Many people have the desire to leave an inheritance to their grandchildren or children. Now even young parents are thinking about the future and making a will for their minor child. According to current legislation, children have a primary right to inheritance, but often, after the death of the testator, many relatives appear claiming their part in the inheritance mass. Let's look at how to pass on an inheritance to children correctly.

Is it possible to write a will for a minor child?

The law does not provide for any age restrictions regarding recipients of property when drawing up a will. The testator can assign property to citizens regardless of their age. Moreover, it does not matter whether the beneficiary is the child of the testator or not (Article 1119 of the Civil Code of the Russian Federation).

Inheritance options:

- If the heir is the child of the testator, then he inherits the property equally with everyone else - children, parents, spouse. That is, he will receive a certain part of the property of the deceased citizen.

- If the testator transfers all his property to the heir under the will, then the remaining relatives will be left without inheritance. A will actually redistributes their share of the inheritance in favor of a specific claimant.

Important! An exception is the obligatory part of the inheritance, which is due to disabled children, parents or spouses. They cannot be deprived of inherited property by a will.

The concept of a mandatory share

Everyone who has not reached the age of majority automatically becomes a claimant to half of the bequeathed estate, property values and savings. In case of compulsory inheritance, a minor child enjoys the protection of the state provided for in Article 1149 of the Civil Code. A newborn is regarded as an equal citizen.

In each case of registration of inheritance, all circumstances are considered individually, and if there are two or more children, all of them have equal rights from birth. Therefore, when drawing up a will, it is necessary to take this aspect into account, so that later people do not waste money, time and nerves on litigation. The state determines a mandatory share for each newborn, either with or without a will.

Situations when the court does not side with the applicant rarely occur, but in practice it does happen. By law, the obligatory share is abolished or reduced if:

- There is a legal successor (under the will) who lives on the bequeathed area. This category includes property assets used to generate income (cars, production equipment, workshops, tools, etc.). Grounds – Part 4 of Art. 1149 Civil Code.

- The heir is declared unworthy. These are people who carried out unlawful actions towards the testator in order to obtain valuables. This also includes attempts to increase your share. Basis – Art. 1117 Civil Code.

In the first case, the court evaluates the property and financial status of the applicants and makes a decision that maximally ensures the safety of the obligatory share. In the second, the decision contains a complete refusal to implement the requirements. Often the judge finds elements of a criminal offense. In any case, a recalculation is made or a resolution is issued stating that the request is not satisfied.

The size of the will is calculated from the position of the volume of material assets due to the heirs if there is no will. In this case, the entire list is taken into account - these are the first-priority applicants (conceived children, spouse), as well as relatives by introduction (grandchildren, nephews). Everyone who can prove their relationship has equal rights.

This volume is formed from values that were not bequeathed. But if their value is not enough, the bequeathed property is included in the calculation by reducing the share under the will. The mandatory portion is assigned by the court, which will determine its size and be able to refuse to satisfy the plaintiff’s claim. When it is a minor, this rarely happens.

Is it possible to bequeath an apartment to a minor child or grandchild?

A will is a one-sided transaction. To draw up a document, the will of the testator is sufficient. The consent of other persons is not required.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

A citizen can assign an apartment to his minor child or grandchild. He can also divide the property between 2 heirs in equal shares or assign a large part of the property to one person.

Is it possible to make a will for minor grandchildren, bypassing the children? Certainly. Moreover, the will may provide for the receipt of an apartment by an unborn grandchild. If on the day of the testator’s death the child has not yet been born, then the notary suspends the issuance of the certificate (Article 1163 of the Civil Code of the Russian Federation).

The notarial act continues immediately after the birth of the baby. If the child is born alive, he is entitled to bequeathed property. If he was not included in the disposal, then he is entitled to an obligatory part of the property. If the baby dies during childbirth, the property will go to other recipients.

Pros and cons of such a will

If the testator wants his property to become the property of his grandson, then this is the only option, more or less reliable.

