In a situation where there is no will and you have not declared rights to the inheritance, after six months you can lose it forever. This rule, however, has its exceptions. For example, a direct heir can assume inheritance rights automatically. Just conscientiously use the property of the deceased and take care of it - for example, pay bills for the apartment, make repairs to it. If no other heirs appear, the property passes to you. But it’s safer and calmer to make everything official.

Queue for inheritance

There is a waiting list for inheritance, which depends on blood ties with the deceased. Closest relatives come first and second cousins last. If the legal heir of any line dies before his parents or his own children, then the property passes to one of them. This is called the right of representation. Here is a list of those who can claim the inheritance and in what order:

- Natural and officially adopted children, widower/widow;

- Close relatives of the deceased - brothers and sisters, parents.

- Third generation of the family.

- Fourth generation of the family.

- Great-grandparents, great-nephews.

- Second cousins, great aunts, uncles and great-grandchildren.

- Unofficially adopted children, stepparents.

Dependents who lived in the care of the deceased for more than a year and are unable to care for themselves are included in a separate category. They also have the right to a share, but only half of what they would receive if they were in the official queue for inheritance.

Is it possible to refuse property?

In some cases, applicants express a desire to refuse the inheritance for various reasons.

Refusal of inheritance is provided for by law. It is done in favor of another applicant, and is also expressed in a simple or silent form.

Refusal in favor of another candidate consists of submitting written notice of this intention to the notary. The notification is submitted within the period allotted for filing an application to open the inheritance of the apartment. It indicates the recipient of the renounced share.

Attention is important! A simple refusal involves submitting an application without indicating who to give your share to. Silent refusal consists of the absence of an application from the applicant within the prescribed time. In both cases, the share is distributed among the remaining applicants.

It should be especially noted: the refusal to inherit an apartment or its share, officially accepted by a notary specialist, is not subject to revocation or change.

Documents for receiving inheritance

The list of papers may vary for each specific case and depends on both the type of property and the type of relationship. General list of documents:

- death certificate;

- evidence of relationship (for a widow or widower this could be a marriage certificate, for a son or daughter a birth certificate);

- identification;

- proof that the inherited property was acquired after marriage (for a widow/widower);

- an extract from the house register about the deceased;

- inheritance documents.

What to consider when inheriting an apartment after the death of your mother

Inheritance law in our country is one of the youngest branches of civil law.

Therefore, in each specific case, the procedure for registering an apartment as an inheritance requires detailed study and understanding in order to identify various obstacles and difficulties.

If you have any questions or the slightest doubt, it is better to seek advice from experienced specialists who provide services in this area. This will save you not only time and money, but also your nerves.

Author: Oleg Vladimirovich Roslyakov, source.

How to calculate inheritance tax without a will

The very concept of inheritance tax has not existed for more than 10 years, but a state duty has appeared, which you must pay at the notary’s office. It includes notary services. The amount depends on the value of the property and the degree of relationship and can sometimes be quite high.

- heirs of the first stage, as well as parents, brothers and sisters give 0.3 percent, the maximum amount does not exceed 100 thousand rubles;

- other family members pay 0.6 percent, the maximum amount does not exceed 1 million rubles.

How long does it take to sell an apartment?

Having received an apartment, you may need to sell it. This is especially true if there are several heirs, and there is a dispute over who will live in the disputed apartment.

You can put your inherited apartment up for sale immediately after it is re-registered in your name. A tax of 13% of the total cost of the apartment will need to be paid if you have owned it for less than three years.

When can you sell an apartment without tax? It is better to do this after continuous use for more than three years. In this case, there is no need to pay tax.

The share in the apartment after the death of the mother can be sold in the usual manner. Only first should you offer to buy out the share to other heirs who have their own pieces of the deceased owner’s apartment. Having secured their reluctance to share the part due to you, you can safely sell your share to any buyer.

Inheriting an apartment in questions and answers

The editors of the online magazine Naslednik.Info often receive questions from site visitors. The most popular ones are listed below, we hope they will help you.

How to revoke a mother's will

Question: Is it possible to challenge a will regarding an apartment?

