Features of determining the amount to be recovered

There are the following important points in this issue, namely:

- Debt is formed if the procedure, amount and other terms of payment are determined by the title documents;

- A debt is formed from the unpaid amount and the accrued penalty on it.

Legal documents include a bilateral agreement certified by a notary, a court decision or order. Without these documents, alimony arrears will not arise.

The penalty is accrued from the first day the debt exists . When accrued before July 29, 2021, its amount is 0.5% of the debt amount for each day of delay.

Expert opinion

Mikhailov Ivan Kirillovich

Lawyer with 8 years of experience. Specializes in criminal law. Law teacher.

From July 29, 2018, this value was reduced to 0.1% (Law 224-FZ). In addition, the penalty itself may be adjusted downwards at the discretion of the court.

Applies in case of disproportion between the penalty and the principal debt.

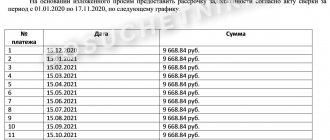

If payments are tied to the minimum wage (minimum wage) or subsistence level, their changes are also taken into account when calculating debt. For example, alimony was prescribed by a court decision dated January 25, 2021 in the amount of 1 minimum wage. The plaintiff filed a claim on November 15, payments are scheduled from this date.

The defendant, as of July 2021, had not fully complied with the obligations imposed by the court decision. The bailiff calculates the debt based on the following minimum wage values:

- Until January 1, 2018 – 7.8 thousand rubles;

- From 1.01. until May 1, 2018 – 9.5 thousand rubles;

- From May 1, 2018 – 11.2 tr.

It is on these amounts that a penalty will be charged. It is calculated for each month separately. The resulting values are added up to form the total amount of the penalty.

How to write a letter to a bailiff?

If you submit an application to the bailiff for the calculation of alimony debt, which will indicate the details of the person who applied and nothing else, you will receive a formal response. Bailiffs are busy with current work; they will not look for V.V. Ivanov, on whom a court decision was made 2 years ago.

The response will require additional information, which is recommended to be provided immediately.

Before writing a letter, the applicant will need to find the number of the enforcement proceeding (IP) and the court decision . The first makes it easier to search for a case, the second is necessary to indicate in the application information about the writ of execution itself: on the basis of what court decision it was issued, what was indicated in it, the amount and procedure for payments.

Related article: Restoring the deadline for presenting a writ of execution for execution

You can find out the number from any bailiff's order. This document states:

- IP number and date.

- FSSP officer involved in the case.

- Name and other details of the writ of execution.

Any of the parties to the proceedings or their representatives can submit an application to the bailiff for the calculation of alimony debt. The latter must have a notarized power of attorney.

Sample document

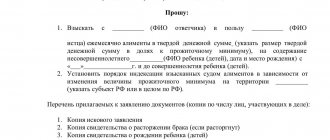

The submitted application conditionally consists of the following parts:

- Hats.

- Introductory.

- Basic.

- Motivational.

- Resolute.

This is the typical structure of a procedural document-appeal, be it a claim or a written complaint. There is no strict form provided, but the more the document resembles a well-drafted claim, the better the effect.

The bailiff immediately pays attention to the applicant’s approach and understands that the letter received can easily be transformed into a complaint to higher authorities or a lawsuit. This does not guarantee that the requirement or request will be fulfilled exactly or on time, but it increases the chances of success.

The header indicates the name of the territorial body of the FSSP, the address of its location, the surname, first name and patronymic of the applicant, place of registration and contact information. Each of the following parts takes 1-3 sentences. The introductory description describes the fact that the court made a decision and carried out enforcement proceedings.

Who can apply

The alimony debt is subject to review at the request of interested parties. They may be:

- recipient of funds;

- representative or guardian of a minor child;

- debtor.

The payer has the right to receive a recalculation if he:

- wants to clarify the amount of the debt in order to pay honestly;

- wants to challenge the amount of alimony awarded to him in court;

- cannot repay the accumulated debt for reasons related to serious illness or lack of income, and wants to apply to the court with a request to review the debt amount.

