When repairing under compulsory motor liability insurance or compensating for losses, quite a lot of controversial issues may arise. The task of any driver is to carefully study all the nuances of car repair under MTPL. It is important to find out what are the features of the legislation on repairs under MTPL, to get answers to the most important questions: how can you get the necessary original spare parts, how to act correctly when repairs are delayed?

Key current repair rules for compulsory motor vehicle liability insurance in 2021 are of significant importance. A lot of questions arise when repairing a car using an MTPL policy, and the task of the car enthusiast is to understand all the intricacies. The main regulatory acts regulating this procedure are Federal Law No. 40-FZ dated April 25, 2001 “On Compulsory Motor Liability Insurance” and Bank of Russia Regulations No. 431-P dated September 19, 2014 “On the rules of compulsory civil liability insurance...”.

How to get a referral for repairs under OSAGO

It is necessary to obtain a referral so that the car can be repaired according to compulsory motor liability insurance. The issuance of a referral for repairs is possible after consideration of the relevant application; it is written by the owner of the car and then sent to the insurance company. When the insured event does not fall within the existing provisions of the law, insurance is provided in the form of vehicle repairs.

At the same time, a referral for repairs under OSAGO is valid for 30 days - during this period the car should already be repaired.

To receive a referral for repairs under OSAGO, the driver must:

- Notify the insurance company about the accident.

- Collect a package of documents, which includes an insurance contract and the policy itself, a title, receipts for payment for a tow truck, examination and parking, a passport, copies of the protocol and resolution of the traffic police and a notification of an accident.

- Draw up an application for payment of the insurance amount and submit it to the insurance company.

- Provide the car for inspection to the insurer (this must be done within 5 days from the date of filing the application for insurance compensation).

- The car is inspected by the insurance company, and it may also be sent for an independent examination.

When all the necessary documents have already been received, the circumstances of the incident have been clarified and an assessment has been made, the car has been inspected and the appropriate examination has been carried out, the insurance company issues an official referral for repairs. The MTPL rules define specific deadlines for this: 20 or 30 days.

The direction includes the following data composition:

- information about the victim;

- details of the policy, insurance contract;

- vehicle data;

- the amount of additional payment for repairs;

- car repair deadline;

- the name of the service station where the repairs will be carried out, as well as its address and details.

When there are contracts between the insurer and the service station, the policyholder will be able to independently determine the service center from the corresponding list.

You need to choose as carefully as possible, since each service may have its own restrictions for vehicles.

The insurance company that provided the direction for repairs under the MTPL policy is responsible for compliance with the deadlines and quality of repairs.

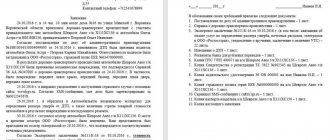

Procedure for going to court

Conventionally, the procedure for filing a claim against an insurance company can be divided into several stages:

- Damage assessment and automotive technical examination.

- Determination of the value of the subject of the claim.

- Drawing up and filing a statement of claim in court. If the cost of the claim does not exceed 50,000 rubles, the claim is filed in the magistrate’s court at the location of the insurance organization. Claims worth more than the specified amount are considered by district courts of similar jurisdiction.

- Court hearings. In your place, you can hire a proxy or attorney to appear in court on your behalf.

- Obtaining a court order and its implementation.

How does the car repair procedure work under OSAGO?

It is necessary to consider in detail the procedure for repairing a car under OSAGO. The Law “On Compulsory Motor Liability Insurance” has a corresponding article 12 , which, among other things, establishes criteria for the accessibility of the place of restoration depending on the location of the accident or the place of residence of the victim.

The maximum distance can be 50 km.

In certain cases, the insurer is willing to bear the cost of transporting the car. Then the distance to the repair site will no longer matter. Now the car owner can independently choose where the repairs will be carried out: this is done in a service center or at an insurance company service station, as well as at an official dealer.

Repair from an authorized dealer

Car repairs at dealerships are in fairly steady demand. It is performed when no more than two years have passed from the moment the car was released from the assembly line. If the warranty is valid, the dealer will perform the repairs at his service center. It is important to understand that this requires an agreement between the dealership and the insurance organization.

Sometimes the list of service stations does not include the corresponding official dealer. In this case, the insurer issues a referral for specialized repairs at the dealer.

