A loan for everyone

A loan is not made in heaven, and a commitment to pay the bank for 25 years does not guarantee a happy marriage.

What to do if the family breaks up, but the mortgage remains? The first thing you need to know: even if the loan is issued to only one of the spouses, the other will not be able to stay in any way. Was the home purchased during marriage? Spouses are automatically co-borrowers, even if this is not indicated in the agreement. And if the husband, the main borrower, packed up his things, left and stopped paying the loan, then the wife will have to do this.

Moreover, the courts recognize the mortgage debt as the common debt of the spouses, regardless of how the mortgaged apartment is divided, explains Daryana Epikhina, lawyer at Petrol Chilikov. That is, the mortgage can be divided equally, even if the apartment is divided into unequal shares.

An apartment purchased with a mortgage is divided during a divorce, as is the mortgage itself. To do this, the spouses must allocate shares in the ownership of the apartment and then divide the loan. It is possible to conclude a separate agreement with each spouse and adjust the payment schedules taking into account the level of wages. The ex-husband and wife will each pay the mortgage for their own share, and the optionality of one spouse in this matter will not affect the other.

If the mortgage is issued to the husband, the wife is recognized as a co-borrower

An apartment and a mortgage loan cannot always be divided during a divorce. For example, when applying for a military mortgage, banks require the military to enter into a marriage contract. According to its terms, in the event of a divorce, the borrower becomes the sole owner of the home and continues to repay the loan alone. But the wives of such mortgage holders risk being left homeless.

How to divide office housing

In accordance with Art. 92 of the Housing Code of the Russian Federation, service residential premises belong to the specialized housing stock and belong to the state or municipality. They cannot be alienated or leased. As a rule, they are transferred to employees of a particular institution for living in accordance with a social tenancy agreement.

When an employer resigns, the contract with him is subject to termination, and he and his family members are subject to eviction. When the marital relationship ends, the former spouse who is not an employee of the lessor loses the right of residence. But, as in previously described cases, there may be exceptions.

If the former spouses cannot agree, the one who remains homeless may try to sue for his rights to office space. For example, the ex-wife of a military man who followed him to a distant garrison often finds herself in a difficult situation. The court may accommodate her by providing the opportunity to live, especially if she has a common minor child.

Important! Service housing cannot be divided between a former married couple during a divorce, since it is not their property. It is only possible to reserve the right to live with a spouse who is not a tenant in need of housing.

Finding an alternative

Even if the loan and meters are divided, joint ownership of an apartment can be a burden for former spouses. So in practice, popular options are those that allow you to divide the mortgaged apartment before repaying the loan.

If the mortgage is paid off by less than 10-20%, one of the spouses may waive the rights to the apartment in favor of the other. For the paid part of the loan, he has the right to demand half of the deposited amount, explains Maria Litinetskaya, managing partner of Metrium. In this case, the obligation to pay the mortgage falls on only one of the spouses, and to avoid discrepancies, the bank enters into a new mortgage agreement with him.

Former spouses can sell the mortgaged apartment. At the same time, the property is pledged to the bank, so they either find a buyer who is ready to repay the loan, or someone who is ready to reissue the mortgage. It is possible that the spouses find money to pay off the balance of the debt, and then sell the home and divide the proceeds.

Partition by mutual consent

Where to contact

Peaceful division of living space between spouses is allowed using 2 methods:

- Marriage contract.

- Property division agreement.

To draw up and certify these documents, spouses must contact a notary, since family law provides for their mandatory notarization.

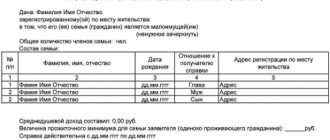

List of documents with samples

The list of documents prepared before visiting the notary is identical for both the marriage contract and the agreement on the division of property and includes the following:

- Passports of wife and husband.

- Certificate of marriage. If an agreement on the division of property assets is drawn up after a divorce, then a certificate of termination of the marriage must be presented.

- A document that is the basis for ownership of an apartment, for example, a court decision, a privatization agreement, an agreement on purchase and sale, donation, equity participation or exchange, a certificate of entry into the rights of an heir.

- A paper confirming the fact of registration of the home with government agencies, for example, a privatization order or a certificate of ownership.

- An agreement on a mortgage loan taken by spouses jointly or by one of them for the purchase of housing.

A sample marriage contract can be downloaded here.

A template for an apartment division agreement can be downloaded from here.

Procedure

A marriage contract can be drawn up:

- Before marriage.

- In registered marital relations until the registry office accepts an application for dissolution of the marital union.

An agreement on the division of property is written and certified by a notary:

- During the divorce process.

- During the statute of limitations in family cases on the distribution of common property of spouses. It is equal to 3 years from the date of issue of the marriage termination certificate.

