Article updated: July 30, 2021.

Author: Lawyer Sergey Vladimirovich.

Most often, courts award alimony as a percentage of salary. This is the simplest and most convenient option for all parties. Moreover, this option is much easier to control, which is a big plus.

In what cases is alimony collected as a percentage?

Alimony as a percentage of salary can only be charged for the maintenance of minor children . When deciding on the assignment of alimony, parents can enter into a voluntary notarized agreement. In this case, the father and mother of the child independently determine the order, size and frequency of payments.

If an agreement between the spouses is impossible, you will have to go to court, which will be guided by Art. 81 of the Family Code (SC) of the Russian Federation. The parent (usually the father, since children usually stay with the mother) will be required to pay a monthly share of their earnings as child support.

To recover payments for a minor child in the form of a percentage of salary or other income, the following conditions must be met:

- whether the parent has regular and constant earnings (other income);

- receiving a salary in Russian rubles , in cash without the participation of in kind (that is, payment of labor in products, consumer goods, etc.);

- the ability to calculate the amount of alimony as a percentage of earnings;

- no violation of the interests of any of the parties.

If at least one of these conditions is not met, the court will order a different method of paying alimony.

If there is no agreement on a different method of payment, alimony as a percentage of income is also paid for minor children left without parental care .

The child's guardian, foster family, or organization that has taken responsibility for the child will receive payments from the birth parents.

What can affect the amount of alimony?

In 2021, the amount of alimony may be affected by:

- Agreement between parents (by notarial agreement). Mother and father have the right to set the amount of payments themselves. The law sets an approximate minimum level, but they determine the exact amount themselves.

- Father's income. When assigning payments as a share of income, alimony always depends on the father’s level of earnings for the past month. If the father was on vacation or sick, then payments are withheld from vacation pay and sick leave.

- Amount of expenses per child. The law obliges the father to pay child support in an amount that will provide the child with the usual level of comfort. That is, he must continue to attend the sections he attended before the divorce, be able to eat at the same level, and go on vacation.

- The size of the living wage. The amount is set quarterly. If the amount increases, the amount of alimony increases accordingly. And if it decreases, it does not change.

- Indexing. If alimony is collected in a fixed amount, it must be proportional to the subsistence level in the region (hereinafter referred to as the PMR). For example, 0.5 PMR or 1 PMR. This is required to simplify indexing. Indexation is carried out by a bailiff or by an accountant of the enterprise where the father works.

What percentage of salary is alimony?

The percentage of child support paid depends on the number of children who are entitled to payments. The table shows the dependence of the parts paid from earnings on the number of children of the payer:

| Amount of children | Revenue share |

| 1 child | 1/4 of income (25%) |

| 2 children | 1/3 (33%) |

| 3 or more children | 1/2 (50%) |

Even if the parents voluntarily agree on the payment of alimony, the shares cannot be lower than those specified in the Family Code in accordance with Part 2 of Art. 103 SK.

The size of the shares depends on the number of children in need of financial support , and not on the number of common children of the plaintiff and defendant.

Example

The man married and divorced twice, and from each marriage he had a child. Child support for two children will amount to a third of his income. That is, each child will receive 1/6 of the salary, and not 25%.

Interest is deducted from official income after personal income tax has been deducted .

Example

A man’s salary is set at 30,000 rubles, personal income tax is 13% of the salary (3,900 rubles), and the employee will receive 26,100 rubles. It is from this amount that the share for alimony will be deducted.

The court decides on the size of the shares, taking into account the financial and family status of the interested parties.

Maximum percentage of alimony

When concluding an agreement on the payment of alimony, the law does not establish maximum permissible standards. Parents voluntarily decide what shares will be paid as child support.

In general, when forced to collect alimony from the payer, no more than 50% is withheld. However, if there is a debt, the court will be guided by Part 3 of Art. 99 of Federal Law No. 229-FZ of October 2, 2007 “On Enforcement Proceedings.” Every month, up to 70% can be deducted from the debtor’s salary in favor of the child until the debt is fully repaid.

If the penalty arose not through the payer’s fault , and he proved this in court, then the maximum percentage will not be assigned. Also, the court may partially or completely relieve the person obligated to pay alimony from paying the debt due to the following valid reasons:

- completing compulsory military service;

- disability.

In this case, it is necessary to prove your difficult financial or family situation at the time of debt formation.

70% of income can only be charged when paying child support for minor children .

