Good afternoon, dear reader.

In this article we will talk about a fine for lack of MTPL insurance , which can be imposed both on a driver who forgot to renew an expired MTPL policy, and on a driver who just left this policy at home. Naturally, the size of the fine in the first and second cases will be different.

Within the framework of this article, several situations will be considered that involve a fine for driving without insurance:

- Fine for leaving your policy at home.

- Fine for using compulsory motor liability insurance for an unspecified period of time.

- Fine for a driver who is not included in the insurance.

- Penalty for expired insurance.

- Do automatic cameras record the absence of compulsory motor liability insurance?

- Discount on fines for lack of compulsory motor liability insurance.

- Possibility of evacuation of the car to the impound lot.

Let me remind you that a table of traffic police fines is available for download on pddmaster.ru, which also includes the amount of the fine for lack of insurance.

What is OSAGO

What is this. OSAGO - insurance for a motorist. An insurance policy will help pay for damages if an accident occurs. Before the compulsory motor liability insurance policy became mandatory, the person responsible for the accident had to pay the damage to the victim out of his own pocket. Now the insurance company does it.

What is the price. The price depends on several factors:

- car power;

- region of registration;

- driver's experience and age;

- the number of accidents in which the driver was involved.

For example, for a Hyundai Solaris car with a capacity of 123 hp. With. from Chelyabinsk, with 2 years of owner experience, the price of the policy is about 7,000 rubles per year. If you imagine that the power of the same machine can be increased to 150 hp. s., the price of the policy will increase to 9,500 rubles.

How to get a. From August 2021, you can buy a policy for any car without a technical inspection. It is enough to contact an insurance company that has the right to sell policies.

Before purchasing a policy, check whether the seller is a scammer. To do this, find the insurance company in the list on the website of the Russian Union of Auto Insurers (RUA).

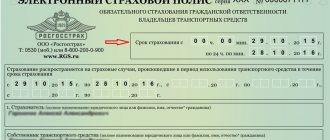

From the beginning of 2021, the policy can also be purchased and issued online. After the purchase, the citizen receives a file by email - an electronic analogue of a paper policy. Such a document is called “E-OSAGO”. We have separate instructions on how to do this.

Additionally, we recommend checking the authenticity of the purchased policy. To do this, enter the series and policy number, as well as today’s date in the form on the RSA website.

OSAGO without maintenance: new rules for obtaining insurance policies have come into force

You can purchase a compulsory motor liability insurance policy without a diagnostic card from August 29. What will change due to the simplification of the rules?

Photo: xload/ru.depositphotos.com

As of today, OSAGO has been “untied” from technical inspection. Now, in order to obtain a compulsory motor liability insurance policy, you do not need to present a diagnostic card.

According to the authors of the law, the exemption from compulsory motor liability insurance from maintenance will increase the availability of compulsory insurance. After all, there are not enough technical inspection stations in all regions, and as a result, drivers were faced with situations where they could not insure themselves even if they wanted to.

Insurers also supported the separation of compulsory motor liability insurance from technical maintenance. They say that now there really is no significant relationship between passing a technical inspection and accident rates. And they cite traffic police statistics, from which it follows that the share of accidents due to technical malfunctions in the total mass does not exceed 0.1%.

However, according to experts, such a step was rather forced. The fact is that many technical centers simply did not have time to switch to the new car inspection regulations (they were required to place photographs of the car on the diagnostic card indicating the time and coordinates of the shooting location). This means that the driver could neither pass the technical inspection nor buy compulsory motor insurance.

But this does not mean that a technical inspection is now not needed at all - without it you will be fined. But not now, but from March 1, 2022, when amendments to the Code of Administrative Offenses come into force. But everything can still change, says Sergei Kanaev, director of the National Public Center for Traffic Safety.

Sergey Kanaev Director of the National Public Center for Traffic Safety “Whether it will come into force or not is unclear, because the readiness of the service station does not yet exceed 50%. And it is not clear whether the technical inspection itself will be mandatory for private individuals or not, because the head of the traffic police spoke in favor of abolishing mandatory technical inspection for private individuals. As for how to make sure that people still undergo a technical inspection, I believe that we need to follow the path of America, when it is not coercion that works, but rather a system of incentives by reducing the cost of the MTPL policy, through a deductible in case of an accident when the payment may be reduced. And thirdly, when paying transport tax.”

