Category updated: July 19, 2021

Mitrofanova SvetlanaLawyer. Work experience - 15 years

Hello. In this section, I will talk about such a transaction as the donation of a land plot, how it is formalized, what the conditions, features and taxes are. Here I am talking about a transaction with a “bare” plot without buildings or with buildings, but which are not registered as property. If you need to find out about donating a plot along with a house, I have a separate article on this topic.

The donor is the one who donates the land. The donee is the one who accepts the gift (Clause 1, Article 572 of the Civil Code of the Russian Federation).

How to give

I have published detailed instructions at this link. It doesn’t matter to whom (a relative or non-relative) and what kind of land is being donated (individual housing construction, private household plots, garden, country house, vegetable garden, etc.) - the article is suitable for all donors.

In short, there are 2 steps to take. The first step is to collect documents and draw up a gift deed.

Collection of documents

A complete list of documents and certificates -. There I divided them into mandatory and optional.

Land donation agreement

Follow this link to find samples and contract forms. She also told me how to compose it correctly (plus examples of text), which points do not need to be written in it, how many copies to make, when to sign, etc.

Where to submit documents

The second step is submitting documents for registration to the MFC “My Documents” or the Registration Chamber (if there is no MFC in the locality). Based on the submitted gift agreement, the transfer of ownership from the current owners (donors) to the donees will be registered. The state duty is 350 rubles (clauses 24 and 25, clause 1, article 333.33 of the Tax Code of the Russian Federation). According to paragraphs. 1 and 2 paragraphs 1 art. 16 of the Federal Law of July 13, 2015 N 218-FZ, the maximum registration period is 9 working days when applying to the MFC and 7 working days when applying directly to the Registration Chamber. All participants will be given their own copy of the agreement marked with state registration. The recipients will be given an extract from the Unified State Register for the plot, in which they will be indicated as the new owners. In section No. 2 in the line “Copyright holder” their full name will be written.

About giving to a relative

A gift transaction between relatives is no different from the most ordinary transaction. Everything is done in the same way as in the case where the donors and recipients are strangers to each other. There is no need to indicate the relationship in the contract and there is no need to bring documents on the relationship to the transaction.

About donating to minor children

In the gift agreement, you must indicate the representative of the child-donee - one of the parents, guardian or trustee Art. 26 and art. 28 Civil Code of the Russian Federation. If a child is given a plot of land by one of the parents and the spouses are married, we indicate the second parent as the child’s representative under the contract. When a plot is donated by both parents, either of them can be a representative of the child. If the spouses are divorced or there is no second parent (died, not indicated on the birth certificate, etc.), the first parent can be both the donor and the representative of his child-done - letter of the Federal Tax Service dated June 21, 2021 N 2664/06 -08. When a child is given a plot of land, for example, by a grandfather, his representative may be one of his parents (guardian). Better mother.

For a child under 14 years of age, the contract is signed by his representative specified in the contract - Art. 28 Civil Code of the Russian Federation. The presence of the child is not required anywhere. A child from 14 to 18 years old signs the contract himself + his representative signs as consent - Art. 26 Civil Code of the Russian Federation. Then both submit the agreement for registration.

The Cadastral Chamber explained how to properly donate apartments and houses

“Giving real estate as a gift - legally this means transferring the rights to it to another person free of charge. But a verbal promise to donate an apartment or a house does not carry any legal force or legal consequences. Only a gift agreement signed by the donor and the donee and the transfer of ownership registered on the basis of it at the rights registration authority indicates that the donee has received such a large gift of ownership,” the Cadastral Chamber emphasizes.

But you can only give real estate during your lifetime. As experts note, an agreement providing for the transfer of real estate to the donee after the death of the donor is void, and state registration of the transfer of ownership under such an agreement will be denied. The parties to a gift agreement may or may not be related.

If the donor and the donee are family members or close relatives: spouses, parents and children, including adoptive parents and adopted children, grandparents, grandchildren, brothers and sisters, then the property transferred as a gift is not subject to any taxes. If the property is received as a gift by someone other than a close relative, then by law he will have to pay income tax in the amount of 13% of the cadastral value of the property.

