Issues discussed in the material:

- Legal provisions regarding refusal of insurance

- Drawing up an application for refusal of voluntary insurance

- Application for waiver of compulsory insurance using the example of compulsory motor liability insurance

- Terms for consideration of an application for waiver of loan insurance

- Pitfalls of refusing insurance

An application for waiver of insurance may be required in a number of cases, among which the most common are those related to reluctance to overpay for a loan. It is not legally prohibited to refuse voluntary insurance, and everything is relatively simple here.

However, there are situations when it may be necessary to terminate a compulsory insurance contract (for example, OSAGO). In our article we will tell you how to fill out an application for refusal of voluntary and compulsory insurance and what pitfalls exist.

Law on Repayment of Collective Credit Insurance – “Cooling Period”

It is not surprising, but in the insurance law Federal Law No. 4015-1 of November 27, 1992, there are no provisions that would regulate or somehow explain how to terminate an insurance contract concluded early when applying for a loan. It also does not indicate what the insured person should do if he has joined a group insurance contract and wants to withdraw from it.

But there is Article 958 of the Civil Code of the Russian Federation (Part 2) and Directive of the Central Bank of the Russian Federation dated November 20, 2015 No. 3854-U. We will look for the necessary information in them. According to clause 1 of Bank of Russia Directive No. 3854 dated November 20, 2015, the “cooling period” for the return of the insurance premium is 14 calendar days. Until the beginning of 2021, this period was equal to 5 working days.

The presence of the above period must be indicated in the insurance contract. If collective insurance is taken out, the insurance company is the insurer, the bank is the policyholder, and the borrower is the insured person.

If the contract does not include return conditions, it is considered invalid in whole or in part on individual points. The insurance company has the right to independently increase the “cooling period” upward. For example, in Sberbank it is 30 days.

In Art. 958 specifies the circumstances under which it is possible to terminate the insurance contract early and return the insurance premium. This is possible if:

- the insured property is destroyed;

- the entrepreneur will cease his activities.

All! There is no word that the borrower has the right to return part of the insurance premium if he repays the loan early. Not fair? This was also the opinion of a certain Mrs. A. A. Melkova, who in 2015 filed a complaint with the Constitutional Court of the Russian Federation, in which she indicated that the provisions of Article 958 violated her constitutional rights and did not allow the return of the paid insurance premium if the contract was terminated early. But her complaint was not even considered.

Confirmation of the above is the Ruling of the Supreme Court of the Russian Federation dated October 31, 2017, thanks to which the decisions of the first two courts, which did not allow the borrower to return the premium and rejected his claims, were overturned.

- Example

Let's look at the situation in more detail...

The woman turned to the bank to apply for a consumer loan. During the procedure, she was forced into collective insurance by a “friendly” insurance company.

The amount of the premium was about 22,000 rubles; the lender took a commission for connecting to the program - about 13,000 rubles. A fee was also charged for participation in the program - 35,235 rubles.

According to the terms of the contract, the insured person has the opportunity to apply for a refund of the premium within 5 working days - this is the “cooling off period” in force at that time.

The borrower applied to the bank within the established time limit for the return of the insurance, but her demands were denied. After this, she filed a lawsuit. Having considered the cases, the court made a negative decision on the claim.

Before the court decision entered into legal force, the woman sent an appeal to a higher judicial body, but even there she received a negative response.

Subsequently, she sent a complaint for consideration to the Supreme Court of the Russian Federation, which did not agree with the decisions of the lower courts and overturned them for several reasons:

- The borrower independently paid the fee for joining the insurance program, therefore, it is he who is the policyholder, and not the bank.

- The policyholder is an individual, and he is subject to the Directive of the Central Bank of the Russian Federation. The woman applied for this within the established time frame.

- The insurance premium must be returned. When calculating, the bank has the right to deduct its own costs for drawing up the agreement and part of the premium for the period of its validity until the client submits an application.

As a result, the court made a decision to cancel the appeal ruling and return the case for retrial.

Important! If the insurance contract does not provide for the possibility of returning the premium within 14 days, it is declared invalid in court. This is a direct violation of the Directive of the Central Bank of the Russian Federation and the rights of the borrower, who is an individual.