The debtor himself can submit an application for calculation of the amount of debt

The alimony worker can apply for payment, including when another person has appeared who has the right provided by law to receive money from him. You can apply for alimony:

- elderly parents;

- minor children of the debtor;

- former spouses, mothers of disabled children;

- former spouses who lost their ability to work and were recognized as disabled during the period prescribed by law;

- former spouses who became pregnant during their official marriage.

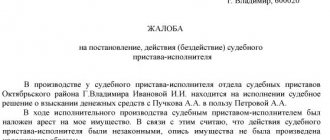

Appealing a decision of officials

As stated above, violations by an FSSP employee or disagreement with his decision can be appealed to higher management, the prosecutor's office or in court . This applies to cases when the payment made towards alimony is not taken into account, or its amount is set incorrectly, restrictions are unreasonably introduced or property is seized.

Finally, the inaction of bailiffs, which happens often, can also be appealed. For example, upon receiving an application, an FSSP employee is obliged to make a decision and immediately forward it to the interested parties.

If there is no document, the payer or recipient of alimony has the right to file a complaint. The same applies to the bailiff’s decision, which does not suit one of the parties.

What types of labor income cannot the bailiffs foreclose on?

Article 101 of Federal Law No. 229 provides for a special list of income that cannot be recovered under any circumstances. One of the items on this list is compensation received within the framework of the country’s labor legislation:

- for business trips, hiring or dismissal, as well as transfer to another place of work;

- for wear and tear on the employee’s personal equipment;

- for registration of marriage, birth of children in the employee’s family or in the event of death of his family members;

- on sick leave;

- for compulsory social insurance, as well as funded pensions and fixed-term pension payments.

It is important to know! Old-age or disability insurance pensions are not included in this list of income, so they may also be subject to foreclosure.

The actions of bailiffs and employees of banking organizations must be consistent with the above provisions of the law.

As judicial practice shows, this is not always the case. For a number of reasons beyond the debtor’s control, he may find himself completely deprived of funds. The consequences of such a situation are fraught with consequences for the debtor. Not every debtor knows how to prove to the bailiffs that the card is a salary card.

We hasten to reassure all debtors! There are no hopeless situations! And today you will learn about this from us.

How to write an application to bailiffs for debt repayment

Enforcement proceedings

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

It's fast and free!

- Compilation rules

- Obligation to return the writ of execution

- Rules and procedure for compilation

- Sample letter

- Speed up the work of bailiffs: sample and application form

- Features of the application

- Deadlines and fines: responsibilities when collecting debt

Results

The writer of the receivables letter can be either the authorized party under the contract (most often) or the obligated party. The document should consistently reflect information about the legal basis for the debt, as well as correctly formulate wishes and intentions regarding solving the problem with existing receivables.

You can learn more about the features of working with accounts receivable in the following articles:

- "Accounts receivable are...";

- “Structure of accounts receivable in accounting policies.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Compilation rules

Expert opinion

Mikhailov Ivan Kirillovich

Lawyer with 8 years of experience. Specializes in criminal law. Law teacher.

Federal Law No. 229 does not contain a form for notification of debt repayment under a writ of execution. The responsibility to monitor the execution of the court decision lies entirely with the bailiff.

Often, for one reason or another (usually due to negligence), an official does not monitor the timing of debt repayment. As a result, the debtor himself has to remind the bailiff that he is clean before the law and the debtor.

Demand the return of the writ of execution, the lifting of restrictions in the form of seizure of property or travel abroad.

The form of such a return letter is arbitrary. It may be typed or handwritten. A prerequisite is compliance with the requirements for business correspondence. The letter should contain:

- name of the FSSP body to which it is addressed;

- surname and class rank of the bailiff who initiated enforcement proceedings;

- Applicant’s full name, address and contact details (phone number, email);

- the essence of the petition;

- copies of documents confirming the execution of the court decision;

- certificate from the accounting department;

- date of;

- personal signature.

If the application is drawn up on behalf of the legal entity in which the debtor works or worked, then the accounting employee composing the letter indicates:

- number and date of issue of the sheet (settlement agreement);

- the grounds and date of dismissal of the debtor employee;

- if known, a new place of work;

- if the debt is not repaid in full - data on the collection of funds provided by law as of the date of dismissal and the amount of the remaining debt.