Answer: Yes, it is possible if it is drawn up incorrectly or incorrectly, for example, it is not certified by a notary, and the form or content does not comply with legal requirements.

What to do with debts

Question: The loan for the deceased’s apartment has not been paid. Is it possible not to pay it?

Answer: No. Not only the apartment is inherited, but also the responsibilities of its former owner. For this reason, the responsibility to repay debts on the loan passes to the heirs.

Tax on inheriting an apartment

Question: From 2021, the period of continuous ownership of residential property has been increased to 5 years for its tax-free sale. Does this rule apply when selling an apartment received by inheritance?

Answer: No, it doesn't work. These innovations do not apply to the sale of an inherited apartment. For her, the tax-free sale period is three or more years.

Notary fee

Question: How much will the notary have to pay in 2021 when registering the fact of inheriting an apartment?

Answer: at least 900 rubles, of which 800 rubles are fees for 2018 and at least 100 rubles for technical services of a notary office specialist.

If the deadline for registering an inheritance has expired

If you did not manage to enter into an inheritance within six months, you will have to go to court. The only way to resolve the matter without litigation is to obtain written consent from all other heirs who have already accepted the inheritance to recognize your right. This happens very rarely. In order to restore your rights through the court, you need to prove that you missed the deadline for a good reason. For example:

- were abroad for some reason and could not return;

- were seriously ill and were unable to move;

- were in prison or colony without the opportunity to contact a notary;

- did not know about the relative/inheritance;

- did not know about the death of a relative.

There is no exact list; situations can be very different, but these are the most common reasons. Evidence of a valid absence can include, for example:

- medical certificates;

- documents from work, if we are talking about a long business trip.

The documents depend on the situation and the reason for the absence. After considering your case, the court makes a decision either to refuse due to insufficiently valid reasons/lack of evidence, or grants the request and restores the term, or allows you to enter into the inheritance immediately.

- Lawyers for inheritance issues

Ways to obtain living space

What is the application procedure? You can obtain an apartment belonging to a deceased mother by actual or legal means.

These methods have their differences, but you can use any.

At the same time, you should know that it is less labor-intensive to directly contact a notary.

Actual path (legal, judicial)

This path is used in the absence of controversial situations in inheritance. It does not require mandatory communication with a notary due to the actual use of the apartment by a relative (relatives).

In other words, in relation to the applicant there is evidence of the actual right to acquire living space as an inheritance.

The following circumstances serve as evidentiary reasons:

- the person is the owner of part of the living space;

- the receiver moved into the home after the death of its owner and legally uses the things belonging to him;

- paid off the apartment debts accumulated by the previous owner and regularly pays for current utilities;

- Measures have been taken to strengthen the protection of the apartment by replacing doors, locks, and installing an alarm system.

The above actions act as conclusive evidence of the actual acceptance of the inherited apartment (clause 2 of Article 1153 of the Civil Code). Their legality is confirmed by documents in the form of papers issued by authorities and organizations at the local or federal level.

It should be remembered that written evidence must indicate the evidence of the actual entry into the inheritance without violating the deadline provided for performing actions of this type.

In the absence of written evidence or the objective impossibility of preparing it within the required time frame, the applicant is obliged to file an appeal to the court in order to establish the actual use of the inherited apartment.

Legal way (notarial)

The impossibility of actually living or immediately moving into the apartment left behind by the mother necessitates the use of the method established by Art. Art. 1152, 1153 Civil Code of the Russian Federation

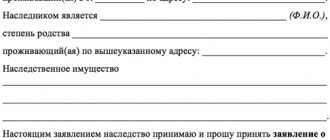

This path consists of a personal visit to the notary at the place where the inheritance was opened. The purpose of the visit is to submit an application for the right of inheritance.

The notary opens an inheritance case, carries out actions to possibly establish a complete list of heirs, then begins collecting the required documents from the recipients of the apartment and their subsequent detailed verification.

This procedure ends with the issuance of a certificate of inheritance. Its receipt transfers the heir to the category of the legal owner of the property, with all the corresponding rights.

