Is it possible to apply for child support for children from different marriages?

According to the current legislation (Part 1 of Article 80 of the Family Code), parents are obliged to support their children. It does not matter in which marriage union the offspring were born. However, during court proceedings and the assignment of alimony for children from different marriages, there are specific features (for example, whether the father has a stable job, the size of his salary, the number of children), which are considered differently in each individual case.

Child support refers to money paid by one of the parents and used to provide for the primary needs of the child. From Article 80 of the RF IC it follows that a mother who raises her offspring on her own has the right to count on payments from her ex-husband. It does not matter whether the spouse is in another official relationship, and whether he has children from other marital relationships or not.

Payments in a fixed amount

There are options when the father:

- does not have a permanent job,

- his income is unstable throughout the year,

- he is registered at work unofficially ,

- they are settled with the currencies of other countries,

- instead of money he is paid in kind.

Then you can amicably decide with your ex-wife what amount the husband should pay in a clearly defined amount. This is called lump sum alimony.

How and who can apply for child support for children from different marriages?

Parents have equal rights and responsibilities towards their offspring. This means that even after the breakup of the family and the departure of the father (or mother), the obligation to provide for the child remains. Thus, a parent living with a child (as well as another legal representative) has the right to expect to receive cash payments from a former spouse aimed at supporting the offspring (articles, RF IC).

Alimony for children from different marriages can be paid by both the husband and wife. Of course, in the overwhelming majority of cases, the recipient of the appropriate funds is the mother, since it is she who, as a rule, raises and raises the common offspring of her former spouse.

For your information

The right to alimony for children from different marriages arises not only when the spouses are divorced. A woman can demand payment for the maintenance of a common child even if she is in a legal marriage. As a rule, such a need arises when a husband has children from previous wives. At the same time, the amount of payments for other offspring will be reduced. If the wife has to go to court, then in the statement of claim it is necessary to refer to Article 119 of the RF IC.

Thus, the legal representative of the child has the right to apply for alimony for children from different marital unions. Usually this is a mother raising her offspring. At the same time, it does not matter whether the mother is the ex-wife of the baby’s father or the present one.

How is alimony divided?

Every minor has the right to financial support, regardless of whether he was officially married or not. The number of children receiving payments from one father is also not limited by law.

The only condition on financial assistance provided to a child is that there is a limit on the maximum amount of withholding. The court cannot recover funds exceeding half of the payer’s total income.

At the same time, a man has the right to enter into an agreement with each mother of his children. The amount is determined by the parties independently.

Peculiarities:

- If an agreement on the monthly financial support of her son is not reached, the mother of the minor goes to court. Money is recovered from the first son in the amount of ¼ of all income of the alimony holder.

- When applying for financial support from another woman, the payment is also assigned in the amount of ¼ of the salary and other income of the payer.

To reduce the total amount of payments to 33%, a citizen must independently bring to the court information about the current court decision to collect alimony from him. If the first wife did not send the document to the bailiffs or the accounting department, the court in any case will not refuse to reduce the payment amount.

Important! A reduction in the amount of alimony or the collection of financial support for a second child, resulting in a decrease in the funds transferred to the first, is considered exclusively through legal proceedings.

If funds for the first son are transferred by agreement, then for the second son the court awards alimony in the amount of ¼ of the defendant’s share of the income.

However, if there is an agreement, they can subsequently be brought in accordance with the law and reduced to half the amount of 1/3, i.e. up to 1/6 share of all income. For more details, see “Alimony for the birth of a child from a second marriage.”

Are child support payments divided between children from two or more marriages?

Issues related to the assignment of payments are regulated by articles of the Family Code. Alimony for children from different marriages is withheld as follows:

- As a percentage, based on the monthly income of the payer for 1 child - 25 percent, for two - 33 percent or 16.6 percent for each of them, for three or more - 50 percent, also 16.6 percent for each of them , but not less than 10 percent for each.

- In a fixed amount, if the father receives income in kind, in the currency of another state, is an individual entrepreneur, unemployed, or works unofficially.

That is, when collecting alimony, the general principle of calculation is applied, in which the amount of deduction is divided by the number of offspring. This is stated in Article 81 of the RF IC. Each child is assigned the same amount of payments. Alimony for children from different marriages is listed by the payer's employer's accounting department.

The total amount of alimony collection cannot exceed 50 percent of the payer’s salary. Therefore, when a new baby is born, the share of the father’s earnings for each child will be reduced. If the payer wishes, he has the right to transfer more interest on alimony for children from different marriages. Then an agreement is concluded between the parents to pay financial obligations. (Article 80, Chapter 16 of the RF IC). The amount can reach 70 percent of earnings. The payer spends the remaining money on himself.