Increasing the amount of alimony

Due to changes in the financial or marital status of the parties, alimony may be increased or decreased. Parents can make this decision by mutual agreement by re-signing the agreement. If this is not possible, the amount of payments will be reviewed in the magistrate's court.

The amount of alimony can be changed both at the initiative of the recipient and the payer. The grounds for increasing the amounts paid are:

- an extreme decrease in the income of the recipient of payments (job loss, salary reduction, sharp rise in prices);

- the appearance of dependents on the recipient (elderly parents, birth of a child);

- a significant deterioration in the health of the alimony recipient, which requires expensive treatment, and there are not enough funds to support the child;

- death of persons who provided financial support to the recipient of alimony - this could be the child’s grandparents, the woman’s new husband;

- the emergence of new sources of income, improvement of the financial condition of the alimony payer;

- reduction in the number of persons dependent on the alimony payer (the coming of age of a child from another marriage, the death of the parents whom he previously supported).

If the payer's official salary does not correspond to real income , the recipient of alimony can go to court to increase the percentage of payments or switch to a fixed amount. It is necessary to prove that the defendant’s expenses do not correspond to the declared salary (having a loan with high monthly payments, expensive purchases).

Reducing the amount of alimony

In some cases, the amount of payments may be reduced due to the following factors:

- disability or loss of ability to work of the alimony payer;

- payment of alimony for children from different mothers (if the second spouse applies for alimony, the man will be charged 33% of the income for the maintenance of two children, each of whom is entitled to half of this amount);

- the presence of other persons in need of financial assistance from the payer (in this case, the plaintiff must prove that dependents do not receive the funds due to them by law);

- extremely high income of the alimony payer (the court must be convinced that it is impossible to direct all the funds received exclusively to the needs of the child);

- loss of a job by the alimony payer for reasons beyond his control (for example, due to layoffs) - it will be important to prove a significant deterioration in his financial situation ;

- emancipation of a minor child (gaining full legal capacity before the age of 18);

- one of the supported children reaches the age of majority ;

- the child for whom alimony is paid is fully supported by the state .

None of the listed conditions (except for the children reaching the age of majority and emancipation) is an absolute basis for changing the amount of alimony. The court always takes into account the financial and marital status of each party. You should carefully prepare for the meeting and prove the need to review the shares paid. The most compelling arguments will be taken into account.

Arbitrage practice

Example 1

If the father pays child support voluntarily, then it is necessary to issue a receipt for each payment, or transfer it by bank transfer marked “Alimony.” But recently, bailiffs have begun to take into account transfers from the father’s account to the mother’s account, even if the purpose of the payment is not indicated.

Marina collected alimony from her ex-husband for her daughter by court order. The man did not have an official job, but regularly transferred money for his daughter to his ex-wife’s account. Over the course of several months, he transferred 218,050 rubles. In May, a quarrel occurred between the former spouses and the woman decided to collect arrears of alimony. To do this, she turned to the bailiffs for a certificate about the amount of debt. The bailiff calculated the debt, taking away the man's expenses for the child in the amount of 218,050 rubles. The woman filed an administrative application to challenge the certificate. She explained that this money was not alimony, it was transferred as voluntary financial assistance to the child. But the court did not share this point of view and refused to cancel the certificate (Decision No. 2A-3102/2018 2A-3102/2018~M-2975/2018 M-2975/2018 dated November 29, 2018 in case No. 2A-3102/2018 ).

No payer is immune from such a situation. Therefore, it is advisable to take a receipt, correctly draw up money transfers and promptly notify the bailiff about the payment of alimony.

Example 2

Often women want to collect alimony from the father of their children in the amount of the subsistence minimum. But the men are trying to challenge such a court decision. As an argument, they cite that mother and father are equal in matters of raising and maintaining the child. That is, they must provide a living wage for a child through joint efforts.

Olga filed a claim against her ex-husband to collect alimony in the form of a fixed payment. The man worked part-time at a car service station and had no regular income. She wanted to receive payments in the amount of the living wage. The court satisfied her demands. But the children's father filed an appeal to reduce the payment to 0.5 MMR, based on equality of parental responsibilities. The court of 2nd instance refused to satisfy the requirements, considering that the decision was made correctly (Decision No. 11-165/2018 of October 23, 2021 in case No. 11-165/2018).

We can conclude that despite the equality of rights and responsibilities of parents, the amount of alimony can be assigned in the form of the full subsistence minimum.

Registration procedure

Alimony as a percentage can be assigned either voluntarily (by concluding an agreement) or in a forced manner (through the court). Each of these methods has its own characteristics that are worth paying attention to.

