Child support payments must be collected in strict accordance with legal regulations. The basis is the presence of enforcement documents, such as: court order, performance list (IL) And voluntary agreement. If the alimony payer works in any organization, company, institution or enterprise, then the obligation to monthly calculate and transfer money from his earnings falls on the shoulders of the accounting department at his place of work. But the child does not always receive money on time: not only the alimony payer is to blame for this, but also the employer himself. The legislation provides for liability not only for the parent, but also for the company through whose fault child support is delayed. We invite you to find out what to do if an organization does not pay alimony: where to go and what to expect?

The deadline for transferring alimony by the enterprise

The process of withholding alimony money is strictly regulated by current legislation.

Important! The procedure for transferring children's money must be carried out no later than three days from the date of calculation of the salary to the payer.

The recipient of the money should know: if the payer is given a salary twice a month, and, according to IL , alimony should be paid once a month, then the accounting department should transfer money once a month.

Then, non-payment of children's money from the advance part of the salary is not considered a delay and does not entail liability.

General information

The collection and payment procedure is regulated by the Family Code of the Russian Federation (Chapter 17). Collection of alimony is carried out in different ways. This could be an agreement or going to court.

The agreement, court order or writ of execution is transferred from the employer to the payer. An enterprise accountant is obliged to:

- Consider the amount to be withheld. This can be a fixed fixed amount or a percentage of salary.

- Deduct and transfer funds to the account specified in the documents.

The amount of payments by law can be specified as a percentage of earnings or a fixed amount. The percentages are set as follows:

- up to 25% – more than one child;

- up to 33% - for two children (16.5% each if children were born in different marriages);

- no more than 50% (70%) – for three or more children.

In this case, the accountant independently calculates the final amount. And only after this can alimony be withheld. If a fixed monetary amount is established, then payments must be indexed.

Withholding of alimony occurs after payment of income taxes. If an employer is late in paying payments, they will be held liable. As for the deadlines, the law gives only 3 days from the moment the employee receives his wages.

What does an employer face for delaying child support?

Russian legislation regulates serious liability for late payment of child support: from administrative liability to criminal liability. Let us ignore such penalties as: fines, deprivation of a driver’s license, taboo on traveling abroad and arrest. Let us consider only the measures of financial liability that are provided for in Art. No. 115 of the RF IC for a delay in transferring children's money.

For the fact that alimony is overdue, the guilty person:

- Must pay a penalty of 0.5% per day of delay.

- Must compensate for all losses resulting from the delay.

To apply these penalties, a court decision is necessary: a lawsuit must be filed.

Note! The above measures of financial punishment can be applied to the alimony payer only if there is evidence of his guilt. But when the delay in alimony payments occurs due to the fault of third parties: for example, officials of the company - the employer, then the alimony payer should not pay the penalty and compensate for losses (see the text of the Resolution of the Plenum of the Supreme Court No. 9, of 1996 ).

Expert opinion

Viktor Evgenievich

Representative of a private law firm, work experience - 7 years

Article No. 109 of the RF IC states that the employer must deduct money from the employee’s salary every month based on his application.

The basis for this is an executive document : either a voluntary alimony agreement of former spouses, or a court order .

The procedure for calculating and transferring alimony must be carried out in accordance with the writ of execution, within a period not exceeding three days from the date the employee receives salary or other payments.

You should know! Article No. 98 of the Federal Law “On Enforcement Proceedings” regulates the requirements in relation to the employer. It says that the official should not violate the timing, amount and procedure for calculating and transferring children's money.

Expert opinion

Sergey Nikolaevich

Judge, judicial experience - 20 years

Following paragraph No. 3, Art. 17.4 of the Administrative Code , the fact of violation of the standards “On Enforcement Proceedings” leads the guilty official (for example, the chief accountant) to the imposition of administrative liability.

Where to contact?

Any delay is a reason for an inspection.

Since bailiffs are responsible for collecting alimony, they also conduct checks on the facts of delays.

In this case, it does not matter on what basis the collection is carried out in the organization - a writ of execution from the bailiff service or a document submitted by the direct recoverer.

To organize an inspection, the claimant must contact the local SSP department with an application. The said document must indicate the fact of the delay and reflect the period of the delay.

You should also provide information about the debtor and the organization in which he works. Upon receipt of an application, the bailiffs will organize an inspection with a visit to the organization. During the inspection, they have the right to receive an explanation from officials, study accounting and other documents on the subject of the inspection.