What percentage is the payment amount?

The legislation establishes the amount of alimony payments collected in favor of minor children in court. In accordance with Art. 81 of the RF IC, the following shares are levied on the parent’s income :

- one child - 1/4 of the payer’s total income;

- two children - 1/3 of the payer’s total income;

- three or more children - 1/2 of the payer’s total income.

IMPORTANT ! Alimony from wages is withheld after taxes are deducted.

The amount of alimony payments depends on the financial situation of the payer and the amount of his income, including unofficial earnings. That is, if a father has 2 children, but they were born in different marriages, from different women, then by law he is obliged to pay a third of his earnings for their maintenance.

He would transfer the same amount if the children were born from the same marriage. In other words, the cost of a father's child support obligations does not change depending on the number of marriages.

The situation is different if a woman has two children from two different marriages. The father of each of them will be required to pay ¼ of his income, unless, of course, he has other obligations to pay child support. In such a situation, the mother and children remain in a more advantageous position. If both fathers pay ¼ of their income, then the child whose father’s income is higher receives more child support.

A third of the alimony payer's income in percentage terms is 33% of his earnings . If you divide the payments equally between both children, it turns out that each is entitled to 16.5%. The changes in the amount of financial assistance for a child from a first marriage are especially noticeable, since initially he was entitled to 25%.

In some cases, mothers file a claim for alimony in a fixed amount. Most often, such a requirement is made in cases where the father does not have a regular income, or is trying in every possible way to hide his real income by presenting underestimated amounts to the court in documents.

The court makes a decision on the payment of alimony, in accordance with which the rights of none of the children are infringed.

In special cases, the court may increase or decrease the amount of alimony if the parties have provided legal grounds for such changes.

There are situations when a man, having child support obligations for a child from his first marriage, is looking for ways to reduce payments, and thereby reduce the cost of maintaining the child. Having acquired a second family and a baby, he files for a divorce from his second wife. After a documented breakup, a woman files a claim in court demanding to recover alimony from her ex-husband.

Of course, according to the law, she has every right to receive financial assistance from her father, so the court will grant the claim with such a request. Since the man is now required to pay alimony for two children, 33% will be written off from his earnings, which will be divided equally between the two children. Thus, the first family will receive 16.5%, instead of the original 25%, and the other 16.5% will remain in the second family, whose marriage is considered dissolved according to documents. It is almost impossible to prove such manipulations of the ex-husband to the first wife.

You will learn more about what percentage of income alimony and other important nuances will be in this article, and you can find out how the amount of payments is calculated here.

Normative base

Issues of assigning alimony in favor of offspring are regulated by Chapter 13 of the Family Code. According to the law, children from different marriages have the right to receive the same share of payments. These provisions are governed by the following articles:

- Parental responsibilities in relation to providing for minors Art. 80.

- The amount of payments that are collected in court Art. 81.

- Types of sources of income from which alimony is withheld, Art. 82.

- Collection in a fixed amount of money Art. 83

In addition to the provisions of the Family Code, this issue is regulated by the following legal acts:

- Code of Civil Procedure.

- Civil Code.

- Federal Law No. 229 “On Enforcement Proceedings”.

You need to understand that child support from different marriages is received not only from the payer’s official earnings, but also from other income, namely:

- Additional payments and salary allowances.

- Premium.

- Pension payments (except survivor's pension).

- Scholarships.

- Income from real estate, securities and other things.

- Contents for military and internal affairs employees.

- Income from doing business and the results of intellectual work.

However, alimony payments for children from different marriages cannot be received from:

- Amounts that were paid as compensation for harm caused to human health.

- Reimbursed amounts (for example, when caring for a sick loved one).

- Travel payments, payments for the use of personal transport, tools, and so on.

Attention

Information about the income from which alimony is transferred for children from different marriages is contained in Article 2 of the Government of the Russian Federation of July 18, 1996 No. 841. Information about which funds cannot be levied is indicated in Article 101 of the Law “On Enforcement Proceedings”.

Methods for collecting alimony

In situations where all children live in the same family, the procedure for collecting child support payments is quite simple. The father and mother of the children either enter into a child support agreement in notarial form or resolve this issue in court.

If the issue is resolved through the court, the decision made by this authority is the basis for issuing a writ of execution and transferring it to the Bailiff Service. After this, enforcement proceedings are opened, and the collection of alimony from the income or property of the payer is already the responsibility of the bailiff.

Everything is much more complicated if children live in different families and are born from different marriages. The claimant is usually the mother, but in this case there are several claimants and, most likely, several courts through which alimony payments are collected. And the grounds for collection can serve as alimony agreements concluded between parents, as well as court decisions or court orders.

