A calculator for calculating state fees in an arbitration court is a service that will help determine the amount payable for filing and considering a claim.

These ConsultantPlus materials will help you. Use them for free:

- Background information: main types and amounts of state duties in the Russian Federation.

- Sample: payment order for payment of state duty for consideration of a case in an arbitration court (according to OKUD 0401060).

- Form: payment order for the transfer of state fees for consideration of a claim in an arbitration court.

- Ready-made solution: how to take into account mandatory payments to the budget when calculating income tax.

- Ready-made solution: how to account for legal costs.

About the calculator

The method of resolving disputes by going to court is becoming very common among Russians. Filing a statement of claim is necessarily accompanied by payment of a state fee, the amount of which is regulated by several legislative acts, which can be quite difficult to understand.

The state duty calculator for courts of general jurisdiction can significantly facilitate the plaintiff’s task of establishing the specific amount that he must pay as state duty.

When will the money be returned?

The party in whose favor the decision is made, the arbitration court awards compensation for legal expenses incurred in the case, including the state duty paid when filing the claim. The collection of legal costs must be declared when filing a statement of claim or submitted with such a statement to the arbitration court, which considered the case as a court of first instance, within six months from the date of entry into force of the last judicial act, the adoption of which ended the consideration of the case on the merits.

If the claim is partially satisfied, legal costs are borne by the persons participating in the case in proportion to the amount of the satisfied claims.

Comments

Mandatory payment

Types of state fees are divided depending on the type of claim.

In addition to statements of claim, the state fee also pays for intermediate procedural actions during the consideration of the case.

In accordance with the Code of Civil Procedure of the Russian Federation and the Tax Code of the Russian Federation, payment of state duty is a mandatory condition when applying to the judicial authorities. Exceptions to this rule are the category of claims and plaintiffs who are legally exempt from paying state fees. All these categories will be given below.

Who pays the court fee

Obviously, the fee must be paid by the person who goes to court with a claim, application or complaint. The claimant in writ proceedings is obliged to:

- fill out an application, confirm the amount of the debt being collected and the grounds for its occurrence;

- independently calculate and pay the fee, or indicate the availability of benefits in the application;

- Submit with your application a document confirming that the state fee has been paid in full.

The applicant also has the opportunity to submit a petition to the judicial authority for a deferment or installment payment of the fee. For example, this may be due to temporary financial problems due to job loss, or a serious illness. The judge may defer payment until the order is made. In this case, the state duty will actually be offset, since it will be collected from the debtor by court order.

Who is exempt from paying duties?

In Art. 333.36 of the Tax Code of the Russian Federation specifies a large list of persons who are generally exempt from paying fees for filing claims and applications for court orders. There is no need to pay state duty when collecting:

- wage arrears, severance pay, other types of payments from the employer;

- alimony.

This benefit is related to the nature of the obligations (debt). The judge will check the nature of the demand based on the content of the application and the attached documents.

The state duty for issuing a court order is paid at the rates specified in the Tax Code of the Russian Federation

For the calculation, the state duty rates provided for filing claims are taken. The resulting calculation result is divided by 2. These are the features of paying the fee for issuing orders. No state duty is paid when collecting alimony and wage arrears.

There are also benefits for certain categories of applicants. Do not pay fees for any types of legal claims:

- disabled people of groups I and II;

- disabled since childhood;

- disabled children;

- Heroes of the USSR and the Russian Federation, full holders of the Order of Glory.

The Tax Code of the Russian Federation also includes a number of other preferential categories of plaintiffs. However, they are exempt from paying the fee only for certain categories of cases for which it is impossible to obtain a court order.

When applying to the arbitration court, disabled people of groups I and II, as well as public organizations of disabled people, are exempt from state fees. However, individuals extremely rarely have grounds to apply to arbitration, especially through writ proceedings.

The availability of a discount on court fees must be indicated in the application. It is also necessary to submit a document confirming the right to benefits, if this does not directly follow from the essence of the requirement. For example, if an application for alimony payments is submitted, the exemption is granted automatically, without additional supporting documents.

Benefits for claims and applications

Claims and applications relating to:

- labor disputes;

- adoption issues;

- requirements for the collection of alimony and maintenance;

- claims related to compensation for damage to health caused by the defendant;

- claims for damages isolated from the materials of the criminal case;

- claims for disputes with administrative authorities;

- statements and claims aimed at protecting minors, incapacitated and disabled people;

- disputes regarding the actions of bailiffs;

- claims arising from the Law “On Protection of Consumer Rights”;

- claims and applications filed by societies or organizations of disabled people;

- claims by pensioners regarding improper actions of Pension Fund employees;

- claims filed by veterans in defense of their rights under the Veterans Law.

