Home / Labor inspection / We write a statement to the labor inspectorate about non-payment of wages (a sample document is attached)

The State Labor Inspectorate regularly monitors compliance with workers' rights. However, these measures do not always bring the desired results. In order to effectively combat unscrupulous employers, the regulatory body calls on the workers themselves to participate.

What to do if your boss delays your salary? Where to go? How to make an application to the labor inspectorate, where to send it? You will learn about all this from this article.

Why are we complaining to the GIT?

State Labor Inspectorate or abbreviated as GIT

is a territorial body of the federal labor inspectorate. The main task of this structure is to carry out state supervision over compliance with legislation containing labor law norms.

Therefore, if we are talking about violations of the rights of persons hired under employment contracts, then such incidents, of course, fall under the competence of labor inspectors. After receiving a complaint, the inspector must conduct an inspection and, if there are grounds, bring the violator to justice. At the same time, the State Tax Inspectorate has the right to apply exclusively administrative sanctions, as well as issue orders to eliminate identified violations.

If the employer’s behavior falls within the norms of the Criminal Code of the Russian Federation, then this should be reported to the prosecutor’s office. This body investigates acts that contain elements of a crime. You can also complain to the prosecutor's office when the employer's actions do not imply criminal punishment. The complaint, of course, will be accepted, but in the future the application will simply be forwarded to the competent authority, that is, to the State Tax Inspectorate.

Another option is litigation. However, they go to court when the employee intends to obtain a specific material result, for example:

- recognition of dismissal as illegal and reinstatement;

- reimbursement of unpaid wages;

- payment of various compensations and the like.

Collective lawsuit of workers against the employer

To recover wages through the court, the labor collective can act together. To do this, it is necessary to appoint a coordinator for the claim filing process, i.e. proactive employee. Features of consideration of collective claims against an employer are:

- consideration at the location of the defendant;

- by virtue of clause 5 of Art. 244.20 of the Code of Civil Procedure of the Russian Federation in the case of labor disputes regarding the protection of the rights of a group of persons (collective dispute), at least 20 plaintiffs must participate in the claim (the more, the greater the chances of a successful outcome of the case);

- The period for consideration of a collective claim is 4 times longer than that of an individual labor dispute, i.e. about 8 months

When drawing up a class action, it is necessary to take into account the requirements of Art. 131 Code of Civil Procedure of the Russian Federation. In addition, the statement of claim must be accompanied by a justification for the involvement of all parties to the dispute in the case under consideration. Otherwise, the process of collecting and submitting documents is similar to an individual dispute.

For a successful outcome of the case, it is better to trust trusted lawyers. International experts with many years of experience will represent the interests of the applicant in an individual or class action against the employer at any stage. To contact a labor law lawyer, call 8 (800) 222-24-50 or fill out an application at rosco.su.

How to complain?

A complaint against an employer can be filed in the standard way or prepared and sent online. Next, let's look at each of the available options in more detail.

The standard method involves writing the application by hand or printing the document on a computer. In any case, the complaint must be signed by its author. This option can be called traditional and accessible to almost any citizen. After all, even if it is not possible to print text on a PC, you can simply take a pen and a piece of paper and write down all your comments and complaints on it. Once the appeal has been prepared, all that remains is to send it to the correct address. But read the next section about how to file a complaint with the labor inspectorate.

However, more and more citizens prefer to contact the State Tax Service online. This is understandable, because such an appeal mechanism has a number of advantages:

- no need to go anywhere in person;

- The website contains tips on how to fill out an application correctly;

- The procedure for preparing and submitting a complaint takes much less time.

When appealing an employer's actions online, preparing and filing a complaint is carried out almost in one step. The user fills out the form provided and selects the “send” option. In this case, you do not need to personally bring the papers to the State Tax Inspectorate or send the documents by mail.

There are also several ways to complain online.

Firstly,

through the official website of Rostrud. To do this, go to https://rostrud.gov.ru/. Next, on the main page of the site, select the “Send a request” option.

The user will be directed to the Public Reception, where he will be offered several services:

- register as unemployed on the “Work in Russia” portal;

- send an appeal on labor relations issues through the onlineinspection.rf system;

- consultation on labor legislation through State Services;

- send an appeal to Rostrud.

Select the last item.

The system will redirect the user to the next tab, where there will be an empty request form. Here you need to specify the subject of the appeal (you can select from the drop-down list), and also enter the text of the appeal. Next, you need to attach attachment files, enter a captcha, consent to the processing of personal data and provide information about the sender and employer.