There is another option: compensation of costs in monetary terms. The limit of insurance payments is 400 thousand rubles (Article 7 40-FZ).

At the service station of an insurance company

Free car repairs under MTPL are carried out by the insurance company. In this case, an agreement is concluded between the service, the insurance company and the client. The documents must describe in detail all the work, its features, deadlines, as well as a list of spare parts indicating their specific prices. If the level of 400 thousand rubles is exceeded, the client will have to independently cover the additional costs of restoration repairs.

In addition, only new components are used during repairs. For example, repairing or replacing a bumper requires the use of new parts, rather than refurbished, previously used parts.

Warranty periods are set in the following amounts: one year for painting and body work, six months for restoration.

When the repair work is completed, the car is handed over to the owner for acceptance. The acceptance certificate can be signed only after there is confidence that all faults have been properly eliminated. If there are any shortcomings, you can already solve the problem through a complaint procedure.

If problems are discovered after signing the acceptance certificate, it is almost impossible to file a claim.

Rules for repairs in an independent service

It is important to remember the requirements for a service station when repairs to a warranty vehicle are carried out by a third-party service. To issue a referral, you will need to obtain the appropriate written permission from the insurance company. It indicates the details of the service station, as well as the address, contacts and name of the specific service center.

The insurance company may agree and send the car to a third-party service. Then the costs are covered without taking into account the wear and tear of spare parts. In addition, the insurer will have the right to consider the application for a longer time (10 days more, 30 days in total).

If the deadlines are not met, the insurer is obliged to pay a penalty.

Where to complain

If the insurance company has counted too little, refused to reinstate or violated the deadline for issuing the referral and the terms of service, complain to the Federal Insurance Supervision Service, the Central Bank and the Union of Auto Insurers.

If the complaint is reviewed positively, the authorized bodies will conduct an inspection of the insurer, deprive the opportunity to send the car for maintenance and oblige you to pay insurance only in monetary terms.

File a claim for compensation and penalties in court.

Car repair time under MTPL

The car must be repaired within a maximum of 30 days (Clause 15.2, Article 12 40-FZ). This period is counted from the very moment when the owner brings his car to the service station or transfers it to the insurer for transportation to the place of repair. It is extremely important that the maximum repair period under OSAGO is not exceeded.

Did the repair take longer? Then you can send a corresponding complaint to the service station, as well as to the insurance company. These authorities are required to promptly consider the appeal.

The maximum period for consideration of a complaint is 5 days/

The specific period required for high-quality repair of a vehicle is determined in each case individually. This is done at the service center after inspecting and diagnosing the car. The repair instructions indicate the exact repair time frame, but it is possible to change them.

Warranty obligations.

The warranty on main parts and components is 6 months.

For body repair and painting this period is 12 months.

Despite the fact that the repair under compulsory motor liability insurance is carried out by a service station, quality claims are made to the insurance company during the warranty period.

For each day of delay in the provision of services (more than the allotted 30 days), the insurer pays a penalty in the amount of 0.5% of the cost of insurance compensation .

Calculation of the cost of repairs according to OSAGO

You can roughly calculate the cost of car repairs in advance. The price of spare parts will be of significant importance here. Keep in mind that the spare parts cost catalog according to PCA reflects current information, so it is always useful to check with it.

Providing services of inadequate quality. What to do if a car service performed poor quality repairs

If you are dissatisfied with the result of the car service, the first step is to prepare a claim.

Making a claim

It must be compiled in two copies, one will remain with you. Make sure that both copies are signed and stamped - this is evidence that their claim has been accepted.

In your claim, you can indicate what compensation you want:

- Elimination of defects at no additional charge.

- Reduced price for work.

- Carrying out work to eliminate any deficiencies that have arisen without additional payment.

- Compensation for the fact that you eliminate the shortcomings on your own.

To check what the true cause of the shortcomings is, the car service can conduct an examination.

Who pays for the examination?

The examination is carried out at the expense of the car service. You can be present to see if it is fair.

However, if it turns out that the deficiencies are not related to the work of the car service employee and are related to how you operated the car, you will have to pay for an examination.

How to properly accept a car after repair

Judicial practice regarding poor-quality car repairs is widespread: the number of trials is increasing literally every day.

The most important thing in such a situation is not to sign the car acceptance certificate after the repairs have been made if you are not sure of its quality.

Be extremely careful: the car needs to be inspected and tested.

