When the initiative for dismissal does not come from the employee, any reason will be unpleasant to him. However, among all other situations where an employee leaves the service at the suggestion of his superiors, dismissal due to redundancy is one of the most “benign”, since it does not involve the employee’s fault. But this type of reduction is the most costly for the employer.

In this article we will try to cover all the points that an employer needs to know in order to properly carry out a reduction. The fact is that employees are legally protected much more strongly, and the employer has many obligations that must be observed in order to avoid conflicts or even litigation. To do this, you must strictly follow the protocol prescribed in the Commercial Code of the Russian Federation.

Legal basis

The Labor Code regulates such an event as a reduction in the number or staff of employees in articles relating to dismissal issues and providing for compensation and guarantees to employees.

The Labor Code regulates the reduction of the number or staff of employees in sufficient detail and clearly, but when applying the norms of the code, questions always arise. Judicial practice is of great importance; the Supreme Court often issues clarifications on the procedure for applying articles of the law, for example, Resolution of the Plenum of the Supreme Court No. 2 of March 17, 2004, which pays a lot of attention to this issue, is still relevant on this issue. The reduction in the number of employees occurs at the initiative of the employer; this basis for termination of the employment contract is formulated in Art.

81 Labor Code of the Russian Federation. Art. 178-180 are entirely devoted to guarantees and compensation for a person dismissed on such grounds.

Who can't be laid off?

Art. 261 of the Labor Code of the Russian Federation establishes categories of persons who are not subject to reduction. These include:

- pregnant woman;

- a woman with a child under 3 years of age;

- a single mother raising a disabled child under the age of 18;

- a single mother raising a child under 14 years of age;

- another person raising the above children without a mother;

- a parent (other legal representative of the child) who is the sole breadwinner of a disabled child under the age of 18 or the sole breadwinner of a child under 3 years of age in a family raising three or more young children, unless the other parent (other legal representative of the child) is in an employment relationship.

For more information about the categories of persons who cannot be laid off, read the article “6 situations when laying off an employee can result in a lawsuit.”

Mass layoffs

An employer has certain obligations when carrying out a massive reduction in the number or staff of an organization's employees. Mass scale criteria are established in sectoral and territorial agreements. As a rule, mass is established by the number of people fired during a certain period of time. If there are no sectoral and territorial agreements, it is necessary to use the criteria established in the Regulations on the organization of work to promote employment in conditions of mass layoffs. This document was approved by Resolution of the Council of Ministers of the Russian Federation No. 99 of 02/05/1993, but it is valid:

- within a period of 30 calendar days - 50 people or more;

- within a period of 60 calendar days - 200 people or more;

- within a period of 90 calendar days - 500 people or more.

Payments for staff reduction in 2021: calculation procedure

To calculate the amount of severance pay, you must first determine the average daily earnings. It is calculated in a general manner based on the employee’s salary data for the previous 12 months. If the reduction occurs on the last day of the month, then this month is also included in the billing period (letter of Rostrud dated July 22, 2010 No. 2184-6-1). In other cases, the calculation is carried out according to the previous month (clause 4 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922; hereinafter referred to as the Regulations).

The specific amount of severance pay is determined by multiplying the average daily earnings by the number of working and non-working holidays in the first month after dismissal (Resolution of the Constitutional Court of the Russian Federation of November 13, 2019 No. 34-P). If we are talking about seasonal workers, then the average daily earnings must be multiplied by the number of working days and non-working holidays that fall in the two weeks following dismissal.

ATTENTION. Severance pay is paid for both working days and holidays.

There are nuances when calculating payments to employees for whom summarized working time recording is established. Here you need to calculate not the average daily earnings, but the average hourly earnings (clause 13 of the Regulations). The resulting value must be multiplied by the number of working hours according to the employee’s schedule in the first month (for seasonal workers - in the first two weeks) after dismissal. This means that for the purpose of calculating severance pay, it is necessary to draw up a schedule as if the dismissed employee continues to work.

Calculate all payments taking into account personal income tax for the dismissed employee

Reasons

A reduction in the number or staff of workers is two different reasons for reducing the number of workers - labor units:

- if changes in the staffing table lead to a decrease in the number of units of one position, the number of employees is directly reduced;

- if entire structural units or specific positions with people are excluded, staff reduction occurs.

Of course, it is possible to reduce the number of staff and the number of positions in parallel; this is a common practice. First, management makes a decision, then implements it - dismissal occurs to reduce the number or staff of employees. Typically, the manager alone makes such a decision, and it is formalized in accordance with the nomenclature of affairs adopted at the enterprise. Or, but much less frequently, the decision is formalized in the protocol of the collegial executive body (depending on the system of management bodies and the distribution of their powers in the organization).