Appealing the FAS decision

Article 52 of the Federal Law of July 26, 2006 No. 135-FZ “On the Protection of Competition” states that any decision or order of the antimonopoly authority can be appealed within three months from the date of its adoption. This can be done in court, which means it is necessary to calculate the state duty to the arbitration court when appealing the FAS decision. Since this claim has no price and is not a property claim, there is a fixed fee in this case. According to the norms of clause 3 of Article 333.21 of the Tax Code of the Russian Federation, it is 3,000 rubles. This amount depends on the arbitration authority to which the applicant applies: in appeals and cassation, you need to pay 50% of the initially paid state duty, and when applying for supervisory review to the Supreme Court - the same 3,000 rubles.

Using the calculator

To obtain information about the amount of the state duty, you must enter data into the calculator regarding the category of the claim and the material claim contained in the claim (for claims of a material and property nature).

The amount of the claim, that is, the material claim presented to the defendant, will become the basis for calculating the state duty based on the interest rate established by the Tax Code for such a category of claims.

Claims that do not contain material claims against the defendant are subject to a state duty at a fixed rate, and to find out the amount of the state duty, you will need to enter the essence of the civil legal relationship on the basis of which the claim is brought into the calculator.

Disputes with material claims

The Tax Code of the Russian Federation differentiates the state duty according to the cost of the claim. The interest rate is set depending on the amount of the claim made against the defendant:

- up to 20,000 rubles - paid with a state duty in the amount of 4% of the claim price;

- from 20 to 100 thousand rubles – 3% up to 20,000 rubles +800 rubles;

- from 100 to 200 thousand rubles – 2% of the requirement up to 100 thousand +3200 rubles;

- 200 thousand rubles up to a million – 1% of the requirement up to 200 thousand rubles + 5200 rubles;

- over 1 million rubles – 0.5% of 1 million + 13,200 rubles. The amount of state duty should not exceed 60 thousand rubles.

Disputes without collection requirements

Claims without material claims against the defendant are paid with state duty at a fixed rate. Differentiation is carried out according to the type of civil law relations.

- claims arising from family law – 600 rubles;

- Applications for alimony are paid with a state duty in the amount of 150 rubles. by the defendant after the court decision (ruling);

- applications with a simultaneous demand for the collection of alimony and funds for the maintenance of the plaintiff (plaintiff) are paid with a state fee of 300 rubles by the defendant after the decision is made.

In order for the calculator to tell you the required amount of state duty at a fixed rate, you should inform it about the category of civil law relations.

How to use the calculator

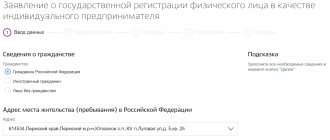

Step 1. In the “Plaintiff” list, select who is the plaintiff, that is, who files the claim with the demands. This can be either an individual or a legal entity. The last option is selected by default.

Step 2. In the “Application Type” list, indicate what type of claim you are filing. This may be a property or non-property proceeding, or an appeal or cassation complaint.

Step 3. If you chose a property claim, you will need to indicate the amount of the claim. Enter it in the field of the same name. The amount of state duty will be displayed automatically. This setting option will be needed to collect penalties.

Step 4. If you have chosen a non-property application or an appeal or cassation complaint, the “Type of appeal” list will open. Find the appropriate item in it and mark it. The amount of the state duty will automatically be displayed at the top of the page.

For example, to terminate a government contract, you need to select the type - a statement of a non-property nature, and the type of application - the very last item “Other statements of a non-property nature, including statements of recognition of rights, statements of an award to perform duties in kind.”

If you change any of the parameters, the fee amount will also automatically change.

IMPORTANT!

Don’t forget, if the claim contains both property and non-property claims, you will have to pay two fees for each type of claim!

Calculation of state duty when dividing property of spouses

The plaintiff must calculate the amount of the state duty for the division of property independently on the basis of available assessment documents, and pay it before filing an application with the court. The supporting receipt is included in the list of required attachments to the claim.

Calculation example.

The spouses dissolve the marriage in court, and at the same time one of them (the wife) applies to divide the apartment (6,000,000 rubles) and the owned dacha plot (1,800,000 rubles). If she claims half, the calculation of the state duty when dividing the property of the spouses will look like this.

Claim amount:

- 6,000,000 × 1/2 = 3,000,000 rubles;

- 1,800,000 × 1/2 = 900,000 rubles.

Then:

- 13,200 + ((3,000,000 - 1,000,001) × 0.005) = 13,200 + 9,999.99 = 23,199.99 rub.

- 5,200 + ((900,000 – 200,001) × 0.01) = 5,200 + 6,999.99 = RUB 12,199.99

In total, the total amount of payment of the state duty when filing a claim for the division of property of the spouses in this case will be 29,599.99 rubles.

The procedure for paying state fees when filing a claim for division of property of spouses

An application to the court can be filed at any time: during the period of cohabitation, during divorce proceedings, after the dissolution of the marriage (no later than 3 years). As a general rule, it is filed at the defendant’s place of residence. However, if it is filed simultaneously with an application for divorce, or a claim for alimony, you can contact the district court at your registered address. Issues regarding the division of real estate are resolved only in court at its location.