Copies of the following are attached to the return application:

- executive document;

- dismissal order;

Obligation to return the writ of execution

In addition to return due to the fulfillment of an obligation (full repayment of the debt), it is provided for in Art. 46 Federal Law No. 229 in several more cases:

- at the request of the claimant;

- if it is impossible to fulfill the requirement of the writ of execution;

- if the location of the debtor has not been established;

- in the absence of property on which foreclosure can be imposed;

- if the claimant refuses to accept the property to pay off the debt;

- if the claimant opposes the bailiff;

- in case of deportation of a debtor – a citizen of a foreign state – from the Russian Federation.

The return does not prevent the same document from being re-applied for collection in cases where the circumstances preventing the execution cease, but the statute of limitations has not expired (3 years).

Rules and procedure for compilation

The rules and content of the application in connection with the dismissal of an employee or due to full repayment of the debt were set out in paragraph one of this article. If the circumstances of the return are different, provided for in Art. 46 Federal Law No. 229, then the reasoning part of the application indicates the paragraph of the article that served as the basis for the return.

Related article: How to get a duplicate of a writ of execution for alimony

Sample letter

As stated above, there are no special requirements and no statutory application form. Documents posted on the FSSP website are used as a sample for preparation, for example:

General Director _______________ /full name/

Chief accountant _______________ /full name/

What role does it play?

In practice, one of the most common accounting statements for the court is about debt . Debtor and/or creditor. She simultaneously performs:

- supporting document (duplicates the necessary information from accounting and tax accounting);

- We prove to the court and the parties to the conflict the existence of specific facts.

Also see “Changes in state duty in 2021: how much you will have to pay.”

Debt payment letter templates

Claim for payment of debt under a supply agreement

Where: _______________________ __________________________________ __________________________________

"___" ___________ 202_g. Moscow

Seeing you as a valuable and promising partner, we are also pleased to express our satisfaction that our company’s products are represented in the trade assortment of your enterprise / in the wine list of your restaurant / …………./. We hope that you share our plans for long-term cooperation and, for our part, we will make every effort to create a stable and streamlined scheme of joint work. In order to avoid possible delays in deliveries due to your violation of the payment terms established in the contract, we ask you to make payment for the delivered goods on time. As of the date of the letter, the amount of the principal debt of your company to __________________ for the goods transferred to your disposal under invoice No. ______ dated “__”__________202__. is (_________________________________) rub.

____ kopecks, the payment deadline for which, taking into account a deferment of ___ calendar days, came on “__”__________202__.

We ask you to liquidate the resulting debt within days from the date of receipt of this letter.

Claim for debt under a service agreement

Seeing you as a valuable and promising partner, we are pleased to express our satisfaction with our cooperation. We hope that you share our long-term plans and, for our part, will make every effort to create a stable and streamlined scheme of joint work. To avoid possible delays in the provision of services by us due to your violation of the payment deadlines specified in the invoice, we ask you to make payments on time.

As of 03/21/2020, the amount of the principal debt of Industry LLC to Land LLC is 2,643.55 US dollars and 1,083.05 euros, the payment period of which, taking into account the indication in the invoices:

No. 219 of January 17, 2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021. No. 220 of January 13, 2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021. No. 416 dated February 28, 2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021. No. 459 of 03/04/2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021. No. 465 of 03/04/2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021.

We ask you to eliminate the resulting debt.

Deputy General Director

Debt claim letter

Company Attention: (Director, Financial Director) Tel: Fax: Date

Re: unpaid bills

Dear Mr... Despite our numerous reminders, the bills listed below remain unpaid:

According to the decision made by the company's management, our company is suspending work with you, since the debt on these accounts has exceeded 45 days.

We remind you that the deadline for payment for work/services agreed upon in the contract has been violated, for which a penalty is payable. If funds do not arrive in our bank account within 3 banking days from the receipt of this request, we will claim a penalty for the entire period of the violation.

We also reserve the right to claim a penalty for late payment of previous invoices.

Cooperation between our companies will resume only after confirmation of full payment of the debt.

From now on, any work with your company will be carried out on an advance payment basis.

Information letter about the debt incurred.

