What is the role of the amendments to the law that came into force on March 29 in arbitration and in what direction the arbitration system will develop further, read in an interview with the vice-president of the Russian Chamber of Commerce and Industry.

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC.” Students who successfully complete the program are issued certificates of the established form.

Your voice is important in the discussion on corporate bankruptcy. persons Lecturers: V. V. Vitryansky, V. V. Batsiev, E. D. Suvorov, O. R. Zaitsev, A. V. Yukhnin.

Document overview

State duty for dividing a land plot

It depends on the basis of inheritance and the degree of relationship with the testator

When dividing a land plot, unlike the division of real estate, the interests of children are not taken into account. State duty for division. Division of various types of property.

How are you related to the testator?

The value of the land plot is of interest to the notary, since the amount of the state duty (tariff) for performing a notarial act depends on the value of the inherited property. The heir can sell his property to anyone and in any way, the main thing is to correctly draw up the appropriate power of attorney. P/S/ But don’t forget about personal income tax.

1. And if it’s expensive, won’t you join? . Quite tolerable amounts. Depending on what papers you already have, the amounts may be different. Ask a notary and he will tell you approximately how much it will be. 2. The cost of the land plot is needed to determine the fee for issuing the inheritance certificate, which the notary is obliged to charge you. 3. Maybe, if you have received a certificate of inheritance for the land plot and it is already registered in the Rosreestr (Office of the Federal Service for State Registration, Cadastre and Cartography for your subject of the federation).

The notary just needs it. costs little. from relatives there is a state duty and that’s all.

How much will the state duty be when registering a lease agreement for a land plot under a residential building (we are 2 people?

How much do you need to pay the state fee for registering a contract for the sale and purchase of a land plot with the transfer of ownership rights?

There are a lot of nuances. How many buyers and sellers are there, is it necessary to make changes to the Unified State Register or not, was a state registration certificate previously issued? registration of rights, etc. In general, when registering for the delivery of a contract, a registration specialist. The chamber must give you details and indicate the amount. In addition, the total amount of one hundred percent will be paid in several payments by both the buyer and the seller.

Contract of purchase and sale of land. Government duty. The amount of the state fee that must be paid for registration depends on the type of permitted use of the site.Additional sections.

How much is the state duty for division of property? divide a plot with buildings on it and a privatized apartment.

A representative of this company must carry out the entire range of procedures for land surveying, that is, dividing your plot. When a large plot belonging to a partnership is divided, the result is the formation of several land plots, which.

It will not be possible to divide a privatized apartment - everyone ALREADY has their own share

The fee is paid depending on the value of the declared property. Better share it yourself.

For reg. 1 dog. Is the state duty paid for each of the objects or just for the contract?

You will be sent two receipts, separately paying taxes for the house and for the land. plot! You own two real estate properties - land and a house. This is confirmed by two documents - certificates of ownership of the land and the house!

The size of the land plot is calculated by dividing the value of the land share of the share by the monetary value of one hectare. For a certificate of the right to inherit the land share of the share, a state fee is charged. g clause 3 article 3 of the Decree on state duty in the amount

This is interesting: Is it possible to extend the easement?

Only for the full contract. Regardless of the fact that the house and land plot are indicated in it.

It depends on what kind of area it is. If this is only the land under the house, then it is an integral part, and one agreement can be drawn up

Please tell me the amount of the state fee for registering ownership of a land plot in the Moscow Region.

State the fee will depend on the price of the claim, that is, on the cadastral value of the land plot.

For example, regarding the division of the original land plot. What will be the amount of the state duty payable when registering ownership of the land plots formed as a result of the division?

An individual entrepreneur buys a plot of land with a workshop. You have to pay the state. duty. How much and where to pay?

Changes in state duties for acquiring ownership of housing and land plots

What changes are you talking about? from 01.03.2013 changes to Part 1 of the Civil Code of the Russian Federation will come into force, according to which real estate transactions will not be registered. Based on this, 1000 rubles, which was paid as a state duty for registering a transaction, i.e., a contract for the sale and purchase of residential premises and houses, for registering any donation agreements (this 1000 rubles was divided by the number of persons participating in the transaction) should not be paid. But this is based on logic. How exactly it will be in Rosreestr they still don’t really know. And in fact, if they remove the state duty for the transaction, they will probably increase the amount of the state duty for registering property rights.