If a marriage contract or agreement is drawn up by spouses or persons intending to enter into a marriage relationship during a period of time that is not provided for by law, then the consequence of this action will be the notary’s refusal to certify these documents.

Having decided to divide the apartment by mutual agreement, the spouses must consistently do the following:

- Collect the list of documents required by law and agree on the date of the visit to the notary.

- When visiting a notary, the participants in the marriage union explain to him the purpose of the visit and hand over the papers they have for verification and study.

- The notary sets the date for the next visit, before which he prepares the text of the marriage contract or agreement on the division of the apartment, if the spouses have not done this on their own, and checks the accuracy of the information in the documents provided by the wife and husband.

- During the next visit, the notary introduces the spouses to the text of the contract or agreement, charges them the fee established by the Tax Code for the provision of notarial services, certifies the document and hands it over to the spouses.

Construction has just begun

Not every family can afford to buy ready-made housing. Therefore, by the time of the divorce it may not be completed.

With an apartment purchased under an equity participation agreement, the nuance is that it is purchased at the construction stage, and ownership is formalized after the object is put into operation and the acceptance certificate of the new building is signed. “Until this moment, apartments in such a building are considered unfinished construction projects and cannot be subject to division,” says Litinetskaya.

If the share participation agreement was concluded and fully paid before marriage, then after delivery the housing will fully belong to the spouse for whom the agreement was signed. In other cases, the second spouse has the right to demand that a share in the apartment be registered as his property if the property is already ready. If the deadline for handing over the house is still far away, you can achieve a change in the terms of the share participation agreement and include the second spouse among the shareholders.

General information about privatization

Privatization is the free transfer of an apartment occupied under a social tenancy agreement into the ownership of citizens. Issues related to the privatization of housing are regulated by the Law “On the Privatization of Housing Stock in the Russian Federation.”

Initially, privatization was conceived as a “temporary action”, the completion date of which was repeatedly postponed, but in February 2017 the right to privatize housing was recognized as indefinite.

Registration of ownership of residential premises through privatization is possible subject to the following conditions:

- the housing is not emergency, service, does not belong to a dormitory and is not located in a closed military camp;

- housing belongs to the state or municipal housing stock;

- a citizen lives in it on the basis of a social tenancy agreement;

- the citizen has not previously participated in privatization.

Children's share

When purchasing apartments, maternity capital is often used, which seriously complicates the division of property during a divorce. But what is the “weight” of this capital? For example, in the cost of housing he could have a very small percentage: 5 or 10. But does this mean that the remaining 90% can be divided between the spouses and the one who leaves the family without children can claim almost half of the apartment? Judges have considered many such claims, but the Supreme Court recently put an end to it.

The apartment, paid for including with maternity capital, must be registered as common shared ownership. The spouses determine the shares of each family member independently; the general practice is to equally divide the shares among everyone. It turns out that if the children were allocated specific shares, then upon divorce, each spouse will receive the strictly due share. But the one with whom the children remain receives their shares too. For example, in a family with two children, the wife will be left with two-thirds of the apartment, and the husband with only a quarter.

If they did not have time to allocate shares, the situation changes not in favor of the wives. The part of the apartment, which is paid for from common savings, is divided equally between the spouses. Children, since they did not participate in the payment, do not receive anything. But all family members - even children - have the right to maternity capital. It is divided equally. As a result, the child can only claim that part of the apartment that is proportional to his share in the maternity capital. With this division, the husband will actually receive almost half of the apartment.

Division of a privatized apartment between spouses

The procedure is no different from the division of any property owned by a private individual.

If the share was determined (documentarily) for all family members in privatization, then during the division everyone will have the right to their part of the apartment.

One spouse participated in privatization

To understand how to divide a privatized apartment during a divorce, if only the husband or wife took part in the process of converting property from public to private, you need to understand the very essence of the problem. Both the donation procedure and the privatization transaction are considered gratuitous transactions.

From the above, the conclusion suggests itself: the division of a privatized apartment after a divorce is impossible if one of the spouses is a participant in the property transformation.

Unequal marriage

It is believed that the acquired apartment is divided equally between the spouses. However, in practice, there is often an excess of meters towards one of the spouses.

Children, for example, can increase the share of an apartment. If, after the sale, a share of the proceeds is not enough to purchase a new home, then the court may allocate a larger share in the apartment in favor of one of the spouses, who will raise the minors. However, the mere fact that spouses have minor children is not a basis for deviating from the principle of equality of shares when dividing common joint property, explains Anton Martkochakov, partner at Enforce Law Company.

You can also achieve an unequal division of the apartment if one of the spouses spent the entire salary on themselves, while the other supported the family, or if, when purchasing, one of the spouses invested money that they had before marriage. For example, funds from a bank deposit, from the sale of a bachelor’s apartment or car.

