The government plans to introduce a feedback platform between the state and citizens based on a single portal of state and municipal services. This follows from government decree No. 1802 of November 10, 2021, published on the portal of legal acts.

Questions and answers How to get an electronic sick leave?

We are talking about an experiment in which citizens can quickly send requests (suggestions, complaints) to specific departments through the government services website and receive answers to their questions. Previously, such a feedback mechanism was established only between citizens of individual regions and local authorities. Now federal departments will also take part in it.

“This format of interaction is an important part of the state’s ‘service’ model, which is created for the convenience of citizens,” said Prime Minister Mikhail Mishustin when considering the issue at an operational meeting with deputy prime ministers on November 16.

Types of violations by credit institutions

When using bank products and services, clients are protected by several federal laws, one of which is the Federal Law “On the Protection of Consumer Rights.” To defend their own interests, it is useful for every individual who interacts with a credit institution to know the provisions of this law.

It is impossible to outline the entire range of violations that a bank could potentially commit. There are quite a lot of cases, and half of them go unnoticed. The reason for this is ignorance of the requirements of the law, and, as a consequence, of one’s own rights. At the same time, there are violations that banks commit especially often. These include the following:

- Unlawful actions in the process of servicing the contract - incorrect calculation of the interest rate on the loan; unilateral change of contract terms; failure to fulfill obligations specified in the agreement.

- Violations committed as a result of the collection of overdue debts - calls at the wrong time; messages with inappropriate content; threats, misleading.

- Technical violations - untimely payment processing; erroneous calculation of interest, penalties, fines; “loss” of a payment received from a client.

Large banks seriously monitor their reputation, so deviations from legal requirements are more common in small credit institutions. To restore his rights and to force the bank to comply with the terms of the agreement, the client contacts the competent authorities.

To which authorities is a complaint filed against the bank?

Initially, it is important to understand the essence and reason for filing a complaint. Clients often neglect to contact the credit institution’s support service because they believe that this option will not bring any results.

In some cases, the violation involves the actions of one or more individual bank employees. The human factor must be taken into account to quickly solve the current problem. Therefore, the first step is to resolve the issue through the support service, which operates on behalf of the head office.

The management telephone number can be found on the official website of the credit institution. For example, a client plans to file a complaint against Sberbank. In this case, you can and should first report the problem to the federal number. Almost every bank has such toll-free numbers for calls throughout Russia.

If a message to the main office does not give any result, the problem is resolved by contacting the regulatory authorities. These bodies include:

- Association of Russian Banks and Financial Ombudsman.

- Federal Service for Supervision of Consumer Rights and Human Welfare (Rospotrebnadzor).

- Federal Antimonopoly Service.

- Central Bank of the Russian Federation (Bank of Russia).

Before contacting one of these organizations, you must consider the reason for your complaint. Consideration of certain types of complaints may not be within the competence of a particular body. It is not necessary to follow the sequence, starting with contacting the bank management.

Answer

Expert opinion

Mikhailov Kirill Anatolievich

Lawyer with 10 years of experience. Specialization: civil law. Extensive experience in defense in court.

There is exactly 1 year to address a complaint from the moment of violation of rights and freedoms. If the documentation was accepted by the apparatus, the person must notify the results within 10 days. We are talking about acceptance/refusal of an application, but not about consideration of the act.

The law does not establish a time frame for the proceedings; they can take months. In 2021, out of 43 thousand applications, only about 3000 were considered.

Nevertheless, the apparatus is obliged to notify the applicant that the act has been accepted for consideration. The deadlines in the ECHR are not regulated in any way; the body is extremely busy. The applicant can wait a year, five or even ten years.

If the answer comes, but the applicant is not satisfied with the result, do not give up - there are other ways to fight for justice. This applies to both the judicial system of the Russian Federation and other supervisory authorities.

Complaint against the bank to the ARB (Association of Russian Banks)

ARB is a non-governmental and non-profit organization whose sphere of interests includes defending the interests of the Russian banking community. The ARB acts as a financial ombudsman who will try to find a solution out of court.

You can apply here when the bank is formally right. Example: a client cannot fulfill the terms of a loan agreement, and the lender refuses to restructure. So ARB will try to ensure that the bank meets the client halfway.

The Association is not a regulatory body like the Bank of Russia or the Federal Antimonopoly Service of the Russian Federation. Therefore, it will not fine the bank for the violation, but will help solve the problem through a compromise or transfer of the client’s complaint to the competent authorities. An appeal is submitted to the ARB as follows:

1. On the official website of the association, the tab “About money” opens, and then “Complaint to the bank”.

2. Fill out a form with the circumstances of the case - you need to describe in detail everything that caused the application to the ARB, attaching files and additional information. Contacts are indicated - the association does not consider anonymous requests.