Let us turn to the above-mentioned Directive of the Central Bank No. 3854. What is interesting here. Here are the main points of this document, which every insurer must include in the insurance contract:

- the policyholder must be an individual;

- The insurance company must include a clause in the contract that would indicate that the client (policyholder) has the right to cancel the contract within 14 days after signing the contract and return the premium paid in 100% of the amount;

- the insurer can set a “cooling off period” longer than 14 days;

- if the insured decides to terminate the contract within 14 days and on the date of filing the application for termination the contract has not entered into force, then the insurance is returned in full.;

- if the insured decides to terminate the contract within 14 days after signing it, but the contract has already entered into force, then the insurance company retains part of the insurance premium and returns the rest to the client. The money will be returned except for those days during which the insurance was valid;

- the insurance contract is terminated as soon as the insurer receives a notice of termination from the client;

- the money must be returned within 10 days from the date of receipt of the written application. Refunds are possible in cash or to a bank account;

Another important point of this document is that all insurers must work in accordance with this instruction. If they do not include at least one of the above points in the insurance contract, then this is a serious violation, which is punishable by fines and sanctions.

If we analyze the document, it turns out that according to the Directive, only individual policyholders can return the money. And borrowers who joined the group insurance program are not policyholders. Here the bank acts as a legal entity.

Therefore, this document does not apply to such persons. For a long time, insurers took advantage of this loophole in the law. But since 2018, the Supreme Court began to make decisions in which individuals were recognized as policyholders, although they were not indicated as such in the collective insurance agreement.

There are also legislative norms that borrowers who decide to terminate an insurance contract early need to know. One of the main complaints of borrowers is that they were not properly informed that insurance is a voluntary service and does not in any way affect the bank’s decision to approve a loan or not.

The bank does not have the right to force you to enter into an insurance contract. This is discussed in Art. 421 Civil Code of the Russian Federation. That is, bank employees do not have the right to refuse a loan because the borrower refuses insurance. In fact, if the borrower refused insurance, the loan was not issued to him.

How to return Collective Insurance at VTB, Sberbank and Post Bank?

When deciding to return the premium, you should keep in mind that this is only possible in a few cases:

- Submitting an application during the cooling-off period. In such a situation, the bank has no right to refuse. Until 2021 it was 5 days. From 2021 it is 2 weeks or 14 days. All return actions must be carried out during this period.

- Appeal after the “cooling-off period”, if the possibility of an insured event due to the death of the insured person or liquidation of the business has disappeared, if the business risk was insured (Article 958 of the Civil Code of the Russian Federation).

- A citizen has the right to refuse insurance at any time if the risk of an insured event has not disappeared for the above reasons, but then the premium will not be returned. When lending, this is only possible if the debt is repaid early.

As for group insurance, it is successfully canceled during the “cooling off period” or after it. The latter is possible only if there are appropriate conditions in the contract. Most often, banks do not provide clients with this opportunity, so you should apply for a refund within the first 14 days after concluding the agreement.

How Much Money Can You Get Back with Collective Insurance?

It all depends on the date of application and the terms of the contract. If an application is submitted during the cooling-off period, the premium will be refunded in full. The fee charged by the bank for processing the documentation may be deducted.

After 14 days, several options are possible:

- Some financial institutions have extended the cooling-off period. The money can be returned in full or minus the days of use of the insurance. The calculation is made individually.

- After 14 days or a “cooling period” extended at the request of the bank, the insurance cannot be returned, unless the contract provides for other conditions. Most often, insurers and insurance companies do not provide clients with this opportunity.

To avoid having to go to court, it is best to refuse insurance at the time of signing the loan agreement.

Despite the fact that a bank employee will impose insurance and explain all its advantages, as well as threaten possible refusal of lending, paying a premium for an insurance company will slightly increase the size of the loan and the overall percentage of overpayment, and it is advisable to avoid this.

- First moment

- Second point

In the Central Bank Directive No. 3854 there are 2 important points that determine the amount of the insurance premium to be returned...

If the contract is terminated within 14 days after its signing, the insurance is returned in full, unless an insured event has occurred and the insurance contract has not entered into force. A very interesting provision, which practically cancels the possibility of returning insurance at one hundred percent, and here’s why.

