Mortgage lending has made purchasing their own home much more affordable for Russian families. However, at present, the interest rate at which the loan is issued continues to be quite high, which causes difficulties in repaying the debt. The situation was aggravated by the fall in income of the population due to the worsening economic situation in the country. The increase in the number of overdue mortgage loan payments was the main reason for the country's leadership to decide to implement a special government program designed to support such borrowers. The AHML mortgage program involves providing state support to families that meet the established requirements. It has been running since 2015.

Mortgage programs

Loan terms:

- A person between 21 and 65 years old can become a member.

- An entrepreneur who has been operating for 12 months, or an employee with continuous work experience of at least 6 months, can obtain approval of the application. at your current workplace.

- Repayment period 3-30 years.

- The minimum amount is 300,000 rubles.

The loan term and interest rates depend on the type of mortgage. Conditions vary for the types of housing purchased. Some categories of citizens can take advantage of preferential programs with reduced interest rates.

Types of real estate and requirements for objects

You can take out a Dom.rf (AHML) mortgage for any type of real estate. Today, loan programs include offers for the following objects:

- house (with land or townhouse);

- apartment (in a new building or secondary market, as well as objects under construction);

- apartments;

- room or share in an apartment.

The bank offers to issue a loan for any of the listed properties, but has established certain requirements that the property must meet. The following are not allowed for the transaction:

- the house is in disrepair (or potentially in disrepair);

- apartment in a new building from a non-accredited developer;

- any type of housing that has controversial or unresolved legal issues.

There are a number of other factors for certain groups of real estate that influence the bank’s decision. This includes the year of construction, type of foundation, area of the object and its condition. This information can be found by going to the Dom.rf website or contacting the bank manager.

Ready housing

Mortgages are possible in both the primary and secondary markets. According to the rules, lending includes apartments, houses, cottages located outside the city, land plots with or without buildings located on them. Loan rate from 10.25%. According to the terms of the loan, it is necessary to obtain personal insurance for the borrower. In case of refusal of insurance, the interest rate increases.

You can use the AHML program if you want to purchase a building that will not be intended for permanent residence. To do this, you need to contribute at least 25% of the cost of a country house, dacha, cottage, or land plot for development. The minimum amount of credit funds is 300,000 rubles.

Home page DOM.RF

The official website of AHML is dom.rf. To access the web page, you must click on the following link.

Home page dom.rf

The main page of the portal illustrates basic information about the company:

- Main news and announcements of the organization;

- Analytical data;

- Mortgage rates

- Interesting videos about choosing the right housing

- Inflation rate and so on.

At the top of the web page, the applicant can click on links of interest to him, such as mortgage, rent, land, about the company, and so on.

Since 2021, the division has changed its name from “AHML” to “DOM.RF”. The main task is to help provide housing to citizens and ensure accessibility and transparency in choice.

To achieve the main goal, the company implements the following functional responsibilities:

- Development of secondary housing mortgage lending;

- Development of residential rentals;

- Providing state-owned land plots for auction for sale;

- Renting out for the purpose of residential construction, taking into account all the requests of the developer;

- Transfer of land to defrauded shareholders or large families;

- Creation of a bank on the basis of which clients can receive all services related to the selection, purchase, registration of residential premises, with subsequent servicing;

- Ensuring reliability. Works only with trusted credit institutions and developers;

- Formation of favorable infrastructure by supporting the quality of improvement processes, development of the urban environment and taking into account the social and economic directions of the country.

DOM.RF is developing steadily. In its growth strategy from 2021 to 2020, it set goals such as increasing the volume of mortgage lending to 500 billion rubles, involving up to 14 thousand hectares of state land, and so on.

Must remember! To ensure you don't miss important news regarding mortgages, home construction or residential building laws, you should regularly visit the site to monitor announcements. For convenience, you can save the link in your bookmarks to save time.

AHML Mortgage Borrower Assistance Program

This type has preferential terms for receiving funds and a reduced interest rate.

The family loan is aimed at helping mortgage borrowers: families who will have a second or third child between January 1, 2021 and December 31, 2022. Both new borrowers and those who have previously signed a contract for a different type can take part in the program. Reduced interest rate, from 6%. The period depends on the number of children:

— upon the birth of the second child, the grace period is 3 years;

— for 3rd–5 years;

– for 2nd and 3rd – 8 years.

What documents need to be prepared?

It is better to prepare a set of papers for AHML in advance. Then the citizen will submit an application the first time, and, accordingly, will receive government financial assistance faster.

The standard list of documents includes:

- copies of passports of all family members of the applicant, co-borrower, guarantors;

- paper confirming entry into a preferential category. This could be a certificate of disability, a decision of the guardianship and trusteeship authorities on adoption, a certificate of a combat veteran;

- certificate of family composition;

- copies of work records of all family members, certified by the personnel department of the employing enterprises;

- certificates in form 2-NDFL. They must indicate income for the last three months;

- a copy of the mortgage agreement;

- Bank statements;

- certificate from the Pension Fund;

- apartment purchase and sale agreement, residential building;

- cadastral passport for the apartment;

- extract from the Unified State Register of Real Estate for real estate.

AHML or the bank has the right to expand this list of documents. You can find out the exact list of securities by calling a credit institution or AHML.

Military mortgage

The program can be used by military personnel who are participants in the savings-mortgage system. You can get a military mortgage after 3 years of participation in the NIS.