The subject of a gift agreement can be either a real estate object directly owned by the donor, or a property right, for example, a right of claim under an agreement for participation in shared construction.

You can give real estate only from the bottom of your heart, without demanding anything in return. The donor does not receive any benefit from the transaction. “If the transfer of rights to real estate under a gift agreement occurs under the condition of a counter transfer of a thing or right or a counter obligation, then such an agreement is not recognized as a gift, and the transaction is a sham,” explains the Cadastral Chamber.

The exception is those cases when the gift agreement is drawn up with an encumbrance and provides, for example, the right of the donor to live in the housing donated by him.

Who cannot donate their house, apartment, cottage or land?

Real estate cannot be given to certain people. Thus, legal representatives of minors and citizens declared incompetent are prohibited from donating real estate to their wards.

Citizens and their relatives undergoing treatment, maintenance and upbringing in medical, educational, and social service organizations, including for orphans and children without parental care, are not allowed to alienate their property as a gift to employees of these organizations.

Who can't give real estate to?

It is not permitted to donate real estate to persons holding government positions, municipal positions, civil servants, municipal employees, employees of the Bank of Russia in connection with their official position or in connection with the performance of their official duties.

Commercial organizations do not have the right to enter into gift transactions among themselves.

What documents are needed to complete a gift transaction?

The main document is a gift agreement, according to which the donor gratuitously transfers the rights to real estate to the donee, who, in turn, agrees to accept the property as a gift.

Mandatory certification of the transaction by a notary is not required, except in cases where a share of the right in common shared property is presented as a gift.

A gift agreement does not require state registration if it was concluded after March 1, 2013. Only the transfer of ownership of the donated real estate on the basis of such an agreement is subject to registration.

If the gift transaction is certified by a notary, the applicant can submit documents for registration through him.

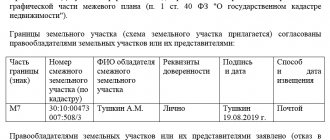

What documents are needed to register the transfer of ownership?

In order to donate real estate in compliance with all legal requirements, you will need:

- application for registration of property rights;

- documents confirming the identities of the parties to the agreement;

- a notarized power of attorney, if a third party acts on behalf of a party to the agreement;

- gift agreement;

- receipt of payment of the state fee (for individuals - 2000 rubles, if documents are submitted electronically - 1400 rubles)

You can submit an application for state registration of rights at the MFC or at the offices of the Cadastral Chamber, or you can also use the electronic service on the Rosreestr website.

About taxes

Donors do not pay tax, because... they transfer their plot to the donee without demanding anything in return. At the same time, they do not receive any income, and since there is no income, there is no tax.

If the donee received the plot from a close relative, there is no need to pay tax. If he did not receive it from a close relative, he must pay personal income tax in the amount of 13% of the cadastral value of the plot or share in it - clause 1 of Art. 224 of the Tax Code of the Russian Federation and clause 6 of Art. 214.10 Tax Code of the Russian Federation. For non-residents of the Russian Federation, the rate is increased - 30% percent (clause 3 of Article 224 of the Tax Code of the Russian Federation). For minor recipients, personal income tax is paid by their parents (guardian/trustee) - clause 2 of Art. 27 of the Tax Code of the Russian Federation.

Find out the cadastral value of land on the Rosreestr website - instructions with pictures.

For example, the cadastral value of a plot is 750 thousand rubles. This means the personal income tax will be 750 thousand * 13% = 97,500 rubles.

After registering the transaction, you must submit a tax return by April 30 of the following year. You must pay the tax by July 15, otherwise there will be fines and penalties.

For example, the plot was donated in 2021. This means that the donee must submit a declaration by April 30, 2021, and pay personal income tax by July 15, 2021. There will be fines and penalties even if they did not know about the tax or did not receive any notifications from the tax office.

The difference when donating a plot of land between relatives and strangers

The recipient, who has become the rightful owner of the land, pays the Tax Service for the gift. The amount of the fee is calculated based on the cadastral value. It is almost no different from the price established on the real estate market and must be indicated in the contract signed by the parties. Its preparation when donating to strangers is no different from an agreement concluded with close relatives.

