According to the Labor Code of the Russian Federation, the indexation procedure is passed down to government institutions through regulations, and in commercial enterprises it is prescribed in internal regulations - Rostrud also points out this responsibility (Letter dated April 19, 2010 No. 1073-6-1).

A commercial organization independently chooses where to prescribe the conditions for indexing employee salaries. This may be a separate Regulation on the organization or a section of a collective or employment agreement. In any case, the document must contain:

— frequency of the indexing procedure;

— part of the salary that is subject to indexation;

— value or indexation coefficient.

In letter No. 14-1/OOG-10305, the Ministry of Labor indicated that indexation is an increase in wages at the rate of inflation. At the same time, the employer has the right to increase wages by an amount above inflation for certain categories of employees at his own request. Salaries can be increased by a proportional increase in all payments to the employee, or by increasing individual ones.

The indexation period must be determined in the collective agreement. We recommend not setting a deadline earlier than February 1, since it is by this date that Rosstat publishes the inflation rate for the past year. If you fixed the increase date as February 1, then for February employees should already receive an increased salary. This amount remains until February 1 of the next year, when the next indexation will occur.

Indexation is formalized by order of the manager. Employees are familiarized with this order against signature. Information about remuneration for labor is an essential condition of the employment contract (EA), therefore, when changing the salary amount, additional agreements to the EA must be concluded with employees. The manager also issues an order to make changes to the organization’s staffing table.

Indexation is reflected in all employees and is taken into account when calculating average earnings for calculating vacation pay. In this case, the increasing coefficient is calculated in one of the following ways:

- if only salaries were indexed: new salary / salary before indexation;

- if all components of the remuneration system were indexed: (new salary + new payments) / (salary before indexation + previous payments).

Conclusion: commercial enterprises and individual entrepreneurs prescribe in the collective or employment agreement the frequency of indexation, the amount of indexation and the part of the salary for indexation (salary or other payments). It is better to index salaries after February 1, when Rosstat announces the inflation rate for the year.

What is wage indexation

Wage indexation is a periodic increase in wages caused by rising consumer prices for goods and services. By its legal nature, this is a state guarantee of wages for workers (Determination of the Constitutional Court of the Russian Federation dated May 29, 2019 No. 1269-O).

Government agencies, municipalities, state and municipal institutions produce it in accordance with regulatory legal acts (Article 134 of the Labor Code of the Russian Federation).

Thus, from 10/01/2020, the salaries of public sector employees were indexed by 3% (Order of the Government of the Russian Federation dated 09/04/2020 No. 2250-r, clause 1 of the Government of the Russian Federation dated 01/08/2020 No. 1153). The federal budget for 2021 provides funds in the form of subsidies in order to partially compensate for additional costs of increasing wages for public sector workers to the budgets of constituent entities of the Russian Federation (Table 158 of Appendix 33 to the Law “On the Federal Budget for 2021 and for the planning period of 2022 and 2023” " dated December 8, 2020 No. 385-FZ).

Indexation of wages can also be carried out at the expense of the regional budget.

Thus, from 01/01/2021, employees of state government, budgetary and autonomous institutions of the city of Moscow, who are not subject to the provisions of the decrees of the President of the Russian Federation regarding the implementation of measures to bring wages to the appropriate level, have increased their salaries by 3.7% due to budgetary allocations capital (clauses 1, 2.2 of the Decree of the Moscow City Government dated December 25, 2020 No. 2378-PP).

The indexation procedure may also be regulated by industry agreements. In this case, it applies to employees of those institutions to which industry agreements apply (Articles 45, 48 of the Labor Code of the Russian Federation).

For employees not employed in the public sector, wages are indexed in the manner established by the collective, labor agreement, or local regulations of the organization.

The employer, depending on the specific circumstances, the specifics of its activities and the level of solvency, has the right to determine the frequency of indexation, the procedure for calculating its value, and the list of payments subject to indexation.

The provisions on wage indexation established in the organization are mandatory for the employer and apply to all employees.

Inflation-indexation spiral

As a result of inflation, prices rise and the entrepreneur raises wages. In turn, as prices increase, production costs also increase, that is, costs increase. To avoid loss, the manufacturer must raise the cost of its goods and services. Raising prices again means inflation.

In order to at least slightly reduce the rate of increase in this “spiral” , some restrictions are provided for the indexing mechanism.

