Organizations and individual entrepreneurs are required to report to government regulatory authorities. Based on clause 3 of Art. 40 No. 14-FZ, only the director of the company has the right to represent interests and make transactions on behalf of the company. Consequently, submitting reports to the tax and other departments is also his responsibility. What if the provision of documents to the departments is not carried out by the head of the enterprise, but by an authorized representative (employee). In such cases, a power of attorney is created to send information.

Let's consider what kind of power of attorney is needed to submit reports to the tax and statistical services, pension and insurance funds, as well as the procedure for preparing these documents.

Who and how can submit reports by proxy

The organization has the right to submit and sign completed reporting forms to:

- legal representative - general director, founder;

- authorized representative - a responsible person of the company, director, chief or staff accountant.

An individual entrepreneur or a third-party organization that performs relevant services under a contract can also represent the interests of the company. In this case, the sent documents indicate the name of such company, details confirming authority, full name. employee responsible for certification of information on behalf of the taxpayer organization.

Each page of the document contains a signature and date of preparation, if such a filling procedure is provided for by law. The absence of a stamp on paper declarations is not a reason for refusal of admission.

Reporting that is transmitted via telecommunication channels (TCC) through EDI operators must be signed with an enhanced qualified electronic signature (ECES). In this case, the authorized employee sends a copy of the power of attorney for the right to sign along with the electronic documents.

TKS is a system for presenting tax and accounting reports in electronic form.

You can purchase UKEP only from an accredited certifying agency that has all the necessary licenses to issue “Astral-ET” and “1C-ETP”. This product makes electronic documents legally significant, allows you to sign documents in EDI services and reports for government services.

What is an electronic signature

An electronic signature (ES) is used in electronic document management, guaranteeing data security. She signs digital text documents, images, declarations, etc.

There are three types of EP:

- Simple (SEP) . Consists of a login and password, suitable for authorization on the site or exchange of documents with individuals. For example, a simple electronic signature is used for authorization on the State Services website.

- Unskilled (NEP) . Stored on storage media (usually a flash drive), protected by additional encryption tools. Previously, it was used in electronic trading.

- Qualified (KEP) . Can only be created by an accredited certification center and allows you to sign any documents. It is issued using specialized cryptographic encryption technologies, excluding any changes to the information.

Most often, to work in electronic document management systems, it is necessary to issue a CEP.

Sign and exchange documents online in Diadoc

Send a request

According to the law of the Russian Federation, documents signed with an electronic signature have the same legal force as those certified by hand.

Power of attorney to submit reports to the Federal Tax Service

A person who represents the interests of the company has the right to submit declarations to the Federal Tax Service for the taxpayer on the basis of Art. 29 of the Tax Code of the Russian Federation. An authorized representative can be an individual, an organization or an individual entrepreneur. In all cases, you will need to submit a power of attorney to submit reports to the tax office. Some types of such documents are certified by a notary or a person authorized to do so.

Below are samples of powers of attorney and the procedure for filling them out for each authorized representative of the company.

Power of attorney for organization

If the submission of reports to the tax authority is carried out by a third-party organization, then the power of attorney of the authorized representative is signed by the head of the company or his deputy. There is no need to stamp or notarize such a document.

It indicates an authorized person of a third-party company who has the right to sign.

Sample power of attorney for an organization

Power of attorney for an authorized employee

Such a power of attorney is issued in the case when the chief or staff accountant submits reports to the Federal Tax Service. The document contains information on behalf of the head of the enterprise about vesting the relevant powers in the responsible employee.

Sample power of attorney for an authorized employee

Power of attorney for individual entrepreneurs

When the tax reporting of an individual entrepreneur is submitted to the Federal Tax Service by another individual entrepreneur, the power of attorney is certified by a notary.

Sample power of attorney for individual entrepreneurs

Electronic power of attorney

The tax report and the power of attorney for its provision are issued in digital form. This method does not require notarization. A copy of the document confirming the authority of the representative is attached to the declaration. The duplicate is signed by the principal's UKEP and sent via TKS.

The draft electronic power of attorney format is posted on the Federal portal of legal acts. The regulatory legal act was developed by the Federal Tax Service and at the time of publication is at the analysis stage. The tax service will soon provide a sample of this document.

The revised unified requirements for electronic power of attorney are also posted on the regulatory legal acts portal. According to the project, the document is drawn up as follows:

- in XML format;

- sign the UKEP in the XMLDSIG format or in the format approved by order of the Ministry of Digital Development dated September 14, 2020 No. 472;

- in pdf format, if the information system does not implement the possibility of automated processing and visualization of document data;

- confirm the principal's UKEP.

Resource “Power of Attorney” in the Federal Tax Service

In order not to provide a power of attorney to submit reports to the tax office with each report, the Federal Tax Service has developed a special data storage system. The information resource “Power of Attorney” is an electronic database of documents that stores information about representatives authorized to provide declarations.

A power of attorney is drawn up and submitted to the tax office. The document is created on paper or in the form of an electronic file, signed by the principal’s UKEP. The text indicates the mandatory details approved by Appendix 2 of the Federal Tax Service order No. ММВ-7-6/200 dated 04/23/2010.