State duty for division of property. Hello. The husband filed for divorce. That is, if you made any investments in the land - fertilizer, planting trees, etc. , then you can demand recognition of the land plot on which the joint house is located.

The amount of state duty for registration of ownership of agricultural land

It’s lucky that it’s not 1000, judging by the fact that it’s a village, then people there have nothing to pay with at all, and 200 rubles is not money yet.

In such cases, it is necessary to divide the land plot. Division can be made only if there are technical and legal grounds for doing so. That is, division of a plot or allocation of a part can only be done by the owner of the land.

Good Evening! I would like to ask for your help in giving me some tips on what documents are needed to sell a plot of land in Klin?

Write to the section Legal advice - Housing law... they will help there. There are only sexual maniacs and maniacs here)))))

The division of land, as well as the association, can be formalized by developing technical documentation on land management for the division of a land plot.

What is the amount of the state duty for registering ownership of a land plot under a residential building?

100 rub. Article 333.33 of the tax code

Thus, when dividing a land plot, with the exception of the changed land plot, the section of the Unified State Register associated with it is closed in the manner prescribed by clause 27.

Sale of land

Calculate the book value in proportion to the share - these are expenses during the sale, the cost of the land in the sales agreement is income.

In order for the registration of ownership of a land plot to be legal, the information in these sections must coincide with the data of the previous title document, regardless of its state duty. Alienation of land.

I want to transfer the land from my mother to myself. Mother is alive. The insurance agent asked for 35,000. How much does it actually cost?

This is probably with land surveying and you have to stand in line at Rosreestr and also real estate agents, but you can even cope with land surveying and clarification of the area for 5 thousand

If two individuals are parties to the land plot donation agreement, then each of them pays a state duty of 500 rubles for state registration of the donation. 1000 rub. 2.

The insurance agent has clearly decided to rob you.

Horror! he is not an insurance agent but an INSURANCE agent 200 rubles state duty a deed of gift can be drawn up a will can be made and nothing can be done if you are the only heir

How to register land ownership? And how long will it take in terms of time and price?

Everything that was provided earlier before the contract can be issued free of charge. If without measurement, then order a cadastral passport here https://rosreestr.ru/wps/portal/p/cc_ib_state_services/cc_ib_granting_data_GKN/cc_ib_electrical_service_granting_data_GKN/cc_gkn_form_new and with documents for land of any year in the Roreestr. If there are no documents for the land, then as the owner of the house you have the right to register it as property under the dacha amnesty.

In the section REGISTRATION OF LAND Registration of dacha plots Legal support for the division of land plots, allocation of land shares. How to pay the state duty? Bank details for payment of state duties, fines and other funds.

Please tell me. How to calculate the state duty on a claim for recognition of ownership of a land plot under a house?

To do this, you need to know the cost of the land.

In the section on the size and procedure for paying the state duty for the state, explain to which point of payment for registration actions the payment of the state duty relates.3. Cadastral plan for a land plot occupied by public lands.

200 rubles This is a dispute about law

Claims for recognition of property rights include a percentage of the value of the land. plot. look at the Code of Civil Procedure of the Russian Federation. and not the Tax Code of the Russian Federation.

Type “state duty calculator” into a search engine. Follow the links. Choose the right one. Enter the cadastral value of the plot in the required column (take it from the cadastral passport, which is issued by the Land Cadastral Chamber for 200 rubles of state duty for 1 copy. Usually 2 are ordered, since they will be required for registering the right in the future based on a court decision. And the cadastral passport is also sent to the court needed). The calculator will automatically calculate everything for you. Good luck.

Who recently bought a house on land, how much did the paperwork cost? (at least approximately)

I bought it but on my tree

Under what conditions is it possible to divide a land plot and what documents need to be collected for this procedure. Conditions under which division can be made. The division of land is usually carried out in the following situations

Registration of property rights in Rosreestr costs 1000 rubles.

The state fee is 1000 rubles each for a certificate for a house and a plot. All. The seller is preparing the rest for sale.

How much does it cost to obtain a certificate of title to a house?

In this case, the land plot, the division of which was carried out, remains within the changed boundaries of the changed land plot. The title documents for the land from which the division occurred.