The contract comes into force after the money is credited to the insurance company's account. Money is transferred to the account on the day the loan is received. So when should the borrower apply to get the full amount back? Before the money is transferred! That is, he must sign the contract, for example, on December 5, but transfer the money on December 8, and submit an application for refusal of insurance on December 5, 6, 7.

And then the entire amount will be returned to him. But this is practically impossible, because in the case of collective insurance, the transfer occurs in a single payment on the day the loan is issued.

If the contract is terminated within 2 weeks after its signing, if it has entered into force, the insurance is returned in proportion to the duration of the insurance contract.

For example, an insurance contract was concluded on December 4. The money is transferred to the insurance company on the same day. The borrower decided to cancel the contract on December 6. He will get his money back minus two days.

When communicating with an employee of a financial institution, it is recommended to turn on the voice recorder so that you can later argue your complaint.

According to the law, refusal of insurance cannot be the reason for a negative response to a loan application. When faced with this, you can do any of the following:

- File a complaint with the Central Bank of the Russian Federation. The Central Bank also controls insurance activities. Contact is possible through the electronic service: cbr.ru/Reception/Message/Register . You can also attach photo, video and audio materials there. You will need to fill out an application with a detailed description of the circumstances.

- Leaving a review about the bank on major financial portals , on which the rating of lenders among consumers depends. Such portals are not official rating agencies, but citizens often read reviews of financial institutions before applying for loans. A negative rating can harm the bank's reputation and reduce the number of loans issued, and its employees will independently contact the dissatisfied customer to resolve the conflict.

- Appeal to Rospotrebnadzor due to non-compliance with the conditions of Art. 32 Federal Law upon actual payment of services to the policyholder. This is also true for refunds in case of early repayment of debt.

Important! When talking with a bank employee, it is recommended to write down his full name. In the future, such data may be needed as evidence that the client is right during an internal investigation, if a citizen files a complaint or leaves negative feedback.

Is the Commission returned if Collective Insurance is canceled?

Often the commission for joining an insurance program is either greater than the insurance premium or equal to it. Therefore, a reasonable question arises: is it returned along with the insurance premium?

The position of the courts is ambiguous. Some recognize the insurer’s obligation to return, along with the insurance premium, the commission for the provision of the service if the contract is terminated during the “cooling off period”, for example, this is the definition:

- Perm Regional Court dated February 21, 2018 No. 33-1785/2018.

Others believe that the commission is non-refundable:

- Ruling of the Orenburg Court dated November 15, 2018 in case No. 33-8880/2018;

- Determination of the Supreme Court of the Russian Federation dated October 31, 2017 No. 49-KG17-24;

Therefore, everything depends on the specific court. But it is necessary to file a demand to return the bank commission in a lawsuit.

Additional questions

No. 1. How many days is the cooling period?

The standard period is 14 days. The countdown of time begins from the moment the contract is concluded.

No. 2. Does the bank have the right to raise the loan rate in case of refusal of insurance?

Such actions by the creditor are completely legal. This is directly stated in Article 11 of the Federal Law No. 353-FZ dated December 21, 2013.

No. 3. Is it possible to get money back from group insurance?

In judicial practice there are already positive decisions on the recovery of money under collective insurance. For example, in the case of long-term loan repayment. However, for now, payments are being made compulsorily. Insurers have to go to court.

No. 4. Is it possible to get money back from collateral property insurance?

This type of insurance is mandatory. Cancellation of insurance and refund of money under it are not provided for by law.

No. 5. How can a borrower return insurance after repaying a loan?

Refund of the insurance premium is allowed only in case of early fulfillment of obligations. If a person has repaid the loan according to the schedule, then he has no reason to contact the insurer.

Submitting an Application for Refund of Collective Loan Insurance

In short, to get back the insurance premium under a collective insurance contract like this:

- Write an application for the return of insurance and send it to the bank and insurance company within 14 days after signing the contract.

- Wait 10 days. If they refuse you, then write a pre-trial claim. The addressees are the bank from which the loan was received and the insurance company.

- Go to court.