When asked to enter into an additional agreement or conduct an additional inspection

You shouldn't sign anything. Usually, an additional agreement includes conditions unfavorable for the client related to additional payments, the establishment of secondary details, and the like.

Sometimes service stations are asked to perform an additional inspection. Its goal is to identify hidden damage with calculations to increase the cost of restoring the car, since the insurer does not take these defects into account. The car owner may agree to carry out such an inspection, but this should not affect the increase in the period of restoration work. The client provided the vehicle, the rest is not his concern. After 30 working days, the car owner must be provided with his car in the condition in which it was before the traffic accident.

You also need to remember that the development of various estimates, work reports and other documentation is not the responsibility of the motorist. They should never be signed. All that is required is to provide a vehicle and receive confirmation of this.

Is it possible to refuse repairs under compulsory motor liability insurance and get money?

Some car enthusiasts prefer to receive money under compulsory motor insurance for self-repairs rather than use the services of a service station. Therefore, many car owners are interested in the question: when the insurance company pays money instead of repairs, what should be done for this?

Now insurance companies themselves decide whether to issue compensation in cash or refuse payment. But you can find a way out. For example, if repairs do not fit within the 30 days required by law, it is appropriate to demand compensation in monetary terms. When the car is not older than 2 years, it must be repaired by an authorized dealer. But if it is not there, and the insurer does not want to pay for transportation, it is better to request compensation in money.

New approach

Lawyers interviewed by Izvestia called this decision extremely important for the industry and advised waiting until examples of new practice appear.

They will answer without wear1

Photo: RIA Novosti/Alexey Mayshev

Targeted approach: why a compulsory motor liability insurance agreement can be terminated

Unscrupulous clients let down honest policyholders

And now, as the press service of the Financial Commissioner told Izvestia, new approaches have already begun to be applied when considering such cases. They clarified that if there are legal grounds, financial commissioners actually make appropriate decisions - they collect from insurance companies the cost of spare parts without taking into account wear and tear.

“The issue of the possibility of changing the practice of considering disputes by the Financial Ombudsman in connection with the adoption of the ruling by the Supreme Court was considered by the methodological committee in April of this year and the approaches adopted by it have been applied since April 26, 2021,” said the press service of the Financial Ombudsman.

They also added that there are no separate statistics on decisions made to collect insurance compensation under MTPL contracts in cash without taking into account depreciation.

Normative base

The legislation on the organization and conduct of restoration repairs of vehicles consists of:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

- Federal Law No. 40 of April 25, 2002 (hereinafter referred to as Law No. 40);

- Rules of compulsory insurance... contained in the Regulation of the Central Bank No. 431-P dated September 19, 2014 (hereinafter referred to as Rules No. 431);

- Regulation of the Central Bank No. 432-P dated September 19, 2014.

Sources

- rbc.ru: Repairs instead of money: how the new OSAGO rules work

- pravo.ru: The Supreme Court clarified the terms of compensation under OSAGO

- Official website of Tinkoff

Recommended for you

- Do you need a compulsory motor liability insurance policy to register a car?

- What are the risks of applying for compulsory motor third party liability insurance online?

- Original OSAGO spare parts will be replaced by “generic” ones

Victor Avdeev Works in the project since 2021, before that he was freelancing. Manages the work of marketers and SEO specialists. Experience working on similar projects allows him to effectively participate in the development of our service.

(16 ratings, average: 4.6 out of 5)

When is an independent examination needed?

In Part 11 of Art. 12 Federal Law No. 40 clearly states that an independent examination is carried out only if the insurer and the policyholder under compulsory motor liability insurance, after inspecting the vehicle, do not agree on the nature and amount of damage. In other cases, an assessment of the damage to the machine by independent specialists is not carried out.

Moreover, in 2021, the examination can be carried out by both the policyholder and the insurer. However, first the responsibility for its implementation rests with the insurance company (Part 13, Article 12 of Federal Law No. 40). And only if the insurer has not inspected the car, or has refused to organize and conduct the examination, then the policyholder can carry it out (clause 2, part 13, article 12 of Federal Law No. 40).

Attention

If the policyholder does not provide the vehicle for inspection, or organizes an examination himself before receiving a refusal from the insurer, the results of such an independently conducted assessment will not be accepted (clause 5, part 11, article 12 of Federal Law No. 40).