While in a registered marriage, one of the spouses registers the acquired apartment as their property. What pitfalls can await him during a possible division of property? How can legislation protect his interests and the interests of other family members? We will tell you about the most important points that every owner should know in this material.

Registration of purchased real estate

There are different ways to purchase real estate during marriage:

- for one of the spouses;

- into joint ownership without allocating a specific share to each;

- with the allocation of shares - in equal proportions or divided by agreement of the spouses according to the invested funds.

While the family lives in marriage, these moments do not play a big role. But if it comes to divorce and division of acquired property, the principle of registration of property will play a decisive role. How will property issues be resolved in the event of a family breakdown?

Important! Let’s make a reservation right away that we are talking about real estate acquired during marriage. If the apartment was owned by one of the spouses before the marriage, it is considered premarital property and is not subject to division under any circumstances. estate received as a gift or inherited, regardless of the time of its receipt, during marriage or earlier, is also not considered joint property

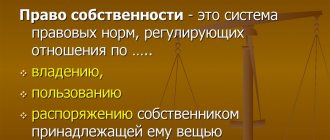

Disposal of the right to sell a share

Co-owners of real estate can alienate their home at any time in any convenient way: sell, donate, exchange. The procedure for re-registering housing in the name of another person will differ slightly depending on the principle on which the shares of property are distributed between co-owners.

For example, if the property is owned by joint ownership, in which shares were not allocated, then the sale will be carried out on behalf of all co-owners at the same time. That is, you can transfer entire property. In this case, all participants will act as sellers. Each of them will have to express their consent to the deal and sign the agreement. This rule follows from the provisions of Art. 253 Civil Code.

If a transaction is carried out by one co-owner without the consent of the others, it may be declared invalid.

If parts of the property right are allocated for each owner, then there should be no problems during the sale. A participant in shared ownership has the right to dispose of his share as he pleases. He can sell, give as a gift, inheritance, lease or pledge his part.

It is worth paying attention to such a moment as the sale of a certain share of the apartment by one of the co-owners. The fact is that it is possible to sell your share to absolutely anyone, but subject to certain conditions :

- The share must be clearly defined (1/2, 1/3, etc.);

- The pre-emption rule must be followed.

Registration of an apartment for one of the spouses

Most often, the purchase of an apartment or house is registered in the name of one of the family members, the husband or wife. The reason is a simpler registration process (there is no need for both spouses to complete all the necessary formalities).

Regardless of whose income was the source of funds for the purchase of housing, it will be joint property if acquired during a legal marriage. It should be taken into account that when registering with Rosreestr, you will have to provide a document confirming the consent of the second spouse to purchase living space.

Important! Such a document will not be required only when registering real estate when:

- the apartment is purchased as shared ownership;

- there is a marriage contract, which spells out in detail in what situations and how spouses have the right to dispose of property;

- There is a power of attorney from the second spouse to draw up a purchase and sale agreement.

You can obtain permission from your husband (wife) to purchase an apartment in advance. In this case, two options for such a document are allowed:

- indicating the specific housing (address, other technical data);

- consent to purchase real estate without specifying the object.

Consent from the spouse must be certified by a notary. This is done in order to protect the seller from terminating the transaction through the court if the buyer’s husband (or wife) wants to challenge the purchase and sale agreement and seek a refund.

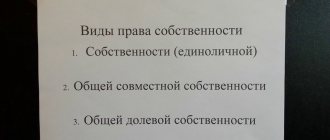

Individual (personal, full) ownership of the apartment

This is the case when the apartment is solely owned by one person. He also manages it. It is indicated in the Title or in the Unified State Register of Real Estate for the apartment.

True, this does not exclude the existence of other rights (for example, the right to use) by third parties (members of his family, for example). Such characters have nothing to do with property and do not affect the disposal of real estate, but actually create an encumbrance (in the form of their right of residence) when selling an apartment.

In addition, if the only owner indicated in the Title/Extract of the Unified State Register is married, then the apartment can also be owned by his spouse under the right of “joint property of spouses.”

!!! Online order Extracts from the Unified State Register and other SERVICES for purchasing an apartment - HERE.

Who are “third parties” in real estate transactions? What rights do they have? Which of them can challenge the completed transaction?

Features of dividing an apartment purchased during marriage

An apartment purchased during marriage can be registered to one owner. However, you need to remember that registering property rights for only one spouse has its pitfalls. We are talking about the possible division of jointly acquired property.