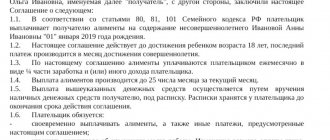

Alimony agreement

Parents of minor children enter into an agreement on the payment of alimony payments on a voluntary basis. Usually, all agreements between them are reached in advance, before visiting the notary, so the essence of the procedure for them is only to officially document the terms of payment of alimony.

Mandatory components of the alimony agreement include an indication of the amount and methods of payment of alimony payments. One of the important conditions is that for three children the share of income paid in the form of alimony cannot be less than 50%, for two - less than 33%, and for one - less than 25%. These amounts cannot be reduced even on a mutually voluntary basis, and the notary will not agree to certify an agreement with conditions that contradict the established law.

Options that parents of three children can, if desired, agree on in a notarized voluntary alimony agreement:

- every month - at least 50% of the payer’s official income (50-70%);

- every month - in the form of a fixed amount (for example, at least 15,000 rubles);

- every month - in the form of an amount tied to the minimum wage, or to the cost of living in the region;

- once in a set period of time (for example, once a quarter, six months or a year) - in the form of a flat amount;

- lump sum - in the form of a set amount or property (car, apartment, country house).

In addition, parents can agree on a mixed version of alimony - for example, divide it as follows: part will be paid as a share of income or a fixed amount, and part - in another form of material assistance (purchase of goods - toys, things, educational games, etc.) etc., payment for classes in creative and sports sections, nannies, tutors, etc.). The law does not establish any restrictions on the types of assistance, except for the requirement to pay no less than the established share of income.

Important! In an official agreement certified by a notary, according to the law, neither the rights of children nor the rights of parents, including the payer, can be infringed.

Amount of alimony for children from different marriages

According to Article 80 of the RF IC, the amount of alimony for children from other marital relationships may be provided for in an agreement that is concluded between the parties on a voluntary basis. In this case, payments for the maintenance of offspring can be transferred in any amount and at a frequency agreed upon by the former spouses (Articles 103, 104 of the RF IC).

If the parents providing for the maintenance of the children were unable to come to a consensus on the payment of financial obligations, then, according to Art. 81 of the RF IC, the amount of alimony for children from different marriages is established by the court, taking into account all the circumstances of the current situation, as well as the family and financial situation of the parties. From the following table it becomes clear how payments are divided between offspring:

| Number of children | Total retention rate | Individual retention rates |

| 1 | 25% (one fourth of income) | 25% |

| 2 | 33.3% (one third of income) | 16,65% |

| 3 or more | 50% (half income) | 16.66%, not less than 10% |

What's new in the law

The state guarantees the provision of adequate maintenance to children with one parent through alimony.

The main legal act is the Family Code of the Russian Federation, which covers all aspects of the issue of alimony obligations. Today the following changes to the law are proposed:

- increasing the payment period - until the age of 24, subject to full-time education;

- the obligation to resolve the housing issue;

- the minimum fixed amount of alimony is 15 thousand rubles;

- changing the calculation procedure for unemployed citizens - using the regional average salary.

Amendments and additions are only at the discussion stage, but are already on the way to implementation.

As of 2021, debtors may be required to pay rent for a child (Article 96 of the RF IC). The amount is divided into several parts. For example, if a mother pays 10,000 rubles under an agreement, she pays 5,000 of them for herself, and another 5,000 rubles. divided between her and her father. The latter must transfer 2,500 rubles.

In what forms can alimony be paid?

Alimony for children from different marriages can be collected in two ways:

- Through the conclusion of an agreement.

- Through the judiciary.

An agreement is drawn up if the spouses managed to come to a common opinion regarding the provision of a common offspring. The document is certified by a notary (Part 1 of Article 100 of the RF IC). If an agreement cannot be reached, this issue is resolved through the court, which establishes the amount and procedure for making payments for alimony for children from other marriages.

What is alimony

Alimony payments are considered funds transferred on a regular basis for the maintenance of dependents.

Recipients can be both minor citizens and adults, for example, a spouse or elderly parents. Most often, when it comes to alimony, child support is discussed. Alimony can be either a fixed amount or a share of income. If a person is officially employed and has a stable salary, then preference is given to the second option. If there is no guarantee of receiving a certain amount on a monthly basis, then a fixed payment is established.

Spouses can agree on the amount and procedure for transferring alimony in two ways:

- conclusion of a peace agreement;

- through legal proceedings.

In the second case, the court, assessing the life situation of both parties, decides what the payment amount or percentage will be, as well as the frequency of payments.