The head of the Russian State Traffic Inspectorate, Mikhail Chernikov, proposed making maintenance voluntary. He said that responsible drivers are already interested in the health of their cars, and therefore must undergo inspection themselves.

But in practice, not everyone underwent official maintenance, to put it mildly, experts say. Drivers bought diagnostic cards on the black market. This is also why we decided to carry out a maintenance reform. But all these initiatives may change not the attitude towards technical inspection, but the price of the MTPL policy (of course, upward), says Anton Shaparin, vice-president of the National Automobile Union.

Anton Shaparin, Vice President of the National Automobile Union “The technical inspection has been falsified for ten years in a row, all the time when it was controlled by insurance companies. And people are used to the fact that no one undergoes inspection. There are not very good prospects. Poor technical condition of a car is a risk that insurance companies around the world will always take into account. They, I am sure, will now turn to the Central Bank with a request to increase tariffs for compulsory motor liability insurance simply because they have an argument: they cannot assess the technical condition of the cars, they consider that risk to be at the maximum - this is the first thing. And secondly, insurance companies will establish that in a number of cases the accident occurred due to the poor technical condition of the car, and will apply to the courts with recourse claims against car owners, which, of course, is a fundamental risk.”

The insurance company has the right to recover the amount paid by it from the person at fault for the accident. This rule can be applied precisely because the driver does not have a diagnostic card. And these are already amounts more significant than the fine of 2 thousand rubles, which is provided for by the amendments to the Code of Administrative Offences. But against the backdrop of the separation of technical inspection from compulsory motor liability insurance and in opposition to the initiative of the traffic police to abolish technical inspection, the Federation Council proposed to begin fining for the lack of diagnostic cards earlier than planned - already from October 1.

Add BFM.ru to your news sources?

Repeated fine for driving without compulsory motor insurance

Is there a penalty for repeat violation? No, if the driver received a fine for the second time in a year for not having a car insurance policy, the punishment will not increase, as, for example, for driving into oncoming traffic again.

Detention of a vehicle. By law, a car can be towed to an impound lot - for example, for stopping under a prohibitory sign.

However, a car cannot be detained for lack of insurance; only a fine is imposed.

Summary

If your car insurance has expired, keep in mind:

- You cannot drive without insurance after the expiration date.

- It is possible to drive a car without compulsory motor liability insurance in a number of exceptional situations: purchasing a vehicle, entering into an inheritance, receiving a vehicle for operational or economic ownership.

- When purchasing electronic insurance, remember that it becomes effective after 3 days.

More…

- How can a victim receive payment under compulsory motor liability insurance after an accident: actions after the accident, procedure for paying compensation

- What happens if you drive someone else’s car without MTPL insurance in the presence of the owner?

- Is it possible to return loan insurance from Rosselkhozbank after applying for a loan?

- What does MTPL cover in case of an accident and how much damage does extended insurance cover?

How is a violation recorded?

Traffic police inspector. A simple document check can result in a fine if the driver has not purchased an MTPL policy. The inspector will check the database - it will take no more than 5 minutes. If the driver’s car is not listed in the database, he will draw up a violation report.

Experiment with cameras. The cameras have not yet learned how to compare car license plates with the database of existing policies. The press service of the Moscow Traffic Management Center reported that there is a technical possibility for this. The only question is connecting the Ministry of Internal Affairs database to the RSA database - this has not been done yet.

Lack of insurance is punishable by a fine

A repeated fine is issued for ineffective insurance in several other cases. Traffic police inspectors regularly check the availability of mandatory documents, so the driver should not hope for a miracle. Administrative liability is provided for in Article 12.37 of the Code of Administrative Offenses of the Russian Federation, so you will have to pay a certain amount.

Compulsory motor liability insurance remains a mandatory condition for driving a vehicle. Its registration is now possible on the Internet, which is directly related to the overload of insurance companies. Yes, the amount is small, because it is only 500 rubles , but re-registration becomes a real problem.