Dear [recipient's name],

Article on the topic: Sale of seized property by bailiffs: bidding

According to the agreement No. [number] dated [date] concluded between LLC [name of the organization] (hereinafter referred to as the Customer) and LLC [name of the organization] (hereinafter referred to as the Contractor), work was performed on [name of the work] for the amount of [amount] rubles.

According to clause [number of clause, which indicates the period for full payment] of the contract, payment for work performed is made by the Customer within [number] banking days from the date of signing the certificate of completion, which was signed on [date]. However, the Customer violated the terms of the concluded Agreement, work performed was not paid on time.

As of [date], the Customer's debt is [amount] rubles.

Based on the above, guided by the norms of current legislation, we suggest that you, within [number] calendar days from the date of receipt of the claim, transfer the amount of debt to our current account No. [account number] in Bank [name] c/s [number], BIC [number] .

If our demands are not satisfied, we will be forced to apply to the Arbitration Court to forcefully collect the amount of the debt, with the accrual of penalties (according to clause [clause number] of the Agreement), as well as charging the costs of paying the state duty to your account.

Best regards, [Your name]

Letter of demand for payment of debt.

Last year and this year, promises of payment were repeatedly made to me personally, ——— Oh.. Since May 2021, we have assigned an individual manager who reminds me about payment on a daily basis and again in response there are only promises, i.e. Empty words not backed up by action.

Payment reminder letters were sent repeatedly and invoices were duplicated with other documents.

Based on the above, guided by the norms of current legislation, we suggest that you transfer the amount of debt to our bank account within 3 working days from the date of receipt of the claim.

If the payment requirements are not satisfied, we will be forced to apply to the Arbitration Court to forcefully collect the amount of the debt.

Notice of debt repayment.

I would like to remind you once again that by [date] we expect you to fully repay the debt under all contracts. If you are unable to do this, then arrange a meeting for us with your general director. I hope that you will agree to meet us halfway and will assist in the prompt payment of all our bills.

Sample letter to bailiffs regarding a writ of execution

Why do you need to write to the bailiffs? Certainly not to congratulate them on their anniversary! Working as a bailiff implies a severe duty to implement court decisions day after day. Representatives of this profession are not liked, they are insulted, but they are secretly very afraid.

Of course, the bailiff only appears on your doorstep when your affairs are bad.

Maybe you have to pay child support and are ignoring this obligation? Or maybe you are unable to repay the loan you took out? Or are you a persistent non-payer of fines for illegal parking? Be that as it may, the appearance of bailiffs indicates your problems with money, or rather, the lack thereof. But first there is a statement from the creditor who did not wait for you to repay the debt.

The application should not be an ordinary piece of paper; all data must be confirmed by a copy of the original court order or other executive document. Indicate in your application your details to which funds will be transferred.

And of course, note the size of the requirements. If the defendant is an organization, send the application to its legal address.

Expert opinion

Mikhailov Ivan Kirillovich

Lawyer with 8 years of experience. Specializes in criminal law. Law teacher.

It has long been known that if you want to do everything efficiently, then do it yourself. Keep this expression in mind and monitor the reaction to your statement.

If the response has been delayed and there has been no action for a week now, then maybe it’s time to file a complaint about the inaction of the bailiffs? On our website you can find all the necessary information. In addition, here you can make sure that you have no debts.

Our specialists will inform you on the preparation of letters to bailiffs, provide guidance on what bailiffs have the right to describe, what they cannot seize, etc.

Author of the article

What is the need

If a banking institution is going to collect an overdue debt from a client, then going to court is the most effective way to achieve this goal, which has already been time-tested. But if it happened that citizens or large organizations always filed claims on any controversial issues, there would be a huge influx of statements that the current judicial system simply could not cope with.

If, within the period specified in this letter, the debtor does not provide the company with the specified loan, the bank can freely go to court to resolve this issue, since it has done what it is required by law to resolve disputes out of court.

The loan agreement must necessarily include a separate section, which must indicate the obligation to carry out claims work, while both parties have the right to independently agree on the time frame within which a claim can be filed if the debtor refuses to comply with the relevant requirements .

If the execution of a letter of claim is indicated by a mandatory measure prescribed in the loan agreement, then in this case, in the process of filing a statement of claim, the court may simply refuse to consider the case if the statement does not indicate a reference to this document.