Why is a redundancy commission needed?

Legislatively, the employer has no obligation to create a redundancy commission, but from a practical point of view, its necessity is beyond doubt.

First of all, it is needed to determine the categories of employees who are not subject to layoffs. In addition, the work of this commission is useful in assessing the preemptive right. The staff reduction commission reviews the information provided for each candidate for dismissal. The decision made regarding employees who are not subject to layoffs and have a preferential right to remain at work is documented in writing - a protocol, a decision, etc.

The commission is created by order of an authorized person. The commission, as a rule, includes personnel specialists, one or two employees who are members of a trade union (if the company has one), and lawyers.

Algorithm of actions

If an employer needs to correctly reduce the number of employees, step-by-step instructions will help you do this without missing anything important.

Step 1. Issue an order.

Step 2. Identify employees who cannot be laid off.

Step 3: Conduct a personnel audit to identify those who have advantages over others in the same positions.

Step 4. Send notices of layoffs (to employees, trade union, employment center).

Step 5. Offer vacancies to those who are planned to be fired.

Step 6. Dismiss those who did not agree to the transfer (fill out documents, pay what is due).

We will analyze in detail the procedure for reducing the number and staff of employees step by step.

What payments are not included in the calculation?

When calculating the average daily (hourly) earnings, on the basis of which the amount of severance pay is determined, it is not necessary to take into account social payments not related to wages. These, in particular, include financial assistance, compensation for the cost of food, travel, training, utilities, recreation, and others (clause 3 of the Regulations).

You must also remember that amounts accrued during the time when the employee did not work are excluded from the billing period. In particular, sick leave is not taken into account, including maternity benefits, remuneration for downtime, payment for additional days to care for disabled children and people with disabilities since childhood. In addition, when calculating, it is necessary to exclude accruals made during the time when the employee did not work (participated in military training, court hearings, investigative actions, etc.). This is stated in paragraph 5 of the Regulations.

Lawyer's answers to private questions

Is it possible to withdraw an application for early dismissal during a layoff?

Yes. The application can be withdrawn until 24.00 hours of the last working day specified in it.

Is it possible to quit before the contract expires?

Yes, but it all depends on what organization it is concluded with. For example, if a contract is concluded with a government agency, you need to take into account the provisions of the Federal Law of July 27, 2004 N 79-FZ “On the State Civil Service”. Federal Law No. 53-FZ of March 28, 1998 “On Military Duty...” is relevant for military personnel.

Is it possible to be laid off earlier than the period specified in the notice?

Yes, if the employee agrees to this. If the layoff terms change as a whole, a new notice is issued, which is introduced to the staff against signature. But dismissal must take place no earlier than two months from the date of review of the initial notice, unless people agree to resign early.

Is the employer obliged to inform the trade union and the employment center about the layoff?

Yes. Notifications are sent at least two months in advance. If the reduction can lead to mass layoffs - three months in advance (Article 82 of the Labor Code of the Russian Federation).

Will sick leave be paid in case of early layoff if the average salary from the date of dismissal to the date of layoff has already been accrued?

Yes, depending on experience. If up to 30 days have passed since the date of dismissal, 60% of average earnings are paid, taking into account the number of sick days.

Features of payments for certain categories of workers

Pensioners

There is no special procedure for dismissal of pensioners. Therefore, parting with them on this basis occurs according to general rules. This means that pensioners have the right to receive the same payments as other “ordinary” laid-off workers (cassation ruling of the Yaroslavl Regional Court dated June 10, 2010 in case No. 33-2930).

REFERENCE. A pensioner dismissed due to layoff must be paid a salary and bonus for time worked, compensation for unused vacation and severance pay. He also has the right to receive average earnings for the second month after dismissal (in certain situations and for subsequent months), if he does not find a new job during this time (letter of Rostrud dated December 28, 2005 No. 2191-6-2, ruling of the Moscow City Court dated April 4. 16 No. 4g-2964/2016).

Workers on probation

There are no provisions for laying off workers who are on a probationary period. However, when calculating compensation for unused vacation, the following must be taken into account.

In general, the probationary period lasts no more than 3 months (Article of the Labor Code of the Russian Federation). Consequently, an employee who is laid off during the probationary period will not be able to claim full compensation for unused vacation for the entire year. Compensation should be calculated in proportion to the time worked.

For certain categories of employees (managers and their deputies, chief accountants and their deputies, heads of separate divisions) it is allowed to establish a probationary period of six months. Therefore, a situation is possible when, on the date of layoff, such a “subject” worked in the current working year for more than five and a half months. In this case, he has the right to count on compensation for full vacation (provided that he has not previously used this vacation or part of it).

