no longer exists, that is, it no longer has rights and does not bear any obligations. In particular, it is no longer possible to collect a debt from a legal entity; it cannot act in court as a plaintiff or defendant. In this case, the rights and obligations of a liquidated legal entity, as a general rule, are not transferred to anyone, but there are exceptions to this rule. Meanwhile, when liquidating a legal entity, not only making an entry in the Unified State Register of Legal Entities about the termination of its activities has its consequences. Certain consequences also occur after making an entry that a legal entity is in the process of liquidation.

What are the legal consequences of performing individual registration actions as part of the liquidation procedure of a legal entity? Liquidation is a rather lengthy process, and as part of it, a legal entity has to contact the registration authority three times. Based on the results of these requests, the registering authority makes entries in the Unified State Register of Legal Entities (clause 1 of Article 62, clause 9 of Article 63 of the Civil Code of the Russian Federation, clauses 1, 3 of Article 20 of the Law on State Registration of Legal Entities and Individual Entrepreneurs): about the presence of a legal entity in the process liquidation. As a rule, simultaneously with notification of the decision on liquidation, the registering authority in accordance with paragraph 3 of Art. 20 of the Law on State Registration of Legal Entities and Individual Entrepreneurs is notified of the appointment of a liquidator (liquidation commission). This is due to the fact that, according to paragraph 1 of Art. 63 of the Civil Code of the Russian Federation, it is the liquidator (liquidation commission) that carries out further actions to liquidate the legal entity, in particular publishes messages, notifies creditors, takes measures to identify creditors and collect receivables. In accordance with paragraph 2 of the above article of the Civil Code of the Russian Federation, these actions must be completed before the preparation of the interim liquidation balance sheet, of which the registering authority is notified later; drawing up (approval) by a legal entity of an interim liquidation balance sheet. The Law on State Registration of Legal Entities and Individual Entrepreneurs does not indicate that when submitting documents to the registration authority for the preparation (approval) of an interim liquidation balance sheet, a corresponding entry is made in the Unified State Register of Legal Entities. However, this follows from clause 100 of the Administrative Regulations, approved by Order of the Federal Tax Service of Russia dated January 13, 2020 N ММВ-7-14/ [email protected] ; termination of the legal entity's activities. At the same time, legal consequences entail not only making an entry about the termination of the activities of a legal entity, but also about the presence of a legal entity in the process of liquidation.

What are the legal consequences of making an entry in the Unified State Register of Legal Entities about the presence of a legal entity in the process of liquidation After making an entry in the Unified State Register of Legal Entities about the presence of a legal entity in the process of liquidation: 1) it is not allowed (clause 2 of Article 20 of the Law on State Registration of Legal Entities and Individual Entrepreneurs): to make changes to the constituent documents of the legal entity ; register new legal entities, the founder of which will be the liquidated legal entity; include the liquidated legal entity among the founders (participants) of already created legal entities; reorganize legal entities in which the liquidated legal entity is a participant; 2) enforcement proceedings are terminated, with the exception of enforcement proceedings not related to property penalties (clause 6, part 1, article 47 of the Law on Enforcement Proceedings, see also the Position of the District Courts); 3) claims are submitted exclusively to the liquidator (liquidation commission). It is possible to submit a claim to the court only if the liquidator (liquidation commission) refused to satisfy the claim or evaded its consideration (Clause 1 of Article 64.1 of the Civil Code of the Russian Federation, see Position of the Administrative Districts of the Districts). At the same time, some courts believe that it is permissible to present a claim to the court without first presenting it to the liquidator (liquidation commission) (see Position of the District Court); 4) it is prohibited to forcibly collect taxes, fees, penalties, fines from this person (see the Position of the AS of the districts); 5) alienation of property if there are insufficient funds to satisfy the claims of creditors is possible only through auction, if the value of the alienated property according to the approved interim balance is 100 thousand rubles. and more. This rule does not apply to institutions (clause 4 of article 63 of the Civil Code of the Russian Federation). In other cases not specified above, making a record that a legal entity is in the process of liquidation does not limit its right to enter into transactions, that is, within the framework of the liquidation process, the legal entity can still conduct business activities.

What are the legal consequences of making an entry in the Unified State Register of Legal Entities on the termination of the activities of a legal entity After entering information in the Unified State Register of Legal Entities about the termination of a legal entity: 1) its liquidation is considered completed, and the legal entity is considered to have ceased to exist without transfer in the order of universal succession of its rights and obligations to other persons (clause 1 of Art. 61, clause 9 of article 63 of the Civil Code of the Russian Federation); 2) the legal capacity of the legal entity is terminated (clause 3 of Article 49 of the Civil Code of the Russian Federation); 3) the obligations in which the legal entity participated are terminated, except in cases where the law or other legal acts assign the fulfillment of the obligation of a liquidated legal entity to another person (for claims for compensation for harm caused to life or health, etc.) (Article 419 of the Civil Code RF). In addition, from the moment this entry is made, the following are considered extinguished (clause 5.1 of Article 64 of the Civil Code of the Russian Federation): 1) claims not recognized by the liquidation commission, if creditors for such claims did not file claims in court; 2) claims, the satisfaction of which was denied to the creditors by a court decision; 3) claims of creditors not satisfied due to the insufficiency of the property of the liquidated legal entity and not satisfied at the expense of the property of persons bearing subsidiary liability for such claims. Please note that this rule applies to a limited circle of legal entities, namely those legal entities that cannot be declared insolvent (bankrupt) (clause 5.1 of Article 64 of the Civil Code of the Russian Federation). For example: state-owned enterprises, institutions, political parties and religious organizations.

Sincerely, lawyer Anatoly Antonov, managing partner of the law firm Antonov and Partners.

Still have questions for your lawyer?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!