When a fine for driving without a compulsory motor liability insurance policy is not issued

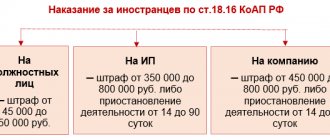

For vehicles with foreign registration and a Green Card. The Green Card is an analogue of the MTPL policy, but it is valid in 48 countries. You will need a policy if the driver is involved in an accident in a foreign country. According to such a card, as well as under the MTPL policy, the victim will be paid compensation. A list of companies that sell Green Cards in Russia is on the RSA website.

If a foreign driver who comes to Russia has such a document, he cannot be fined for not having an MTPL policy.

If 10 days have not passed since the purchase of the car. The law allows you to drive without registration and insurance for 10 days from the date of purchase of the car. The date can be found in the car purchase agreement.

Is it still valid if the insurance has expired?

Based on what has already been stated, we note that the MTPL policy ceases to be valid (how to find out if the insurance policy is valid?). Past agreements between the car owner and the insurer are not taken into account. But calling OSAGO invalid is wrong. More precise wording:

- inactive;

- expired;

- expired.

Based on the norms of legislation, in particular civil law, a document that is drawn up with any violations of the law is considered invalid.

If the policy meets all current requirements, but its validity period has expired, then it cannot be called invalid. He's:

- made using official form;

- issued in accordance with the rules provided for by law;

- an insurer who has a license and other necessary documents, an insured who owns a vehicle and is legally competent.

But this is all a discussion about wording. By and large, it does not matter whether the policy is called invalid or inoperative. It is important that if the date and time of expiration have arrived, then there are no longer any obligations between the parties to the contract.

What to do if you received a fine for not having a compulsory motor liability insurance policy

Even if the driver received a fine for driving without compulsory motor insurance, there are three options for the development of events.

Challenge the fine. This can be done within the first 10 days from the date of the decision.

Pay with a discount. If there really was no insurance policy during the check, the driver can only pay half the fine. To do this, you need to meet the first 20 days from the date of the decision. For example, instead of 800 rubles, the driver will pay only 400.

Pay the full amount. The discount expires on 21 days from the date of the decision. But there are still 40 days left for payment. If there are several fines, it is easy to get confused about the dates. In order not to keep all these dates and amounts in your head, subscribe to the traffic police fines notifications.

When the discount expires, you will receive an email.

Sanctions for using a fake policy

This situation is fraught not only with a fine, but also with criminal liability. If you travel on knowingly forged documents, then you may face:

- Fine up to 80 thousand rubles.

- A fine in the amount of your salary for six months.

- 480 hours of correctional labor.

- Arrest for up to 6 months.

OSAGO is issued for 1 year, but the policyholder can reduce this period and save. This solution is actively used by summer residents who use their cars only from late spring to mid-autumn.

There is only one disadvantage of this program: if you go on a trip in winter, when the policy is not valid, then you will face a fine of 500 rubles.

Is it possible to reduce the amount of debt?

If you pay the debt within 20 days, you will receive a 50% discount. Consequently, the fine will be 250 rubles (instead of 500) or 400 rubles (instead of 800).

Can inspectors require proof of insurance?

The cost of an insurance certificate is rising, so some drivers decide to save money and refuse to purchase it.

But if they are stopped by a traffic police inspector, he can legally demand to see a document. Choice of CASCO

Cases when a fine can be challenged

When can you challenge? For example, sometimes an inspector does not accept an electronic policy for inspection and issues a violation report. After this, the driver receives a fine, which can be appealed.

How to dispute. The driver has 10 days from the date of the decision to appeal. The date is on the paper copy. You can also see the date when checking on the main page of the “Traffic Police Fines” website.

The date in the red frame is the day the traffic police officer issued the order

In the complaint, indicate the reason, policy number and a screenshot of the policy check using the RSA database.

The name of the head of the department can be found by calling the resolution

Wait for an answer. The complaint will be answered within 10 days.

If your appeal is denied, contact the district court. If they refuse there too, you need to appeal the decision to a higher court.

What to do if you don't have insurance?

A repeated fine for driving without insurance should alert the driver. The administrative penalty may change, so you will have to take the car away for a parking fine or face imprisonment due to regular non-payment.

