Who will be drafted and who will not?

Russian President Vladimir Putin signed decree No. 247 of April 26, 2021 on conscription for military training in the ranks of the Russian Armed Forces and federal security agencies in 2021.

If a citizen is in the reserves, he has the right to be called up for military training. Civil liability for organizing military training and violations of established rules is regulated by Federal Law No. 53-FZ of March 28, 1998 “On Military Duty and Military Service” (Article 7 53-FZ). Article 53 of Law No. 53 divides citizens in the reserve into three categories. The rank determines the order of mobilization and the period of registration in the reserve. The first discharge during mobilization is used first of all.

Summons for training and testing sessions are received by:

- reserve rank and file who completed military service;

- citizens who have a deferment and received a military ID after 27 years;

- reserve officers who are in the reserve after leaving the Armed Forces;

- reserve officers who received the rank after studying at a university where there was a military department.

The following are exempt from verification fees (Article 55 of Federal Law No. 53 of March 28, 1998):

- women;

- citizens transferred to the reserve within two years after dismissal and who completed alternative civilian service;

- citizens reserved by state authorities and municipal governments;

- employees of the Department of Internal Affairs, National Guard troops, state fire service, Federal Penitentiary Service and customs;

- civil servants of military formations;

- aviation, railway and navy workers;

- citizens engaged in sowing and harvesting work during the conscription period;

- teachers;

- students of all forms of education;

- citizens with three or more children;

- everyone staying outside the Russian Federation;

- members of the Federation Council, senior officials of the constituent entities of the Russian Federation.

Reviews

Dear readers, you can leave your review about the characteristic features of dismissal of an employee due to conscription in the comments, your opinion will be useful to other users of the site!

Basil

I quit because I was drafted into the army. I had to say goodbye to my place, and it wouldn’t even have been possible to evade it, since the employer was obliged to notify me against a personal signature. And so it happened. I served for a year, but they didn’t hire me back.

Artem

I had a question about the workplace. I was drafted into the army, I resigned, but agreed that after a year I would be returned to the same position. So I served, came to this company, and they told me that there are no places, the staff is staffed and they will not fire anyone from my place. It's a shame.

What should an employee do if he is called to training camp?

Testing and training conscription of reservists consists of several stages:

- selection of citizens for exercises and testing together with military units and units;

- notification and appeal of citizens;

- organization and conduct of medical examination;

- transportation of citizens from the commissariat to the location of the exercises.

Reservists are called up by summons from the commissariats. Summons-notifications have a prescribed form and must be delivered personally or through the employer. Do not respond to invitations by mail, by telephone, or through third parties.

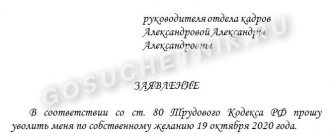

According to the rules, if an employee is called up for military training, the employer is obliged to issue an order and maintain work and income for the employee. According to Article 170 of the Labor Code of the Russian Federation, the employee is paid the average salary for the period of absence. When signing the order, you should check the presence of this item. You must make notes about this on your time sheet.

ConsultantPlus experts analyzed at what point the average earnings during military training should be calculated and when the organization is obliged to transfer the amount of personal income tax to the budget from the amount of average earnings. Use these instructions for free.

to read.

Severance pay article

According to Article No. 178 of the Labor Code of the Russian Federation, an employee of an institution or company is obliged to exercise his own right to receive severance pay. Its volume is equal to the average earnings of a citizen, which is calculated over 14 days.

The legality of the basis obliges the manager to make a final payment for the actual time worked. If the employee was not on paid leave this year, then he is entitled to compensation. The conscript employee must receive other monetary payments provided for in the agreement at the time of dismissal.

Labor Code of the Russian Federation, article No. 140. Payment terms upon dismissal

If the employment agreement is terminated, the payment of funds due to the employee from the manager is made on the day the employee is dismissed. If the manager did not carry out his work activities for certain reasons on the day of dismissal, then payments must be paid no later than the next day after the dismissed employee submits a request for payment.

In case of disputes about the amount of the amount that is due to the employee upon dismissal, the manager must pay the undisputed amount within the period of time specified in this article.