Non-payment of tax when a plot is transferred to the ownership of another family member is a benefit provided by the country's leadership.

Close relatives include:

- grandparents and parents of the taxpayer;

- adopted and natural children;

- spouses and blood brothers and sisters.

Although a child who has not reached the age of majority cannot independently make such expensive gifts, the law does not prohibit accepting land as a gift. However, the only condition must be met - the plot is registered in the name of a trusted person.

Usually this:

- guardians;

- parents;

- guardianship workers.

Such a transaction is possible after children reach 14 years of age. It is from this age that they sign business papers on their own. In this case, the child’s representative notes his consent in the contract.

Formally, he is considered the owner of the donated land, but only for the period until the teenager reaches adulthood.

Despite this, the law prohibits him from:

- sell or rent land to tenants;

- donate or exchange it for another plot.

The land is transferred to the ownership of the child after he turns 18 years old. He has the right to dispose of it as he wishes.

Agreement of gift and exchange: comparison

Let's look at the characteristics of DM and DD in comparison:

| Gift deed | Mena |

| Free deal | Compensatory deal |

| Obligations arise from one party - the donor | Obligations apply to both parties |

| There is a ban on gifts between commercial enterprises and to other persons. | There are no prohibitions or restrictions. But you cannot dispose of the property of children under 14 years of age without the consent of the guardianship authorities |

| Donees who are not close relatives are obliged to pay personal income tax when receiving a gift | If there is no profit, there is no taxation |

| You cannot get a property tax deduction | A tax deduction is provided for additional payments for real estate |

Challenging an agreement of exchange or gift

The deed of gift is disputed on the grounds provided for in Art. 578 Civil Code of the Russian Federation:

- The death of the donor occurred as a result of the guilty actions of the donee (disputed by the heirs);

- The new owner committed a crime against the health of the donor and his relatives;

- The donor issued a DD within six months after declaring himself bankrupt, and the gift was purchased with money from the business (disputed by creditors);

- The deed of gift provides for revocation by the donor in the event of the death of the donee before him.

There are other conditions for canceling exchange and donation.

For example, if an agreement is drawn up for the purpose of covering up another transaction, it may be considered sham (Article 170 of the Civil Code of the Russian Federation). Agreements drawn up under the influence of misconception or unlawful influence from other participants or third parties are also disputed; issued by incapacitated or partially capable citizens.

Form and content of the exchange agreement

The provisions of Art. 159-160 Civil Code of the Russian Federation. If there is no mandatory notarial form or registration of ownership, the transaction can be completed orally at the request of the parties.

Written form is required if:

- The value of the property exceeds 10,000 rubles;

- The transaction is carried out between legal entities and individuals;

- Consent to the procedure from a third party is required;

- An attorney participates in the procedure under a power of attorney.

Important! If the DM requires notarization, the power of attorney for the representative is also certified.

Sample exchange agreement

If there is an exchange of real estate, the contract must contain comprehensive information about the transaction:

- Date and place of imprisonment;

- Full name, passport details of the parties;

- Information about real estate: addresses, area, cadastral numbers, number of rooms, dates of construction;

- Information about additional payment (if the exchange is unequal);

- Conditions for amendment and termination;

- Responsibilities, duties and rights of the buyer and seller;

- Information about encumbrances (if any);

- Dates of ownership;

- Allocation of expenses;

- Signatures of the parties.

Sample agreement for the exchange of real estate: alt: Agreement for the exchange of equivalent apartments

Pros and cons of an exchange agreement

The advantages of DM are the speed of execution of the transaction: the parties only need to agree on the terms, sign the document and exchange property. If the exchanged item is confiscated from the buyer or seller by a third party, you can demand compensation for losses from the second participant in the procedure.

If the DM is declared invalid, but the property is lost, the party pays equal compensation to the second participant.

One of the disadvantages is that you cannot transfer the right to claim a debt or repay a debt under a DM, as with a gift. In addition, if citizens agree to an unequal exchange, they will have to indicate a deliberately false value in the contract, and the transaction may be declared invalid.