The state duty awarded by the court is the collection of a mandatory fee paid by the plaintiff when filing a petition, but directed at the same time to the defendant. This is possible if the court makes a decision in favor of the initiator of the process. In this case, the losing party receives a notification from the bailiffs demanding payment of the duty. Such precedents occur when a citizen has debts to any government agencies or banking institutions.

- What is a duty fee

- The fee awarded by the court

- What to do if you receive a notification from the bailiffs

- State duty amounts

How it works

Let's start right away with the fact that payment of state fees through State Services is possible only if the application for the service is submitted specifically on the state portal. If, for example, you personally want to submit an application for divorce to the registry office, then it is impossible to simply pay the fee at the State Services.

In order for the possibility of payment to open, it is necessary to submit the application itself through State Services, then the system will indicate the required amount and open a form for its payment. And there you can already pay with a card or in another way.

What should the receipt be?

The procedure for paying state fees for the production and issuance of a driver’s license is described in the Tax Code (Article 333.33, paragraph 4, part 1).

A correctly completed receipt of payment of the state fee for a driver's license will allow you to seamlessly submit documents to obtain a license. Required fields for personal identification and type of payment in 2021:

- Payer's passport details.

- Registration address.

- Details of the traffic police department.

- Type of payment (fee for issuing a driver's license, replacement).

- Payment amount (with currency decoding).

More detailed information about the rules for providing a receipt can be found in the traffic police department where you plan to obtain a license.

How to pay state duty on State Services

Let's look at the state duty payment scheme using a specific example. For example, you decided to obtain the status of an individual entrepreneur and receive it through the State Services.

First you need to submit an application for the service. It can be found through a search on the website, after filling out all the necessary fields, entering the information required by the system:

After filling out the application and checking it, the system opens a page with information about the amount of the state duty and with the “Pay” button, which you need to click.

That's it, you can make a payment in any convenient way and wait for it to be processed. Afterwards, the public service will be completed within the time period allotted by law.

For some types of services, the page for paying state fees opens immediately, for others - after the information is processed by the receiving authority. For example, if you apply to change your passport, obtain a driver’s license, etc., information about the need for payment may appear within 1-3 days in your personal account.

Step-by-step instructions for paying the state fee for obtaining a license from the traffic police

To deposit funds at the branches of the road inspection, you should use the terminal. Payment of the state duty for rights in 2021 is made using the details that are usually issued at the application registration counter. Data entry instructions:

- The type of fee (for a driver's license) is indicated.

- The required traffic police department is selected.

- Information about the applicant is recorded (last name, first name, patronymic, passport details, registration).

- Payment of the fee in the required amount is confirmed.

Most terminals provide for entering passport data to identify payments. Therefore, it is worth preparing the document in advance.

Some devices charge a commission, which is used to credit the required amount of funds. The withheld remuneration will be indicated in the finished receipt.

Payment options

If, after submitting an online application, the payment form opens, you can proceed immediately. It’s convenient that the system immediately indicates the amount. There are 4 payment options available.

Bank card

The most popular deposit option, you can pay with any debit or credit card. It is noteworthy that no commission is charged for such a transfer.

You can pay simply by card or card from your Google Pay, Samsung Pay account. If the device from which the payment is made already has some cards saved, they will be offered.

You can select a card already specified by the system or add a new one. The system will ask you to enter the details of a new card or the CVC code of an already saved one. Then it will redirect to the transaction confirmation page. Confirm, and that’s it, the payment has been made.

Mobile payment

It is possible to pay state fees on State Services from your mobile phone account. In this direction, the service cooperates with Beeline, MTS, Rostelecom, Megafon, Tele2.

An important point is that depositing money in this way will already be paid. The exact commission amount depends on the specific operator. For example, for paying an individual entrepreneur registration fee of 800 rubles, MTS will charge a fee of 32 rubles.

After selecting an operator, you must specify the phone number from which funds will be debited. Next, the system will send a request to it indicating the details of the operation. You must confirm the payment by sending a reply SMS.

From an electronic wallet

Payment of state fees on State Services is also possible from an electronic wallet. But in this direction, the system works only with two operators - WebMoney and Elplat.

After selecting the electronic system, the portal will redirect to the authorization and payment confirmation page. There is no commission for this form of payment.

