The gift agreement itself does not require notarization: in the entire 32nd chapter of the Civil Code, dedicated to the deed of gift, there is no mention of a notary at all.

However, in two cases you will still have to certify it - not because it is a donation, but because of the participants or the subject of the transaction. The law requires the participation of a notary if a deed of gift is made for a share in real estate. If a husband or wife wants to donate common property, then the notarized consent of the other half is required.

In all other cases of donation, a written (and sometimes even oral) agreement is sufficient. Of course, the parties may want to protect themselves and contact a notary, even if certification of the transaction is not necessary.

However, since this is not cheap (and also for the gift, everyone except the closest people pays 13% tax), it is not done often. For not the most expensive gifts, it is quite possible to draw up a deed of gift yourself. But when it comes to real estate, it is better to involve a lawyer in order to correctly place the emphasis in your deed of gift.

Registration of a gift agreement

Exclusively in writing. According to paragraph 2 of Art. 574 of the Civil Code of the Russian Federation does not provide for the transfer of rights orally. The agreement is drawn up in 2 copies and signed by both parties. One copy is kept by the donor, and the second by the donee.

The deed of gift is a document of title. It is necessary to present the title to the car when registering it.

Relatives, colleagues, and strangers can act as donor and recipient. Taxation depends on the status of the parties to the transaction, according to clause 18 of Art. 217 Tax Code of the Russian Federation. That is, income received by citizens in kind through donation is subject to personal income tax, except in cases where the parties to the transaction are members of the same family.

When drawing up a contract, you must indicate:

- Data of both parties - full name, passport details, residential addresses.

- Information about the car - model, make, color, year of manufacture, engine number, body, chassis, other information to facilitate identification of the subject of the transaction (in case of legal disputes).

- Details of PTS and STS.

- A separate paragraph should highlight the responsibility of the parties for violation of the terms of the agreement.

- At the end, you need to again indicate the details of the donor and recipient.

Each party to the transaction signs the document. This is a mandatory condition for the validity and validity of the contract.

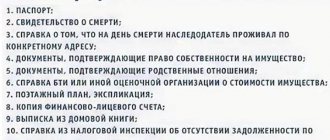

What documents will be needed

A set of documents must be attached to the contract, which includes:

- Passports of both parties.

- PTS and STS for the subject of the transaction.

- A valid MTPL policy - the new owner will then take out insurance again in his name. But the donee can be included in the policy in advance as a driver.

- The appraisal report is not a mandatory document if the transaction is concluded between close relatives.

- If the car was purchased by the former owner during an official marriage relationship, then the spouse’s consent to the transaction must be provided. The document is drawn up in a notary office.

- Receipt for payment of the registration fee.

An appraisal report is needed if the parties to the transaction are strangers or distant relatives. Based on the estimated value of the car, the amount of tax payable will be calculated.

When you can't do without a notary

On July 31, 2021, the legislation in the field of real estate transactions changed. (the text of the law is at the end of this article). The bottom line is that such agreements (and donation is also a transaction) now need to be certified by a notary only in certain cases.

They all relate to shared ownership. But if previously any transaction with shares necessarily required contacting a notary office, now the procedure is less strict.

Share in real estate is given as a gift

A notary is not needed if:

- there is only one owner of the apartment, and he gives it away as a gift;

- the sole owner gives a share of his apartment;

- all homeowners donate their shares at the same time (in one deed of gift, this is important).

In all other cases, when donating a share of real estate, it is mandatory to have the transaction certified by a notary. In this case, it does not matter who gives it to whom - close relatives or not.

Actually, the changes in 2021 affected only the last named condition. Previously, all transactions with shared apartments had to be certified by a notary.

If the property is donated as a whole, it is not necessary to draw up a deed of gift with a notary. It doesn’t matter whether the home has one owner or several, whether it is divided into shares, or how many people the gift is intended for.

If the apartment is jointly owned, then it will not be possible to donate a share in it, because the part is not defined. And in the gift agreement it is necessary to name the thing that is being transferred, otherwise it is invalid. To donate part of such housing, you will first have to divide it, and only then the share can be donated (division is also a notarial transaction). Our magazine has an article on this topic, “Giving your share of an apartment to a close relative.”

Spouse's consent required

According to the Family Code, all property acquired during marriage is considered common, even if only one person is indicated as the owner. And if a husband wants to donate some real estate, he needs his wife’s consent signed by a notary (and vice versa).

But there is one exception: if this property was also received under a gift agreement, then the husband/wife is free to dispose of it without asking the spouse or involving a notary.

If the apartment is jointly owned by the spouses, and they decided to give a share in it, then they need to divide the housing either by agreement or by drawing up a marriage contract. Both are done by a notary. Then you will need to register all this with Rosreestr, and then you can formalize the donation of the part. And since we are talking about a share, such a gift requires certification by a notary as a general rule.

If a child is involved in the transaction

Law 218 on state registration of real estate names another case when a notary is needed: alienation of the property of a minor (or incompetent) person. Giving is also alienation, but for nothing. On behalf of children, the law does not allow their parents or guardians to give anything more than 3,000 rubles. Therefore, a child or an incapacitated adult cannot make a gift of real estate (neither the whole nor a share).