If you have collected all the title documents necessary for registration, you only pay for civil registration. duty (1000 rub.). If not, their registration may also entail costs.

Question about re-registration of real estate

In this case, it is better to re-register through a purchase and sale agreement.

A copy of the cadastral passport of the land plot, an extract from the state real estate cadastre .3. A state fee of 200 rubles is paid and attached to the original application. Your rights are in the section. You cannot create new topics.

Through BTI and reg. everything is done in the ward. All prices for services are provided. Go and have a look) You may have to redo the technical passport for your house, since it is valid for no more than 5 years. they can force...

If the seller has owned the property for less than 3 years, the price indicated is less than a million. in one contract. . to avoid taxation.

And don’t forget to get a tax deduction of 260 thousand rubles

Who should remove the snow that fell from the neighbor's roof onto the passage through which the 2nd homeowner passes?

First, you need to establish whether the house is in shared ownership or whether there are separate cadastral numbers for each half of the house. Secondly, when renting out a house, an agreement is drawn up in which it is necessary to look at the conditions for maintaining the house and the surrounding area. Thirdly, is there a clear demarcation between the two halves of the house, that is, the fence or paths are not connected to each other. If there is no fence, then the tenant can ignore the neighbor’s request, because he should only complain about the second owner and solve the problem together. Health cannot be an indulgence in order to assign a responsibility to someone else. If there is a single path between two halves and everyone uses it, then again the two owners must agree. If there is a fence and a separate path, then there is every reason to write officially to the owner so that he removes the snow from the roof, which causes inconvenience to traffic and interferes with the use of his property. If the neighbor ignores you, then the only thing left is the court, which will make a decision on snow removal. Do you think a sick person can do this on his own?

This is interesting: Land tax in the Chekhov region

Division of land. How to divide a land plot The question often arises: is it possible to split one plot into two and sell one of them? Exception: As a result of the division of land, several plots are formed, but the original plot ceases to exist.

When buying a country house, what taxes are paid?

Property and land tax annually.

When purchasing - none. During operation - property tax and land tax (if the land is owned)

Was land surveying done?

Land surveying is the placing of pegs on a site. You can sell it with ownership documents and a cadastral passport.

2 a document confirming payment of the state fee for registration or deregistration from the cadastral register. A document resolving a land dispute about the location of the boundaries of a land plot. This permission is required in all cases, except for the division of plots that.

Tell. There was a plot of land in perpetual lease and there was a stall on it. the stall was sold, but there were debts to pay

A claim for the formation of a land plot by dividing a land plot will be a non-property claim of a property nature. How to determine the cost of a plot? What percentage of the cost of a plot is the state duty?

Online payments

Making payments via the Internet today is very convenient and does not take much time. If a citizen has an online wallet, he can make payments through it. And also using online banking.

Sberbank Online

Payment of state fees through online banking of Sberbank of Russia is one of the most common and convenient services. To do this, the payer needs to create his own account and make payments there.

The algorithm of actions in this case will be as follows:

- To begin, a citizen will need to log into his personal account.

- In the payments section, select the one you need.

- Enter or select from those listed to whom the payment will be transferred and the amount.

- It is necessary to select the account from which the money will be debited.

You can receive a payment receipt by ordering a bank statement. You can receive it in person at the bank or by email.

Allocation of state duty share

What is the amount of state duty if I file a claim for the allocation of my share in the common joint property with my husband?

In this case, the amount of the duty will depend on the value of the property (for a house or apartment, see the MUPTI certificate (it’s always cheaper there), it will be more expensive depending on the cadastral value). Go to the website of any court in the state duty section and calculate it there automatically, or according to Article 333.19 of the Tax Code of the Russian Federation yourself. I also recommend writing an application for an installment plan/deferment of the state duty due to a difficult financial situation.

When separating property in shares, in what amount is the state duty paid - as in the DIVISION of property or in a smaller amount?

Hello! The claim for the allocation of a share relates to property, and the state duty is calculated according to the rules of Art. 333.19 of the Tax Code of the Russian Federation from the cost of the share that you ask to allocate to yourself.

Please tell me the amount of the state duty when filing a claim in court for the allocation of the debtor’s share in the common property.