Court payment details.

In order to pay the state fee to the court, you should find out the bank details of the court to which you are applying.

If you don’t yet know which court you should file a claim in, then read about it in the article “Which court should file a claim in.”

If you know the name of the court to which you intend to file a claim, then you can find out its payment details in two simple ways:

- In the court itself, but for this you need to go there. In the court office, or rather near the office, there is usually a desk or an information stand, where the details are indicated. They look like this:

You will have to copy the payment details with a pen on a piece of paper, which is not very convenient, and in general, it is not humane.

You can find out the bank details on the website of the court you need. We go to the site and if there is no direct link called “State Duty” on the main page of the court, then usually the details are located in the column on the left or right in the “Reference Information” section.

Sometimes details can be found using the “site map”. We copy, save... Print out the receipt or carefully copy it onto a piece of paper.

If all the above methods do not work

If you do not have a card, an electronic wallet and a mobile phone with a sufficient balance, then there is only one option left - to pay the state fee in cash. What can be done at the cash desk of any bank.

To do this, in the list of payment options, you must select the “Download receipt for payment” option. Download it to your device. The form looks like this, all the necessary information has already been entered into it:

Now you need to print it. Next, go to the cash desk of any bank and deposit money in cash. But please note that banks may charge a commission for making such a payment according to their tariffs. Please check this information in advance.

What to do after payment

The online payment form opens in a new tab, in which you perform the transaction using a convenient method or simply download a receipt for paying the fee in cash through the bank's cash desk.

After payment, you must return to the application completion page and enter payment information. The payment order number will already be reflected; it does not need to be changed. You can change the date. If the payment was made through a bank, you need to indicate its BIC (can be found on the Internet).

If you closed the application page on State Services, it’s okay. If you find the same one in the list of services and open it, the page will reflect previously submitted applications. When you open a previously filled one, it will be at the same stage as when you closed the page.

Discount on state duty on State Services 30%

State fees for most government services can be paid with a significant 30% discount. This is only relevant when making a payment on State Services online, that is, from a card, e-wallet or mobile account.

For example, if you apply to replace your passport upon reaching 20 or 45 years of age, the system will immediately indicate that when paying online there is a 30% discount on the state fee. You need to pay not 300 rubles, but 210:

The discount is valid only when submitting an application at State Services and paying the fee there via the online channel.

Reflection of non-cash payments

Accounting for settlements for payment of state duties by bank transfer is carried out using account 303.05 “Settlements for other payments to the budget.”

In accordance with Instruction No. 162n, clauses 104, 111, operations for the calculation and payment of state duties from the personal account of a government institution are carried out using the following accounting entries:

| Contents of operation | Debit | Credit |

| State duty charged | 1 401 20 291 1 109×0 291 1 106 xx xxx | 1 303 05 731 |

| State duty transferred to budget revenue | 1 303 05 831 | 1 304 05 291 |

Fees for popular services

When ordering a service on the state portal, a citizen immediately sees the amount of the state duty and whether a 30% discount applies to it. This information is given before you go to the application page.

Examples of fees for some popular services:

- marriage registration - 350 standard and 245 with a discount when paying online;

- replacement of a passport due to its damage - 1500 rubles or 1050 with a discount;

- replacement of a passport due to age, due to a change of surname, change in appearance - 300 or 210 rubles;

- replacement of a passport due to its theft or loss - 1,500 rubles, no discounts are provided;

- issuance of a new type of international passport for an adult - 5000 or 3500 for online payment. For a child - 2500 and 1750 rubles;

- obtaining an old-style international passport - 2000 and 1400 at a discount;

- obtaining a driver's license, replacing it - 2000 rubles or 1400;

- changing vehicle registration data - 500-800 rubles or 245-560 depending on the situation.

As you can see, paying state fees through State Services is very profitable. And the 30% discount applies to almost all types of applications. If the service is provided free of charge, for example, as in the case of issuing a birth certificate, the system will immediately indicate this.

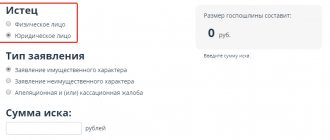

As part of the execution of a judicial act

In a situation where the plaintiff is an individual, settlements with him are reflected in budget accounting using account 302.96 “Settlements for other payments of a current nature to individuals,” and if the plaintiff is a legal entity, then account 302.97 “Settlements for other payments of a current nature to organizations” is used. .