The project makes it possible to buy a home with almost no personal finance. Monthly repayment of the loan and making a down payment are made from funds that go to the personal savings account. A service member can use his money to increase the size of the down payment, this allows him to purchase property of greater value.

This website is for informational purposes only. Official website of the bank: dom.rf

Personal Area

Interaction with AHML takes place through VTB Bank or your personal account, which can be accessed using the link.

Home page of the site

The borrower’s account allows you to make various transactions without a VTB intermediary, such as:

- Submitting an application for partial or full repayment of debt;

- Control over overdue debts;

- Receiving data on completed payments and repayment history;

- Checking information about the debt balance, monthly payment, and so on.

Important . To always be aware of the news of overdue debts and the date of debt repayment, you should register on the home.rf portal. and receive all the necessary information directly to your email. To register, you need confirmation of the service agreement and information about your full name, date of birth, mortgage number and contact phone number.

Registration in your personal account

Reviews

So far, few have been able to obtain a mortgage through a mortgage lending agency, although the organization has been operating for a long time. Either the requirements for borrowers are too strict, or citizens trust commercial banks more. However, those who managed to obtain a mortgage were satisfied with the conditions and low rates.

But the mortgage debtors whom the agency tried to help are mostly unhappy. Especially the deadline for re-registration and redemption of their loan from the bank. The fact is that while the procedure is going on, borrowers do not pay their fees, during which time they accumulate even more significant debt, as a result they remain in debt to both the bank and become indebted to the agency.

Product features and terms of issue

AHML mortgage bonds are a special type of securities. This is a debt obligation confirmed by a profitable loan with material collateral. Even if the creditor goes bankrupt, the debt will be repaid through the resale of the collateral. The high reliability of MBS ensures demand among investors and allows banks to attract investment capital for long periods.

AHML also issues standard exchange-traded bonds: there will be more than 10 series in circulation by 2021. The last episode was released on June 6, 2019. This is a long-term loan with a repayment period of 20 years: the payment date for the bonds is May 12, 2039.

Investors are offered the following purchase conditions:

- The interest rate of coupon income is 7.9% per annum. For individuals, this income is taxed, and you will also have to pay commissions for brokerage services.

- There is no possibility of early repayment.

- There are 2 coupon payments annually.

- The total value of issued securities is 25 billion rubles.

- The face value of one bond is 1000 rubles.

You can purchase AHML bonds through the Moscow Exchange; a commission is charged for the services of stock brokers.

Summary

AHML offers a variety of lending offers for groups of the population of the Russian Federation, which allows you to take out a loan on the most favorable terms.

A distinctive feature of the Dom.rf mortgage (AHML) is the conclusion of a loan agreement with the client, and not a loan agreement. This is what allows you to buy real estate that is pledged to the bank and the seller’s debt has not been repaid. More details about such transactions in another article: Purchase of collateral real estate under the mortgage of Dom.rf (AHML).

To pre-calculate loan terms and the possible amount of overpayment, you can use a special calculator on the bank’s website. The software will consider commissions and additional payments, and will also take into account benefits and rate reductions.

It is possible to apply for a mortgage online. To apply for a loan, you can use the online form or contact the bank. Addresses of representative offices are indicated on the website of the financial institution.

Rate the author

Share on social networks

Author:

Maria Yurievna Sokhan

Date of publication February 5, 2019February 25, 2019

What is AHML and how is it useful?

This is an agency for issuing mortgages to all citizens of the population. It acts as an intermediary between borrowers and the state, but in fact, the state itself gives you money. Today, the structure is engaged in issuing mortgages to the entire population, as well as purchasing debts from banks for previously taken out mortgages. A large share of the agency's clients are those who once took out a foreign currency mortgage. After the dollar greatly increased in value, it became simply impossible for ordinary citizens to pay off such loans. The cost of a mortgage has more than doubled. It was precisely to “save” such borrowers that the state, through the organization it created, devoted all its efforts.

Most often, the agency buys out a loan at the request of a borrower who cannot repay it. But, there are times when a bank independently sells mortgage loans, for its own reasons and considerations. In this case, nothing changes for the borrower, his debt is transferred in full to another organization, he continues to pay monthly payments in the same amount, just to a different account.

The benefits of this organization are obvious; it helps borrowers not to go completely bankrupt or to take out a mortgage on convenient terms with government support.

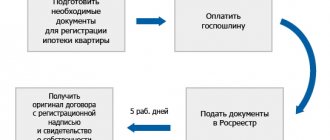

The main stages of a real estate acquisition transaction

In general, the scheme of the transaction for the purchase of a property with a Dom.rf mortgage is as follows:

- Submitting documents and applications for a mortgage;

- Ordering a real estate appraisal from an accredited appraiser;

- Providing a package of documents for the property;

- Insurance of the property, life and health of the borrower;

- Signing a loan agreement;

- Transfer of the down payment to the seller, signing of receipts;

- Submitting documents for registration to the MFC;

- Providing the Dom.rf specialist with a list of documents issued by the MFC and transferring the loan amount to the buyer’s account;

- Transfer of borrowed money to the seller, signing of a receipt;

- Receiving a registered agreement and an extract from the Unified State Register of Taxes at the MFC;

- Providing Dom.rf with documents on the buyer’s ownership.

If the borrower is about to sign a purchase and sale agreement, it is useful to read the information in the article: Sale and purchase agreement with a mortgage - important points for the seller and buyer.

If a buyer asks to inflate the price of a property, then it is important to read the article: Overpriced mortgage: risks for the seller and the buyer.