The state duty must be calculated from the allocated share, for example, the value of the property is 100 units, the allocated share of the debtor is 30 units, pay the state duty not for 100 units, but for 30 units, that is, only for what you ask to allocate.

The amount of state duty when allocating a spouse’s share in jointly acquired property.

When dividing property in court, the price of the claim is calculated according to the general rules for calculating the state duty for filing a claim subject to assessment.

The court allocated a share in the apartment. Do I need to pay a state fee for dividing an apartment in kind? The same question regarding the land plot. Thank you.

Good afternoon Yes, you will have to pay a state fee. This is a claim of a property nature, since when dividing in kind you raise the question of recognition of your ownership of both the house and the land plot with the termination of the right of common ownership.

How is the state duty calculated when allocating a marital share in an apartment without a divorce?

Hello. In accordance with Art. 333.19 of the Tax Code of the Russian Federation - from the value of the property that is asked to be allocated. All the best to you and successful resolution of the problem. Thank you for choosing our site.

Good evening, dear visitor! The state duty is calculated based on the value of the allocated property. All the best, I wish you good luck in resolving your issue!

Please tell me how to calculate the amount of the state fee for filing a claim for the allocation of the debtor's share in the common property for foreclosure (the debtor in the enforcement proceedings re-registered the house to his wife). And the amount of the state duty for filing a claim to invalidate the transaction (the debtor in the enforcement proceedings re-registered the car to the mother). Thank you in advance for your help.

Good day, dear visitor. Of course, regarding the share, we can say that if the housing is the only one, then it is impossible to foreclose on it. Good luck to you in resolving your issue.

Good day to you. If the housing is the only one, then foreclosure cannot be applied to it. I wish you good luck in resolving your issue and all the best.

Good day to you! There should be a link “State duty calculator” on the website of Rospravosudie or the relevant court. You can use it. All the best to you and thank you for contacting the 9111 website for legal assistance!

Is it necessary to pay a state fee when filing a claim for the allocation of a share in kind if the share belongs to a minor son and the mother files a claim on his behalf?

Hello! Yes, of course, the state duty must be paid. In the amount of 300 rubles. Good luck Thank you for visiting our site

I’m going to allocate shares in the quarter to the children from notaries, I bought them for microns! how much will it cost for the state duty to the Rosreestr?) Thanks in advance)

When registering the right to shares in property, the state duty will be 2000 rubles for each transaction, please contact the MFC.

Is it necessary to pay a state fee on a claim for the allocation of a share in a spouse’s business?

Hello! Of course, you need to pay the state fee for the court in accordance with the requirements of Article 333.19 of the Tax Code of the Russian Federation.

Yes, you need to pay a state fee, since this is a property claim. The amount of the state duty will depend on the claims.

The amount of the state duty for a claim in court to establish boundaries (land survey) and allocate shares between individuals. faces?

If the claim is not property, the state fee is 300 rubles.

The amount of state duty in court with a claim to establish land boundaries. plot (land survey) and allocation of shares between owners? Thank you.

There is a state duty calculator on the website of any court. You did not write between which persons the dispute is taking place - legal entities or individuals

What state duty is paid when allocating a share in kind, the shares are determined, everyone has evidence for the house and land?

300 rub. duty

How to calculate the state duty when allocating a share and must this be done through the court?

it is not necessary to go through the court, you can simply conclude a share donation agreement

It can also be allocated voluntarily if there is no dispute between the owners. If so, then go to court. The duty is calculated based on the rates based on Article 333.19 of the Tax Code of the Russian Federation based on the cost of the share.

How much do you need to pay the state duty on a claim for the allocation of a share in kind? According to the documents, the plaintiff has 3/4 of the share, however, the plaintiff asks to be allocated 1/2 of the share (1/2, accordingly, remains with the defendant)

You must pay from the allocated share.

When allocating a share in kind through the court, how to determine the amount of the state duty?

Three hundred rubles duty.

Allocation of a share of a land plot from common shared ownership, what is the amount of state duty.

How to calculate the state duty? A claim for the allocation of a share from the common property of the spouses, the plaintiff’s share is 3/4, the defendant’s is 1/4, is the state duty paid from the property as a whole or from the plaintiff’s share?

The state duty is paid from 3/4 share.

What is the amount of the state duty when filing a claim for the allocation of 1/2 share of the common-law wife’s apartment from the direct heir?