These transactions for reimbursement of legal costs to the plaintiff (in terms of the state duty paid by him) are reflected in the accounting records as follows:

| Contents of operation | Debit | Credit |

| The costs of reimbursement of legal costs to the plaintiff are reflected (in terms of the state duty paid by him): | ||

| to an individual | 1 401 20 296 | 1 302 96 737 |

| legal entity | 1 401 20 297 | 1 302 97 734 |

| Compensation transferred to the plaintiff: | ||

| to an individual | 1 302 96 837 | 1 304 05 296 |

| legal entity | 1 302 97 834 | 1 304 05 297 |

FAQ

I submitted an application to State Services, but the payment page did not appear. What to do?

Most applications for State Services first undergo a preliminary check by the body to which they are sent. If the authority gives the go-ahead, the system will allow you to pay the state fee. The information is duplicated to the applicant’s email.

Is it possible to return the money paid for the state duty?

If you end up not using the service, you have 3 years to file a non-refundable application. The application is submitted to the department where the money is sent. But please note that in some cases the fee is not refundable.

How to get a 30% discount?

If you submit an application at State Services and pay the fee online, the system automatically sets a discount of 30%. Provided that the service includes such a discount.

How to pay state duty through Sberbank?

When choosing a payment option, indicate the “card” method and simply enter its data. You can also print a receipt and pay the fee through the bank cash desk.

Is it possible to pay with Yumani at State Services?

Yes, if we are talking about a map. If we are talking about an electronic wallet, then no, State Services do not work with this system. But you can open a Yumani virtual card in a couple of clicks and make payments from it as from a regular card.

Sources:

- Public services: Frequently asked questions.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Who will be able to receive installments from bailiffs in 2021: read the new rules for debt collection

Organizations, individual entrepreneurs and retired individuals against whom enforcement proceedings have been initiated will be able to receive installment payments for debts without the participation of the court.

And for individual debtors who have not retired, until the end of 2020 there will be a ban on inspection, seizure and seizure of movable property. Such rules are enshrined in the new Federal Law of July 20.

20 No. 215-FZ (came into force on July 20, 2021).

The procedure for debt collection is established by Federal Law dated October 2, 2007 No. 229-FZ “On Enforcement Proceedings.” In general terms, the procedure is as follows.

The bailiffs receive the writ of execution. It states the amount that the debtor is obliged to pay to the creditor. Here are some examples of such a document:

- writ of execution (issued by the court);

- court order (issued by a single judge);

- a notarized agreement on the payment of alimony;

- resolution of the head of the Federal Tax Service on the collection of tax at the expense of the taxpayer’s property (adopted within the framework of Article 47 of the Tax Code of the Russian Federation);

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

- decision of the labor inspectorate on payment of wages.

Next, enforcement proceedings begin. Its purpose is to forcefully obtain the debtor's funds and transfer them to the creditor.

In most cases, bailiffs first block bank accounts and cards, write off money from them until the debt is fully repaid. If there is not enough money, bailiffs can sell the property at auction. The proceeds are transferred to the lender.

Restrictions are most often imposed on the debtor: they are not allowed to travel abroad, dispose of real estate, etc.

Who is entitled to installment plans in enforcement proceedings?

In general, any debtor has the right to ask for an installment plan to pay the debt. To do this, you need to submit a corresponding application to the court or other authority that issued the writ of execution. Installment plans can be granted, but they can also be refused (Article 37 of the Law on Enforcement Proceedings).

Order an electronic signature for remote submission of documents to the court Receive in an hour

Order an electronic signature for remote submission of documents to the court

The commented Federal Law of July 20, 2020 No. 215-FZ (hereinafter referred to as Law No. 215-FZ) introduces additional grounds for installment plans. They are related to the pandemic, so refusal is not provided for them. The right to “coronavirus” installment plan is granted to debtors:

1. Organizations and individual entrepreneurs that are SMEs as of March 1, 2021, and classified as the industries most affected by the pandemic (see.