When inheriting an apartment by legal means, ignoring a trip to the notary within the established time frame is considered as a refusal to inherit the apartment. Such a decision can only be appealed in court.

Insure your life

If the parents die or become disabled, the child will receive insurance. The amount of compensation depends on the severity of the damage received. For temporary disability due to injury, disability and death, the payment amounts will be different.

Benefits of life insurance against accidents:

- upon the death of the insured, the insurance company will pay compensation within a few weeks, and not after six months, like an inheritance;

- You can include a specific person in the policy, then other heirs will not be able to claim money from the insurance company;

- you can insure the life and health of both parents and other family members for almost any amount by choosing the appropriate policy conditions;

- with small expenses for issuing a policy, the insurance compensation will be tens of times greater - for example, with a policy price of 10,000 rubles per year, if an insured event occurs, you can receive more than 1,000,000 rubles, depending on the insurance program.

One option to protect the interests of children is to take out accident insurance for the family breadwinner. Then, in the event of his death or disability, the family receives a payment from the insurance company.

The client chooses the insurance amount himself. Within this amount, compensation is paid, which in the event of group 1 disability or death will be 100%.

The cost of such a policy depends on the amount of coverage. The price is also affected by the profession, sports that the insured is involved in, and some additional factors. For example, for an insured amount of 4,000,000 rubles, a policy for an office worker will cost about 17,000 rubles per year with protection for the risks of death, bodily injury and disability, if you leave only the first two risks, then about 14,000 rubles.

Any insurance policy has exceptions, for example, no payment if the insured was intoxicated or caused the accident. Therefore, having insurance does not protect you 100%. Carefully study the terms of the insurance contract to protect your family to the maximum.

Life and health insurance against accidents on Sravni.ru

Choose suitable insurance

Open a deposit or brokerage account on behalf of a child

If a father or mother keeps money on their card and in deposits only in their name, then the children will have access to the money only six months later, when they register an inheritance. Moreover, the amount will be divided among all heirs of the first stage. There are other financial products that can be placed in the name of minors so that they can collect the money owed to them earlier themselves or through a representative if an accident happens to their parents.

Open a bank deposit in the name of the child

A deposit in the child’s name can be opened in any bank. Anyone can top up their account with any amount. The bank charges interest on the deposit, this will slightly protect the money from inflation.

Official representatives of the child can manage money only with the permission of the guardianship and trusteeship authorities. To withdraw money from a child’s deposit, you need to bring to the bank a written consent from this authority indicating a certain amount, your documents and the child’s birth certificate.

From the age of 14, a teenager can begin to deposit money himself or receive interest, but, again, with the written consent of his legal representatives. He personally has the right to withdraw his entire deposit from the bank only from the age of 18.

The guardian has the right to spend money from the child's deposit only in the interests of the child. He will have to justify to the guardianship authorities the purpose of withdrawing them from the account, and then provide a report on the expenses.

Until the age of 14, a deposit can be opened by a child’s legal representative. The child himself has the right to open a deposit from the age of 14. To do this, you will need a passport and some banks will ask for parental or guardian consent. Up to 14 years of age, deposits are opened in the name of the child, or you can open a deposit agreement in favor of third parties. Also, parents or a guardian can enter into an agreement with the bank on behalf of the child.

Children's deposits on Sravni.ru

Choose the most profitable investment

Open a brokerage account

Parents can open a brokerage account in the child’s name, fund it and buy stocks, bonds, or invest on the stock exchange. This can be done through a bank with a brokerage license or a broker.

But there are restrictions - brokerage accounts are not available for children under 14 years of age; they can only be opened by minors from 14 to 18 years of age, and with the written consent of their legal representatives. In reality, it happens like this: a teenager with his passport and one of the parents with his passport come to the office of the broker company and sign documents on the spot.

A brokerage account can be opened for a minor by his representative - a parent, guardian, trustee, adoptive parent

When signing an agreement for servicing a brokerage account, the teenager’s representative gives permission that he can carry out transactions on the stock exchange himself. Separate permission is not required for each transaction; they are concluded remotely in your personal account.