At the same time, often after the will is opened, relatives who have not received anything begin litigation to challenge the will of the deceased. If it was drawn up correctly, certified and there is no doubt about the testator’s capacity, it is difficult to challenge it.

On inheritance issues, you can get a free consultation from our lawyers.

Fill out the form below or call the contacts provided. Facebook

Is it possible to make a will while your spouse is alive?

The testator can alienate property even if there are other applicants. The only limitation is the spousal share. The husband/wife cannot dispose of property that belongs to the spouses under the right of joint ownership.

As for personal property, it can be bequeathed to young children even if the spouse is alive. However, if the husband/wife has the status of a disabled citizen at the time of opening the inheritance, then he is entitled to a mandatory share of the inheritance. The rule applies regardless of the content of the administrative document.

Disposal of inherited property

There are also a number of restrictions on the right to dispose of property inherited by a minor.

The law establishes a ban on the alienation of property (sell, donate, make contributions to an LLC, etc.) without obtaining the consent of the guardianship authorities. Such permission is issued only if such a transaction does not violate the rights of the child. For example, an inherited apartment will be sold, and the parents will use the funds received to purchase housing with a larger area.

Guardianship authorities must control all manipulations with property and money. This is done to ensure that unscrupulous parents do not deprive the child of property contrary to his interests.

Assigning responsibilities to minor heirs

The testator may make a testamentary refusal. It means the imposition of a certain obligation on the heir (Article 1137 of the Civil Code of the Russian Federation). For example, providing living space for one of the relatives of a deceased citizen.

If the heir assumes rights, he automatically accepts the assigned obligations. Refusal of them gives the right to the legatee to demand fulfillment of the obligation through the court. If the testator has appointed an executor, then he must monitor the fulfillment of his duties by the heirs.

Who can you file a claim against if the will is not executed? The legatee or executor may bring a claim against the heirs represented by legal representatives (Article 37 of the Code of Civil Procedure of the Russian Federation).

A popular option for testamentary refusal in relation to minor recipients is the possibility of receiving a cash contribution upon reaching a certain age (18 years or 21 years).

Since minor children cannot independently dispose of their property, the ability to use and dispose of the inheritance rests with their legal representatives. If the testator does not want the parents or guardians of the heir to spend his property, he can establish a testamentary refusal.

Is it possible to refuse an inheritance?

It is not always necessary for a minor to accept an inheritance. There are a number of cases when it is better to refuse an inheritance. This happens when the rights to the property come with the responsibilities of the property. Loan debts and collateral obligations are often transferred. Therefore, a decision is made to refuse the inheritance.

On a note

The decision is made by legal representatives with the participation of guardianship authorities. The guardianship authorities review the inheritance case and give an opinion, which must be submitted to the notary's office along with a package of documents: passport, will, documents confirming the powers of the legal representatives.

Advantages and disadvantages of the order

Advantages of a disposal for a minor child or grandchild:

- Undesirable recipients are deprived of their rights to property by law. The exception is for obligatory assignees.

- The owner can set an age limit for receiving property. Therefore, upon reaching a certain age, the child will be provided with money or living space.

- A minor child can be not only a direct heir, but also a sub-heir and legatee.

- A parent or other legal representative cannot dispose of the inheritance of a minor at his own discretion.

Disadvantages of a will for a minor:

- The recipient will be able to register the property only if there is a legal representative. He does not have the right to submit documents to a notary on his own.

- If the deceased has significant debts, the legal representative cannot independently formalize the refusal of the inheritance. The procedure is possible only with the consent of the district guardianship department.

- Real estate registered in the name of a minor cannot be sold in case of relocation or to improve living conditions. The transaction is possible only with the consent of the district guardianship department. In practice, the procedure is quite complex.

- Money that is placed in the child’s account (compensation for a share in the inherited property, money from the deceased’s contribution) cannot be spent. They must be kept on the account until he reaches adulthood. The legal representative can only receive a certain amount for a specific purchase in the interests of the child.