This situation most often arises in the process of divorce, but even if the family is preserved, it is quite likely that the second spouse will want to secure his right to real estate. And it is not at all necessary that the apartment or house will be divided equally.

If the spouses fail to reach an agreement through negotiations, the size of each share will be determined by the court. The interests of minor children, the existence of a marriage contract and other legally established nuances will be taken into account.

However, an owner who bought real estate while married and registered ownership only in his own name, in certain cases may well claim its indivisibility. There are several reasons for this decision.

Housing was purchased with money inherited or donated by a relative

In such a situation, you will need to take care of two things:

- record the fact of donation by agreement with a notary or make copies of documents on bank transfer of funds from the donor to the recipient. In an inheritance situation, you will need an appropriate notarial certificate;

- record the fact of transfer of funds for the purchased housing from the buyer’s personal account.

If the apartment was purchased in cash, you must have a document confirming the origin of the amount spent on the purchase. This will help subsequently prove that the purchased housing was, in fact, given to one of the spouses and the second cannot claim a share in it.

The apartment was purchased entirely with the owner’s income

The fact that the second spouse is fully supported by the owner of the property without good reason may result in the housing purchased during the marriage going to the person who purchased it.

It should be borne in mind that the court may recognize the following as valid reasons for lack of income:

- the need to care for a sick relative, confirmed by a doctor’s conclusion (certificate of disability);

- the presence of minor children who are being raised by a non-working spouse;

- a serious illness that does not allow the second spouse to work and earn their own income.

Disposal of property and judicial practice in “equity cases”

Legal advice

In accordance with the law, each shareholder can dispose of his part of the property with the full right of the owner. However, it is worth understanding that he is also burdened by certain terms of the agreement with other shareholders, or by a court decision.

Disposal and ownership are practically interchangeable concepts, therefore the owner must dispose of his share only in compliance with previously agreed conditions and without violating the rights of the other owners.

Considering that shared ownership is in fact common property, before carrying out any significant actions on it, it is important to consult with the other shared owners (Article 246 of the Civil Code of the Russian Federation).

Judicial practice in so-called equity cases is widespread in Russia. When considering such situations, the judiciary uses all the legislative provisions presented above. At the end of the article, our resource will present you with a typical situation regarding a “share business”:

Divorced spouses Vasily Ivanov and Alla Baklashkina decided to divide their 3-room apartment (75 sq.m.) into shares. Since the only daughter of the former spouses, 13 years old, remained with her mother, citizen Baklashkina and her minor child were allocated most of the apartment (50 sq.m.), that is, 2/3 of the property. At the request of citizen Ivanov and citizen Baklashkina, the court determined the procedure for using the apartment, which all shareholders must adhere to.

In general, determining the procedure for allocating and using shares of an apartment between its owners is a rather complex undertaking, which often requires an appeal to a judicial authority. The resolution of all controversial issues in “share cases” is primarily carried out on the basis of Chapter 16 of the Civil Code of the Russian Federation, therefore, for an understanding of the general essence of shared ownership of property, refer to it.

You can learn more about shared ownership by watching the video:

See also Phone numbers for consultation Jan 08, 2021 kasjanenko 1225

Share this post

Discussion: 5 comments

- Nina Nikolaevna says:

03/15/2019 at 21:33Hello. I am the owner of 1/2 share in a 2-room apartment. Recently, the previous owner of 1/2 of the other share sold it to another owner. I, my husband and adult daughter, have been living for 3.5 years in a room of 18 sq.m., and the new owner, a man, has a room of 11 sq.m. He said that he wants to receive compensation for the missing meters of living space. How is such compensation calculated, in what amounts and within what time frame is it paid by me to the other owner. How can the issue of payment be resolved if I don’t work? What mandatory amount will I have to pay him? From a conversation with him, I learned that he is not officially married, but has two children from two different women. He can register both children without my consent, can he register the child’s mother in his living space without my consent, if the relationship is not formalized, but the child must live with the mother? What if it’s made official? Can I be forced to give him my room if more people are registered with him, although the second child from another woman will only be registered? What if the second family is only registered, but will not live? My phone number, if needed, is 889638810665. I’m really looking forward to your answer.

Answer

- Galina says:

11/10/2020 at 00:15

In some situations, when relatives quarrel, it is better to sell the share. If you can’t sell it, then you can rent out the premises, but do you need to get permission from the other shareholders?