Healthy! An alimony agreement can be concluded orally, however, if the recipient does not agree with the amount or the payer evades obligations, then it is advisable to either have the document notarized or go to court.

Registration of alimony for children from different marital unions by agreement

In the case of registration of alimony for children from different marriages by voluntary agreement, payments aimed at supporting the offspring are transferred in amounts and in the order, according to the information specified by the agreed parents, stated in the document. The official consent must include the following information:

- Full name and passport information of both parties.

- Amount to be paid.

- Child support payment period.

- Transfer method.

- Details where funds should be transferred.

A sample agreement on the payment of alimony for children from different marriages is available.

To conclude an alimony agreement, the following documents will be required:

- Parents' ID cards.

- Birth certificates of children.

Sometimes additional paperwork may be required, for example:

- Document confirming residence with the parent.

- Passport if the child has reached 14 years of age.

Notary specialists will order documents on the legal capacity of parents themselves.

The procedure for obtaining alimony for children from different marriages by agreement is as follows:

- Draw up an agreement or decide on its main points.

- Collect the necessary documents.

- Contact a notary and agree on the text.

- Wait for the submitted documentation to be verified.

- To certify a document.

- Make payments on time.

A notarized alimony agreement for the payment of alimony for children from different marriages has the same legal force as a writ of execution issued by a judicial authority (Part 2, Article 100 of the RF IC). This means that if the payer fails to fulfill the relevant obligations, the recipient can turn to the bailiffs to collect the money forcibly.

The provisions of the agreement on the payment of alimony for children from different marital relationships can be changed by mutual agreement of the parties. For example, if the payer has another child from a new marriage, the maintenance for the first offspring should be reduced. If the recipient does not agree to this, then the alimony obligee will have to go to court to forcefully reduce the amount of payments (Article 119 of the RF IC).

Payment upon application or by court decision

It is possible to draw up a mutual agreement, certified by a notary, on the amount and date of receipt of funds for the maintenance of joint offspring . Such a document itself has legal powers equal in force to a writ of execution (Article 109 of the RF IC).

Child support agreement form:

Alimony for two, three, four children through a magistrate judge

It is possible to do without judicial red tape; if there are no questions about establishing paternity or maternity or other complications , then to request alimony you can apply to the magistrate to issue a court order .

In this case, there will be no meetings, no showdowns, and no later than 5 days later you can receive a court order with the functions of a writ of execution . This is the simplest, fastest and most hassle-free method of claiming financial support for a child from the father.

There are also pitfalls in this method: if alimony is not paid within 10 days, counting from the appointed date, then the court order will be revoked as an unjustified remedy , and you will still need to go to court.

Claim form for a child, as well as 2 or more children: .

According to a writ of execution from the court

Submit a statement of claim to the magistrate's court , where the full trial will take place, taking into account the general rules.

The result of the court will be a decision according to which a writ of execution should be obtained and transferred to the bailiffs at the service at the place of residence of the alimony payer.

The court may also assign a larger amount of payments for children than the minimum interest . It all depends on earnings, living conditions of the husband and his family in previous marriages, and also on the number of dependents on the alimony provider’s neck at the moment.

Necessary documents for registration of alimony through the court

When applying to a judicial authority to obtain alimony for children from different marriages, the plaintiff draws up an application indicating the claims. The document is prepared in several copies. One of them is handed over to the court, the other is sent to the defendant, and the third remains with the plaintiff. In addition to the application, it is necessary to submit other documents, namely:

- A copy of your ID.

- Children's birth certificate.

- A certificate from the place of residence confirming that the child lives with the plaintiff.

- Document confirming income.

- Evidence justifying the receipt of a certain amount of alimony (payments that indicate relevant expenses).

How to reduce

The Family Code does not contain a list of grounds for reducing alimony. But based on established judicial practice, these include:

- the onset of disability of the obligated person or illness that prevents him from continuing his previous work (but only if this resulted in a significant decrease in income);

- the inability, due to alimony, to provide minimum conditions for disabled family members;

- work of a minor child under an employment contract or individual entrepreneurship;

- the child receiving an inheritance or the emergence of another source of stable income;

- awarding alimony for other children.

The court may consider other reasons for reducing the amount of payment to be valid. But it is very difficult to prove this. The judge may find that the son or daughter needs alimony in the same amount.

Sample application for reduction of alimony

If a parent is determined to fight for a reduction in child support payments, then he will need to write a statement of claim. It will need to most fully highlight the circumstances that worsen the financial situation of the payer and may serve as a reason for reducing the salary, for example, a certificate of disability, a birth certificate of a second child, etc.

The sample application for a reduction in alimony is the same as in the case of dividing alimony for two children, only the real circumstances that served as the reason for filing this document are indicated.

Registration of alimony for children from different marriages through the court

After the enactment of the regulatory act on amendments to the law on justices of the peace and the Code of Civil Procedure of the Russian Federation, on the basis of Law No. 451-FZ, from October 1, 2021, on the issue of collecting alimony for children from different marital unions, you can only apply to judicial authorities of general jurisdiction.

IMPORTANT

Previously, the issue of alimony for children from other marriages was also resolved through writ proceedings, in which the parties were not summoned to trial. At the same time, the magistrate issued a ruling - an order, which was an executive document. The document entered into legal force only in the absence of disputes. If the defendant expressed an objection, the case was transferred to a court of general jurisdiction, where it was considered in the standard manner. However, the order could be applied when alimony was calculated exclusively as a share of earnings, and also when the payer had no other monetary obligations.

Thus, when applying for alimony for children from different marriages, you must contact the district court. The application must be submitted at your place of residence or the defendant’s place of residence. It should contain the following information:

- Name of the court where documents are submitted.

- Full names of the parties, as well as their addresses and contact details.

- The basis for the emergence of alimony obligations.

- Information about the defendant's obligation to make payments.

- Claims indicating the exact amount.

When deciding on alimony for children from different marriages, the court proceeds from how many minor children the defendant has, the financial and marital status of the plaintiff and defendant, and determines the financial support for the offspring in such a way that neither party is disadvantaged.

A sample statement of claim for the collection of alimony for children from different marriages is available.

How to file a claim?

After a man breaks off the marriage in which he had a baby, the mother, of course, will express a desire to receive legal financial assistance from her ex-husband. The payment amount will be 25% of the husband’s earnings. If the issue of payments was resolved in court, then alimony will be paid according to the writ of execution .

This will happen until the man has a new family relationship, in which he will also have offspring, but the whole idyll will again end in divorce and new obligations to pay alimony.

Where to contact?

To recover alimony payments, the second spouse files a claim with the court. The first ex-wife and her child need to prepare for the fact that the amount of financial assistance from the father will soon decrease due to the emergence of new family members who are legally entitled to alimony.

IMPORTANT ! In judicial practice, there are no cases where both ex-spouses simultaneously apply for alimony. However, if such a situation arises, the payments will still be divided equally between the children.

Since alimony obligations have already been assigned after the first marriage, the second spouse will act as the applicant. To file a claim, you must apply to the magistrate’s court either at the place of residence of the defendant or at the place of residence of the plaintiff.

Drawing up a statement of claim

The application must be submitted in writing. When drawing it up, it is necessary to take into account that the document must necessarily contain the points specified in Art. 131 of the Civil Procedure Code of the Russian Federation (Civil Procedure Code of the Russian Federation).

If the claim is drawn up without complying with the necessary requirements, then the judge leaves it without movement and sets a deadline for making adjustments (Article 136 of the Code of Civil Procedure of the Russian Federation).

The statement of claim must include the following items:

- The name of the judicial body to which the plaintiff applies with the application.

- Full name, place of residence and contact telephone number of the applicant.

- Full name, place of residence and contact telephone number of the defendant.

- Information about marriage and its dissolution.

- Information about children indicating relationship, date of birth.

- Grounds for collecting alimony.

- The amount of payments and the procedure for their payment.

- List of documents that the applicant attaches to the claim.

- Personal signature with transcript and date.

The text of the application must clearly describe the situation . It is necessary to indicate when and with whom the marriage was entered into and dissolved, as well as indicate the children who were born in each of the unions. It should be noted that the husband already fulfills his alimony obligations to his wife from his first marriage and makes payments in a certain amount. It is better to confirm this with the number and date of issue of the court decision.

In addition, the document must mention that the father does not live with the second family and does not provide financial assistance. The statement of claim must be accompanied by a package of documents confirming the legal rights to receive financial assistance from the plaintiff.

The decision to satisfy the claim will be made at a court hearing, where all parties to the case will be invited. After the decision is made, the court will issue a writ of execution , in accordance with which amounts will be collected from the alimony payer.

You can learn more about the specifics of drawing up and filing a claim here.

Timing and cost

An alimony agreement on alimony for children from different marriages is drawn up and certified by a notary. This may take from one or two days to a week. The cost of certification varies, since notaries have the right to independently set tariffs for legal and technical services. The amounts of the state fee for performing notarial acts are specified in detail in Article 333.24 of the Tax Code of the Russian Federation.

IMPORTANT

The trial takes much longer, about one to two months. Sometimes the process of considering a case in court can drag on for a longer period. When collecting alimony for children from different marriages, the mother raising the child and acting as the plaintiff is exempt from paying state duty, since she acts in the interests of the offspring. But this does not mean that the state fee will not have to be paid. The corresponding payment falls on the shoulders of the defendant. According to clause 15, part 1, article 333.19 of the Tax Code, the amount of the state duty depends on the price of the claim, but cannot be less than 150-300 rubles.

In what cases is the entire amount of alimony transferred to the account?

The full amount of child support awarded may be transferred to the child's deposit account for the following reasons:

- By agreement of the former spouses, specified in the voluntary agreement on children;

- The child is brought up in a state institution: boarding school, orphanage;

- The child has a guardian, but is not officially adopted by a foster family.

Expert commentary

Shadrin Alexey

Lawyer

The law limits withdrawals to prevent embezzlement. The parent living with the minor must be responsible for his upbringing and maintenance. The child will be able to use the amount accumulated on the deposit upon reaching the age of 18.

Alimony payments for two children from different marriages

Let's consider a situation in which a man pays child support for two children from different marriages. According to the law (Article 80 of the RF IC), all offspring have equal rights to be provided for by their parents. Therefore, in general, the court divides part of the collected income of the alimony provider by the number of children.

If there is one child, then the amount of payments is 25%, and if there are two, then it will be 1/3 of the defendant’s income for both. Then each offspring born to different mothers will receive 1/6 of the payer’s earnings.

The calculation for two children looks like this: Total income * 1/3/2 = child support for each of them.

For example, a father receives a salary of 24 thousand rubles. monthly. He has no other income. The calculation will be as follows: 24,000 * 1/3 / 2 = 4 thousand rubles. Each child from two families will receive 4 thousand rubles. monthly.

The calculations presented concern only the father of children who grow up in two different families. If we consider the issue from the point of view of a mother who has offspring from two fathers, then the situation will be somewhat different. Calculation of child support for children from other marriages will be made separately for each child, and the final amount will depend on the earnings, as well as the financial and marital status of the fathers. The size will be different for each offspring.

Payments to children from different fathers

In practice, situations arise when a woman raises two or more children alone and all or some of them have different fathers. In this case, the general procedure for calculating alimony will be applied and the issue will be resolved based on an agreement with each of the fathers. All men should also be sued, and the amount of payments will be determined taking into account their income. The alimony providers are not related to each other in any way.

It is better to consider the situation when different fathers pay alimony to different children using an example. Let's say a woman has three children. Two are from her first husband, and the third is from her second, from whom she is also divorced. Both men are ordered to pay by court order. However, the amount of these alimony payments will vary.

A man who has two children will pay them half of his earnings, which is, for example, 40 thousand rubles. That is, for two children a woman will receive 20 thousand rubles. The second husband is the father of only one and receives a salary of 20,000 rubles. Consequently, he is obliged to pay 25%, namely 5 thousand rubles. And in total, the woman will receive 25 thousand monthly alimony for different children and from different men.

Note! It is impossible to sum up alimony if there are different husbands with obligations for different children. Everyone is responsible for their responsibilities to their own children.

Alimony for three children

According to the law, if there are three offspring, payments are withheld in the amount of 50% of the payer’s earnings (Article 81 of the RF IC). Then the calculation of alimony for three children from different marriages is made by applying the following formula: Total income * ½ / number of children = alimony payments for each child.

So, if we take the previous example, where the father receives a salary of 24 thousand rubles, then the amount is calculated as follows: 24,000 * ½ / 3 = 4 thousand rubles. It is precisely this kind of alimony for children from different marriages that the mother will receive for each of her offspring. For example, if in the first marriage a man has two children, and in the second - one, then the first wife will be transferred 8 thousand rubles, and the second - only 4 thousand rubles.

Is it possible to change the amount of alimony?

The main reason for recalculating the amount of alimony, whether up or down, is a change in the financial and social situation of the obligated person.

For example, if a man loses his job, then alimony can be converted into a solid form, since he has no official income. Or vice versa, the father’s salary increases, and accordingly, the percentage deduction of alimony from it also increases.

If there is an alimony agreement, the amount of payments can also be changed by agreement.

Alimony payments for four children

The same formula as in the previous case is used when calculating alimony for four children from different marriages. When substituting the values into the formula, you get the following: 24000 * ½ / 4 = 3 thousand rubles. For example, if a man has two children in one and the second marriage, then each mother will be paid 6 thousand rubles. If in the first family a man has three offspring left, and in the second one another baby was born, then the ex-wife, who gave birth to three, will receive 9 thousand rubles, and the second, who gave birth once, will receive 3 thousand rubles.

When applying the general formula for calculating alimony for children from different marriages, the court takes into account the number of offspring, the presence of other dependents supported by the defendant, and his financial situation. But priority is given to the interests of the children. The same rule applies when establishing payments in a fixed amount of money (Article 83 of the RF IC).

Examples of alimony distribution in special cases

The general principle for the distribution of alimony is indicated above. Let's look at several typical cases and the procedure for collecting funds.

The payer has no income

Lack of wages or low income is not grounds for stopping alimony payments.

In such a situation, a fixed payment is assigned, which is tied to the subsistence level. Let us note that the maintenance of the child is the responsibility of both parents and they must provide it equally. Therefore, if the payer has a difficult financial situation, then the amount of the transfer will not exceed half of the subsistence level established in the region of residence of the child.

This rule will apply to all children. For example:

- A citizen has three children from different marriages and has no income.

- All children live in one region, where the cost of living per child is 9,000 rubles.

- Since parents must equally support the child, the payment amount for each child will be 4,500 rubles.

Read also: What to do if your wife does not allow you to see your child?

In this example, the payer, even in the absence of income, needs to find 13,500 rubles monthly. If he does not have such funds, the bailiffs have the right to seize the property and sell it at auction. The proceeds will go towards paying off the child support debt.

Attention! Alimony can be collected not only from wages, but also from other sources of income, for example, scholarships, pensions, business profits.

Two children

According to the law, if a citizen has two children, regardless of the number of marriages, then 33% of the income is collected from them. The amount is distributed among the children proportionally, that is, 16.6%.

Let's say a person has an income of 30,000 rubles. One third of the funds will go to support the children, that is, 10,000. Each child will receive 5,000 rubles.

What to do if a parent has no income or is too small to support children was described above.

How is alimony calculated?

Healthy! There are situations when the payer’s income is very high and the amount paid for child support exceeds what is necessary for life. In such a situation, a person has the right by law to reduce the payment if he considers it necessary. However, no one limits parents in the financial support of their children.

More than three children

If a parent has three or more children, then 50% is deducted from his income, which is distributed among the children.

Example

- The citizen has a salary of 50,000 rubles and five minor children from different marriages.

- 50% is deducted from his salary, that is, 25,000 rubles, which are proportionally distributed among the children - 5,000 rubles for each.

In such a situation, an increase in payments for each child is unlikely, since 5,000 rubles is more than half the subsistence level in most constituent entities of the Russian Federation.

Is it acceptable to charge more than 50% of income?

In most cases, if a parent has three or more children, then half of his income is deducted, which is distributed among all the children.

On an individual basis, the payment amount can reach 70%. This can be done in two cases:

- Long-term avoidance of obligations due to lack of income. When a person gets a job, bailiffs have the right to confiscate up to 70%.

- The need to support not only children, but also ex-wives raising them.

The second option applies if a woman has lost her job or has health problems.

How is child support paid between children from different marriages if the father is unemployed?

The law protects those children whose abandoned fathers (or mothers) are not officially employed or are temporarily unemployed. In this case, the court may set the payer a fixed amount to be paid as alimony. This is a more problematic situation compared to assigning payments if the father has a stable job. However, it is also possible to receive alimony for children from different marriages from a non-working father. This is stated in Article 83 of the RF IC.

For example, the court may order financial obligations based on the father's most recent salary. Also, the calculation of child support from different official relationships is made on the basis of average earnings in the region. If the content turns out to be too small, then the state has the right to take care of the assignment of part of the payments. But the alimony provider must look for a job, and then pay off the arrears of alimony for children from different marriages. Otherwise, the bailiffs can seize money from him in various ways, including arrest and subsequent sale of the property.

For your information

The situation may develop in such a way that at the time of the trial the father had a stable job, and the court decided to pay two children from different marriages in the amount of 16.6% of earnings. But by the time the writ of execution was handed over to the place of work, the man quit. Then the employer will return the writ of execution to the FSSP service, informing about the dismissal of the employee. Until such a father gets a new official job, or if he does not register with the employment center, the court may order child support from different official relationships, based on the average salary in the country. And when the man gets a job, another executive document must be submitted to the accounting department. It will contain information about the necessary support for the offspring, as well as about the accumulated arrears of child support from other marriages, which must be repaid.

Options for calculating alimony payments

There are two ways to determine the size of monthly payments for the maintenance of minor children: as a percentage of the father’s income and as a fixed amount.

In percentage terms, in accordance with the provisions of the first part of Article 81 of the Family Code, accruals are made as follows:

- a quarter of income - for one child;

- a third of the income is for two children;

- half of the income is for three or more children.

Collection of alimony is made after personal income tax is withheld.

If the salary has changed, the amount of alimony is adjusted accordingly.

In the form of fixed payments, alimony is collected in the following cases:

- The payer is not officially employed.

- The amount of income is not constant.

- Salaries are paid in kind or in foreign currency.

Due to the fact that in this case it is impossible to calculate interest, alimony is calculated in the form of a certain amount of money.

The amount of payments depends on the needs of the minor, the financial condition of the debtor and his marital status.

In accordance with the second paragraph of Article 83 of the Family Code, when assigning alimony, the court must take into account the child’s lifestyle and calculate alimony in such a way as to preserve it.

When establishing a fixed amount of payments, the cost of living in a particular region is taken into account. If it is not established, the federal minimum wage is taken into account.

As this indicator increases, payments are also subject to indexation.

Equalization of child support payments for children from different marriages

To calculate the amount of alimony for children from different marriages, the following formula is used:

Total income * % / N = child support for each child , where

% – this is the percentage of income applied in a specific situation.

N is the number of offspring.

The formula follows from the provisions of Article 81 of the RF IC, which indicates the percentage of penalties for the maintenance of children, depending on their number.

Arbitrage practice

Typically, women go to court to collect alimony, since they are the ones with whom the children remain. Here are some example solutions:

- The man asked the court to reduce child support from a previous marriage from 1/6 to 1/8 of all types of earnings. He referred to his difficult financial situation and the presence of minor sons from another marriage. By decision No. 2-411/2019 2-411/2019~M-368/2019 M-368/2019 dated December 26, 2021 in case No. 2-411/2019, the requirements were satisfied.

- The man filed a lawsuit to reduce the amount of alimony for his first child, indicating that he had a second child and the family was in a difficult financial situation. By decision No. 2-1433/2020 of May 26, 2021, in case No. 2-1433/2020, payments were reduced from 1/4 to 1/6 of all income.

- The woman recovered 1/6 of all types of earnings for the child she shared with the defendant, because he also pays alimony for another minor (Decision No. 2-290/2020 2-290/2020(2-4985/2019;)~M-4540/2019 2-4985/2019 M-4540/2019 dated January 21, 2021 in case No. 2-290/2020).

Claims to increase the amount of alimony are also often filed, but are considered more difficult. Plaintiffs need to prove that the children need a different, higher amount of child support.

Example. The court decision determined the financial support of two children from different marriages in equal parts - one-sixth of the income. The first was injured and began to require expensive treatment. The first wife filed a claim to increase the amount of alimony, attaching medical documentation and receipts for medications.

The court refused, but ordered compensation for additional expenses in accordance with Art. 86 RF IC.

Rationale - the presence of significant evidence suggests the possibility of increasing the amount of alimony (albeit temporary) with a change in the form of payments.

Is it possible to reduce child support for a child from another marriage and what needs to be done for this?

In accordance with Article 119 of the RF IC, the amount of alimony for children from different marriages may be reduced. The following situations may be grounds for reducing payment amounts:

- The onset of disability of the first or second group.

- The birth of another baby.

- Receiving high earnings is significantly more than the amount spent on maintaining the offspring.

- The presence of offspring on state support and when the mother does not spend money on them.

- A sharp decrease in the payer's income.

There is no point in specifically looking for a reason to reduce child support for children from different marriages. But life circumstances may develop in such a way that it is truly impossible to provide for the offspring on the same terms. Then the monthly allowance may be reduced. You can read about how to write off alimony debt on our website.

There are also cases in which alimony providers are simply trying to avoid their responsibilities. In such situations, the law comes to the defense. Fathers should know that in addition to the accumulated debt to pay child support for children from other marriages, a penalty may also be collected from them (according to Article 115 of the RF IC)

A statement of claim to change the amount of alimony for children from different marriages is possible.

Situations of possible reduction of alimony

Sometimes the life situations of the alimony payer develop in such a way that the amount of alimony for children from different marriages can be significantly reduced. They are spelled out in the law and have the following meaning:

- receipt by the alimony worker of 1 or 2 disability groups;

- increasing the number of dependents per debtor;

- the amount of payments as a percentage is significantly greater than a reasonable limit, even if there is a high level of income;

- children from marriages receive full state support and funds paid by the debtor are not spent in the necessary way;

- the personal income of one of the children significantly exceeds the amount of prescribed alimony;

- official income decreased due to reasons beyond the payer’s control.

All of the above reasons are considered in court and if the situation of the alimony payer changes, they can be reviewed in the reverse order.

At the same time, there is no need to specifically and artificially look for a reason to reduce payments; this does not add dignity and honor. But if there really is an unbearable financial situation, then you should try to judge the level of payments.

When the situation stabilizes, it will be possible to increase the allowance for children.