The law provides for a deferment of payment of the state duty on the division of jointly acquired property of spouses during a divorce at the request of the plaintiff, or its payment in installments (installment payment). To do this, you need to provide a justification supported by documents. For example, a certificate from the employment center about registration as unemployed, a pension certificate. Based on the results of consideration of the appeal, the court makes a ruling:

- satisfy the request indicating the terms and date of final payment;

- refuse and set a deadline for depositing funds into the account.

Another basis for obtaining a deferment is the fact that the objects are registered in the name of the defendant. For example, the plaintiff may not have information about the value of real estate, since all the documents are in the possession of the spouse. In this case, petitions can be attached to the claim to request evidence and to defer payment of the state duty for the division of property until responses to requests to identify its value are received.

State duty for division: cadastral, and other types of property value

Since the amount of the fee for dividing the property of spouses in court depends on the value of the claim, the question arises: how to evaluate the existing property? This is especially important when it comes to real estate: apartments, houses, land plots. They make up a significant part of the joint property, and their value is high.

The law does not establish strict rules defining the rules of assessment for such cases; it is important that the specified amount is supported by documents. There are three well-known methods for determining the value of real estate.

- Inventory cost. It is confirmed by a BTI certificate, and most often does not reflect the real price of the object. You can often find advice to the plaintiff to represent her specifically in order to reduce the state duty when dividing the jointly acquired property of the spouses during a divorce. However, this is disadvantageous if he expects to receive monetary compensation for his share.

- Cadastral value. You can find it out in Rosreestr by requesting an extract from the State Property Committee. This is a government assessment and is carried out solely for tax purposes. Of course, you can use the cadastral value to calculate the state duty for the purpose of dividing property, but it may differ from the real one, either down or up.

- Market valuation. Conducted upon request and for a fee by an independent expert. This is a licensed specialist, he is responsible for his report before the law. The courts trust this assessment more. It is almost impossible to challenge it, however, if it differs from the cadastral one by more than 30%, a justification must be provided.

Thus, you can use any of the options, and remember that the defendant has the right to file a counterclaim to reduce (increase) the assessment amount, and petition for the appointment of an examination. According to Art. 8 of the Law on Valuation Activities, it is carried out without fail during division at the request of one of the parties.

Collection and refund of state fees when filing a claim for division of property of spouses

The party that wins the court dispute has the right to recover from the other the legal costs, including the state fee paid when dividing the property of the spouses. This issue can be considered within one case if the petition was filed during its consideration. Then the question of distribution of costs is reflected in the court decision.

If the claim is partially satisfied, they will be distributed in proportion to the satisfied claims. However, you can contact the judge after the decision is made, before it enters into legal force. In this case, a ruling will be issued indicating the defendant’s obligation to reimburse the costs of paying the state duty for the division of the spouses’ jointly acquired property during a divorce.

In addition, in some cases, you can return the amount paid in full or in part (Article 333.40 of the Tax Code of the Russian Federation). This is permitted in the following cases:

- the plaintiff refused the appeal and withdrew the application;

- the claim was returned or the proceedings were terminated;

- the application was left without consideration;

- the amount was paid in excess.

The latter situation may arise due to the fact that the state duty for the division of property of the spouses was calculated incorrectly, or the price of the property was reduced during the contestation process.

To receive money, you need to submit an application to the same court where the claim in connection with which the payment was made was heard. Upon receipt of the determination, it is submitted to the tax office at the location of the court. A return application is filled out and payment documents are attached to it. Originals - if the amount is returned in full, copies - if partially.

How is state duty reflected in tax accounting?

All types of state duties in tax accounting are included in the category of other expenses. Moreover, it should be reflected at the time of accrual (subclause 1, clause 1, article 264 of the NKRF). For different circumstances, this moment may fall either on the date of payment, or on the date of registration documents, etc.

Thus, when registering any actions, the state duty is paid in advance, but it should be included in expenses only after the registration documents are accepted by the authorized body. But when paying the state fee for licensing, it is taken into account at the time of accrual (letter of the Federal Tax Service of Russia dated December 28, 2011 No. ED-4-3/22400). If the state duty is due to the purchase of non-current assets, then the amount of the state duty will be included in the initial cost of the objects, provided that it is paid before their acquisition. If after, then in the category of other expenses.

Nuances of accounting for state duties in 2020-2021

State duty, according to Art.

13 of the Tax Code of the Russian Federation, is recognized as a collection at the federal level. Recently, no adjustments have been made to this area, therefore in 2020-2021, as before, an account is used to reflect accounts for its accrual and payment. 68 (subaccount “State duty”). Read more about the classification of taxes and fees in the Russian Federation here.

At the same time, the type of corresponding account when calculating state duty depends on its type. State duty may be paid in connection with:

- with the acquisition of certain property assets;

- carrying out business operations related to the main activities of the company;

- carrying out operations that are not related to its main activities;

- participation of the company in legal proceedings.

Let's look at how state duties are recorded and what transactions are necessary to record the operation to accrue the corresponding amounts in the listed situations.

You will find an algorithm for filling out the details of a payment order for payment of state duty in the Ready-made solution from ConsultantPlus. Get trial access and proceed to expert explanations.