You can top up your account using any convenient methods, including from third party accounts. You also do not need separate consent to withdraw funds. A minor will be able to receive earned investment income only to a bank account opened in his name. And to withdraw money from a bank account, you will need parental consent.

Parents can invest funds in their brokerage account and bequeath it to their children, then all securities and money will pass to the heirs by law or by will. If at the time of acceptance of the inheritance the child is still under 14 years old, then his legal representative will receive the investment for him with permission from the guardianship authorities. If the child is over 14 years old, they will open their own brokerage account in the presence of a guardian and transfer funds from the parent’s account there.

The best way to obtain financial protection for a minor is personal life and health insurance for the parents. An important nuance: a minor child must be indicated as a beneficiary under a life insurance contract upon the occurrence of the insured event “death”.

It is also recommended to open a bank account for the child and indicate it in the insurance contract in order to receive compensation using its details. Until the child reaches adulthood, his guardians or legal representatives will have access to this account.

Inheritance in questions and answers

If an inheritance comes unexpectedly, then many are at a loss as to what to do about it.

To help such people, our consultants have prepared answers to the most frequently asked questions.

They concern not only the registration of inherited property, but also the taxation of further transactions with it. So.

We recommend! The procedure for inheriting a residential building and land after the death of parents: step-by-step instructions + list of required documents

If the apartment is in another city

Often parents and children live in different localities or even parts of the country. And then inheriting an apartment after the death of the mother results in additional hassles, which, however, are easy to overcome if desired.

We recommend! Is the loan inherited after the death of the debtor?

We found out that the inheritance is opened by a notary at the place of last residence of the late mother. Getting there may not be possible for everyone.

Then Art. 1153 of the Civil Code of the Russian Federation allows for alternative courses of action. For example, you can send an application for acceptance of an inheritance or the issuance of a certificate for it by mail with all the necessary documents offered.

In this case, the heir must first have his signature on the application notarized.

Deprivation of inheritance rights

There is a concept in law - unworthy heirs. These include the following persons:

- who tried to illegally increase their share of the inheritance;

- who encouraged other participants to do so;

- who killed the owner;

- which caused harm to the health of the apartment owner.

If such facts are established in court, then such persons will not inherit the property of the deceased relative. An exception is a will executed by the testator after the loss of the right to inheritance.

What is included in the inheritance

The hereditary property includes the following objects:

- apartment;

- car;

- House;

- company;

- land plot;

- vehicle;

- securities;

- stock;

- jewelry.

The marital share must be excluded from the inheritance. It includes ½ share of all joint property. To allocate the wife's property, you must contact a notary.

The specialist will issue a certificate of allocation of the marital share. Based on the specified document, the wife’s property is not subject to inclusion in the inheritance mass.

Important! Obtaining a certificate of allotment of the marital share does not deprive the wife of the right to inherit her husband's property.

Who gets the share of the deceased heir?

The order of inheritance depends on the specific situation

| No. | Option | Order of succession |

| 1 | Mother and children died together or the child died before the mother died | The children of the heir (grandchildren of the main testator) become claimants to the property. This method is called inheritance in order of presentation. The deadlines for entering into inheritance have been preserved. Grandchildren must submit documents within 6 months from the date of death of the grandmother. |

| 2 | The death of the heir occurred after the death of his mother | The share of a deceased person goes to his heirs - hereditary transmission. The deadline for contacting a notary remains the same. But, if the death occurred on the eve of the issuance of the inheritance certificate, then the deadlines may be shifted by another 3 months. |

The shares of heirs by way of transmission and by right of representation are determined depending on the number of participants. The share of the deceased legal successor is divided between them in equal shares. To register an inheritance, you must submit a separate application.

The right of representation does not apply to property that belongs to a deceased heir. That is, assets that are separate from the estate upon the death of the primary testator. Registration of inheritance is carried out by applicants according to general rules.

Sample application for issuance of a certificate of inheritance (hereditary transmission)

Through a notary

Another option that is practiced is that all documents for an apartment can be submitted with the help of a notary who has practice in his city.

Then the application, along with all the required documents, will be sent to its destination. As a result, a certificate of inheritance will be received.

The mediation of a local notary will be useful because he will check in advance both the composition and the correctness of filling out the submitted documents.