What's the easiest way to do it?

- Return home and pick up documents;

- Renew insurance within the prescribed period;

- First, apply for compulsory motor liability insurance, and then hit the road.

Compulsory MTPL insurance has become a new thing for experienced drivers. They usually did not use additional documents, being confident in their own skills. At first, active campaigns were conducted to bring some sense to car owners, but it did not bring results. After this, a provision of the legislation of the Russian Federation was adopted, strictly indicating the possibility of applying penalties against violators.

Remember

- OSAGO is an insurance policy that covers repair costs in the event of an accident.

- The fine for lack of MTPL insurance is up to 800 rubles. For repeated violations, the penalty is the same.

- Only traffic police inspectors record such violations. Cameras have not yet learned how to do this.

- You cannot be fined for not having a printed copy of the policy - it is illegal.

- A fine cannot be issued to those who have owned the car for less than 10 days. Those who have a Green Card, too.

- If a driver receives a fine for lack of compulsory motor insurance, he has three solutions: pay at a discount, pay in full, or appeal.

- The fine can be challenged if the inspector was wrong - for example, he refused to accept a paper copy of the E-OSAGO. The law allows the presentation of an electronic image of the policy.

Other articles by the author: Evgeniy Lesnov

When can you drive without insurance?

Federal Law No. 40-FZ of April 25, 2002, amended on December 29, 2017, in Art. 4 clause 3 provides for cases in which registration of compulsory motor liability insurance is not required.

- You own a vehicle whose maximum speed is limited to 20 km/h.

- The driver drives a vehicle registered in the Armed Forces of the Russian Federation.

- The car is registered abroad and insured by an international insurance system.

- The vehicle moves with the help of non-wheeled propulsion systems: sleds, caterpillars, etc.

- I own a trailer for a car.

If the vehicle was inherited, insurance must be obtained no later than 10 days after the person became the full owner of the car.

Payment period

According to the provisions of Art. 32.2 of the Code of Administrative Offenses of the Russian Federation, a fine issued to a violator of traffic rules must be paid within sixty days from the date of entry into force of the resolution imposing the specified penalty. The agreed document gains legal force after ten days from the date of its preparation, unless it has been appealed. If the fined person has not taken action to challenge the legality of the actions of the traffic police officers, the total period for paying off the fine is seventy calendar days.

Important! Since 2021, the traffic rules of the Russian Federation have undergone a number of changes, according to which violators who pay a fine within a period not exceeding twenty days from the date of drawing up the administrative protocol pay 50% less.

Do traffic cameras record the absence of compulsory motor liability insurance?

The vehicle tracking system using automatic cameras has been launched in test mode in Moscow. The experiment is still ongoing in 2021. So there is no exact time frame for introducing this practice throughout the country yet.

The detection system thanks to traffic cameras will work with the traffic police and RSA databases as follows:

- The video camera records the license plate number of the car.

- The information is sent to the traffic police database.

- The state number is compared with the vehicle identification information (chassis number, body number or VIN).

- Using the machine identification information, a document is searched in the RSA database.

- Information about car insurance is sent to the traffic police.

- In the absence of a motor vehicle license, a penalty is issued.

- The notification is sent to the owner by email.

If you have insurance, then you don’t need to worry about the new system. But if it is overdue by at least a day, then punishment is guaranteed to follow. Its size will not differ from the standard one - 800 rubles for each violation.

If compulsory motor liability insurance has ended, how long can you drive in 2021?

Until 2009, from the expiration of the insurance, you were given a month to apply for a new one. Now the extension is necessary immediately, and the question “if the compulsory motor liability insurance has expired, how long can you drive” has lost its meaning.

Movement is allowed in two cases:

- The car is insured under a “Green Card” outside Russia by an international insurance company. If the insurance period expires on the territory of the Russian Federation, a Russian “motor citizen” is issued. Valid from 5 to 365 days. The green card is renewed in the country where the car is registered.

- The car has just been purchased. The state has given 10 days after the transfer of the right to transport for registration. Before this you need to get insurance. If necessary, a diagnostic card. An acquisition is considered, for example, the conclusion of a purchase and sale agreement, a gift agreement, or the receipt of a car by inheritance.