- Possibility of legal challenge. Most often this happens when older people are making orders. The basis for invalidating a will is the inability to understand the consequences of one’s actions. For example, if the testator does not realize the consequences of his own actions due to a long illness.

Entering into the inheritance of a minor

If the drawing up of a will for children is carried out according to the general rules of civil law, then the entry into the inheritance of a minor child after the death of his father or other relative has a number of features.

This is due to the fact that until the age of eighteen a person cannot independently exercise his rights in full. Inheritance for minors (under 14 years of age) is entirely carried out by their parents. Whether it is mother or father does not matter. It also doesn’t matter whether they are married or divorced. Each of them has the right to act on behalf of the child. If there is deprivation of parental rights, then these powers belong to the guardian or the institution where such an heir is being raised.

Persons from 14 to 18 years of age may partially exercise their rights with the consent of their legal representatives. At this age, the child himself must write an application to the notary. Parents put a mark on the document indicating that they approve it.

The exception is cases of marriage or emancipation before adulthood. The above-mentioned persons may exercise all rights themselves, including inheritance, until they reach the age of 18. They do not require the consent of parents or guardianship authorities.

Parents of a child under 14 years of age or a teenager between 14 and 18 must submit an application to a notary to accept an inheritance. This is done within six months after the death of the testator.

It is also possible to actually take over rights. This means performing actions indicating that the person treats the bequeathed property as his own. For example, moving a child with his parents into an abandoned apartment or making utility and other payments for it. But in such a situation, if you fail to submit an application to the notary within six months, you will subsequently have to formalize your rights in court.

Sometimes parents do not fulfill their responsibilities in good faith. They may be indifferent to the will written in favor of their child and take no action to formalize the rights. Judicial practice proceeds from the fact that if the deadline was missed due to the fault of the legal representatives, then after the heir reaches the age of majority, he has the right to restore it.

Parents of a minor applicant for property do not have the right to independently declare a refusal to enter into an inheritance without the consent of the guardianship authority. Even if this is due to the interests of the child - for example, the costs of maintaining the property are very high.

The parents of a minor are required to pay a fee for inherited property. When the child is a close relative of the testator, 0.3% of the amount received is contributed, but not more than 100,000 rubles. All other persons transfer 0.6%, maximum 1,000,000 rubles.

There are also features of the transfer of property when bequeathing all property to a child. In this case, if the deceased had dependents to support them, they have the right to receive their share of the inheritance. These individuals include:

- children of the deceased under 18 years of age who were not included in the will;

- children over 18 years of age who cannot work due to disability;

- disabled spouse or parents of the deceased;

- other persons who are fully supported by the testator (regardless of priority).

As you can see, all of the listed categories (except for the last) include heirs of the first priority by law. These persons have the right to receive from the property left half of what they could have expected if the will had not been written.

Inheritance by minors by law, if the heir under the will receives all the property, is also provided for in the following case. A child conceived but not born at the time of the death of the testator has the right to allocate a compulsory share. The distribution of the property left behind occurs only after his birth.

How to draw up a will for a minor child or grandchild

The administrative document is subject to mandatory notarization. Therefore, the testator will need to visit any notary at his place of residence. If necessary, you can draw up a will in any city in the Russian Federation.

Rules for compiling and writing

Features of order execution:

- A will is drawn up in writing.

- You can develop a draft document yourself or use a sample available from a notary.

- If the text of the order has any peculiarities, then after preparing the final version of the document, the testator will have to familiarize himself with it.

- If there are no comments, the document is signed in the presence of a notary.

- After which the notary puts his signature and seals the document.