If the dismissed employee is not in the organization on the day of payment, his wages must be deposited. A notification is sent to your home address about the presence of amounts due at the organization's cash desk. The funds can be collected by a relative of the employee, however, for this purpose it is necessary to issue a power of attorney, which will be certified by a notary or by the unit commander.

Note! The manager does not have the right to demand that the employee return money for the vacation period used in advance before dismissal due to service in the army unit.

What should an employer do?

If an enterprise or organization has employees on its staff who are called up in accordance with 53-FZ, the personnel officer, after receiving notice of the employee’s call-up for training and testing sessions, will need to correctly record the absence. Here are instructions on how to register an employee's military training:

- Register the notification received.

- Check that there are no conditions preventing the employee from participating in the draft.

- Decide on the procedure for replacing an employee during absence.

- Issue an order for release from work.

The main documents for reimbursement of military fees are an order and a time sheet. There is no need to make any entries in the work book.

Calculation terms

The money must be issued in person or transferred to a bank account (if the salary was previously credited in this way).

The issuance of all compensation and wages, as well as the work book, is carried out on the day of dismissal .

When settling in cash with an employee who is absent on the day of dismissal, the entire required amount must be paid no later than the day following the day on which he applies for money.

There are situations when an employee goes into the army with urgent conscription without having time to notify the employer and provide a summons.

IMPORTANT. In this case, the employer must make a request to the military registration and enlistment office to clarify the fact of conscription.

After confirmation, the dismissal is formalized and accruals are made to the salary card, which can be sent by mail or given to relatives by proxy.

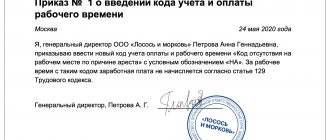

How to create an order

An order to release an employee from work during conscription does not have a standard mandatory form. The requirements for its execution comply with the general rules of personnel document flow.

The text of the document must indicate:

- basic details of the organization's order;

- the basis for releasing the employee from work and details of the notification to the commissariat;

- dates of absence of the employee from the workplace in accordance with the notice;

- procedure for replacing an employee during absence;

- information about how much they pay for military training, that is, about maintaining average earnings;

- signatures of all interested parties and responsible persons.

IMPORTANT!

If the call coincides with the employee’s next vacation, the employee has the right to reschedule it (Article 124 of the Labor Code of the Russian Federation). The order due to conscription for military training in this case contains the deadlines for postponing vacation. The period of passage itself will be included in the length of service for granting leave.

Payments to an employee who leaves to serve

Payments to the dismissed employee are made on the final working day.

Payouts include:

- earnings for actual hours worked;

- monetary compensation for vacation days not taken off;

- severance pay - in the amount of 2 weeks' average salary for the last year.

If an employment contract was drawn up with a person for a period of up to 2 months, then severance pay is not accrued to him.

If the employee is absent, the payment is transferred to his card or the salary is deposited. In the latter case, the money is not paid until:

- the appearance of a former employee or his representative acting on the basis of a power of attorney;

- receiving information from the leadership of the military unit about the procedure for transferring funds (for example, referral to the place of service).

The employer does not have the right to demand that the employee return funds for vacation used in advance before terminating the contract in connection with military conscription.

How is absence from work paid?

Articles 2 and 6 No. 53-FZ “On Military Duty and Military Service” regulate how to pay an employer for a summons to the military registration and enlistment office: the employee is compensated for the average earnings for the number of days of conscription indicated in the commissariat’s certificate. Average earnings are calculated strictly in accordance with the requirements of the Labor Code of the Russian Federation. There is no special procedure.

pp. Clause 2 of the rules for compensation of expenses incurred by organizations and citizens states that the state reimburses the following expenses:

- for the travel of citizens called up to participate in events to fulfill military duty to the place of the exercise and back;

- for renting housing;

- for payment of travel allowances (daily allowances);

- for the payment of average earnings (scholarships or benefits), taking into account payroll charges.

Based on average earnings, payment for a working day is also made when called to the military registration and enlistment office on a summons - the employee is released from work with payment of the average salary, and the employer accrues and pays the due funds. Later, these funds are compensated to the employer (clauses 2, 5 of the rules for compensation of expenses from the RF PP No. 704 of December 1, 2004).

IMPORTANT!