When signing the agreement , the parties themselves stipulate in what order alimony will be collected: the amount of payments, their frequency, the form of transfer (cash or to a bank account). If there are no objections, you must contact the notary with the following list of documents:

- passports of both parents;

- the child’s birth certificate, regardless of the presence of a passport;

- marriage certificate (or divorce certificate);

- salary certificate of the payer for at least the last three months.

When signing the agreement, both parties must be present in the notary's office, as well as children over 14 years of age. The legal force of the agreement corresponds to the legal force of the writ of execution .

The state fee for concluding an agreement on the payment of alimony is 250 rubles in accordance with clause 9, part 1, art. 333.24 of the Tax Code of the Russian Federation. However, the notary also charges fees for legal and technical services, which increases the cost many times over. You should check the price in advance with the notary office you will contact.

Collection of alimony through court

In the absence of an agreement, alimony is collected by force. If there are no disputes about minor children (establishing paternity, order of residence, etc.), such cases are considered in the magistrate's court . The following forms of collection exist:

- simplified (obtaining a court order);

- claim

An application for a court order can be filed if the defendant has a stable official income and has no other child support obligations. You can go to court both at the place of residence of the child’s mother and father.

The order is prepared within 5 working days without a court hearing and sent to the bailiff service for collection of funds. The defendant may refuse to pay alimony in writing. In this case, you will have to go to court again, but with a statement of claim.

Claim proceedings

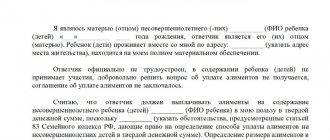

If a written objection from the defendant has been received, a statement of claim . The same will need to be done if there is no information about the earnings of the future payer, or if he pays maintenance funds to other persons.

The court will hear the parties' arguments, review the attached documents and, if necessary, interview witnesses. The result of the trial will be a court decision and a writ of execution .

The recipient of alimony needs to pick up the writ of execution and transfer it to the division of the Federal Bailiff Service (or apply for its transfer there directly). In addition, you can independently take this document to the payer’s place of work .

It is recommended to use the services of government agencies, as they are authorized to conduct checks and take legal action to collect payments.

Article 109 of the Insurance Code regulates the procedure for accruing funds to the recipient. After receiving an agreement, court order or writ of execution, the employer of the alimony payer is obliged to transfer funds to the recipient's account on a monthly basis. This must occur within three days after the accrual of wages and (or) other payments.

Conditions for paying child support for one child

A man becomes obligated to pay child support if the child:

- born in a registered marriage;

- born within 300 days of his mother's divorce;

- adopted;

- was recognized as a man through establishment of paternity (in court or the registry office).

Important! Wards, adopted children, stepsons and stepdaughters are not entitled to alimony.

If a child was born in a civil marriage, then the man has no rights to the child. In order for him to receive paternal rights, the parents must submit a general application to the registry office or one of them to the court. A man's paternity rights and responsibilities arise from the moment his data is entered into the child's birth record. It is from this time that alimony can be collected from him.

Example

Igor and Nina lived in a civil marriage. Nina gave birth to a daughter. Since the couple was not married, Nina was recorded as a single mother. When the couple broke up, Igor did not pay alimony. Nina decided to collect them through the court. To prove the relationship, she had to file a paternity suit. In the trial, the man tried to prove that the girl was not his daughter. The court ordered a DNA examination. According to the results of the analysis, paternity was confirmed. The court satisfied the request to establish paternity and collect alimony.

From what income is alimony collected?

All types of income from which alimony is collected are indicated in Decree of the Government of the Russian Federation No. 841 of July 18, 1996 “On the List of types of wages and other income from which alimony is withheld for minor children.”

Income from which deduction is made , in particular, includes:

- all types of wages at the main place of work and part-time (bonuses, additional payments, vacation pay, allowances, rewards, additional payments, salary or allowance, fees);

- all types of pensions (except for survivor pensions), scholarships, temporary disability and unemployment benefits, doctoral payments;

- income from doing business, leasing property, under civil contracts, income from shares;

- income of prisoners and persons in drug treatment departments of psychiatric dispensaries and hospitals.

However, not all income can be used to withhold child support for minor children. The restrictions are specified in Art. 101 Federal Law dated October 2, 2007 No. 229-FZ. is not collected from these funds :

- funds for compensation of harm in the event of the death of the breadwinner or injury in the performance of official duties;

- compensation for caring for disabled persons;

- compensation for the purchase of medicines, travel expenses, etc.;

- alimony received for the maintenance of other persons;

- payments at the place of work in connection with: business trip;

- tool wear;

- the birth of a child;

- marriage registration;

- death of relatives;

- with natural disasters and other emergency situations;

Knowing all the restrictions, you can more accurately calculate the amount of alimony that will be paid for a minor child.