The department employee enters the power of attorney into the database. The submitted information is stored by the tax office for three years. After this, the authorized employee, together with the tax reporting, sends an information message indicating the previously submitted details of the power of attorney.

A submitted power of attorney can be revoked. The application is made in any form. The communication of the revocation is carried out in the same ways as the submission of a document granting authority.

If an organization changes its name or director, then the power of attorney does not need to be revoked.

Where can I download an order for the right to sign primary documents - sample

You can download a sample order for the right to sign on our portal.

ConsultantPlus experts told how tax authorities check signatures in primary documents during an audit and how to properly prepare for a tax audit. Study the material by getting trial access to the K+ system for free.

Power of attorney for submitting reports to the Pension Fund of Russia

In accordance with Art. 11 No. 27-FZ, companies submit to the Pension Fund information about insurance premiums and insurance experience of employees, as well as about other persons to whom they paid income. Without confirmation of authority, submission of reports to the Pension Fund of the Russian Federation is carried out only by the legal representative of the organization - its head.

Individuals provide information to the Pension Fund as an employee of an organization, a third party, or another legal entity, having a standard power of attorney. Such a document is created in writing. It is signed by the head of the organization. It indicates the date of issue and validity period of the power of attorney. If the expiration date of the document is not specified, then it is used for one year.

If the submission of reports to the Pension Fund of Russia is carried out on behalf of an individual, then such a power of attorney is certified by a notary.

A standard form of the policyholder's power of attorney for the right to represent the interests of the principal in the territorial pension authority is posted on the PFR website.

How to carry out electronic document transfer between the policyholder and the Pension Fund of Russia can be found in the section “Information for residents of the region”.

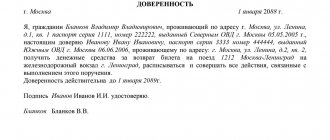

Power of attorney to the Pension Fund (sample)

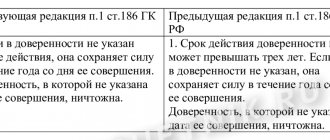

Duration of power of attorney

Each trust form has a limiting period of legal capacity. It is customary to indicate the validity period of the trust certificate at the end of the trust text. The maximum period of legal capacity is three years. If this period is exceeded, the trust automatically becomes ineffective. In some cases, this period is not reflected in the text, therefore, according to the civil code of the Russian Federation, the trust document will retain its legal force for one year.

However, in addition to the expiration of the period specified directly in the document itself, the trust document may interrupt its properties for other reasons. These include:

- early revocation of the power of attorney by the witness;

- refusal of the attorney to act on this document;

- death of the principal, his incapacity or limited legal capacity, or is considered missing;

- death of the attorney, his incapacity or limited legal capacity, or is considered missing.

Power of attorney to submit reports to the Social Insurance Fund

A power of attorney for the Social Insurance Fund gives the representative the right not only to submit reports, but also to receive various documents: certificates, requests, applications, reconciliations of payment orders, payments of insurance premiums, etc. It can be drawn up by a lawyer or company secretary, and only the manager can agree and sign it.

The principal draws up a document giving the right to act as a representative in the Social Insurance Fund on behalf of the organization, without restrictions, or vests the document with part of the powers. In the second case, a power of attorney is created:

- one-time - to perform a specific function;

- special - limited in time for use.

If the validity period of the document is not specified, the power of attorney for the Social Insurance Fund can be used for one year and renewed if necessary.

A power of attorney is drawn up for any employee over eighteen years of age. Only that copy of the document that is drawn up taking into account the right of delegation is notarized.

The state does not establish a specific format for the power of attorney form for the Social Insurance Fund; it is drawn up in free form, which is prescribed in the accounting policy of the organization. This can be an A4 sheet or company letterhead.

The power of attorney for the Social Insurance Fund is drawn up in a single copy and must necessarily contain the following:

- registration address of the organization and date of drawing up the form;

- text indicating that this power of attorney was drawn up for the Social Insurance Fund;

- information about the trustor company:

- Name;

- Full name and position of the manager or deputy;

- Full name and position of the authorized employee;

- details of the identity document of the authorized employee;

It is not necessary to stamp the document.

If the power of attorney needs to be revoked, the principal notifies the FSS of the termination of the document.

Power of attorney to the Social Insurance Fund (sample blank form)

Power of attorney to submit reports to the Social Insurance Fund (sample of filling out the form)

Can a legal entity issue a power of attorney with the right of substitution?

Let's first understand the terms.

A power of attorney with the right of substitution is a document issued by the principal to the representative, giving the latter certain powers that he exercises on behalf of the principal.

A power of attorney by way of subrogation is issued by a representative of the principal, who transfers his powers further down the chain.

A legal entity has the full right to issue a power of attorney both with and without the right of subrogation - the legislation does not contain restrictions in this regard.

The rules on transfer of trust are prescribed in Art. 187 Civil Code of the Russian Federation. By default, the actions specified in the power of attorney can only be performed by the representative who appears in the document.

However, if the power of attorney states that the original representative has the right to transfer (delegate) his powers to another person, this is permissible.

It does not matter who issued the power of attorney - an individual or a legal entity.