Rules for the testator

| No. | Rules |

| 1 | When preparing a document, you need to check the correct spelling of your full name. heirs, their addresses and the composition of the property being transferred. Mistakes made may result in unnecessary litigation, legal fact-finding, or will challenges. |

| 2 | One copy of the order is given to the testator, and the second remains with the notary. If a document is lost, he can always take a duplicate document. After the death of the owner, the heirs and the executor of the will have similar rights. |

| 3 | If the testator is elderly, then in order to exclude the possibility of challenging the will, witnesses can be invited. As a last resort, a certificate from narcology and psychiatry to confirm sanity. |

Sample will for a child or grandchild

Sample order in favor of a minor child

Sample will in favor of a minor child

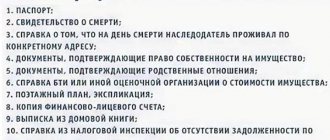

List of documents

To issue an order, the testator will need:

- civil passport (valid, timely replaced);

- list of heirs;

- It is advisable to have with you the title documents for the alienated property.

Rights of illegitimate, adopted and stepchildren

The basis for legislative acts is the equality of rights of minor children born into the world. Therefore, even if it is an unofficial spouse and adoptive parents, a minor has the right to use the will with the same chances as his own children. If paternity is indicated on the birth certificate, this is a sufficient basis.

Adoption is an optional condition. It is enough that the minor has been a dependent for more than 12 months. The presence of two disinterested witnesses in court (neighbors, relatives) who can confirm this fact is a sufficient reason to recognize the right to be a minor adoptive parent if the adoptive parent has died.

Adopted minors immediately after registration acquire the same opportunities as those born by birth. The requirements of the will are lawful and unshakable, since from the point of view of legislation, all minors become relatives. All descendants who will be born from adopted citizens can claim what remains after the death of their adopted grandparents.

Amount of state duty

The age of the recipient of the property is not reflected in the amount of the state duty when drawing up the order. Therefore, the testator bears his expenses in full.

Costs for registering the will in 2021:

- A state fee is charged for notarization of a will. Its size is 100 rubles .

- Notary services are paid separately. The amount of payment depends on the region of circulation. For example, in Moscow the testator will pay 2400 rubles, in the Voronezh region 1900 rubles.

Check the amount of expenses on the website of the Federal Notary Chamber. Just select your region in the special line.

Contents of the document

The contents of the inheritance document are very important. It is worth noting that the inheritance under the will will go to the minor child immediately, but he will be able to fully dispose of such property after he comes of age. But for this moment to happen as quickly as possible and with a high level of guarantee, you will need:

- clearly indicate the initials and date of birth of the heir;

- carefully copy the documents on the property and its location address;

- make a will in sound mind;

- if possible, determine the correct administrators of the property before the child reaches adulthood.

Each of these points is of great importance from the point of view of further appeal of the document by relatives, especially if, in addition to the future heir under the will, there are other first-degree relatives.

It is important to remember that, as judicial practice shows, after the death of the owner of the property, the relations of former relatives change radically, and all the promises made during his life are simply forgotten and an unpleasant legal battle begins. And if during such proceedings even minimal spelling errors are found in a document (for example, misspellings of a first or last name, date of birth, address of property, etc.), this becomes grounds for declaring the will invalid.

Appointment of executor of a will

The testator may appoint an executor to protect the interests of a minor heir or legatee. The only condition is the consent of the person who is entrusted with the duties of the executor.

A corresponding note is made about this in the will, or the executor writes a separate statement, which is attached to the order (Article 1134 of the Civil Code of the Russian Federation). If the will was drawn up without the participation of the executor, then he can confirm his consent after the inheritance opens.

is given 1 month to make a decision . If a citizen does not confirm his position within the specified period, then he is recognized as having refused the duties assigned to him. Inheritance of property occurs without the participation of the executor of the will.

Should the executor be included in the estate? No. Any trustee can be the executor of a will.

Can there be more than one executor in a will? Yes. The Civil Code does not contain a prohibition on involving several citizens in the inheritance procedure.

What are the responsibilities of an executor? The powers of the will executor are determined by the document itself. This includes ensuring the safety of property, transferring inheritance to applicants, and receiving money due to the testator from third parties. If necessary, the executor may require the heirs to execute a testamentary assignment. The executor of the will can count on compensation for expenses and remuneration for work performed (Article 1136 of the Civil Code of the Russian Federation).