By proxy

In some cases, it is easiest to place all actions related to receiving an inheritance on the shoulders of a representative.

They can be either a lawyer (attorney) or any other person with whom the future heir maintains a trusting relationship.

The representative will need a power of attorney certified by a notary. It should describe not only all powers regarding acceptance of inheritance.

Rights must also be specified:

- for representation of interests in courts (this is often necessary);

- registration of an apartment in Rosreestr;

- registration of new housing documents (for example, technical passport).

It is best to set the validity period of the power of attorney with a reserve. After all, the period for registering an inheritance may be postponed due to legal proceedings and other unforeseen circumstances.

Insure your health

Accident life insurance policies generally do not cover the risk of illness. If disability is assigned as a result of a serious illness, then payment can only be received under the health insurance program.

Such insurance programs are more expensive, because the risk of getting sick is higher than dying. To insure your health for 5,000,000 rubles, you will have to pay from 10,000 to 35,000 rubles per year for the policy.

Special cancer insurance programs allow you to count on support when diagnosing cancer. The conditions of insurance programs may include other critical illnesses, such as heart surgery, organ transplants, any surgical operations, as well as injuries and damages, including burns, fractures, and concussions. Check the lists of such diseases when choosing a policy.

Pros of health insurance:

- payment can be received not only in case of an accident, but also in case of detection of any deadly or serious illness;

- the amount of compensation depends on the severity of the damage, so, in case of disability of the 1st group, the payment will be 100% of the insured amount, and in case of temporary loss of ability to work, for example, due to a broken arm - about 10–15%;

- compensation is issued immediately after diagnosis and confirmation of the disease, the money can be used for treatment and rehabilitation;

- if treatment does not help, the insurance payment will go to financial support for the family in the event of the patient’s death.

The cost of insurance will be higher if you are over 45 years old and have chronic diseases.

In some cases, it is necessary to undergo regular medical examinations at a partner clinic in order for the insurance company to formalize an agreement with the client. More often, the policy is sold without a medical certificate, and this threatens with refusal of payments if the client, for example, does not indicate all his illnesses in the questionnaire, violating the terms of the contract.

They also do not issue compensation if the insured did not take the necessary precautions, but went to an exotic country without vaccinations, drove without a license, or did not seek medical help in time after a dog bite.

Responsibilities of a notary in searching for heirs

The notary learns about the death of the testator from one of the heirs. The law does not provide for any other communications for this purpose. If the notary knows the coordinates of other applicants for the inheritance, he is obliged to inform them about the inheritance.

The coordinates can be obtained by the notary from the will, from other claimants to the inheritance, or from other sources. So: the notary must inform the applicants for the inheritance, whose coordinates he has, but he is not obliged to search. Information about this is contained in Art. 61 “Fundamentals of legislation on notaries”.

In addition, the notary is not obliged to search for inherited property. He only has to check the estate at the address of the testator. Information about this is contained in Art. 71 of the above document.

The search for heirs of property falls on the remaining claimants to the inheritance, if they consider it necessary to do this. Without experience, it is extremely difficult to achieve results in such searches.

Applicants for inheritance should contact a search office or a notary. The notary is not obliged to search for inheritance and citizens who have the right to inherit, but he is not prohibited from doing so. The notary has access to the necessary databases and experience in such work. You can try to negotiate with him.

- To summarize, by law a notary is obliged to search for heirs if the notary: knows the place of residence of the heir;

- the place of work of the heir is known, which will allow him to be found.

Sources:

Order of succession by law

The notary's duty to notify the heirs

Checking the hereditary mass

Lack of property documents

Sometimes heirs are faced with the lack of title documents for property.

Options:

- Data lost . Lost papers can be restored at the appropriate government agency.

- The documents have not been completed . If the testator did not have time to complete the documents, but submitted an application for privatization of housing, but did not complete the procedure, then such property can be included in the inheritance. Applicants will have to file a claim in court and prove that the testator has applied to government agencies with an application to privatize the apartment.

If there is a court decision, the notary will include the property in the estate and issue the necessary certificate to the legal successors.