If the fact of deliberate actions is established against the guilty person, an administrative protocol will be drawn up, and then a resolution will be issued imposing a specific punishment.

The issue of assigning a particular fine amount is resolved by the head of the bailiff department.

What to do if your employer goes bankrupt?

Quite often, the reason for the termination of calculations and alimony payments is the financial insolvency of the company in the event of its bankruptcy. An organization declared bankrupt loses all opportunity to transfer money not only to its business partners, but also to employees.

To clarify the situation, you should make sure that the issue of declaring the company bankrupt is actually being considered. To do this, you need to use the case search system on the official website of the arbitration court .

Helpful information! Issues of collecting money in a situation where an organization does not pay alimony according to a writ of execution because it has been declared bankrupt are regulated by Art. No. 134 IC RF . This article explains two options for bankruptcy:

| №/№ | Company bankruptcy | |

| 1. | When the alimony payer works for the company while the bankruptcy case is being considered. | It is necessary to write an application addressed to the arbitration manager with a request to pay the alimony debt. |

| 2. | When the alimony payer quit, but never received salary or severance pay | It is necessary to fully rely on the actions of the parent receiving child support payments, since such a parent (mother) is sincerely interested in receiving money. In this case, there is no guarantee of receiving money: judicial practice suggests that debt collection is very difficult due to the lack of assets of the bankrupt company |

What should you do to receive alimony?

Let's figure out what to do if the company is constantly delaying the payment of alimony? In order to achieve payment, you must take certain steps:

- first of all, it is necessary to understand why the company does not pay child support;

If the person receiving the money enters into a regular dialogue with the accounting department of the organization responsible for transferring alimony, it will not be difficult to find out all the necessary information “first-hand.” For example, employees, as part of a private dialogue, can tell the approximate date of payment or report the impending bankruptcy of the company.

- in the case where the delay in alimony is in no way connected with the financial insolvency of the company, then it is necessary to write a free-form application addressed to the manager about payment of the debt and present it;

This application should be printed in two copies: on one copy, the company office must put a mark on the fact of receipt. If the organization does not respond to the application and does not want to pay the debt, you should proceed to the next steps.

- If the employer of the alimony payer violates the deadlines for transferring money, you must contact the bailiffs ( FSPP ) who carry out the collection.

It is the bailiff who has the right to initiate an administrative investigation, with the application of penalties to an organization that does not pay children's money for its employees.

Appeal to the bailiff

In order to contact the bailiff, you need to write a statement in free form. Such a statement must contain the following information:

- information about the addressee (you must indicate the FSSP department that carries out the collection);

- information about the applicant and debtor (full name, name of enterprise, address and telephone number);

- information about the problem that has arisen (problem: delay in alimony payments);

- information about the requirement to bring the guilty party to justice.

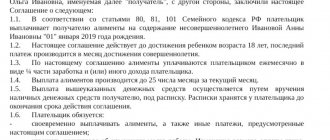

As an example, here is a sample of such a request:

Going to court

The main advantage of contacting the FSSP (or the prosecutor) is that the recipient of children's money only needs to write one small document: a complaint against the employer company, or a statement . The law does not impose any strict requirements on these two documents.

But, in the case when the recipient of alimony living with the child wants to solve this problem in court, it is best for him to seek help from an experienced lawyer. Here are two main reasons for this:

- The claim must be drawn up in strict accordance with the rules of procedural law.

- This statement of claim should be accompanied by a number of documents proving the fact of lack of payment from the employer.

Expert opinion

Sergey Nikolaevich

Judge, judicial experience - 20 years

Important note! If the above requirements are not met, the plaintiff will receive a refusal to consider his claim.

Most often, such claims are considered by a magistrate judge. There is no fee for consideration, since the resolution of the issue is aimed at improving the quality of life of a minor citizen.

The last resort is to contact the prosecutor's office.

What should you do if the accounting department does not transfer alimony? In this situation, it is necessary to contact the prosecutor's office: it is the prosecutor's office that must monitor the observance of citizens' rights in various spheres of life. Especially when the rights of a minor to a decent life and material security are violated.

After the issue is considered, the prosecutor will prepare a proposal on the need to eliminate the detected violations.

If a company has been evading alimony payments for a long time, then the official will have to go to court and hand over all the necessary papers to the jurisdiction.

Complaint to the prosecutor's office: how to file?

The legislation does not provide a strict framework for drawing up a complaint to the prosecutor's office regarding non-payment of children's money. Therefore, the recipient (mother) has the opportunity to independently draw up this document. The main thing is that the complaint contains the following information:

- Information about the person receiving alimony.

- Information about the specific facts of this case (information about IL ; evidence that the employer company refuses to transfer children’s money to the recipient’s child support account).

- Information that the employer of the alimony payer violated the rights of a minor to receive money from the payer (father).

- Please consider the current situation and understand it, followed by applying appropriate punishment to the culprit.

Note! It is not at all necessary to add other information to the text of the complaint. But, at the same time, it should be understood: the more specific the complaint is, the easier it will be for the prosecutor to understand the problem and identify the culprit.

Penalty for non-payment of alimony

Unfortunately, many companies are very tolerant of late payments of alimony money to their employees, believing that delaying payment is not critical. Even in cases where such payment is provided for by IL or by court order . But today, accounting employees who “forget” to transfer children’s money to a minor’s account are increasingly being held accountable.

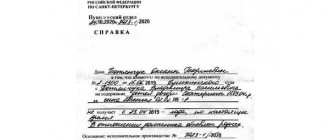

Expert opinion

Elena Vladimirovna

Bailiff for the Petrogradsky district of St. Petersburg, work experience - 3 years

You should know! Article No. 315 of the Criminal Code of the Russian Federation regulates penalties for non-payment of alimony money from an employee’s earnings.

This article implies liability standards for an authorized person, such as:

- imposition of a fine in the amount of up to 200,000 rubles ;

- the right to arrest such a person for a period of up to two years.

Thus, delay in alimony due to the fault of the employer implies liability, both administrative and criminal. Article No. 115 of the RF IC regulates the following sanctions:

- compensation of a penalty in the amount of 0.5% for each day of delay;

- compensation for damage resulting from violation of the terms of transfer of alimony money.

These measures are applied only if there is an appropriate court verdict, when guilt is fully proven.

In accordance with the text of Art. No. 109 of the RF IC and Art. No. 98 Federal Law “On Enforcement Proceedings” , the employer has only three days to process the calculation and transfer of alimony for his employee. If an organization does not pay child support to its employee, what should you do? According to Article 17.4 of the Administrative Code , for violation of the conditions specified in the IL or the requirements of the bailiff, material sanctions are imposed on the guilty employee in the amount of 15,000 - 20,000 rubles .

In this case, the entire company may be fined in amounts from 50,000 to 100,000 rubles .

What is the punishment?

Since delays violate the rights and interests of the child and constitute an actual failure to comply with a judicial decision, federal administrative liability is provided for such actions.

It occurs when intent is established on the part of an accounting employee or the head of an organization. If intent is established, they are subject to an administrative fine in the amount of 1,000 to 3,000 rubles.

In addition to the administrative fine, the manager has every reason to bring such an employee to disciplinary liability.

In the event of a repeated violation by the same employee, the amount of the fine doubles.

Summary

The obligation to withhold alimony money from the employee’s earnings lies entirely with the enterprise if the employer receives a writ of execution. The procedure for transferring child benefits, and responsibility for evading them, are prescribed by law. The transfer procedure is handled by the accounting department.

Alimony must be paid once a month from all income of the payer: from advance payments, from salary, from bonuses, from sick leave payments, from vacation pay and any other income accrued by the enterprise.

The law strictly regulates the period of alimony payment - three days from the date of receipt of salary. The accountant calculates the entire monthly income of the alimony payer and determines the alimony amount, which is transferred to the recipient’s account within three days. If the company does not do this, then already from the fourth day the “meter starts working” and a penalty is charged.

The legislation provides for a wide range of impacts on an unscrupulous employer who does not transfer alimony money in a timely manner. The culprit can be brought not only to administrative, but also to criminal liability. If an organization goes through bankruptcy proceedings, the chances of receiving alimony become significantly less.

Failure or untimely fulfillment by the organization of its obligations

An employer may stop making payments for various reasons, from the banal negligence of an organization’s accountant to deliberate non-payment of alimony.

It is important, if an organization fails to fulfill its obligation to pay alimony, whether it transfers the salary to its employee in full or makes deductions from them, which for some reason do not reach the addressee.

If an employee receives a salary without deductions, then he is obliged to pay alimony himself for the period during which no deductions were made from his earnings. If the funds were withheld but not paid to the alimony collector, the responsibility lies entirely with the employer.