How is the executor released from his obligations? One way is to carry out the will of the testator. If the executor of the will wishes to be released early from his obligations, he can file a claim in court. Additionally, heirs can initiate legal proceedings. For example, if circumstances arise that prevent the execution of the administrative document by the executor.

Registration procedure

You can inherit all property, a share in it, or some specific property (for example, an apartment or a car) to your minor child.

It is permissible to draw up a document in relation to one person or several. You can make a bequest to your minor children, as well as grandchildren, nephews, brothers and sisters, and other persons. These can be children from different mothers, including illegitimate ones. In this case, the testator can decide which of them should receive what, or establish the share of each of them. When there are no such instructions, the property will be distributed equally between them.

To draw up a will for your minor child, you need to go to a notary who will prepare and notarize it. It can also be written by the applicant himself. To compile, you must submit the following documents:

- testator's passport;

- passport or birth certificate of the potential heir;

- confirming the testator's ownership of specific property (when inheritance is formalized for certain things).

Sample will:

You can register an inheritance for your minor child with an open will. This means that its contents will be known to the notary who certifies the signature of the originator.

Also, the document may be closed. It must be drawn up by the testator himself and sealed. The paper is then placed in another envelope, which is signed by two witnesses and a notary. In any case, the will must have the following contents:

- date and place of document preparation;

- testator's data;

- data of the heirs - it is enough to indicate only the last name, first name and patronymic, date of birth;

- information about property being inherited (in the case of transfer of specific objects);

- information about the shares in which the heirs should enter into their rights (when determining them);

- appointment of an executor and determination of his duties (if desired);

- other orders (for example, on the sub-appointment of an heir);

- signature;

- notary data.

To make a will for a child, the consent of his parents is not required. In the text of the document it is possible to identify specific persons responsible for carrying out the will of the deceased. They are called executors.

Performers must agree to perform this role. The powers of the specified person are confirmed by a document issued by a notary. The testator may detail the duties of the executor, who must follow them. If this is not done, the performer is authorized:

- take measures to ensure that the teenager receives inherited property;

- ensure the protection of property;

- carry out, if necessary, management of inherited property in the interests of the child (for example, a share in an LLC or other commercial organization);

- secure money or property for an heir.

The executor of a will has the right to refuse the functions assigned to him at any time. He can also be released from them at the request of the child’s relatives or other heirs, if there are obstacles to this (for example, conflicting interests).

How to guarantee the fulfillment of will?

There is a proven method of executing a will - appointing an executor. He must be appointed by the testator when making a will. The responsibilities of the performer include:

- control the process of transfer of ownership;

- provide all conditions so that the heirs avoid delays;

- control over the execution of the will of the deceased in strict accordance with the will.

This is interesting: Who has the right to challenge a will in 2021

It is advisable to choose an executor in whom the testator can completely trust, while the executor is not interested in dividing the property.

Conclusion: you can draw up a will for a minor child, similar to writing a regular will. But there are several nuances. A minor cannot fully use the property. Therefore, to guarantee compliance with the will, it is necessary to appoint an executor of the will, who will ensure that the child receives his inheritance upon reaching 18 years of age.

For additional information on this issue, please see the “Wills and Donations” section here.

Free legal support by phone:

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Who is an executor?

Civil legislation allows for the emergence in inheritance legal relations of persons who will be responsible for the full or partial execution of a will.

The presence of an executor allows you to avoid inaccuracies in the interpretation of the will, as well as claims from other persons to the inheritance.

The specified person is appointed. Most often, he has no interest in dividing the inheritance, although there are no restrictions regarding the involvement of one or more heirs as an executor.

A mandatory condition for the functioning of the executor is to receive from him the execution of those actions that are determined by the testator. He carries out his work at the expense of inherited funds (property). He may refuse to perform the assigned functions due to his own health condition or a number of other reasons, which must have documentary evidence.

The responsibilities of the executor include:

- ensuring the safety of the hereditary mass;

- its distribution in accordance with the will of the deceased;

- protection of the interests of persons who become heirs.

The testator who appointed the executor has the right to independently determine the scope of his duties.