Employer's liability

The received documentation should be stored in a safe, and when an employee resigns, the accountant sends a message about this to the bailiff or the recoverer (in case of an agreement) as soon as possible. In this case, you need to make a record of the payments made. Violations of the provisions of the law on enforcement proceedings are subject to administrative or criminal liability.

The first occurs when:

- submission of incorrect information about the earnings of the obligated person;

- loss or damage to documentation;

- violation of the deadlines for sending it.

Penalties are for:

- individuals – 2-5 thousand rubles;

- due persons – 15-20 thousand;

- legal entities – 50-100 thousand.

Criminal liability is provided for:

- failure to withhold funds from the debtor's salary;

- failure to transfer them to the claimant or to the FSSP.

Who exactly will be held responsible - the head of the organization, the chief accountant or the accountant - depends on the guilt of the person, which is determined by a court decision.

Advantages and disadvantages of the method

Receiving alimony as a percentage of your salary has its strengths and weaknesses. More details about them can be found in the table.

| pros | Minuses |

| Possibility of simplified application for alimony | The payer may change jobs and not notify the new employer about payments, which often results in debts |

| The amount of payments increases along with the salary | Official salaries may decrease or not increase for a long time |

| Knowing the official income, it is easy to calculate the amount of alimony | Alimony is calculated from the official salary of the employee. Income in the “envelope” is not taken into account |

Parents must equal care of their common child even in the event of divorce. The ideal way to resolve child support issues is to sign an agreement. This frees the participants in the process from wasting time and effort, allowing them to take care of the child. If dialogue between former spouses is impossible, the only solution to the problem is to go to court.

Calculation of alimony from wages and the procedure for their deduction

The legislation identifies several circumstances on the basis of which a person may be assigned to pay alimony in a shared ratio:

- the citizen has a minor child who does not live with him. At the same time, he is obliged to take financial care of him.

- The person has a stable income. For example, a citizen works under an employment contract.

- Availability of the relevant document. If money is transferred by court, then alimony is transferred on the basis of a writ of execution. In a situation where the parties have entered into an agreement, the money is transferred at the request of the payer.

If all three elements are present, then payments can be assigned.

You will learn about the alimony percentages of 1/6, 1/4 and 1/3 below.

Watch the video in more detail about the conditions for assigning alimony:

For the obligated person, you can find several positive characteristics when assigning alimony in shared terms:

- If your earnings decrease, the amount of alimony will also decrease. If a fixed amount is assigned, the payment may become unaffordable for a person with a low-paying job.

- A citizen can find an informal part-time job and improve his financial situation. Bailiffs will not carefully monitor this, since money is transferred according to the writ of execution.

The main disadvantage of this method for the recipient of alimony is that the obligated person can come to an agreement with an unscrupulous employer who will pay the salary “in an envelope”. Among the disadvantages are the following points:

- an increase in total income will affect the citizen’s well-being to a lesser extent. Because the percentage of alimony payments will increase.

- The payer should take into account that large cash receipts can be seriously reduced. For example, receiving royalties for an author's work or dividends on shares.

- The need to notify the bailiff in the event of a change of place of work.

- Ambiguous attitude towards obligated persons in society. Alimony payers have a reputation as people who try their best to avoid this obligation. That is, such a circumstance can negatively affect relationships in the work team.

Calculation examples

Calculation of the amount of debt based on the average Russian salary

Payer Sergienko A.G., working at the plant, received a salary of 22,000 rubles. His child support obligations for one child were determined by the court as 1/4 of his income and amounted to:

(22000 - 13%) x 25% = 4785 rubles.

He quit his job in July 2021 and did not pay child support until September 2017. At the beginning of October Sergienko A.G. I received a notification from the FSSP about the calculation of debt for 3 months, which is equal to 28,562 rubles. 19 kopecks It was made up of the following numbers.

The average monthly salary in Russia for September 2021 was 38,083 rubles. Therefore, the amount of alimony by month will be as follows:

July – 38,083 x 25% = 9,520 rubles. 75 kop.

August – 38,083 x 25% = 9,520 rubles. 75 kop.

September – 38,083 x 25% = 9,520 rubles. 75 kop.

Total – 28562 rub. 19 kopecks