However, it is possible to give housing to a child. If this is a whole apartment, then a notary is not needed here; if it is a share, he is needed, but precisely because of the share, and not because a child is involved in the transaction.

By the way, if something is given to a minor, there is no need to notify guardianship. They make sure that property rights are not infringed, but here, on the contrary, there is an increase in property.

Car donation agreement between relatives

Absolutely anyone can act as a donor and recipient. But, as practice shows, a deed of gift is drawn up between close relatives (detailed article at the link). You can make a deal at any time. According to the provisions of family law, close relatives are:

- Spouses in relation to each other.

- Parents and children.

- Adoptive parents and children.

- Grandparents and grandchildren.

- Brothers and sisters, even if only one parent is common.

A car donation agreement between close relatives is concluded in writing and is subject to mandatory registration with the State Traffic Safety Inspectorate. Without this, the transfer of property rights is impossible. Whether the transaction is notarized or not is up to the parties to decide. There is no such rule established by law.

When concluding an agreement for donating a car between close relatives, the recipient is exempt from the obligation to pay income tax - 13% of the estimated value of the gift item . But the set of documents must be accompanied by certificates and extracts confirming the family relationship between the parties.

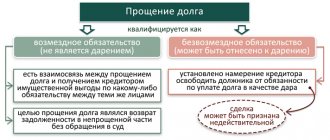

Basic provisions

Gift deed is an agreement according to which the donor expresses his intention to donate now or later property or the right to it. The object is transferred free of charge - you cannot demand money for it. It is also impossible to indicate in the deed of gift that the gift will be transferred to the person after the death of the donor, since in this case a will must be drawn up.

In order for the owner to issue a deed of gift, he must meet the following requirements:

- age of majority;

- full legal capacity;

- normal mental health;

- understanding of the consequences of his actions;

- lack of pressure from the recipient and other interested parties;

- availability of documents confirming ownership of the car.

You cannot give a car to teachers from students, or to doctors from patients. It is also prohibited to give cars or other expensive gifts to government employees when fulfilling their obligations.

Is there a tax on gifting a car?

Tax legislation of the Russian Federation states that gratuitous transactions are the income of the recipient and are therefore subject to taxation. The recipient of the gift must pay 13% of the value of the subject of the transaction. But close relatives are exempt from this obligation.

Documents about close family ties must be attached to the general set of documents. It is also recommended that the contract make a separate reference to family relationships.

The recipient calculates the amount of tax to be paid himself. You need to take the estimated value of the gift item and multiply by 13% (that is, by x0.13). The amount received will need to be paid to the budget. The obligation to pay arises the following year. You must submit a declaration to the Federal Tax Service and make payments to the budget before April 30 and July 15 of the year following receipt of the gift.

Is a transfer and acceptance certificate required?

The law does not oblige you to draw up a transfer and acceptance certificate, but it is better to fill it out.

This is needed for the following purposes:

- if there is a deed, it will be easier for the donee to prove that the donor hid significant defects, due to the elimination of which he suffered damage (Article 580 of the Civil Code of the Russian Federation);

- the donor will be able to cancel the donation if he proves the recipient’s improper handling of the transport, entailing the threat of its loss;

- the deed of gift confirms only the intention to give. The deed indicates the actual transfer to the donee.

Sample transfer and acceptance certificate

To draw up the act, you will need the following data:

- Full name, passport details of the parties, registration addresses;

- information about the car: make, model, year of manufacture, license plate number, VIN, color, date of ownership;

- things additionally transmitted with the vehicle: radar detector, tires, etc.;

- description of technical and external defects;

- date of preparation and signature of the parties.

The act is drawn up in two copies. One each remains with the donor and the recipient; the third may be needed by the traffic police, but its provision is not always required.

Sample car acceptance certificate:

Cost of registration of a gift agreement

The cost depends on how the parties will formalize the transaction - independently or through a notary office. If you fill out the standard contract form with your own hand, you do not need to pay anyone.

The need for payment arises when registering a transaction:

- Entering new information into a technical passport of a vehicle costs 350 rubles.

- Issuance of a new certificate of ownership – 500 rubles.

If the parties decide to contact a notary, this is their right! But you will have to pay for the preparation and certification of the deed of gift. The notary calculates the fee as follows:

- Tariff is established by law.

- Payment for legal support – according to the price list.

Therefore, the cost of notarization of a gift can range from 800 to 1200 rubles. But this amount will have to be paid if the parties bring an already drawn up agreement to the notary’s office. The notary office employee will only need to check the correctness and relevance of the documents.

If you need to draw up and certify a deed of gift , then the amount to be paid will depend on the value of the item of the gift (an appraisal report will be needed) and the status of the parties. The data is shown in the table below:

| Estimated value of the vehicle | Amount to be paid at the notary office |

| Close relatives | |

| Up to 10 million rubles | 3000 rubles + 0.2% of the assessed value |

| Above 10 million rubles | 23,000 rubles + 0.1% over 10 million rubles |

| Distant relatives | |

| Up to 1 million rubles | 3000 rubles + 0.4% of the assessed value |

| From 1 to 10 million rubles | 7000 rubles + 0.2% over 1 million rubles |

| Above 10 million rubles | 25,000 rubles + 0.1% over 10 million |

How to register possible additional items?