Indexation is aimed at compensating not for any price jumps, but only for those associated with inflation. The rate and size of inflation is monitored at the state level; other factors of a market economy are less amenable to accounting and control.

Not any income is subject to indexation, but only those that are controlled and regulated by government bodies (wages, pensions, social benefits).

Additional protection is not needed for the income that the owners bring to their private property and business activities:

- Rental Property;

- trade in personal property;

- income from private farms and subsidiary plots;

- profit from other types of legal activities.

Owners and businessmen themselves regulate the level of costs and income by freely setting prices for their goods and services.

What is the difference between indexation and salary increases?

1. The wages of all employees of the enterprise are indexed (clause 2 of the Determination of the Constitutional Court of the Russian Federation dated November 19, 2015 No. 2618-O). And salary increases, as a rule, occur in relation to individual employees. It may be due, for example, to the fact that the employee has proven himself well, improved his skills, and increased his productivity.

2. Indexation means an increase in wages by a certain percentage established in a regulatory or local act, in a collective agreement and due to inflation. The decision on how much to increase an employee's salary is made by the company's CEO.

Documentation of salary increases

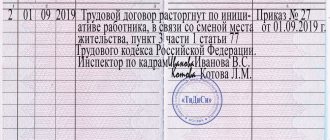

If a change in wages occurs due to a change in the employee’s position, the following documents are needed:

- Employment history. A record of transfer to another position is made in it.

- Staffing schedule. It reflects the changed salary and position.

- Order T-5 or T-5a on transfer.

- An additional agreement is a document clarifying the employment contract in terms of payments and a new position.

If the employee remains in the same position, the procedure is as follows:

- A memo is sent to the director with a request to increase pay for a specific employee. The initiative can come from both the employee himself and his immediate supervisor.

- After approval, an additional agreement is drawn up and signed by both parties.

- Order to increase wages.

- Adjustment of staffing.

Is the employer obliged to index wages?

The employer is obliged to ensure an increase in the level of real wages in connection with rising prices. Indexing is one way, but far from the only one. Instead, the employer has the right to periodically increase wages by raising salaries, paying bonuses, and so on (clause 10 of the Review of Judicial Practice No. 4, approved by the Presidium of the Supreme Court of the Russian Federation on November 15, 2017).

If the company’s internal documents stipulate the obligation to index salaries by a certain coefficient, then it must be observed. And the fulfillment of this responsibility will not be affected by the fact that the general director, by a single decision, increased the salaries of all employees.

For failure to carry out indexation, the company faces administrative liability under Art. 5.27 of the Administrative Code (letter of the Ministry of Labor of the Russian Federation dated December 26, 2017 No. 14-3/B-1135). In accordance with it, violation of labor legislation and other regulatory legal acts containing labor law norms entails a warning or the imposition of an administrative fine:

- for officials and individual entrepreneurs - from 1 to 5 thousand rubles;

- legal entities - from 30 to 50 thousand rubles.

Article 5.31 of the Code of Administrative Offenses provides that violation or failure by an employer to fulfill obligations under a collective agreement or agreement entails a warning or the imposition of an administrative fine in the amount of 3 to 5 thousand rubles.

LEGAL BASIS FOR INDEXING

The issue of wage indexation is regulated by the norms of the Labor Code of the Russian Federation:

• Article 22 - obliges the employer to comply with the provisions of labor legislation;

• Article 46 - indicates the possibility of including in the agreement obligations regarding wages, including the establishment of a procedure for wage indexation;

• Article 130 - establishes types of guarantees for the remuneration of workers, including measures to ensure an increase in the level of real wages;

• Article 134 - obliges the employer to index wages.

How to register wage indexation

Employers not related to the public sector must establish the indexation procedure in a local regulatory act or in a collective agreement.

The act that sets out the indexation procedure can be either a separate document (for example, a regulation on wage indexation) or an appendix to a collective agreement or a local act (for example, an appendix “The procedure for indexing wages” to a wage regulation).

When describing the indexing procedure in the document, it is necessary to fix:

1. Indexation frequency (every two years, once a year, once a quarter, and so on).

2. The procedure for determining the indexation value. The indexation coefficient can be calculated (review November 15, 2017, Appeal ruling of the Moscow City Court dated July 16, 2020 in case No. 33-12366/2020) based on:

- from the projected inflation rate in the country. This indicator can be found in the federal budget law for the next three years. For example, for 2021, inflation is planned at 3.7 percent (Clause 1, Article 1 of Law No. 385-FZ);

- the cost of living, determined for Russia as a whole or in a specific constituent entity of the Russian Federation;

Starting from 2021, the cost of living in the Russian Federation as a whole is set for the next year until July 1 of the current year. For the working-age population, the cost of living in 2021 is 12,702 rubles, in 2022 its size will increase to 13,026 rubles (Resolution of the Government of the Russian Federation of June 30, 2021 No. 1070). The cost of living per capita in a constituent entity of the Russian Federation for the next year is established by September 15 of the current year by the constituent entity of the Russian Federation, taking into account the coefficient of regional differentiation. For example, in the Moscow region, the cost of living for the working population in 2021 is 14,987 rubles, in 2022 - 15,394 rubles (Resolution of the Moscow Region Government dated August 24, 2021 No. 706/29);

- growth in consumer prices for goods and services. The consumer price index is officially established both for the country as a whole and for a specific region. It is published monthly by Rosstat and its territorial bodies.

In this case, the starting indicator (consumer price index, inflation) is not a mandatory value. The employer can choose another arbitrary value. The main thing is to take into account the rising cost of living.

3. List of payments subject to indexation (for example, only the salary can be indexed, while the amount of the bonus will remain unchanged or only a part of the salary equal to the regional minimum wage or other threshold will be indexed).

In no case should the document state that it does not apply to some employees. For example, the salaries of homeworkers or people working remotely are not indexed. This will be considered discrimination, for which the company will be held accountable.

An institution can carry out indexation depending on its economic indicators. To do this, you need to record in the document:

- the relationship between indexation and the financial performance of the company. For example, a local regulatory act should provide that the employer, depending on its solvency, carries out indexation by a coefficient that can change annually or quarterly by order of the manager;

- indexation coefficient in an amount not lower than the inflation rate.

For the absence of a document regulating the indexation procedure, the employer may be held administratively liable under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

In what order and by how much should salaries be increased in 2021?

Unlike government agencies and budgetary institutions, where wage indexation is carried out in accordance with federal legislation and departmental acts, commercial organizations have the right to independently determine the mechanism for wage indexation.

In organizations that do not receive budget funding, indexation and the specific procedure for its implementation may be established by a collective agreement, agreements or any other local regulations. For example, the provision on wage indexation.

The Labor Code of the Russian Federation does not impose any special requirements for the indexation mechanism. The labor legislation does not contain norms regulating the frequency of indexation, the specifics of its implementation at different enterprises, and also does not indicate a list of payments subject to indexation. All these aspects of the employer, which do not receive budget funding, are determined independently, based on their own financial capabilities and performance results.

An increase in wages can be carried out either by a proportional increase in all payments provided for by the organization’s remuneration system and the employees’ employment contract, or by increasing individual payments included in wages. The moment of indexation is also not regulated in any way, which allows the employer to carry it out both at the beginning and in the middle of the year.

As for the specific indexation value, it is also not regulated by labor legislation. There are no norms in the Labor Code of the Russian Federation establishing minimum values and frameworks that employers should follow when implementing wage indexation. The question of how to increase employee salaries next year is decided by the employer himself.

At the same time, the legislation does not require employers to increase employee salaries exactly at the level of the official inflation rate in the country. In Art. 134 of the Labor Code of the Russian Federation, inflation is mentioned only as a basis for wage indexation. At the same time, this norm does not contain the condition that when carrying out indexation, employers must be guided by official inflation. If the employer indexes salaries below the official inflation rate, this will not be considered a violation (determined by the St. Petersburg City Court dated January 30, 2017 No. 33-1934/2017).

But so that Rostrud inspectors do not have any complaints and do not have to defend their case in court, it is still better to increase wages by the amount of official inflation. Of course, if the employer has the appropriate financial capabilities. Now the Ministry of Labor proceeds from the fact that indexation is an increase in workers’ wages precisely by the level of inflation and no less (letter of the Ministry of Labor dated December 24, 2018 No. 14-1/OOG-10305).

How to apply for wage indexation

Indexation is processed in the following order.

1. We fix the procedure for indexing. It can be formulated as follows:

- salaries, hourly tariff rates and piece rates are subject to indexation;

- Additional payments, allowances and bonuses set in a fixed amount are not subject to indexation;

- the payments indicated above are indexed once a year by the indexation factor;

- the value of the indexation coefficient is calculated from the projected level of inflation in Russia for the current year.

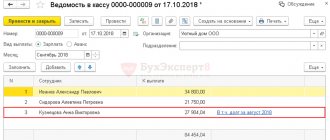

2. We issue an order to index wages. It must indicate the specific coefficient by which the salary will increase, as well as the date from which wages must be calculated in a new way. You should indicate the threshold amount for indexation if a local act provides for the establishment of such an amount by the head of the company. The order must be familiarized to employees against signature.

3. We make changes to employees’ employment contracts, since information on remuneration is an essential condition of the employment contract.

4. We make changes to the staffing table.

Indexing procedure

The rules for conducting and documenting salary indexation are not established by law. Thus, it is defined in the local regulations of the enterprise. Calculation and introduction of changes to personnel and other documentation occurs on the basis of the administrative document of the manager, while it is possible to take into account the opinion of the trade union body.

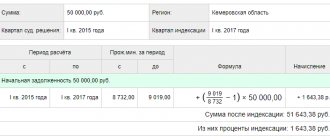

For example, the calculation of wage indexation for the year, if the consumer price index is taken as the main indicator, may look like this:

Total = salary x CPI,

Where:

The result is the amount of earnings after adjustment;

ZP – amount of earnings;

CPI is the consumer price index for the year, it is calculated as a percentage.

The initial data is earnings - 15,000 rubles, CPI - 102.1%.

Calculation:

Total = 15,0000 x 102.1% = 15,315 rubles.

What part of the salary should be indexed?

The employer has the right to establish the procedure for indexing wages independently. At his discretion, all components of the salary, as well as individual ones, for example, salary, can be indexed.

If a company indexes the salaries of its employees, then additional payments, allowances and compensations, calculated as a percentage of the salary, will be calculated automatically in new absolute values when calculating salaries. If additional payments (allowances, compensations) to the salary are set at a fixed amount, then they should also be indexed in order to prevent a decrease in the employee’s real level of income.

In 2021, the Prosecutor General’s Office may enter the game

You may receive a fine for not indexing your employees' salaries. This is the responsibility of every company (Article 134 of the Labor Code). The prosecutor’s office will now check whether the company indexes employees’ salaries (Order of the Prosecutor General’s Office dated March 15, 2020 No. 196). Previously, only labor inspectors were involved in this, but they are not able to control all companies - there are not enough people. To begin an investigation, prosecutors only need an employee’s statement that his salary is not being increased. If this information is confirmed, prosecutors will forward the information to labor inspectors. They will fine the company up to 50,000 rubles. (Part 1 of Article 5.27 of the Administrative Code). The draft order of the Prosecutor General is already undergoing anti-corruption examination. Therefore, it is worth specifying the indexing order now, if you have not already done so.

Delicate duty of the employer

The Labor Code contains norms that define possible and mandatory ways to improve people's living standards. Indexation of the minimum wage is one way. If an employee works in a company that is not financed by the state budget, then it is still necessary to carry out indexation, but on the basis of the following documents:

- internal company rules;

- collective agreement;

- agreements.

Remember that ensuring indexation is the direct responsibility of the employer! Moreover, it should immediately affect all employees of the enterprise. Regulatory provisions on wage indexation provide for its mandatory implementation in organizations not only of the budgetary, but also of the extra-budgetary sphere. The difference lies only in some procedural points.

Private firms and individual entrepreneurs themselves determine how to carry out indexation. This gives business owners the opportunity to take into account the interests of not only their subordinates, but also their own benefits.

Let's sum it up

- The employer is obliged to index the wages of all its employees.

- Expected indexation in 2021 will be 4.9%.

- Commercial companies independently develop indexing procedures.

- Discrimination during indexation is unacceptable.

- The fact of indexation in an organization is formalized by order of the manager, making changes to the staffing table, notifying employees, as well as signing additional agreements with them to employment contracts.

- It is the employer's right to increase wages.

- Lack of indexation both on paper in the company’s internal documents and in fact is punishable by substantial fines.

Where to get funds for indexation

How can regular salary increases be carried out in conditions of inflation? For this, there are official sources, different for certain areas of activity:

- budgets of different levels - for public sector workers;

- Pension Fund of the Russian Federation - for calculating pensions;

- Federal budget, social insurance funds - for social payments;

- own funds - for commercial entrepreneurship and the private sector of the economy (current income or retained earnings of past years).