It is important to consider that when returning, unlike individual insurance, you should contact the bank and not the insurance company. The step-by-step algorithm of actions looks like this:

- The borrower fills out the application in two copies. Samples are set individually by financial institutions; a blank form can be downloaded on the website of the lender or insurance company.

- The application with the attached documents is submitted in person to the bank or via mail. In the latter case, delivery is carried out by registered mail with acknowledgment of receipt. The review period begins from the moment the documentation is received.

- 10 days are allotted for consideration of the appeal. During this time a decision must be made.

- The final response to the return is drawn up in writing and provided to the applicant. If it is negative, the reasons must be indicated with references to legal norms confirming the correctness of the policyholder and the insurer.

Clients of Sberbank and VTB most often manage to get their insurance back. Other financial institutions may use additional loopholes in the law that do not allow refunds after 14 days. For example, do not include such a possibility in the terms of the contract.

If the answer is unsatisfactory, the further actions of the insured person are as follows:

- A claim is filed in the district court at the insurer's registered address. The application is accompanied by a copy of the reasoned refusal, passport, insurance and credit agreements. If previously a citizen applied to Rospotrebnazdor on the basis of a violation of Art. 32 of the Federal Law “On the Protection of Consumer Rights”, a conclusion from this body will be required.

- Within 5 days, the judge initiates proceedings. A date is set for the first meeting, at which a representative of the bank is present as a defendant.

- The maximum period for consideration of a case does not exceed 2 months. During this time a decision must be made.

- The decision is drawn up and the operative part is announced.

If the court decision is made in favor of the plaintiff, he takes the extract from it and re-applies to the bank with it and an application for return. The insurer has no right not to comply with the requirements of the court document; it must be guided by it.

How to Write an Application for Refund of Collective Insurance?

Before making an application, you should study the loan agreement and insurance policy. The contract should be analyzed to determine whether the loan rate will increase if you refuse insurance. This point must be taken into account.

The statement itself has an unusual form. In it you need to write not only that the client wants to terminate the insurance contract, but also demand the return of the insurance premium. In addition, it must contain references to the definitions of the Supreme Court and the Directive of the Central Bank of the Russian Federation. So the structure is like this:

- Name of bank and insurance company and their addresses.

- Borrower details: full name, address, telephone number.

- Next comes the text of the statement itself. Write when you were included in the insurance program, the name of the program and its number, as well as the number of the loan agreement. Indicate that you are canceling insurance services and want to return the insurance premium. Be sure to indicate the refund amount.

- Links to legislative acts. Be sure to refer to the Directive of the Central Bank of the Russian Federation dated November 20, 2015 No. 3854-U. Write about the cooling-off period, about the fact that the application was made within 14 days and that no insured events occurred. We also need links to case No. 49-KG17-24 dated October 31, 2017.

- Details: full name of the recipient, his account number, the name of the bank, his BIC and TIN.

- At the end there is a list of attached documents.

What Documents Are Required for a Collective Insurance Refund?

When visiting a financial institution, in addition to the application, other documentation is provided:

- lending and insurance agreements;

- passport;

- TIN and other additional documents provided when applying for the loan.

It includes:

- copy of the passport;

- application for connection to the insurance program;

- account statement;

- confirming the write-off of the insurance premium.

There should be 4 such statements. Don't forget to attach copies of documents to your applications. Two of them belong to the bank where they received the loan. You give one to the employee, and ask to return the second with the stamp, date and signature of the employee who received it. Do the same with the application addressed to the insurer. If specialists refuse to accept the document, ask them to write a written refusal.

Documents can also be sent by mail. Send the set of documents by a valuable letter with a list of attachments. There will be 2 inventories: for a letter to the bank and to the insurance company. A copy of the inventory must be kept, as well as a receipt for sending a valuable letter.

Is it possible to refuse insurance?

In Russia there is a Law “On the Protection of Consumer Rights” dated 02/07/1992 No. 2300-1. It prohibits commercial organizations from imposing additional services on citizens. One of these services is insurance. Purchasing insurance must be voluntary. Consequently, the borrower has the right to refuse to purchase the policy.

The obligation to take out insurance should follow directly from the law (Article 935 of the Civil Code of the Russian Federation). Receiving a conditional bank loan does not fall under this rule (exception is secured loans). Therefore, a person must decide for himself whether he needs a policy.