In 2021, all expenses of the organization for maintaining average earnings and travel expenses will be compensated, as before, by the Russian Ministry of Defense.

A citizen is exempt from the need to attend military training for a number of valid reasons (Article 7 No. 53-FZ):

- loss of ability to work due to illness or injury;

- serious health condition of a close relative or his death;

- force majeure obstacle;

- other valid reasons recognized as such by the draft commission or court.

All valid reasons for non-appearance must be documented and submitted to the commissariat as soon as possible.

Any violation by the employer of the procedure for compensation and provision of regular leaves in connection with participation in military exercises is appealed in accordance with the procedure established by law.

The table shows how to reflect the average salary of an employee during military training in budget accounting:

| Accounting transaction | DT | CT |

| The employee is paid the average salary | 4 109 60 211 | 4 302 11 730 |

| The accountant calculated insurance premiums | 4 109 XX 213 | 4 303 XX 730 |

| Income tax withheld | 4 302 11 830 | 4 303 01 730 |

| The average salary due to the employee was issued from the cash register | 4 302 11 830 | 4 201 34 610 |

| The institution presented the military registration and enlistment office with an amount to compensate for expenses | 2 205 30 560 | 2 401 10 130 |

| The military registration and enlistment office transferred funds to the institution’s personal account | 2 201 11 510 17 (under Article 130 of KOSGU) | 2 205 30 660 |

Possible difficulties

When terminating an employment relationship with a person serving in the military, some difficulties may arise:

- When choosing grounds for dismissal. It is important to take into account that termination of the contract under paragraph 1 of Art. 83 of the Labor Code of the Russian Federation is allowed only during army conscription. This article does not apply and dismissal is not carried out upon receipt of a summons for training, upon entering service under a contract, and so on. However, such a basis (clause 1. Article 83 of the Labor Code of the Russian Federation) is mandatory when calling a citizen to alternative civil service. In this case, forcing a person to write a letter of resignation at will is unlawful.

- When determining the date of dismissal. Termination is not carried out on the day the employer receives the summons. The date is calculated taking into account the day when the citizen must arrive at the collection point (at least one day). The date of dismissal is the last day actually worked by the person.

- When familiarizing yourself with the order, issuance of the work book, calculation. Difficulties arise when an employee is absent from work. In this case, an appropriate note is made on the order, the money and documentation remain in storage in the organization or, upon official request, are sent to the citizen.

We can briefly summarize what has been discussed: termination of employment relationships in connection with military conscription is carried out on the basis of a summons sent from the military registration and enlistment office to the employee or employer. In this case, processing is not provided. Registration of dismissal is carried out according to the standard algorithm based on the order.

In addition to basic payments, the employee is also provided with severance pay in the amount of 2 weeks' earnings. A person’s job is retained only if he is employed in a government agency.

How to punish for violations

A citizen has the right not to appear at the place and time specified in the summons only for a good reason. They are listed in paragraph 2 of Art. 7 53-FZ dated March 28, 1998. The liability is not as strict as for evading conscription. According to Art. 21.5 of the Administrative Code, failure by citizens to fulfill military registration obligations entails administrative liability. Those who do not want to participate in testing sessions without a good reason will face a fine of 100 to 500 rubles.

The law also provides for administrative liability for the employer for failure to notify the employee of the call-up. The amount of the fine (Article 21.2 of the Administrative Code) is from 500 to 1000 rubles. Production conditions are not grounds for preventing an employee from fulfilling his military duty.

Contributions and tax

As the Tax Code of the Russian Federation states, conscripts do not need to pay taxes and insurance contributions on the weekend benefits received. However, according to the third paragraph of Article 217 of the Tax Code of the Russian Federation, you will still have to pay tax and insurance contributions for compensation for unpaid vacation .

Personal income tax must be paid by the tax agent no later than the day when the amount to pay compensation to employees is received and when the amount is transferred to the employee’s account. Contributions and personal income tax are paid at the rates that apply in the company.

The conscription of an employee into the army is a frequent occurrence for which any employer should be prepared. This inevitably threatens the termination of the employment contract, and the employer is obliged to provide the conscript with all necessary payments and compensation . Calculating the amount of benefits and salary is not difficult, but it is important that they are transferred to the bank account not only in full, but also on time.