Residents of the Far North

When laying off employees of an organization located in the Far North or an equivalent area, additional guarantees are established. Thus, the average earnings for the period of employment can be maintained not only for the second and third months after dismissal, but also for the fourth to sixth months. In this case, special rules apply for the transfer of these amounts.

Calculate your salary taking into account all current local and regional coefficients and allowances

Thus, payments for the second and third months are made by the former employer on the basis of the employee’s work book and passport. Confirmation from the employment service is required only if the dismissed person wants to receive average earnings for the fourth to sixth months (Part 2 of Article 318 of the Labor Code of the Russian Federation).

IMPORTANT. When transferring payments to persons dismissed from “northern” organizations, you need to remember tax preferences. The total amount of payments (including severance pay), not exceeding six times the average salary of a laid-off employee, is not subject to personal income tax and insurance contributions. And only from the excess amount will it be necessary to withhold income tax and charge insurance premiums on this amount (clause 3 of Article 217 of the Tax Code of the Russian Federation and subclause 2 of clause 1 of Article 422 of the Tax Code of the Russian Federation, subclause 2 of clause 1 of Article 20.2 of the Law No. 125-FZ).

The guarantees provided for workers dismissed from organizations located in the Far North or equivalent areas do not apply to part-time workers (Article 287 of the Labor Code of the Russian Federation). This means that “northerners” - part-time workers cannot count on payment for the fourth to sixth month after dismissal. But are they entitled to payments for the second and third months? Let's figure it out.

Part-timers

As mentioned above, the average salary for the second month after a layoff is paid based on the work record book. And the work book of a part-time worker (if it is kept in paper form) must be kept by his main employer (Article of the Labor Code of the Russian Federation).

Part-time work means performing one more job, which is additional to the main one (Article 282 of the Labor Code of the Russian Federation). This means that even after the layoff, the part-time worker remains employed (letter of the Ministry of Labor dated 08/03/18 No. 14-1/ОOG-6309).

Thus, in a normal situation, a part-time worker cannot claim to receive average earnings for the second, and especially for the third month after dismissal. However, in practice there may be exceptions.

Thus, labor legislation does not prohibit drawing up a contract for part-time work in the absence of a main job. Nor does it oblige you to stop part-time work or re-register it as your main job if the employee has already lost his main job during the part-time job.

Draw up and print an employment contract

In such situations, a part-time worker laid off due to layoffs becomes unemployed and can receive average earnings for the period of employment. To do this, he has a work book in his hands, in which there is no record of employment (cassation ruling of the Rostov Regional Court dated 10/17/11 in case No. 33-14084, ruling of the Moscow City Court dated 01/30/12 in case No. 33-2395).

Other payments (salaries, bonuses, compensation for unused vacation, severance pay) are transferred to part-time workers on a general basis.

Let's sum it up

- Art. 180 of the Labor Code of the Russian Federation allows an employee who has been warned about an upcoming layoff to resign early. With such dismissal, in addition to all other mandatory payments accompanying the reduction, he will receive one more compensation - for the time between the dates of the actual and announced dismissal.

- Consent to early dismissal must be made in writing. There is no specific form for such a document. But it must reflect the employee’s intention to resign early and have an employer resolution approving such action.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

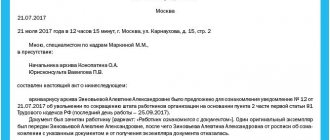

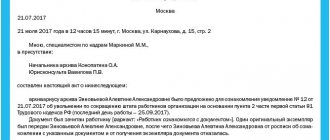

How to properly issue a notification

The law makes absolutely no requirements for the content of the document or for its execution. In other words, the notification can be written either by hand or printed on a computer on a simple blank sheet of A4 or A5 format or on letterhead.

There is only one indispensable condition: all information contained in the notification must be certified by the head of the enterprise or another employee authorized to sign such documents.

There is no strict need to stamp the form, because... Since 2016, legal entities, as previously individual entrepreneurs, have been exempted from the obligation to certify their documentation using seals and stamps.

The notification must be made in two identical copies , both of which must be signed by the originator and the addressee. Next, one form remains with the employee , and the second is transferred to the personnel department of the enterprise , where it is attached to the employee’s personal file.

After this, it, as part of other personnel documentation, must be stored in the archive for the period established by law or internal local legal acts (but not less than three years).

Where are the orders?

Due to the fact that dismissal due to staff reduction is the most problematic (dismissed employees often challenge dismissal, pointing out that due procedure was not followed), it is important to thoroughly follow the procedure established by law and correctly draw up a dismissal order.

To avoid significant mistakes, we advise you to familiarize yourself with the already completed document compiled by experts. You can download a sample of a completed dismissal order due to staff reduction on our website using the link below: