People who are not citizens of Russia often turn to the Chistye Prudy Academy of Sciences. Nowadays, buying an apartment in Moscow for a foreigner is neither a problem nor an innovation. Borders are becoming transparent and people themselves choose where it is better for them to live and work.

Liberal conditions for purchasing real estate have been created at the legislative level for foreign citizens in the Russian Federation. For many non-residents, the cost of apartments will seem much more attractive than the price of housing in their homeland. This may occur due to the ratio of the ruble to foreign currency. Tax rates are low and there are no legal obstacles. There are no strict restrictions regarding non-residents planning to buy housing in Russia. First of all, they need to have the necessary documents confirming the right to stay on the territory of the Russian Federation. Such a document could even be a tourist visa. A non-resident chooses the apartment he likes and concludes a standard deal.

But foreigners still have questions regarding the purchase of apartments in Russia. We will answer the most asked questions:

Frequently asked questions about buying an apartment by foreigners

All persons who are citizens of another country and do not have a Russian passport are foreigners. They are located on the territory of Russia and are not citizens of our country. Foreigners ask a lot of questions about purchasing housing in Russia.

- Do I need a document confirming a residence permit in Russia?

- Is it easier to obtain a residence permit if a non-resident buys an apartment?

- Is registration of purchase and sale more expensive for foreigners?

- Should a non-resident renounce his citizenship when buying an apartment in Moscow?

You do not need a residence permit to buy an apartment in Moscow. There are no advantages for people who already have an apartment in Russia for obtaining a residence permit. There are no additional fees for foreigners on the transaction; the only expenses when concluding an agreement may be when translating a document or hiring a translator. We also debunk the myth of a non-resident renouncing his citizenship when purchasing housing in Russia.

It is very important that on the territory of Russia there is a list of districts, cities and districts (mainly border areas) in which the law prohibits the acquisition of real estate by non-residents.

Purchase of real estate abroad by citizens of the Russian Federation: laws, rules, taxes

Russians wishing to buy foreign real estate need to learn about the existing rules that are established by Russian and foreign legislation. Before making an investment, you should consider what the financial implications may be for investors. Let's look at this question in more detail.

When buying property abroad, what you need to know (laws, regulations, taxes)

To complete a transaction for the purchase and sale of an apartment, house or other real estate abroad, you must first obtain answers to the following questions:

- Does Russian legislation allow Russians to purchase real estate abroad?

- Is it allowed by the laws of another state for foreigners (in particular Russians) to acquire real estate?

- What taxes are imposed on transactions related to making a profit from the disposal of property (for example, leasing) or from its sale or inheritance.

- Tax on income from renting out an object under a lease agreement.

- Tax on proceeds from the sale of foreign property.

- Tax on income upon entry into inheritance rights.

- A tax on the benefit received from differences in mortgage interest rates.

- determine your residence;

- calculate the personal income tax tax base;

- find out whether double taxation avoidance agreements have been concluded with the country where you plan to purchase real estate;

- determine sources of financing for the purchase.

- whether the assets will be under legal protection;

- what is the amount of tax on real estate, on profits and on the distribution of dividends in the country of its location for legal entities and individual shareholders;

- recognition of such a company in Russia as a foreign controlled company (CFC) with the ensuing consequences associated with deoffshorization (submission of a separate declaration, inclusion in the personal income tax base of the Russian shareholder (beneficiary) of the income received by the CFC).

- In which country is the property purchased (what is the tax regime, are there agreements to avoid double taxes, are non-residents allowed to purchase property, does the country participate in the automatic exchange of information).

- In what status is the property acquired - as an individual resident of the Russian Federation, or as the owner of a CFC?

- What is the source of funds to pay for the property (own or borrowed funds, if borrowed, then from a foreign bank or not).

- How the property is planned to be used.

Legislative norms

In accordance with Russian legislation, there are no prohibitions for Russian citizens on the acquisition, ownership and other disposal of foreign real estate. In addition, Russians are not required to report to the tax authorities about their foreign assets if they are not officials. State and municipal employees are required to indicate such objects in their annual declarations.

But as far as international legislation is concerned, a number of countries may introduce restrictions on the ownership of real estate by foreigners. For example, in Austria, non-resident individuals (foreigners without a residence permit) cannot become the owners of either a plot of land or holiday apartments or housing. In this particular case, there is a way out - to establish a local company and purchase real estate as a legal entity.

Taxes

Residents of the Russian Federation are considered individuals who live in the country for more than 183 days a year. This status obliges you to pay taxes not only on income that was received directly in Russia, but also on the territory beyond its borders.

Among the main taxes that Russian individuals who own foreign real estate must pay are the following:

All income received by Russians from the disposal of their real estate, including foreign ones, is taxed at a rate of 13%. The exception is assets received by inheritance. In Russia, heirs (no matter what line of inheritance) are protected from excessive taxation. That is, the tax is not levied only on the condition that the inherited property is not sold within a certain period of time (3 years).

In the event that agreements are signed between the governments of Russia and another foreign country to eliminate double taxation, then the taxpayer will only have to pay the difference in taxes. If a Russian has already paid tax on income received from the use of his foreign real estate in the country where it is located, and the rate of such tax is more than 13%, then he will no longer have to pay anything in Russia. It will be enough to provide documents confirming that such tax has already been collected in another country.

Taxation of the estimated benefit from interest rate differences is another matter. As a rule, foreign mortgage rates are an order of magnitude lower than Russian ones. This percentage difference, multiplied by the value of the property, will have to be declared as a taxable base and tax paid accordingly.

How to buy real estate abroad for a Russian

When planning a purchase, you should consider the following rules:

It is strongly recommended not to hide the fact of purchasing foreign real estate from Russian tax authorities. Although, in fact, ordinary Russians do not have an obligation to notify the fact of purchasing real estate abroad, no one has been exempted from liability for tax evasion (by concealing such a fact).

Everything secret sooner or later becomes clear, especially in light of the automatic exchange of information within the OECD and FATF. Although Russia never became a member of the OECD, it takes part in data exchange projects. As of the beginning of 2019, it exchanges information on transactions on bank accounts with 71 countries. This list includes almost all European countries. The exception is the UK, which in the spring withdrew from relations with Russia on the automatic exchange of information, but the Federal Tax Service can obtain information of interest from there upon request.

For those countries that have not joined the standards of international information exchange (for example, Costa Rica, the Philippines and a number of others), Russia has established currency restrictions.

If the property of interest is located in a country where non-resident individuals are not given the opportunity to freely purchase it on the market, then the transaction can be completed through a legal entity. In this case, the following nuances should be taken into account:

Where to buy foreign real estate is easier and more profitable

So, before spending money and making a purchase, you need to analyze all the initial data:

In order not to get into trouble and not to acquire problems with real estate related to difficulties in complying with tax and currency laws, we recommend using the services of specialists. Seek advice from a specialized company so that they can calculate all possible risks and describe the rules for purchasing real estate in the chosen country.

What documents does a foreigner need to buy an apartment?

- Passport of the country of residence of a non-resident

- A copy of this passport, its translation, notarized

- Confirmation of a foreigner’s stay in Russia

- Consent of spouses

To begin with, a non-resident needs confirmation of the authenticity of the foreigner’s papers. This document is called an apostille. It was developed by the Hague Convention. When concluding an agreement, such an apostille is attached as an addition. Such a document may contain information about the data of the foreign buyer and is sealed by the institution that issued it to the non-resident. Before registering a purchase or sale, the apostille is translated into Russian and notarized.

The foreign buyer and seller should discuss in advance the issue of settlements, organization of the transaction, and registration. Foreigners often turn to competent notary offices, which help draw up an agreement in two languages and provide a translator. The buyer must know under which text he puts his signature. Also, a foreigner can attract a Russian, issue a power of attorney for him, and he will sign an agreement on the transaction on his behalf.

Land fee

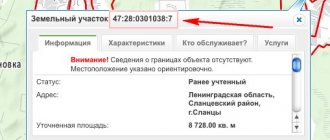

The amount of land tax does not depend on the citizenship of its owner. Taxpayers are everyone who owns land by right of ownership, perpetual use or lifelong inheritable possession. Land tenants do not pay such a fee.

Payment occurs once a year, before December 31st. The cadastral value of the site is taken as the initial base, and the rate is set by local municipal authorities. However, it cannot exceed:

- 0.3% in relation to agricultural land, plots for personal farming, gardening or vegetable gardening, plots occupied by housing and infrastructure;

- 1.5% for other lands.

Acquisition of real estate by a foreigner by power of attorney

When buying an apartment in Moscow, a non-resident can entrust this procedure to another person—a citizen of Russia. A power of attorney is drawn up, then it is certified by a notary in the Russian Federation or in the territory of residence of the foreigner. According to the Hague Convention of 1961, a power of attorney is legalized by an apostille. If the state in which the non-resident buyer of an apartment in Moscow lives is not part of the Hague Convention, the power of attorney is legalized at the Ministry of Foreign Affairs and the consulate. Foreigners living in the CIS countries will not legalize the power of attorney; it will only be enough to translate it into Russian.

Insurance premiums

In addition to income, Russian employers transfer monthly insurance contributions from payments to employees. Contributions go to different funds and are intended for different purposes:

- pension;

- health insurance;

- insurance in case of maternity or temporary disability (VNIM);

- insurance against accidents at work or occupational diseases.

Pensions are in charge of the Pension Fund, medical insurance is in charge of the Federal Compulsory Medical Insurance Fund, and insurance of accidents at work is in charge of the little-known FSS. PHOTO: fss.ru

The status of a foreigner affects what contributions are assessed to him.

- Pension contributions (22%) and insurance in case of temporary disability (1.8%) are deducted from payments temporarily staying foreigners

- Pension (22%), medical insurance (5.1%), and VNiM insurance (2.9%) are deducted from payments made temporarily (TRP) or permanently (PRP) to IG residents as well as residents of the EAEU

- Pensions (22%) and VNiM (2.9%) are deducted from payments to highly qualified specialists

Taxation when purchasing an apartment in Moscow by a non-resident

Purchasing real estate in the Russian Federation does not cause problems. You draw up a purchase and sale agreement taking into account your marital status and pay a fee to the state. But if a non-resident decides to sell an already purchased property, he will have to pay a tax of 30% of the cost of the apartment. Please note: tax residents can be foreigners and stateless persons who have been in the Russian Federation for at least 183 days of continuous stay.

Russia has the lowest level of costs for registering the purchase of real estate. Although rumors cannot be ruled out, there are many legal barriers. It is not true. Let's give an example: in European countries, the tax levy is up to 25% of the cost of housing purchased by non-residents. We add to these figures government duties, which are simply exorbitant in comparison with Russian ones. Therefore, real estate for foreigners becomes more attractive and interesting every year.

Nuances of conducting foreign exchange transactions.

If we talk about currency transactions between residents and non-residents, in the context of real estate transactions, they can be carried out without restrictions, with the exception of the method of payment. And this is exactly what is very important.

First! Settlements between residents and non-residents cannot be made in cash.

Second! Settlements between residents and non-residents are carried out exclusively through accounts opened with authorized banks (clause 3 of Article 14 of the above law).

If the transfer of money from the buyer to the seller (where one of them is a resident and the other is a non-resident) is carried out in a different form, then this is a violation of the currency legislation of the Russian Federation.

And for this, liability is provided in the amount of 75 to 100% of the amount of the illegal currency transaction (i.e., the value of real estate) (Article 15.25 of the Code of Administrative Offenses of the Russian Federation).

The statute of limitations for such transactions is two years from the date of the offense, i.e. from the date of transfer of money (Article 4.5 of the Code of Administrative Offenses of the Russian Federation).

Obtaining a mortgage for the purchase of an apartment in Moscow by foreigners

Let's touch on the issue of mortgage lending to non-residents located in Russia. There is an opinion that it is impossible for foreigners to obtain a mortgage to buy an apartment in Moscow. It's not like that at all. Many banks are happy to issue loans. The formula for issuing mortgages to foreigners is simple: there is a down payment and collateral - the risks for the bank of non-payment of the loan are reduced to zero. Finding the right bank for foreigners will not be difficult. They can also recommend him to NA.

It is especially important to familiarize yourself with the terms of the mortgage agreement. Subject to non-payment, the bank or other financial institution reserves the right to sell real estate owned by foreign citizens. Only with the right actions is it possible to avoid the risks and nuances associated with buying an apartment in Moscow.

Registration procedure

For citizens of foreign countries, the rules for obtaining a mortgage are similar to the rules in force for Russians. A mortgage with registration occurs in several stages:

- Study and comparison of loan offers, as well as the conditions and requirements of banks for foreign borrowers.

- Selecting a financial institution and the most profitable mortgage program.

- Collecting a package of documents (you may need to collect some certificates in advance).

- Contacting the bank and submitting an application (this can also be done remotely through the official website of the credit institution).

- Waiting for a decision on your mortgage application.

- If the decision is positive, you must sign the relevant papers, including the loan agreement.

- Making a down payment using your own savings.

- Registration of the transaction.

- Issuance of funds from the bank's cash desk (or transfer to a current account) to the real estate seller.

What can foreigners buy?

There are requirements and restrictions for choosing an object:

- farmland (they are obtained only for rent);

- allotments in the border zone;

- objects from the subsoil, on the continental shelf;

- forested areas;

- lands from the state fund in natural reserves;

- objects on lands classified as defense or transport industries;

- property in areas with restricted access (areas with special regime).

The priority right to purchase land is reserved for the lands on which buildings are erected.

Transport tax

If a foreign citizen has a vehicle registered in Russia, he is obliged to pay tax for it in accordance with the general procedure. Vehicles include not only cars, but also any other types of land, water and air vehicles. For example, jet skis, snowmobiles and scooters.

Taxes are paid on any vehicle. PHOTO: unsplash.com

The percentage is set depending on the engine power. Each subject of the Russian Federation has the right to set the amount of the obligatory payment, but it cannot be more than 10 times higher than the base figure specified in Article 361 of the Tax Code of the Russian Federation.

The transport fee is paid once a year, before December 1.

If you drive a car or other vehicle under a power of attorney, then you are considered the payer of the transport duty, and not the owner of the car.

Subscribe to Migranta Rus: Yandex News.