Secondly,

You can write a complaint on the official website of the labor inspectorate, or rather, complain to the State Labor Inspectorate through the Onlineinspektsiya.rf service. However, in this case you will need to log in to the site through State Services. Next, click on the main menu in the upper left corner of the screen and select the “Report a problem” option.

The system will redirect the user to the “Send a statement about violation of labor laws” section and prompt you to select the appropriate category. After selecting a problem category, the following positions will appear in front of the complainant:

- organize verification of the stated facts;

- provide official advice to the State Tax Inspectorate.

Place a checkmark next to the appropriate line and click continue.

Any work must be paid

From Investments in Russia and abroad About me 09/16/2018

Sometimes I receive letters in the style: Ivan, I have a capital of more than $100,000, let me give you a free consultation, you say that you don’t make money from consultations?

To this I always answer: No. Any work must be paid. If you don’t think so, then we’re not on the right path.

Why is that?

Firstly, you won’t surprise me with a hundred thousand. This is not the first year in this business.

Secondly, at least a million. Perhaps this is a professional deformation, but I am very relaxed about money. This is a resource that needs to be managed wisely. Moreover, when the pursuit of money begins on either side - consultant or client - it always ends sadly. Money cannot be the goal.

Therefore, large potential commissions will not force me to abandon my principles; I made this mistake once, I will not repeat it again. Nothing terrible happened then; during the consultation it immediately became clear that we would not reach an agreement, but the time was wasted. And I value my time and my client’s.

Thirdly, the principle itself is important: any work must be paid. When you are asked to do something for free, most often your time and efforts are not valued. And this is not a partner position.

That being said, if you are offered something for free, especially in the financial world, then take a closer look! Maybe it's crap.

Let's talk about the commissions of instruments with trust management.

How do you know if you are being offered a tool with high commissions or low ones? You need to compare it with something. With what?

I consider the standard commission for American hedge funds to be: 20% of new profits + 2% annually of capital. (And do not compare with the commission of a simple broker. We are talking about trust management)

It is this type of motivation system that clients are most often looking for. But there is a problem...

Hedge funds in the US are only available to qualified investors. And this is $200,000 of confirmed annual income, or $1,000,000 of capital.

If you have a million dollars and you are ready to start with it, then I will provide you with such conditions

What if you only have $10,000? Or $50,000?

Creating a new investment account and organizing the entire infrastructure that supports it (bank, broker, consultant, depository...) for 10 thousand and for a million requires approximately the same effort. But the commissions in absolute terms are very different... Then what is the interest in doing ten?

To ensure that the investment company is interested, the following rule is included: the lower the starting amount, the higher the commission. If you start with 500 thousand, they will charge you 2%. If you start with 2 thousand, they can easily charge you 50% at the entrance. Just for you to go in there.

If the commission at the entrance is high, then what is the point of investing there at all?

You need to understand what this commission is paid for. If you see a 5% annual return, but they want 5% on entry + 20% on profit + 2% annually, then they want a lot. Because all the profit will go to commissions, it’s easier to put it on a deposit. Past and further. And if you see 20% annual return, but want 5% at the entrance + 20% from profit + 2% annually, then this is an interesting offer. Because the math is in your favor.

Who cares how much it costs if it's profitable?

Any work must be paid. If a manager gives a client a 15% net return, then his services may cost significantly more than the work of a manager who gives the client 5%. The only question is the net profitability that the client receives. And you need to count on a horizon of at least 3 years.

At the same time, a bad manager may start giving you discounts, unique offers... And a good one will say: - Discounts - in Pyaterochka. If you don’t understand the benefits we provide to our clients, then we’re not on the same path. Anyone who doesn't see any benefit in our products simply shouldn't use them.

Filing a complaint in person or by mail

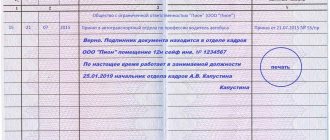

If a person writes a complaint in the standard way, that is, by hand on a piece of paper or prints it out using a printer, then the document must be submitted to the State Tax Inspectorate in person or sent by mail.

Personal submission of an appeal implies that the author of the document or a person authorized by him goes to the address of the relevant inspection and leaves there one copy of his complaint. It wouldn’t hurt to prepare a second copy of the document - an official, for example, a secretary or reception specialist, should put a mark on it that the paper was accepted.

For those who do not have the opportunity to visit GIT in person, the option by mail is suitable. But you should not send the letter as simple correspondence. It is better to opt for a registered letter with a list of attachments and notification of delivery to the addressee. Then the sender will have evidence of what exactly he sent and when the complaint was delivered to its destination.