Hello! see Article 333.19 of the Tax Code of the Russian Federation

The state duty will be 14030.00 rubles.

How to correctly calculate the state duty when filing a claim for the allocation of a share in kind? There is a plot of land. 2/5 of the land plot was purchased under a purchase and sale agreement. As a result, the plot became in common shared ownership (2 owners) with the issuance of a certificate of common shared ownership. Later, land surveying was carried out and 47 plots were formed from one plot, with a separate certificate being issued for each plot. Cadastral passports for newly formed plots indicate the cadastral value. The owner of 3/5 plots does not voluntarily wish to divide the plots. Therefore, there was a need to go to court. What cost should I take when calculating the state duty? If we take the cadastral value of each of the 47 plots, then the state duty is huge. Is it possible to take into account the cost of 2/5 of the common plot specified in the purchase and sale agreement?

Svetlana, the allocation of shares in kind is a non-property dispute, this is a requirement of an intangible nature, and is subject to a state duty of 300 rubles.

District/need to submit an application for allocation of a share in an apartment? And how much is the state duty now?

When allocating a share in kind, you will have to pay a large state duty; in case of allotment, will the state duty be assigned to the defendant?

Hello. Yes, there will be legal costs.

The amount of the state duty to the court at the request of the creditor to allocate the debtor's share in the common property of the spouses for subsequent foreclosure on this share.

This is interesting: Land tax in program 1C 8.3

from the price of the statement of claim

Will the court accept the state duty for the allocation of a share in kind, calculated based on the inventory value for 2012?

Yes, I must accept it, because... There is no information about other costs.

What is the amount of the state fee for an appeal to the Moscow Regional Court against the decision of the district city court in the case of allocating a share of the house in kind? Thank you.

The state fee for an appeal is 100 rubles.

Please tell me how to calculate the amount of the state duty when filing a claim for the allocation of a share of a land plot in kind?

property claim, evaluate and pay based on this value

Division of land

A plot of land is a surface of the earth with clear boundaries. The boundaries, status and other details of the site are recorded in technical documentation and reflected in the state cadastre. If it is necessary to divide it for one reason or another, instead of one plot, two (or more) are documented, for each of which a separate certificate of ownership is issued. By registering the plot of land with the cadastral register and drawing up a title document, the owner can use the land at his own discretion.

The division of a land plot is legally regulated by Art. 11.4 of the Land Code of the Russian Federation. It should be remembered that when dividing land, the following characteristics are retained:

- Category of land and intended purpose of the site;

- The size of the allocated shares within the area of the plot that was divided;

- Existing rights of third parties to use the object (easements);

- Requirements for land protection established by current legal regulations of federal and local significance.

The procedure begins with making a decision on dividing the plot and contacting a specialized land management organization to carry out land surveying. Land surveying is the establishment of new boundaries for future areas that will appear as a result of the division. This is a mandatory stage of work to obtain a certificate of state registration of property rights.

Based on the survey results, technical documentation is drawn up, which will indicate detailed characteristics of the new objects. Based on this documentation, new plots will be registered for cadastral registration.

Privileges

There is no fee for the provision of state cadastral registration services (without registration of rights).

For the state registration of a right to an immovable property that arose before January 31, 1998 (the date of entry into force of the first law on state registration of rights to real estate No. 122-FZ) the state duty is not paid if the right is registered simultaneously with its transfer to a new owner (upon sale property) or when registering a transaction on the alienation of an object of real estate (clause 8 of part 3 of article 333.35 of the Tax Code of the Russian Federation).

If the right is registered on its own (without a further transaction with property), the state duty is paid in the amount of 50% of the established rates (clause 8 of part 3 of Article 333.35 of the Tax Code of the Russian Federation and Letter of the Ministry of Finance dated December 29, 2021 No. 03-05-04- 03/79179).

When providing services for registering rights electronically to individuals, the amount of state duty is reduced by 30%. Other benefits established by the Tax Code of the Russian Federation also apply.

Registration of ownership of a land plot during division

When a land plot is divided, it ceases to exist legally, and in its place two or more new objects with the same status appear. For their state registration, it is necessary to prepare a package of documents.