In total, the association has 192 members, of which 111 are credit institutions. If the bank that violated the client’s rights is a member of the ARB, then the issue will be resolved fairly quickly. The disadvantage is the absence of large Russian banks among the association’s members. For example, Sberbank of Russia is not a member of the ARB.

Legislation of the Russian Federation

The central act establishing the terms of reference of the Commissioner for Human Rights is Federal Law No. 1 of 1997.

In Art. 15 of the law states: the Ombudsman considers complaints from citizens of the Russian Federation. Its activities do not replace the competence of other structures, but complement the decisions of the main supervision and help in situations where the state apparatus is not able to compensate for the gap.

IMPORTANT! The Commissioner considers appeals from citizens of the Russian Federation regardless of their place of residence. Moreover, protection is provided for foreigners and refugees.

How to file a complaint against a bank with Rospotrebnadzor

Unlike the ARB, Rospotrebnadzor has broad powers to monitor compliance with consumer rights in Russia. This should be addressed if the bank has violated the client’s consumer rights. Almost anything can fall under violation - from the imposition of additional services to the use of hidden conditions in the loan agreement.

The complaint is submitted only through the official website of the government agency. After going to the resource, the user needs to follow the following path:

1. Open the “For Citizens” section and select the “Citizens’ Appeals” tab.

2. Go to the very bottom of the page and click on the “Continue” button.

3. Select the option of submitting an application that does not require authorization through the Unified Identification and Logistics System.

4. Follow the link “Compose and send an appeal to Rospotrebnadzor.”

5. Fill out the form fields and submit your request for consideration.

The text of a complaint against a bank to Rospotrebnadzor cannot exceed 4,000 characters. To submit longer complaints, you must write them by hand and submit them for consideration through the public reception of a government agency.

Corruption, bribes

Now, regarding complaints about corruption in government agencies, fraud, coercion to give a bribe, extortion of money, non-payment of taxes. They must be submitted to the relevant district departments for combating economic crimes.

Here are their addresses and telephone numbers:

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the Eastern Administrative District of Moscow: 111123, Moscow, 2nd Vladimirskaya St., 14; tel. 304-26-84, 304-26-84

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the Western Administrative District of Moscow: 119602, Moscow, Michurinsky Avenue, Olympic Village, 3; tel. 431-74-20, 431-90-27

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the Zelenograd Administrative District of Moscow: 124681, Zelenograd, st. Sovetskaya, 6; tel. 538-07-91

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the Northern Administrative District of Moscow: 125212, Moscow, st. Vyborgskaya st., 14, building. 1; tel. 601-00-08, 601-01-78

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the North-Eastern Administrative District of Moscow: 129337, Moscow, st. Veshnih Vody, 10; 183-01-10

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the North-Western Administrative District of Moscow: 123060, Moscow, st. Marshala Rybalko, 4, building 1; tel. 197-13-78

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the Central Administrative District of Moscow: 109029, Moscow, st. Wed. Kalitnikovskaya, 31; tel. 676-40-11

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the South-Eastern Administrative District of Moscow: 109417, Moscow, Sormovsky Ave., 13, building 2; tel. 919-19-62

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the South-Western Administrative District of Moscow: 117218, Moscow, st. Krzhizhanovskogo, 20/30, building 6; tel. 124-47-04

- Department for Combating Economic Crimes of the Internal Affairs Directorate of the Southern Administrative District of Moscow: 115409, Moscow, Kashirskoye sh., 76, building 5; tel. 324-29-79

Higher authority in relation to these departments:

Department for Combating Economic Crimes of the Main Department of Internal Affairs of Moscow 115093, Moscow, st. Lyusinovskaya, 44, building 2; tel. 200-85-40, 950-44-40

How to complain about a bank to the FAS

FAS - Federal Antimonopoly Service, deals with complaints in the field of free competition and protection of entrepreneurship. In terms of the banking sector, the FAS of the Russian Federation monitors the advertising of banking services, as well as ensuring that the offers of credit institutions correspond to real conditions.

If a bank, in advertising its product, indicated some incomprehensible or confusing conditions, which led to problems for the client, then this is a direct reason to contact the antimonopoly service. A complaint to the FAS is submitted as follows:

1. Open the official website of the department, and in the top toolbar select the “Write to FAS” option.

2. Read the rules for submitting electronic appeals to the FAS, and select the “Write a letter” option.

3. Provide personal information and gain access to your personal account, and formulate your request in writing.

A clear description of the current situation will be required, including contact information. FAS sends a response in the form of an electronic document to the specified email address. If there are objective reasons, based on the results of consideration of the application, the information provided by the citizen is verified.