Who can apply?

Any employee whose wages were delayed by at least a day. You can submit a complaint:

- In an individual form, if only one of the employees has claims against the manager for delayed payments;

- In a collective form, if non-payment of wages concerns an entire group of subordinates;

How to complain about an employer to the labor inspectorate?

How to sue an employer correctly?

How to write a complaint to the prosecutor's office against an employer?

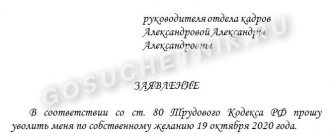

What to write in a complaint?

The legislator does not give a clear answer to the question of how to correctly write a complaint to the labor inspectorate. There is no single universal form. If the complainant files a complaint online, then his task is partially simplified, because the system itself will request the necessary information and automatically generate a complaint.

When completing your application yourself, you should adhere to the same principles as when writing any application. First, in the upper right corner we write a “header” in the name of the head of the inspection, and also indicate the author’s details - full name, passport details, position and place of work. Next, in the middle of the sheet, indicate the name of the document “COMPLANT”.

After this, you can proceed to the very essence of the appeal. In this part, it is necessary to describe the circumstances and dates of the offense, list the measures taken by the employee to resolve the conflict. It is also necessary to mention how the manager responded to the claims made by the employee.

Features of the application form

A complaint to the State Tax Inspectorate, like any other statement, is of an official nature, so when writing it you should adhere to some rules :

- The document must be written without errors, there must be no value judgments or obscene speech. All claims must be stated clearly and concisely;

- When writing an appeal, you should refer to the articles of the law under which violations were identified;

- Before submitting an application, if possible, you should collect evidence of the violation: printouts of correspondence with the employer, internal memos, etc.;

- It is necessary to indicate your data in the application; anonymous requests to the inspection are not accepted for consideration.

If you intend to file an anonymous complaint with the labor inspectorate, we recommend that you read this article.

How to complain anonymously?

Anonymous complaints in accordance with paragraph 1 of Art. 11 Federal Law No. 59 are not subject to consideration. The same goes for requests that do not include a feedback address. That is, inspectors, in any case, must be aware of the person who has declared a violation of her labor rights.

But this does not mean that the employer will necessarily find out who complained about him. The fact is that in labor relations the employee is always the more vulnerable party. The employer has the right to bring a subordinate to disciplinary liability, including dismissal, or simply create conditions for the employee under which he himself will be forced to leave the company.

The legislator took this point into account. Therefore, the complainant has the right to ask in his appeal for non-disclosure of his personal data. Basis – Art. 358 Labor Code of the Russian Federation. Also Art. 6 Federal Law 59 states that it is prohibited to persecute a person who has applied for the protection of violated rights.

That is, GIT officials will definitely know the details of the citizen who filed the complaint. But this information may be hidden from the employer.

Of course, in some cases it is difficult to maintain the anonymity of the applicant, because during the inspection the inspector must examine the documents for a specific employee. And this will allow the employer to easily figure out which of the subordinates complained. In such a situation, the inspector can request materials on several employees so that the complainant’s identity remains unknown to management.

Rules for filing a claim

There are no legally established rules or requirements for the content of a claim. Therefore, such documents are drawn up based on the general rules of legal technology.

The document includes:

- the title part, which indicates to whom the claim is addressed and from whom, the name of the document, date and place of preparation;

- a descriptive part that describes the history of the occurrence of wage arrears;

- the motivational part, which contains references to the norms of the Labor Code of the Russian Federation, for example, to the provisions of Art. 136 of the Labor Code of the Russian Federation, collective agreements or employment contracts with employees, which oblige the administration of the organization to pay wages on time;

- the operative part, which indicates the demands of employees to repay the debt, indicates the deadlines and the actions that employees are ready to take in the event of non-fulfillment of their demands.

How long will it take to wait for results?

The appeal will be considered within 30 days. The applicant has the right to choose his preferred method of receiving a response; otherwise, the response will be sent by mail.

Within a month from the date of receipt of the complaint, the inspector is obliged to examine the complaint, as well as verify the fact that an unlawful act has been committed. If it is discovered that the employer has indeed violated the law, he will be fined and given an order to eliminate these violations.

Sometimes inspectors during an inspection determine that the investigation of an unlawful act does not fall within their competence. For example, if we are talking about a crime or misdemeanor, administrative sanctions for the commission of which are applied by another service. In this case, the State Tax Inspectorate will forward the complaint to the prosecutor’s office or another competent authority.