However, bankers pass on potential losses to consumers through the contract. For example, if the borrower refuses to take out insurance, the interest rate on the loan increases. This way they indirectly force consumers to buy a policy. To avoid misunderstandings, citizens should carefully study the provisions of the agreement before signing it.

Banks usually try to impose insurance on credit risks, the life and health of the borrower, and collateral. The first two directions are voluntary. You can not only refuse this insurance, but also get a refund. The rule applies regardless of the time a person pays the insurance premium. But insurance of collateral is mandatory. Cancellation of such a policy is not provided.

The choice of insurance companies is also limited. Banks usually suggest insurers with whom they cooperate. Some organizations establish their own insurance companies (Alfastrakhovanie, RSHB-Strakhovanie).

Help from a Lawyer for the Recovery of Collective Loan Insurance

In 99% of cases, banks already have established forms of collective agreements with insurance companies for signing with clients. They are written by professional lawyers who know how to avoid paying premiums legally.

- Most often, lawyers appeal to clients’ ignorance of the law, and such agreements exclude the possibility of receiving money even during the “cooling off period,” which is a violation of the Directive of the Central Bank of the Russian Federation.

- Another option is to draw up a form of agreement with the possibility of paying premiums within 14 days, but subject to the client meeting certain conditions, which is also considered incorrect.

- The third problem that courts have to face when resolving disputes about the return of premiums is the untimely application of citizens for a refund.

- If they miss the deadlines and the contract does not contain the possibility of paying money after a “cooling off period,” the only option is to terminate the insurance contract. Funds paid are not refundable.

All of the above is a good reason to involve “your” lawyer in the transaction. Despite the fact that the bank will immediately offer its copy of the contract, the specialist himself will find the “pitfalls” and, if they do not suit the borrower, it is better to refuse insurance.

When refusing insurance, financial institutions make negative decisions on loans without explaining the reasons. The lawyer will also help to understand this situation before the trial or represent the client’s interests in court if he himself is involved in the situation.

What does the new version of the law say?

In 2021, amendments were made to the following laws:

- Federal Law dated December 21, 2013 No. 353-FZ.

- Federal Law No. 102-FZ dated July 16, 1998.

- Civil Code of the Russian Federation.

The changes affected provisions on consumer lending, mortgage loans and the issue of early termination of insurance contracts. Under the new rules, borrowers can get back part of the money spent on insurance. For example, in case of early repayment of a loan.

On a note! The changes apply only to those contracts that were concluded after 09/01/2020.

At the same time, the bank has the right to raise the interest rate on the loan if the borrower refuses insurance or does not pay for the insurance policy for more than 30 calendar days (Article 11 of the Federal Law of December 21, 2013 No. 353-FZ).

Refusal to Refund the Insurance Premium under the Collective Insurance Agreement

First of all, if you refuse, you should find out a few things:

- how does the bank justify its negative decision;

- what are the terms of return under the contract;

- whether the contract was concluded without violating legal norms;

- whether the “cooling period” has been missed and whether it is possible to apply for payments after it.

If the borrower believes that he was refused unreasonably, he can first file a complaint with Rospotrebnadzor.

If, after an inspection, a government agency has drawn up an order to eliminate violations obliging the citizen to return the bonus, but the requirements have not been met, a repeated complaint is filed for failure to comply with the terms of the order, and then the creditor may be held administratively liable.

After submitting your application, wait 10 days. If they refuse to return the money, write a pre-trial claim and send it to the bank and insurance company.

- pre-trial claim: drive.google.com/file/d/pretenzia .

The claim must indicate:

- in the header - the name of the bank and the name of the insurance company, and the address of both organizations. Here is the client’s data: his full name, address, phone number;

- in the text: when the loan agreement was concluded and for what amount, when the application for the provision of the service “connection to the insurance program” was signed;

- amount of service. If possible, the amount of commission and insurance premium;

- excerpt from Directive of the Central Bank of the Russian Federation dated November 20, 2015 No. 3854-U (clauses 1 and 8);

- information about when the application for refusal to participate in the insurance program was sent. Indicate that the application was either refused to be accepted or ignored. Please indicate how the application was sent;

- excerpts from the ruling in case No. 49 KG17-24, which indicate that the insured is the borrower himself, and not the bank.