When should you not file a complaint?

There are 2 main cases when you should not file a complaint with serious structures:

- The microfinance organization did not violate anything.

- You want to try to resolve the dispute peacefully.

In the first case, you will waste your time - the answer from the government organization may come in a month, and it will not give you anything (and the penalty will increase during this time). In the second case, it is better to write a letter directly to the microfinance organization, and not to the Central Bank or the prosecutor's office - if a government agency comes to a microcredit organization with an inspection based on your tip, you can forget about the peaceful resolution of the conflict.

Complaint to the Central Bank of Russia about the actions of the bank

The final authority and main regulator is the Central Bank of the Russian Federation. Clients whose rights are violated by the companies can complain against a credit institution, microfinance organization or insurance company. To file a complaint, it is recommended to follow the following algorithm:

1. On the official website of the department, select the “Internet reception” option.

2. In the group of types of complaints, select “Submit a complaint.”

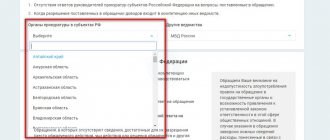

3. Specify the topic of the complaint - you must select from the list proposed by the system.

4. Fill out a form with a description of the situation, loan agreement number, data of the credit institution - the most complete and only reliable information.

After these steps, contacts are indicated to which the main regulator will send a response to the request. Received complaints are reviewed within 30 banking days. If the information in the appeal is unreliable or insufficient, the Central Bank of the Russian Federation will leave it without consideration.

If a violation is detected, the Bank of Russia sends an order to the credit institution to eliminate all facts. The client who filed the complaint, if there are sufficient grounds, is restored to his rights.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 198

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Peter

10/08/2021 at 04:31 I was defrauded by Bank University Ave. 25 Naskhi Sovetsky district they stole a day from my card 2500t and issued a credit by e-mail using cards and I don’t know what to do, well, my sister Olga Aleksandrovna Pichko helped me 06/19/1975 he lives with his roommates, he too I could apply for a loan, they knew where my passport was and they could easily carry out a scam, he is also Alexey Evgenivich Zaborovsky, May 29, 1977, I’m afraid that they have already collected a lot of loans on my document and I’m a disabled person of the 3rd group, people, help me figure out the problem and how can I solve this problem because Am I the only one who can help me?

Reply ↓ Anna Popovich

09.10.2021 at 18:18Dear Peter, if you have not applied for a loan, then you need to contact the police with a corresponding statement.

Reply ↓

10/04/2021 at 05:45

Peter cheated me Bank Universitet Ave 25 naskhi they formulated a loan online and the managers of the Bank were fraudster Alexander and employee Tatyana, so they cheated me like a sucker, well, there were three of them employees Alexander Ekaterina, who processed the loan and then Tanya completed the loan Yes, now we ourselves Banks scam people and them there will be nothing for this and the police have been completely inactive where to go people help, they have robbed me and I am a disabled person of the 3rd group, how can they have no shame, no conscience, okay, if you were rich, like an orphan, they should offend or now it’s so fashionable in Russia, human rights, sort it out and advise me, they totally robbed me of 1700 rubles. imposed insurance??? this Tanya Yes, from now on I will avoid this Bank because they cheated me right, they say you can’t trust the Bank, the same swindlers are sitting there and swindlers are waiting to hang up a loan???

Reply ↓

- Anna Popovich

04.10.2021 at 14:10

Dear Peter, thank you for your feedback! We hope it will help our visitors when choosing a credit institution.