The parties may indicate additional points in the document and indicate:

- who pays the costs of registering a deed of gift (notary and state fees, if necessary);

- when the new owner must register the car (within 10 days);

- The gift recipient's obligation is to pay fines and transport tax on the car.

Sometimes a “Waiver of Gift of Gift” section is included in the agreement. It stipulates that the recipient of the car can refuse it at any time before the gift is transferred and under what conditions the gift can be canceled. The contract in these cases will be considered terminated.

Also, if the donor has a spouse, the document must indicate whether he or she agrees with such a gift. This is not a mandatory requirement, but if the case comes to court, consent will come in handy.

Who can be a donor?

An adult capable person who owns a vehicle has the right to act as a donor.

If he cannot be present at the transaction in person, a notarized power of attorney is issued to a representative who will hand over the keys or contact the notary together with the donee to certify the DD. The car can legally belong to the child and be registered with the traffic police in his name. In this case, taxes are paid by the parents.

You cannot give a car that belongs to a child under 14 years old (Clause 1 of Article 575 of the Civil Code of the Russian Federation).

Important! An oral or written transaction made on behalf of an incapacitated person can be declared invalid through a court.

What is an apartment share

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The owner of the premises may be one person or several. If there are several co-owners, each of them owns a certain part of the property (house, apartment).

Moreover, property can be common or shared (Article 244 of the Civil Code of the Russian Federation). Common property means property without determining the shares of participants.

Their size depends on the number of co-owners. For example, in a privatized apartment for three people, each family member owns 1/3 of the housing.

With shared ownership, each owner owns a specific portion of the property. Moreover, the shares may be different.

What is the activity?

The requirements for notary employees bear the imprint of strictness. This is, first of all, Russian citizenship and obtaining the title of lawyer. Next – a one-year internship, an exam to confirm qualifications, and obtain a license.

After this, the notary begins to certify transactions, draw up various documentation, make copies and extracts. He explains to clients the importance of strictly following transaction rules.

The notary has the right to demand that he be provided with the necessary information and documents, identify the person, and verify legal capacity.

Legislator's position in 2021

I would like to note right away that, in most cases, the parties do not need to apply for support for the donation transaction. However, based on the information established by the legislator in the Federal Law “On State Registration”, the deed of gift must be certified in the following cases:

- The subject of the donation is the share of an apartment, land or other property that is owned by other persons in addition to the donor (according to Part 1 of Article 42 of the above-mentioned legislative act).

- The donating party is a person with limited legal capacity or a minor child who has already turned 14 but has not yet turned 18 years old (Part 2 of Article 54 of the same Federal Law).

In addition to the cases described above, the legislator provides other situations when the parties to a transaction need to seek the services of a notary, but not to certify the gift agreement, but to draw up other documents, such as:

- Spouse's permission to conduct a transaction . We remind you that if the object of the gift is an object of jointly acquired property, the donor is obliged to obtain written permission from the husband/wife to donate this property to another person.

- Power of attorney to conclude a transaction . In some cases, one of the parties cannot be present when signing the gift agreement, and in this case, the legislator allows the document to be signed by a proxy, who must have a notarized power of attorney.

At the same time, based on the practice of experienced lawyers on the Legal Ambulance website, it can be argued that every year more and more citizens choose the option of registering a deed of gift with the participation of a notary, because the participation of a specialist is a guarantee of a transparent transaction and the absence of problems in the future!

ARTICLE RECOMMENDED FOR YOU:

Prohibition on giving and receiving gifts

Deed of gift for a car between close relatives without a notary, how to draw up

In this case, it does not matter who exactly the parties to the transaction are. The steps to transfer a car to a son, mother or daughter are similar to those described above. A notary is not needed in this case. This is also due to the fact that close relatives have a high degree of trust in each other, so assurance is not required.

If we take into account the written form, the deed of gift should include the following elements:

- Document's name.

- An indication of the parties to the transaction and the place where it was concluded.

- A full description of the subject of the contract, including the color of the car, the subject of ownership, identification number, make, model, etc.

- A reference to the essential terms of the agreement (for example, that in the event of the death of the donee, the gift is returned back to the donor).

- Date of conclusion of the agreement and signatures of the parties.

These are standard terms of agreement. The parties, at their discretion, have the right to include other aspects there.

A sample document can be found ⇐

Is it possible to refuse a gift?

According to Art. 573 of the Civil Code of the Russian Federation, the recipient has the right to refuse to accept the gift. If the donation is made orally, an oral refusal is sufficient. When concluding a written DD, a refusal in a similar form will be required.

Sample refusal

The written refusal must contain the following information:

- information about the gift;

- FULL NAME. parties, passport details;

- details of the deed of gift;

- the wish of the recipient to give up motor transport;

- signature.

Sample refusal of a gift agreement by the donee: