Photo is for illustrative purposes, source: pixabay.com

Today, the most common forms of fraud on the Internet are:

- sending (SMS, e-mail, via instant messengers) offers to participate in projects, entry into which requires payment of a fee or transfer of personal data , dissemination of information about winnings in competitions and promotions, for which it is necessary to transfer a certain amount or provide bank card details ;

- sending malicious emails and messages containing links to installing malware under the guise of licensed software, which subsequently “pulls” personal data from the device;

- “fake sites” - at first glance, outwardly indistinguishable from the desired websites (similar structure and design, confusingly similar domain), on which an unsuspecting user enters his personal data;

- hacking accounts on social networks to spread requests for financial assistance for charitable purposes (for example, under the guise of transferring money for sick relatives, orphanages, shelters, etc.);

- hacking and blocking of accounts with a large audience , to restore access to which scammers require a money transfer;

- calls on behalf of representatives of the servicing bank, demanding, under various pretexts, to provide them with bank card details and other personal data (vishing).

What to do if fraud has already taken place?

Online fraud: types

There are many ways to deceive people over the Internet.

The ingenuity of scammers knows no bounds; new techniques are constantly appearing aimed at luring money out of Internet users. It is impossible to describe all types of fraud, so below is general information about methods of deception, grouped according to similar characteristics. Existing types of fraud on the Internet can be divided into 2 large groups:

- Software. Money is written off from the user using special means: viruses, fake sites, etc.

- Psychological. The basis for fraud is the human factor: users independently transfer money to the accounts of criminals, believing in the story they set out.

○ What to do if you become a victim of scammers on the Internet?

In accordance with Art. 159 of the Criminal Code of the Russian Federation, fraud is the theft of property or obtaining the right to someone else’s property by deception. It does not matter how exactly such an illegal act was committed. This means that if your money or other valuables are stolen via the Internet, it is the same criminal offense as if committed in real life.

However, despite the same characteristics and elements of the act, it is more difficult to bring virtual fraudsters to justice. This is due to the lack of personal contact and sufficient information about the individual. However, it is still possible to find online thieves and bring them to justice if you act correctly.

Fraud using software tools

Examples of online fraud carried out using various software include:

- Phishing. A message is sent to your email/phone asking you to confirm your password to use a bank card or log into your account on a website. Fraudsters report that if you refuse to provide such information, access to the card or resource will be limited. The user submits the required data, after which the fraudsters have the opportunity to unlimitedly use the card or account in their own interests.

- Debiting funds via SMS. To complete registration on the site or gain access to download a file, the user is asked to go through an identification procedure confirming that he is not a bot (a program that automatically generates new accounts or continuously downloads files from the server). To do this, the site owners suggest using a mobile phone. An SMS message with an access code to the system is sent to the number specified by the user. It must be entered into the appropriate field on the page that opens. The following are several possible scenarios:

- All funds on it are debited from the user's account;

- funds are debited not only from the account, but also from bank cards linked to the phone number;

- a subscription to paid services is automatically formed, as a result of which the user’s phone balance is regularly reduced by a certain amount.

- Fake sites. Instead of the official website of a bank or online store, the virus program transfers the user to a fake website that has a similar design and differs by one or more letters/numbers in the domain name. The user, unaware of the substitution, places an order on it, pays for it, and the money goes to the fraudster’s account. The payer, of course, will not wait for his purchase.

Definition of Fraud

The Criminal Code of the Russian Federation gives the following definition: “Fraud is the theft of someone else’s property through lies and infiltration of trust.” The essence of the crime is that a deceived citizen transfers valuables into the hands of the criminal voluntarily, and only after a while realizes that he has been deceived. In recent years, fraudulent activities have increasingly been committed via the Internet.

Schemes of action of Internet fraudsters:

- An invitation to participate in an interesting project that requires payment of a down payment,

- Hacking social network pages in order to withdraw money from a personal account,

- Blocking the computer with viruses demanding payment in order to return the equipment to its normal state,

- Offer to purchase goods with prepayment,

- Please donate a certain amount to a charity organization,

- Invitation to financial pyramids on “favorable” terms.

This list is constantly updated and expanded. Attackers do not stand still, coming up with new, more sophisticated and effective ways to take money from the population.

Psychological Fraud

The following methods of online fraud fall into this category:

- Imaginary charity. Treatment of seriously ill children, assistance to fire victims, restoration of churches and shelters, etc. - social networks are full of requests for help in such situations. Despite all the moral nuances of holding such collections, scammers often create fake pages using other people’s photographs and documents confirming the fact of their need for money. To protect yourself from this type of deception, you should transfer money only through large charitable foundations or, if the details of a private person are used for collection, require the presentation of original documents (or scanned copies with the id of the group or page through which the collection is made).

- Selling a non-existent product or a product that does not have the stated characteristics. The buyer, seeing an attractive price, seeks to take advantage of the offer and transfers money to the online store or private seller. At best, he will receive products that do not correspond to the order, and at worst, he will be left without money and without a package.

- Selling online courses. With the development of digital technologies, it has become easier to obtain the necessary knowledge: you don’t need to go to the library for a specific book, just download an electronic textbook or video lesson. There are decent video courses, the creators of which really understand the subject and share their knowledge with other people. However, there is a lot of various garbage on the Internet, purchasing which users waste their money. “How to make a million without any effort”, “How to build muscles in 2 days” are vivid examples of what courses you don’t need to buy.

How scammers work

Article number 159 is responsible for fraud in the Criminal Code. It is very extensive, has many points and sub-articles. But the information in it gives very little insight into exactly how scammers work and in what exact ways scammers commit crimes. Therefore, let’s look at the main fraud tools:

- Exploiting the victim's gullibility. Fraudsters can pretend to be friends, government employees, concerned citizens, specialists of various categories and commit their crimes under these guises;

- Providing false information. The most common type of fraud is lying in order to obtain some benefit. This is used by all criminals: sellers of low-quality goods, service providers, street scammers and large criminal organizations;

- Forgery of documents . Almost any paper, regardless of its importance, can be counterfeited. This is used by fraudsters involved in especially serious crimes (for example, those who falsify ownership rights to an apartment);

- Use of modern technologies . The widespread introduction of high technologies has led to new types of fraud: theft of card data, bank accounts, use of other people's passwords, etc.

So how can you avoid crime and protect yourself? There is no universal protection, but we can give you some extremely effective advice

- Increase your level of legal literacy: read the laws, consult with lawyers, visit relevant forums, do not miss messages from government services;

- Carefully study all documents that you sign, no matter how important they are;

- Do not distribute important information about your financial situation, and do not give anyone access data to your valuables and confidential information (for example, passwords);

- Use the law to your advantage - basic knowledge of the current legislation can scare off most scammers;

- Always carefully check the information about those with whom you want to conclude any transaction: there are many different services for this.

Checking an online store for fraud

To avoid falling for scammers, you should choose only trusted online stores and not pay in advance for orders made through social networks or classifieds sites.

If the product is extremely necessary or the price is very attractive, you should check the online store for fraud before placing an order. To do this you can:

- Find out the domain registration date. If the site was created recently (a week or even a month ago), the likelihood that it is being used by scammers is extremely high.

- Read reviews on forums or specialized review sites. If there are no such reviews or they are negative, you should refuse the purchase. The abundance of the same type of enthusiastic responses should also alert you - most likely, they are custom-made and do not correspond to reality.

- Really evaluate the store's offer. Liquidation of a branded collection at a 90% discount from the initial cost, sale of confiscated goods, or sale of flagship models of electronic equipment at half price is most likely just a bait from scammers.

Contacts where to contact Internet scammers

Where to go against Internet scammers:

- A regular application to the Ministry of Internal Affairs of the Russian Federation (previously it was possible anonymously, but according to the legislation, the Ministry of Internal Affairs cannot allow entry to all the tools for catching fraudsters upon an anonymous request - human rights and all that.)

- Directly to the hotline of the Ministry of Internal Affairs.

- To the General Prosecutor's Office of the Russian Federation. If the violation concerns not only Internet fraud, but also facts of fraud or violation of the law by officials become known.

- You can also write to the Federal Security Service of the Russian Federation. But, as a rule, these FSBs are of little use. They have more important things to do. And the site was made by some students, but the form always doesn’t work. BUT, you never know!

Internet fraud - how to get your money back

Unfortunately, it is almost impossible to recover money lost as a result of fraudulent activities on the Internet. Most often, scammers have minimal computer and legal literacy skills and accept money not to a bank card, but to an account that does not require identification confirmation (for example, to a wallet opened in the Payeer system), which complicates the procedure for finding them.

It will also not be possible to contact the scammer on your own and appeal to his conscience. Usually the telephone numbers indicated in the advertisements do not answer, and the copies of documents and information about the registration address provided are fake.

Contacting law enforcement agencies may give you a slim chance of getting your money back. How to do this is described below.

Scheme: you paid for a purchase on a clone of a well-known company’s website

Since April 2021, 56 copies of the Delivery Club website and at least 30 fake Yandex.Food and Sbermarket sites have been identified on the network, according to Infosecurity a Softline Company. It is very difficult to distinguish them from real ones.

An example of a clone website, the real address of the company website is https://www.delivery-club.ru

Websites for electronics, railway and air tickets are also often counterfeited.

How to get my money back?

If a client paid for an item on a scammer’s website, the situation will depend on the parameters of the specific transaction (for example, the payment was made to a private person’s bank card or to a business account), Otkritie Bank says. When transferring funds to a private person’s account, you must contact the police, as in the case of transferring money to a “friend.” The chance of their return is minimal.

If the money went to the account of a company (legal entity), then the victim has the opportunity to challenge the operation. This procedure is called "chargeback". Sberbank explained how the challenge occurs:

- The client must contact the bank with an oral or written application to cancel the transaction.

- The bank will examine the method of conducting the transaction and the reason why the client wants to cancel the payment.

- It will then ask the merchant or its bank for payment details.

- If the cancellation of the operation is approved, money will be credited to the card.

- Otherwise, the bank will suggest other ways to solve the problem. For example, this could be contacting the police.

I searched for a sofa on the Internet for a long time and finally found it on the website of a well-known furniture company. I paid for the purchase. They promised to deliver the sofa in two weeks. Two weeks later they called from the store and said that we needed to wait another 10 days - there were no components for production.

After 10 days the sofa was still not delivered. The support specialist said that most likely they wouldn’t be able to make the sofa and it would be better to write an application for a refund. At the same time, I found out on the Internet that the sofa store had tens of millions of rubles in debt to suppliers.

I wrote a statement. They promised to return the money in 12 days, but it never came. The support service said that it was precisely because of the virus that the company had not yet produced a single sofa, but it was better to wait for it. Otherwise, the turn for a refund will arrive in at least 3.5 months.

I didn’t wait and contacted my bank (Tinkoff Bank) for a chargeback. It’s easy to do - you just need to find the transaction in Internet banking and click on the “Dispute” button. A bank specialist contacted me and asked me to send evidence that the company had not fulfilled its obligations. I submitted an electronic application for a refund. That was enough. The money for the undelivered sofa was returned to me after about 10 days.

Tatyana Akhapkina from Rosbank explains that only those customers who paid for the product but did not receive it have a high chance of getting a chargeback. But this procedure will not work if money was transferred to scammers through payment with a confirmation code from SMS or if the client voluntarily disclosed codes or card numbers to scammers.

I was planning to go to St. Petersburg for the November holidays. I typed in “tickets for Sapsan” into the search and opened the first website in Google: sapsan.ru. The site was beautifully and conveniently designed, all the company details and support number were indicated, and the price was 30% lower. There were no doubts about the reliability of the site, I chose tickets and entered my card details. After entering, I received a notification that the payment did not go through, I confirmed the operation again.

After payment, the tickets never arrived in the mail. I immediately started checking Sberbank Online - the money was written off twice to someone’s Qiwi wallet, the number provided in technical support was incorrect. I immediately called Sberbank, but the operation could not be canceled.

Then I submitted an application to the Sberbank security service, but they refused to return the money, citing the fact that the operation was confirmed by me (I entered the code when paying).

They advised me to contact the police to get my money back. I didn’t do this because I didn’t have time. As a result, I lost 13 thousand rubles, and the fraudulent site moved from sapsan.ru to sapsan.me.

Each case is individual, reminds Irina Gudkova, director of the legal department of the ICD. According to her, there are also abuses by clients themselves. For example, a person purchased something, transferred money with a code confirmation, he did not like the product, and he contacts the bank to return the money. “In this case, there will be no protest, since the bank that services it has no grounds for debiting money from the recipient’s account, and therefore there will be a refusal,” she explains.

Where to report online fraud

Despite the fact that the media and popular electronic resources constantly publish information about existing methods of deceiving the population, law enforcement agencies daily record hundreds of cases of dishonest actions against consumers of information. Where to turn in case of Internet fraud if you have encountered deception on the Internet?

First of all, the victim must submit a statement to the police department located at his place of residence. A separate division, the “K” department, has the authority to handle complaints regarding Internet fraud.

The application must indicate:

- Full name, passport details, registration address, contact phone number of the applicant;

- description of the situation that occurred: date, time, place where the fraudulent actions were committed, as well as the essence of the actions that led to the deception of the victim;

- date of application and signature of the applicant.

You can submit your application either in person or online. To do this, you need to follow the link https://mvd.ru/request_main and send the document (you can attach additional evidence of fraud to it: screenshots of pages, Internet banking receipts, etc.).

Scheme: a friend asked for a loan on social networks

One of the most common scams is when a friend asks you to borrow money on social networks, citing a sudden problem. Then it turns out that a friend’s account was hacked by scammers.

How to get my money back?

According to the press service of Otkritie Bank, if a client has become a victim of social engineering (voluntary transfer of funds to a “friend”), it will not be possible to challenge the operation and return the money. You need to contact the police so that they can find the scammers and recover damages from them.

“If the client confirms the transaction or discloses information that made such confirmation possible, compensation for damage can be obtained from the guilty person as part of a criminal case,” confirmed Sberbank.

What you need to indicate in your police report:

- Full name of the head of the police department (to whom it is addressed) and information about the victim (full name, residential address, contact phone number);

- a detailed description of what happened;

- your requirement (for example, to find the perpetrators, recover damages, initiate a criminal case, etc.);

- list the documents confirming your words (for example, receipts, correspondence) and attach them;

- The application must be dated and signed with a transcript.

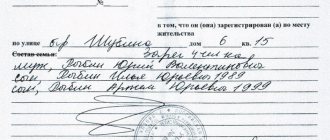

Sample statement to the police

But the percentage of solving such cases and returning funds to victims is extremely low, says Gleb Zhizhanov, chief analyst of the Association of Russian Banks. According to him, during the investigation the scammers manage to withdraw money and, most likely, even spend it.

At the same time, Tatyana Akhapkina, director of the customer relations department at Rosbank, believes that it is still possible to try to return the money if the bank that issued the victim’s card for some reason delayed it and did not have time to credit it to the recipient’s account. To do this, you need to call your bank as quickly as possible and ask to cancel the payment. However, success in getting money back in this case is also minimal, since payments are made between banks very quickly.

Punishment for online fraud

Responsibility for fraud (including fraud on the Internet) is provided for in Art. 159 of the Criminal Code of the Russian Federation. The sanction of this article establishes the following types of punishment:

- a fine of up to 120 thousand rubles;

- a fine in the amount of the salary or other income of the convicted person received by him for a period not exceeding one year;

- compulsory work lasting up to 360 hours;

- correctional labor for up to 1 year;

- restriction of freedom/forced labor for up to 2 years;

- arrest for up to 4 months;

- imprisonment for up to 2 years.

Thus, the punishment for fraud on the Internet is not severe enough, even taking into account the legislator’s differentiated approach to its possible types.

Blocking the card

If you understand that you have become a victim of fraud, and attackers have gained access to your personal data, then block your bank cards . You can block a card in the following ways:

- call the 24-hour contact center of the servicing bank (usually the number is indicated on the back of the plastic card);

- call directly to the 24-hour customer service of the Bank Processing Center (8-(017)-299-25-26);

- via mobile or online banking;

- via SMS banking;

- at a bank branch.

Recording information

If possible, it is necessary to record “hot on the heels” all available information about the attacker: screenshots (of a website, social network, correspondence), names, addresses, information voiced during the dialogue, and other characteristic features. In the future, such information can be very useful for identifying and searching for the perpetrators .

Contact the bank

Report the theft of money . Based on the request, the bank will conduct an internal audit, the results of which may also be useful for investigating the incident.

We also recommend that you request written confirmation from the bank about the illegal withdrawal of funds from your current accounts - this information will help to more accurately determine the amount of property damage from the actions of criminals.

Contacting law enforcement agencies

Don’t think that since you don’t know anything about the attacker, the matter is hopeless. Since the existence of Internet fraud, law enforcement agencies have developed effective measures to investigate such cases.

Also, you should not refuse to contact the police because of the small amount of stolen money: any information about the attackers helps in solving crimes. It is likely that you are not the only victim of illegal activities.

For reference

Depending on the circumstances of the fraudulent actions and the amount of the stolen goods, fraud on the Internet is subject to administrative liability of up to 30 basic units or criminal liability with imprisonment for up to 12 years.

5.1. Making a statement

If the amount of damage exceeds the limits established by the Code of the Republic of Belarus on Administrative Offenses, criminal liability arises .

The application must be drawn up on paper by hand or printed on a computer. The application is drawn up in free form with the obligatory indication of the following data:

- name of the body (position and full name of the official) to which (to which) the application is submitted;

- last name, first name, patronymic (if any) of the applicant citizen (organization), place of residence (location), contact telephone number;

- a statement of all information known to the applicant about the crime committed;

- list of documents attached to the application (if any);

- date and signature of the citizen (representative of the organization with the seal of the organization).