At the end, write: “I ask you to return the bank commission within 10 days after receiving the claim in the amount of such and such.” The amount of the commission is indicated in the application.

Also be sure to include your details. The money can be returned to any bank account, including a credit account. In this case, you can repay part of the loan early. The claim must be accompanied by copies of: passport, application for refusal to participate in the insurance program, check and inventories (to the bank and insurer).

All that remains is to sign the claim and date it. Don't forget to keep a copy of it for yourself. If a pre-trial claim does not help to return the money, then there is only one option left - going to court.

For what reasons may you be denied a refund?

The insurance company will refuse you:

- if deadlines are missed;

- if the possibility of a refund is not provided for in the contract you signed.

Most often, independent insurance companies include such a clause in contracts in order to attract as many clients as possible.

Bank insurance companies are unlikely to include a provision on the return of money in case of early termination in their documents. After all, they already have many chances to sell their services to bank clients.

Rospotrebnadzor or the court may refuse, citing the same rule of law (clause 3 of Article 958 of the Civil Code of the Russian Federation), according to which insurance companies return money in case of early termination of the contract on a voluntary basis.

Judicial Practice of Refund of Collective Insurance Agreements

Nowadays, judicial practice on the return of collective insurance is constantly updated with new decisions and determinations, where the courts take the side of the plaintiffs. A typical example is the Determination of the Armed Forces of the Russian Federation dated October 31, 2017 N 49-KG17-24. Thanks to the above Determination, the case was remanded for re-examination.

There is also a negative example - Decision No. 2-1789/2018 2-1789/2018, where the borrower asked the court to invalidate the clauses of the loan agreement regarding the payment of the insurance premium and the cost of connecting to the insurance program. The claim was not satisfied on the basis of the voluntary signing of the agreement by the client.

Insurers who do not return money within the 10-day period established by law after receiving a refusal application must pay not only a commission for connecting the service, but also compensation for moral damages, a penalty, a fine for failure to comply with the voluntary procedure for satisfying claims, and a state fee.

This decision, for example, was made by the Kalininsky District Court of the city of Ufa of the Republic of Bashkortostan. On February 8, 2021, a certain G.D. entered into a loan agreement with Sberbank and signed an application for participation in the voluntary insurance program. On February 15, she submitted an application for denial of the insurance program.

But the insurer (Sberbank Life Insurance Insurance Company) did not return the money. After which G.D. went to court. He sided with the plaintiff and ordered the insurance company to pay not a commission for connecting the service, a fine and compensation for moral damage. And such decisions are being made by courts more and more often, so insurers are trying to return money in the pre-trial period.

Each case is considered by the courts individually, but if citizens believe that the decision to refuse to satisfy the claims was made unmotivated, they have the opportunity to challenge it on appeal before it enters into legal force.

Reasons

According to the law, the reasons for canceling a life insurance contract, like any other, do not matter. General grounds that have meaning under the Civil Code of the Russian Federation are indicated in Art. 958 code. In the terms of the insurance agreement, the parties have the right to agree on cases when termination is made with the payment of part of the premium. Common reasons for termination include:

- destruction of property;

- termination of business activity (risk insurance in the commercial field);

- change of ownership of property (sale of a car);

- revocation of a license from an insurance company.

An exhaustive list of grounds is not established at the legislative level. Termination is made dependent on the possibility of an insured event occurring. Regulatory acts establish in which cases the insurance contract is terminated at the initiative of the insurer, for example, if the amount of the insurance premium is not paid on time. Such grounds include an increase in insurance risk in the absence of the policyholder’s consent to an increase in premium.

Refund of Insurance under the Collective Agreement – Video Instructions

Step-by-step instructions for returning collective insurance on a loan at Post Bank, VTB, Renaissance, Sberbank and AlfaStrakhovanie.

The first step: we analyze the terms of the collective agreement and the possibility of returning money for insurance.

Second step: we look at the insurance contract, what will happen if we refuse collective insurance, will the interest be raised?

Third step: write an application for the return of group insurance and send the form.

Fourth step: filing a claim if the insurance company refuses to refund the money.