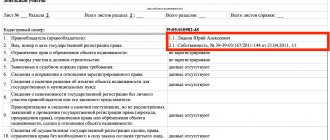

Documents for registering ownership of a land plot

- Application for registration of ownership;

This document is the basis for accepting the case of land division. Registration work is carried out by the Federal Service for Registration, Cadastre and Cartography. Document of title for the object that is subject to division;

The certificate of ownership will be canceled, and a separate one will be issued for each of the created objects. A title document can be a certificate of ownership, a decision of government bodies to provide land, or a court decision to recognize the right to land for a certain person. Partition agreement;

The division can be formalized by a notarized agreement, the parties to which will be the owner (owners) of the plot that is subject to division and the owners of the new plots. If there are disputes, such a document may be a court decision on the division of real estate (land), which has entered into legal force. Technical documentation

A cadastral passport for a land plot is developed by a land management organization. It indicates the area of the object, its geodetic coordinates and other technical details of the land plots. An integral part of the technical documentation is the cadastral plan, land survey plan and site layout diagram linked to the existing coordinate system. Power of attorney for a representative

In the event that the interests of the owners of the land plot are represented by a third party, he must be issued a notarized power of attorney, where a list of his powers must be indicated.

Registration procedure

The authorized service of Rosreestr accepts for consideration applications for the division of land plots if a complete list of documents is available. Land title for all new sites is carried out simultaneously, and all existing easements, restrictions and encumbrances are subject to registration. The cadastral number of the land plot will be assigned to each of them based on the results of the registration.

The time frame for completing the work is from 5 to 12 working days from the moment the complete package of documents is submitted to the local authority of the Federal Service for Registration, Cadastre and Cartography.

State duty for land registration

The state fee for registering land ownership is 2 thousand rubles for individuals and 22 thousand rubles for legal entities. In this case, cadastral registration is free of charge - the customer only pays the registration fee.

Payment details

Details for paying the fee can be found on the Rosreestr website:

- You must select the region of registration of the object;

- Select the tab with the name of the area next to the “Central Office” section.

On the same page you can print a payment form. Details are also issued at the MFC and Rosreestr branches after submitting a set of documents.

Problems you may encounter when registering real estate transactions

The most common problem that can be encountered when registering land ownership is the presence of disputes between owners. As with the registration of ownership of an apartment, registration of land rights is associated with the need to agree on documentation by all persons entitled to a share in the real estate. Dispute resolution is usually carried out in court, and a court decision is submitted to register land rights, which has entered into legal force.

Also often there are errors in technical documentation, that is, a discrepancy between the real characteristics of the object and those recorded in the cadastre. The registration authority, in this case, has the right to refuse to provide registration services until the identified deficiencies are eliminated. Responsibility for such errors falls on the shoulders of land management organizations, the selection of which must be approached very carefully.

Registration of ownership of a land plot after its division is a procedure associated with many documentary and technical nuances. Without the appropriate knowledge and experience, it will be difficult to go through this entire procedure on your own, so the best choice would be to contact professional lawyers in the field of land law. Specialists will not only ensure that work is not delayed, but will also ensure that all details comply with the requirements of current legislation. This will prevent the possibility of refusals to register property rights.

Cost of your lawyer's services

For civil cases

| Consultation with a lawyer | Drawing up a statement of claim | Conducting a case in the court of first instance/appeal in Moscow |

| from 1500 rub. | from 5 thousand rubles. | from 35 thousand rubles / from 15 thousand rubles |

| Consultation with a lawyer | Defense during the investigation stage in Moscow | Defense in the court of first instance in Moscow |

| from 1500 rub. | from 25 thousand rubles/month. | from 25 thousand rubles/month. |

| Consultation with a lawyer | Drawing up a statement of claim/claim | Conducting a case in the court of first instance/appeal in Moscow |

| from 2000 rub. | from 10 thousand rubles. | from 40 thousand rubles / from 25 thousand rubles |

| Consultation with a lawyer | Drawing up an application/complaint | Conducting a case in the court of first instance/appeal in Moscow |

| from 1500 rub. | from 5 thousand rubles. | from 15 thousand rubles / from 15 thousand rubles |

The cost of a lawyer’s services is determined in each case individually, depending on the complexity of the case, the place of proceedings, the qualifications of the lawyer, and may differ from the stated one, either down or up.