The court clarified when, during a divorce, housing goes to one of the spouses

In our case, the husband sold his inheritance, and a few weeks later, with the proceeds, he bought an apartment for the family, who settled in it. And now - divorce. And the question arises: how to divide such an apartment - in half, as jointly acquired property, or does this apartment belong only to the husband, since it was bought with his money?

This situation is not something exceptional. Many citizens face such difficulties. Therefore, the Supreme Court's clarification may be useful not only for judges.

Our story began in the Rostov region. The couple lived there legally married for several years. After which the husband received an inheritance from an elderly relative. It was a share in her private house and a plot of land.

The man made a decision: to sell the inheritance and improve the family’s living conditions.

The inheritance when sold amounted to two and a half million rubles. And with all this money, an apartment was eventually purchased. The property, as decided at the family council, was registered in the name of the wife. After buying the apartment, several more years passed and the marriage broke up. Now the ex-husband and wife began to divide property. They failed to come to an agreement on peace.

The ex-husband appealed to the district court to recognize this apartment not as joint property, but exclusively as his personal property. In court, he explained that the family bought the disputed apartment solely with his personal funds, which he received from the sale of the inheritance he received. And as proof he explained: his ex-wife is a teacher. Her earnings did not allow her to buy an apartment, and she had no savings.

The ex-wife did not deny at the court hearing that the housing was purchased with money from her husband’s inheritance. She confirmed the financial contribution of her ex-husband to the purchase of the apartment. But she considered the apartment to be shared.

After hearing both sides, the court of first instance took into account the period between the sale of the inheritance and the purchase of the apartment, as well as the amount of proceeds - two and a half million rubles. This is exactly how much the disputed living space cost. That is, the spouse actually used the money he received to purchase real estate for the family.

Dividing property during a divorce is one of the most painful matters. Photo: Photoxpress

As a result, the Volgodonsk District Court of the Rostov Region decided that the family purchased the apartment with the husband’s personal money. Based on this, the disputed apartment cannot in any way be considered joint property of the now former spouses.

Therefore, the district court agreed with the claim in full and made a decision in favor of the ex-spouse.

Property purchased during marriage with the money of one of the spouses excludes it from common property

The losing side decided to challenge this verdict. And I turned to the next authority. The appeal did not agree with this decision. The judges of the second instance did not dispute the fact that the man purchased the property at his own expense. But, according to the appeal, he actually contributed money to the family budget, since he bought a joint living space.

The appeal stated that attention should be paid to the following fact - the husband registered the disputed apartment not in his name, but in his wife’s name. This, according to regional judges, only confirms that there is no reason to consider the property as personal property. The court divided the disputed property equally, citing Article 39 of the Family Code - “Determination of shares in the division of common property of spouses.” And this decision was challenged. Now my ex-husband.

The third court - cassation agreed with the appeal and left the ruling unchanged.

But the ex-husband categorically disagreed with such refusal decisions. He reached the Supreme Court of the Russian Federation and found understanding there.

The Judicial Collegium for Civil Cases of the Supreme Court requested the apartment case, carefully studied the dispute and said the following.

To correctly determine the status of property - whether it is general or personal - you need to understand with what funds it was purchased and under what transactions. Based on Article 36 of the Family Code of the Russian Federation - “Property of each of the spouses”, what one of the partners received free of charge (including inherited) is not community property.

It will remain personal even if the partner sells it and buys another house or apartment in return.

Property purchased during marriage with the money of one of the spouses excludes it from the regime of common joint property. And this rule applies even if this property was once registered in the name of the other spouse, the Supreme Court of the Russian Federation emphasized.

The High Court cited as an argument the resolution of the Plenum of the Supreme Court (dated November 5, 1998) “On the application of legislation by courts when considering cases of divorce.” It says literally the following: property purchased during marriage is not community property, but with personal funds.

Therefore, the Judicial Collegium for Civil Cases of the Supreme Court decided that only the first instance, the district court, took the absolutely correct position during the review. Well, the conclusions of the following authorities - appeals and cassation on dividing the disputed apartment in half - are “not based on the law.”

As a result, the Judicial Collegium for Civil Cases of the Supreme Court overturned all previously adopted decisions of local courts, except for the decision of the district court, which the Supreme Court upheld. So there was no need to reconsider this “housing” dispute on the spot.

Experts assure that such a position - when property purchased with the personal funds of one of the parties to the dispute is left to the one who paid - is well established in domestic judicial practice.

After all, this is what turned out to be true in our case. Local Rostov courts, in fact, in their decisions recognized the acquisition of the disputed property from the personal funds of one spouse, but classified it as joint property.