Before and after 14 days

The period during which you can refuse insurance must be specified in the contract. The minimum period is two weeks.

In case of cancellation of insurance within 14 days, the policyholder will be refunded the entire amount of the insurance premium. If the refusal occurred within 2 weeks, but after the start date of the policy, then the insurance company has the right to withhold part of the premium in proportion to the term of the contract.

Insurance waiver scheme:

How to terminate a contract

To terminate the contract, you first need to collect a package of documents.

- Statement;

- Passport;

- Insurance contract with a receipt for payment of the premium.

If the application is submitted through a representative, a notarized power of attorney with appropriate powers must be issued for it.

You can submit an application directly to the insurance company, through a bank branch, or using the postal service.

At the Sberbank office

This is the most reliable and convenient way. The applicant will be able to receive detailed advice on the consequences of refusing insurance; a bank employee will help with drawing up the application and check the availability of all necessary documents. After all, if errors are found in the application or an incomplete package of documents is submitted, the application will have to be submitted again, which will further extend the period for making a decision by the Investigative Committee.

After a bank employee has endorsed the application and registered it in the system, the client can be confident that the documents will be accepted for consideration and the insurance return period will begin.

Sending by registered mail

This option is possible if the client cannot visit the bank or use the remote method of submitting documents. The procedure in this case will be as follows:

- Download and print the application form;

- Filled out in block letters or on a computer;

- A package of documents is generated: an application in the original, a copy of the passport (main page and registration), copies of insurance documents;

- An inventory is drawn up and certified by the sender and the postal worker;

- Documents are sent by registered mail with acknowledgment of receipt to the address: st. Pavlovskaya 7, Moscow, 115093. Please note that the decision to refuse insurance should be made not by the company’s division, but by persons vested with the appropriate authority. Therefore, it is better to clarify the address for sending the letter by calling the UK hotline.

If there is an error in the application or not all required documents are submitted, the application may be refused. This may result in the customer being unable to meet the 14-day return period and being unable to obtain a refund.

Online Application through Sberbank Insurance

You can submit an application online through the Sberbank Insurance website, in your personal account only if an insured event occurs.

You can submit an application remotely by sending a package of documents to the email address [email protected]

. To do this, the client must have an electronic signature.

The procedure will be as follows:

- Prepare an application for termination of the contract and other necessary documents;

- Take photographs of all documents;

- Generate a file to send;

- Sign documents with digital signature;

- Send to the specified email address.

Termination procedure

First of all, you need to make a written statement. Do not doubt whether it is possible to terminate the loan insurance contract - each policyholder has the right to refuse their obligations at any time.

We are writing a statement

A unified template for drawing up an application for termination of a life insurance contract has not been introduced by law; it is often developed by a credit institution. According to the practice of accepting applications, the application will need to indicate the following information:

- name of insurance company, insurer;

- name of the policyholder indicating passport details, address, telephone number for operational contacts;

- title of the application;

- express notice of termination of the insurance agreement: indicate the reasons for such a decision, for example, a cooling-off period;

- details for transferring the award;

- signature, date.

The motivational part of the document differs depending on the reasons for termination of the legal relationship. For example, when selling an insured vehicle, we begin the main part with the wording “I ask to terminate the insurance contract due to a change of owner,” after which we indicate the details. After drawing up, we transfer the document by personal request or sending it through the postal service. When applying in person, provide two copies of the application. On the second, the insurance company employee will put a mark on the date of acceptance indicating his full name. and positions.

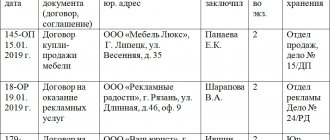

Collecting documents

Please attach a policy or other document confirming your membership in the collective program to your application. If the loan has been paid, confirmation of this. If the insurance agreement is terminated for the reasons specified in Art. 958 of the Civil Code of the Russian Federation, attach documents confirming this circumstance. It is not established at the legislative level what documents must be attached when terminating an accident insurance contract; general rules apply. When applying through a representative, a power of attorney must be attached. Copies are certified accordingly: for a simple written form, indicate “Copy is correct, date, signature, transcript, location of storage of the original document”; A notarized copy is required for a notarized power of attorney.