Reply ↓

09/28/2021 at 01:43

Hello, please tell me. During the pandemic, I applied for a mortgage holiday under the federal program due to layoffs at work. Before this, I asked the Sberbank managers if there would be any additional payments or interest charges - they answered no, they would only extend the mortgage for six months, the term would be shifted. After submitting the application, two months later, without notice or any agreement, the holidays began and they stopped writing off money. At the end of the period, they called me and informed me that I needed to come to the bank’s office to sign an additional agreement; if I didn’t come and sign it, it would be considered half a year overdue. I arrived, didn’t understand anything from the additional agreement, it was very vague and not clear, I asked the manager to tell me what the conditions were and whether there was interest, she said no, it’s a vacation, just a deferment. I signed. As a result, the monthly payment was increased, the term was cut to a year instead of six months, and the debt was 160,000 rubles. Now I wanted to deposit a certain amount ahead of schedule, to take away Sberbank from me at a percentage, but in my loan agreement the entire amount should go towards the principal debt. Now, as I understand it, there are different rules in the additional agreement. I filed a complaint, to which the agent replied that I was not given a vacation, but a restructuring, and that all this was spelled out in the additional agreement, but I signed it, I didn’t have to sign. How is it that I don’t know how to read such contracts and the manager confirmed to me that everything is ok. Tell me, is Sber right and what should I do now? I applied for vacation, they should have notified me that they were giving me restructuring? They slipped me some kind of terrible additional agreement, where I now ended up with large sums. Who can help me? I filed a complaint against Sberbank several times with the Central Bank of the Russian Federation, there were only replies that the appeal was sent to your bank. What's the point if they didn't solve my question? So it’s unlikely that the Central Bank of the Russian Federation will sort it out and help itself

Reply ↓

09/23/2021 at 00:00

My family and I suffered from a hacker attack that took place on August 27 - 30, 2021 at PJSC VTB Bank, as a result of which all my funds were stolen. On August 27, 2021, I was unable to log into the VTB online application installed on my iPhone. I immediately reported the problem to the bank in writing and also called the contact number listed on the VTB Bank website. I saved screenshots of all correspondence and calls. I reported my problem to the bank on August 27, 28, 29, 30, 2021. I didn’t have information about the status of my accounts, I didn’t receive any SMS messages, if my calls went through, they were interrupted very quickly and I didn’t even have time to talk about the problem (I was always switched somewhere, and I was roaming). As a result, on August 29 and 30, all funds were written off from my account. On August 27, a complaint was filed on the VTB website, which was reviewed on September 15 and the bank informed me that as of August 30, my entrance to the VTB online account was unblocked. On September 2, a complaint was submitted to the “Na Krylova” branch in Novosibirsk, a formal response was received on September 15. On September 3, a statement was written to the police, and a criminal case was initiated. On September 10, a complaint was filed with the Central Bank of the Russian Federation. I am outside Russia and our family was left without a livelihood and without the opportunity to fly to our homeland. Please advise where else I can go?

Reply ↓

- Anna Popovich

09.24.2021 at 20:52

Dear Maria, the above actions are sufficient. Wait for the Central Bank of the Russian Federation to react and contact the bank again, taking into account the position of the central regulator.

Reply ↓

09.19.2021 at 19:40

Hello! I would like to know your attitude to my current situation... During the pandemic, in response to my online request, one of the banks gave the go-ahead to refinance my existing consumer loan, which was paid on time for a whole year. I didn’t have a refinancing agreement in hand (in the midst of a pandemic - everything was online). There was no information about the bank (secondary lender) supporting the refinancing procedure and that, for example, I personally must notify the primary lender about full early repayment. A year later, I accidentally found out, by requesting my credit potential, that my loan taken from the primary lender was not closed, because the amount received as part of the refinancing was not sufficient for full repayment and contrary to the bank loan order (which made the refinancing and transferred the money). which clearly states that the amount is for full early repayment, simply monthly payments were made. My primary lender didn't tell me about this! As a result, over the year of supposedly using the loan, interest amounting to 54 thousand rubles has accumulated for early full repayment today! None of the banks admits their negligence. Where can I go in your opinion?

Reply ↓

- Anna Popovich

09.22.2021 at 00:06

Dear Irina, you must first refer to the refinancing agreement that you entered into. You must have received the refinancing agreement electronically, otherwise the provision of funds is impossible. Further, the rules for early repayment of the loan are specified in the agreement with the primary lender, and not as part of the refinancing agreement; you, and not the bank where you refinanced, should have taken into account the rules for such repayment. We recommend that you write appeals to both banks, receive written responses and then re-evaluate the situation taking into account the position of credit institutions.

Reply ↓

3

Claim to the debtor

Carefully analyze the concluded contract regarding the following conditions:

- whether the deadline for refund has arrived;

- is there a condition in the contract that in the event of failure to claim funds by the deadline specified in the contract, the validity period of the contract is automatically extended;

- whether the contract contains a mandatory claim procedure.

Based on these conditions, it is necessary to send a claim to the debtor demanding the return of funds. If at the time of sending the request the deadline for the return of funds has not arrived (for example, based on the terms of the contract or the contract contains a provision for automatic extension), the claim must require termination of the contract.

The claim is sent by a valuable letter with a list of the attachment to the location of the debtor, indicated in the Unified State Register of Legal Entities.