Judging by these decisions, the appeal and cassation assessed the registration of real estate in the name of the wife as a contribution of money to the general family budget. In similar disputes, family law experts say, the spouse who wants to recognize the property as personal must prove to the court that the funds used to purchase the disputed property are not shared. But there aren't many options here. You just need to prove that either the citizen earned them before marriage, or received them through gratuitous transactions - such as inheritance, donation, privatization.

For many years

How long can ex-spouses divide property? The statute of limitations is usually three years, but there is a nuance - from when to count it. The opinion that from the moment of divorce is incorrect, is correct - from the moment when the spouse learned or should have learned about the violation of his right to jointly acquired property, says Daryana Epikhina.

For example, a few years after the divorce, the ex-husband, who did not renounce the rights to a shared apartment, but also did not live in it, learns that the ex-wife has decided to sell this property. Or the wife sold the apartment, but did not pay monetary compensation to the ex-husband. In these cases, the statute of limitations will be counted from the moment of sale of the home. And this may be beyond the three-year period.

How to divide an apartment in shared ownership?

There are many legal and actual ways to divide an apartment owned by spouses on the right of common shared ownership. Alas, there is no method that is 100% suitable for all types of disagreements, and the method of division is determined by the parties or the court, taking into account the characteristics of each situation.

Allocation in kind

If the technical parameters of the apartment allow, the court can make a division of housing with the allocation of shares in kind.

This option provides for the physical isolation of certain rooms, the arrangement of a separate entrance and other premises with the termination of the right of common shared ownership.

In fact, only that property can be divided, the division of which will not cause serious damage to it. If this is not possible, the court may oblige one party to compensate the other for the cost of the share that cannot be allocated.

The section in kind applies to:

- low-rise apartments;

- small apartment buildings (essentially private houses for 2, 4 owners, etc.)

- large-area apartments with a number of rooms of 3 or more (subject to all permits for redevelopment and a conclusion from a construction and technical examination on its feasibility).

In relation to apartments located in multi-apartment buildings, it is almost impossible to produce a division in kind. The courts take the position that division is possible only for such immovable objects for which it is technically possible to isolate the premises and provide separate entrances (accordingly, such rules apply to residential buildings, but not apartments).

Offset against the value of other property

The share of one spouse in the common property may be transferred to the second spouse to offset the value of other property. This is possible if the subject of the dispute is not only an apartment, but also other assets - cash, vehicles, non-residential premises or business.

The offset mechanism is simple: one spouse transfers the right to his share to the second spouse in exchange for a car, other property or cash.

If the case goes to court, in this part the spouses have the right to enter into a settlement agreement, which will be approved by the court.

If the division of real estate occurs disproportionately to the existing shares, and one of the participants receives a larger part, then he is required to pay compensation to the spouse due to the disproportionate shares

Sale of real estate with division of funds

Spouses can agree to put the apartment up for sale with the subsequent division of the proceeds from its sale in equal or other proportions.

This method of division is ideal if it was not possible to reach other options for agreement.

Establishing a procedure for using common property while maintaining shares

If none of the above methods is applicable for a number of reasons, the spouses retain ownership of the previously determined shares. The court or an agreement between the owners establishes the procedure for using the common property of the spouses.

The features of this order directly depend on the characteristics of the living space and any conditions can be specified in it, including the time of use of certain rooms, the order of priority, the procedure for paying for utilities and other points.

Unfortunately, in practice this option is rarely applicable due to the many conflict situations associated with its implementation. Spouses who cannot agree, even through court, on the method of dividing property, will under no circumstances be able to peacefully coexist in the same living space.

Lawyer answers questions about the division of a municipal apartment during a divorce

What to do if a male employer drives you out onto the street, and your ex-wife and children have nowhere to live?

To use the right of residence, you must go to court. Based on the court decision, the woman will be able to use the premises on an equal basis with the tenant, or another solution to the problem will be found.

Is it possible to sell a municipal apartment and then divide the proceeds?

Such housing is not the property of citizens, and its sale is strictly prohibited. Privatization of real estate with subsequent sale to other persons is allowed.

Collection of documentation for the exchange of municipal housing

The procedure through the court is lengthy, the authorities carefully check everything. The main thing is to correctly fill out the statement of claim. The wording should be unambiguous - this makes the document easier to perceive, and the court has a positive attitude towards the applicant.

It is important to correctly fill out the statement of claim.

If the statement is drawn up incorrectly, it may not be considered. Refusal is possible when there are no additional documents that need to be presented along with the claim.

Please note that when dividing your home, you must provide the following documents to the court:

- statement of claim in several copies;

- receipt of payment of state duty;

- passports of those registered in municipal housing;

- a copy of the social tenancy agreement;

- children's birth certificates;

- personal accounts, copies;

- everyone agrees to exchange housing;

- permission from the guardianship authorities to divide the apartment;

- other documents required by the court.