Answer

- Zhanna says:

11/10/2020 at 12:55

You can rent out if you have a separate personal account, but also try to find tenants for such an apartment. Few people will agree to this, and the money will be ridiculous. In such a situation, it is better to negotiate humanly, but as for the payment of money, everything is complicated here, there are cases when relatives ask for millions for an insignificant share, realizing that the second shareholder cannot do anything.

Answer

- Katya says:

11.11.2020 at 01:29

As far as I know, through the court it is possible to recognize a share as insignificant if it is really small in the apartment, and then it will be possible to voluntarily and compulsorily pay money for this share. Is this true or is it actually impossible?

Answer

- Natasha says:

11/14/2020 at 00:13

It seems to me that a room in a dorm is better than a share in a communal apartment, but this is purely my opinion, which may be very erroneous and incorrect, studios now also cost a lot of money.

Answer

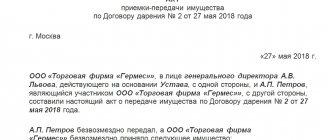

Association by donation method

Combining several shares into a single whole is also possible by registering a deed of gift, this is especially true if the share owners are close relatives. If there is a relationship between the co-owners in the first place, such registration of the transfer of shares into the ownership of one owner is the most profitable option for concluding a transaction. Since relatives (first priority) who have drawn up a deed of gift among themselves are exempt from a significant tax fee - payment of personal income tax.

Personal income tax is not payable if the participants in such a transaction are persons whose family relations are confirmed by the first degree of relationship (Article 217 of the Tax Code). They are:

- children, parents (adopted, adoptive parents or blood);

- brothers, sister (independently, both parents are natural or one of them is common, i.e. half-brothers, sisters);

- spouses;

- as well as family ties between the first and third generations (i.e. grandparents and granddaughters, grandchildren).

Other categories of citizens receiving a share(s) as a gift should know that they will have to pay a certain amount from the gift received. Since this will be the income of an individual. The amount of the tax fee will depend on who the donee is:

- 13% of the amount donated as a share – if the donee is a resident of our country;

- 30% of the value of the share donated – if the recipient of the gift is a foreigner (non-resident).

Even when receiving only part of the real estate as a gift (share under gift), the acquirer is obliged to indicate this in the declaration. Its cost will be calculated by independent cadastral service specialists. And the tax service, when calculating the fee, will proceed precisely from these data.

Providing information on the cost of housing (share) is received by the tax office through electronic communication between government agencies and the information provided by the owner. So, if the citizen who received this property as a gift does not agree with the amount of tax payment, he has the right to file a claim to revise the amount of the tax contribution.

Since a deed of gift for a share of living space is an alienation transaction, it is also subject to mandatory notarization.

Form of share donation agreement

FOR FREE

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

Life situations are different, and it may happen that in an apartment where the property was shared, there remains only one owner. In such a situation, many legitimate questions arise: what to do now with the remaining shares, I automatically become the sole owner, can I dispose of them at my discretion, is it possible to legally combine them, and how to formalize all this.

To do this, it is necessary to go through a step-by-step procedure for re-registration of shared ownership into full-fledged sole ownership, by registering real estate in a general manner, observing certain nuances.

Where to contact

Rosreestr is authorized to register the merger of shares. The owner has the right to contact this department in various ways:

- personally hand over the package of documents to the department official;

- send an authorized person there (in this case, his passport and power of attorney from the equity holder must be added to the package of documents);

- personally or through a representative submit an application and papers through the MFC;

- act remotely - through the State Services portal;

- send all documents by mail.

Rosreestr employees must register within three working days. If the owner or his authorized representative submitted documents to the multifunctional center, the period is increased to five days.

Save and share information on social networks:

- A 2-room merger application form is required. apartments - one whole and allotment of shares.

- I need a form Agreement on merger and establishment of shares.

- Tell me, how can I merge shares in an apartment through the court?

- Consolidation of ownership shares

Is it possible to apply for a child?

The child, of course, can be the full owner. The registration procedure depends on his age:

- up to 14 years of age, parents decide all registration issues on his behalf;

- from 14 to 18 years of age, the minor signs independently, but written permission from the parents is required.

The procedure for registering an apartment depends on where it was purchased: on the primary or secondary market. It is not recommended to delay this procedure, because the lack of ownership rights entails not only certain risks, but also the impossibility of full use and disposal of housing at your own discretion.