Recommendations for presenting information in the application:

- indicate the name and location of the attacker. If you do not know this information, describe the style and characteristics of oral and written speech, any defects, accent, voice, background noise (if any);

- describe the situation in chronological order;

- indicate exactly how the criminal deceived you, what the deception or breach of trust was;

- indicate the exact amount of stolen funds (if possible) or determine the estimated amount of damage caused (you can focus on the market value of the stolen property);

- do not allow offensive words, threats, obscene words to be included in the application, do not call the attacker a “criminal” or “swindler”;

- you can reflect the full name and contact information of persons who are aware of the incident, as well as information about other victims of similar actions;

- a request to initiate a criminal case based on the information specified in the application or to conduct an investigation into fraudulent activities;

- list of applications. You can attach existing screenshots and documents from the bank to your application.

5.2. Submitting an application to a law enforcement agency:

For a faster response and speed up the process, the application should be submitted personally to the person who has suffered from the actions of criminals, to the department “K” - this is a structural unit of the Ministry of Internal Affairs for solving crimes in the field of high technologies or to the Main Directorate of the Ministry of Internal Affairs for Combating Organized Crime and Corruption (GUBOPiK) . All contact details are linked here and here.

The application can also be submitted to the police department (ROVD) at the place of residence and (or) the place where the theft was committed at the discretion of the applicant.

In these bodies, upon acceptance of the application, you will be issued a document on registration of the application indicating the official who accepted it, the time of registration and the registration number. In the future, using this document you will be able to clarify the status of the submitted application.

The refusal to accept a statement of crime can be appealed to the prosecutor's office.

Based on the received application, a preliminary inspection will be carried out, based on the results of which a decision will be made to initiate a criminal case or to refuse one.

Where to go besides the police?

If, as a result of fraud, funds were transferred to fraudsters through an electronic payment system (for example, EasyPay, WebPay, etc.), then it makes sense to contact the support service of this payment system. The support service can block the account (wallet) of the attacker, which will help prevent or prevent other potential thefts.

You can complain about a “fake site” by sending a request for blocking to the Ministry of Information of the Republic of Belarus, including by filling out an electronic form on the site, as well as through special services designed to block malicious sites:

- https://cert.by/ (national segment of the Internet);

- https://www.google.com/safebrowsing/report_phish/?hl=en;

- https://virusdesk.kaspersky.ru/;

- https://analysis.avira.com/ru/submit-urls.

Results

So, fraud on the Internet can be based on the use of special software tools that can withdraw funds from user accounts, or it can consist of a set of psychological techniques aimed at misleading the user, as a result of which he independently transfers funds to the fraudster. It is very difficult to recover money lost as a result of fraudulent activities. This can only be done if the criminals are found by law enforcement agencies and brought to justice.

See also: “Fraud using payment bank cards.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What do you need to know before applying?

Before you file fraud claims, you need to determine whether what happened to you constitutes fraud.

The concept of the term “fraud” is spelled out in Article 159 of the Criminal Code of the Russian Federation. Thus, “fraud” is usually understood as the theft of someone else’s property or rights by deceiving him, instilling him with trust and, as a result, misleading him.

Fraudulent actions are always intentional, i.e. the criminal party intentionally commits acts of a criminal nature towards the other party.

If the criminal acts committed against you correspond to the characteristics described above, you should file a fraud report with the police.

Read the next section for information on how to file a police report.

Protection against Internet fraud

The measures listed below, although they will not protect you 100% from fraud, will reduce the likelihood of suffering from attackers.

- Install a licensed anti-virus system on your personal computer, do not disable it and update it promptly.

- Don't use the same password. Create complex passwords. Have at least two email accounts. Use one for important registrations, the other for everything else.

- Refrain from clicking on links in suspicious emails. You will most likely fall for scammers.

- Do not provide personal information from debit or credit cards or electronic payment system accounts on unknown resources.

- Do not download or install from unknown Internet resources. With the right file, you can download a malicious program.

- Take the time to spend a few minutes reading reviews about the portal, downloadable programs, and online store.

- Analyze information about the site. Pay attention to the site address. The scam site may differ from the official one by just one letter. Find a page with contact information and a feedback form.

Even if, despite all the precautions, you still become a victim of scammers, do not give up. Contact law enforcement agencies, bank security service, and if necessary, feel free to go to court. Most scammers are counting on the fact that you don’t want to waste time and energy on all this red tape. Don't leave crime unpunished!

( 13 ratings, average: 4.46 out of 5)