“The list of OKVED codes has been expanded, which determines the business affected by the coronavirus”). The exception is companies and entrepreneurs to whom, at the request of the creditor, a moratorium on bankruptcy has been applied.

They are not entitled to installment plans (see “The government has changed the rules for applying the moratorium on bankruptcy”).

You can check whether an organization is included in the SME register, as well as find out which OKVED codes are assigned to an organization or individual entrepreneur, using the “Kontur.Focus” service.

Connect to the service "Contour.Focus"

2. Pensioners for old age, disability and (or) loss of a breadwinner, if three conditions are met for them. Firstly, they have no other sources of income other than pensions. Secondly, they do not have real estate, except for the only residential premises suitable for permanent residence. Thirdly, the total amount of all types of pension payments is less than 2 minimum wages.

What debts are covered by the “coronavirus” installment plan?

For companies and individual entrepreneurs, the deferment applies to debts under enforcement proceedings of a property nature (in particular, for the collection of taxes and fees from property). But there are exceptions. According to the commented Law No. 215-FZ, it is impossible to obtain an installment plan in relation to the requirements:

- for compensation for harm to health or in connection with the death of the breadwinner;

- on compensation for moral damage;

- for payment of severance pay;

- on remuneration of persons working (working) under an employment contract;

- on the payment of remuneration to authors of the results of intellectual activity.

For pensioners, loan debts are covered by installments.

Where to go

It is necessary to submit an application to the bailiff, attaching a debt repayment schedule. The bailiff, in turn, should not apply to the court or other authority that issued the writ of execution. Instead, the bailiff himself is obliged to issue a decision on the granting of installment plans.

Deadlines and amounts

According to the commented law, installment plans are given for the period that the debtor indicated in the application. But there are limitations. For organizations and individual entrepreneurs - for no more than 12 months and no later than August 1, 2021. For pensioners - for no more than 24 months and no later than July 1, 2022.

Limitations on the amount of debt for which installment plans can be obtained:

- for organizations and entrepreneurs - no more than 15 million rubles;

- for pensioners - no more than 1 million rubles.

Installment procedure

Due to the pandemic, you can only get installments once. Those to whom it is granted must repay their debt monthly in equal installments. The first payment must be made in the month following the one in which the decision to pay in installments was made.

Debtors do not have the right to give guarantees and guarantees. They cannot enter into transactions to encumber or alienate their property. Legal entities are not allowed to pay dividends, income from shares and shares, or distribute profits among the founders.

Select a bank guarantee for free under 44-FZ and 223-FZ online

During the installment period, bailiffs are allowed to seize the debtor's property. They may also impose a ban on registration actions in relation to property, the rights to which are subject to state registration. Other enforcement measures (seizure of property, eviction, etc.) are prohibited.

Are the previously imposed restrictions still in effect? Yes, except for one thing - debt collection using funds in bank accounts. During the installment plan it will be cancelled. As for collectors, they cannot repay debts for which the “coronavirus” installment plan is valid.

Special rules for individual debtors (except pensioners)

Individuals who have not retired are not entitled to installment plans due to the pandemic. But special rules have been introduced for them. Valid until December 31, 2021 inclusive.

Until this date, bailiffs will not inspect, seize or seize movable property of individual debtors located at the place of residence or stay. An exception is made for transport. Namely - for cars, motorcycles, mopeds, quadricycles, tricycles and self-propelled vehicles. Another exception is made for movable objects, which must be seized by court order.

At the same time, debtors do not have the right to alienate both movable and immovable property. Therefore, bailiffs are allowed to impose a ban on registration actions in relation to objects, the rights to which are subject to state registration.

Source: https://www.BuhOnline.ru/pub/comments/2020/7/15871

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Jalil

07/27/2021 at 00:24 Good afternoon! I received this notification in the mail. Your application requires payment. You can do it on the portal using a bank card, mobile phone, or electronic wallet. Do this right now so that the department has time to receive payment information before your visit to the department.Service Issuance of a foreign passport

View application

And in public services there is only a notification about filing an application. How can I pay the state fee at a discount? Thank you

Reply ↓

Anna Popovich

07.28.2021 at 02:34Dear Jalil, contact a specialist of the State Services hotline by phone or short number for mobile phones - 115.

Reply ↓