4,50

5

| Reviews: | 11 | Views: | 41822 |

| Votes: | 14 | Updated: | n/a |

File type Text document

Document type: Application

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

(SAMPLE) APPLICATION FOR REFUSAL OF AN INHERITANCE IN FAVOR OF ANOTHER HEIRS To the ________________________________ notary office of the city __________ from _______________________________ (full name) residing at the address: __________ __________________________________ APPLICATION for renunciation of an inheritance in favor of another heir I, _______________________________, renounce the share of inheritance due to (full name) me in the property ____________________________________, (full name, degree of relationship) of the deceased “__”______________ 20___, in favor of ________________________ (full name, _____________________________________ degree kinship) “__”___________ 20___ ________________ (signature) COMMENTS: ———— According to Art. 550 of the Civil Code of the RSFSR, the heir by law or by will has the right to refuse the inheritance within six months from the date of opening of the inheritance. Refusal of inheritance is allowed both in favor of other persons from among the heirs by law (Article 532 of the Civil Code of the RSFSR) or by will (Article 534 of the Civil Code of the RSFSR), and in favor of the state or a specific state, cooperative or public organization. There are no restrictions and renunciation of inheritance in favor of other heirs is allowed, regardless of their turn in inheritance by law. Refusal of an inheritance is permissible in favor of one or more heirs, and the person renouncing the inheritance has the right to indicate the shares due to them. If the heir, having refused the inheritance, does not indicate in whose favor he refused, his share goes equally to the heirs who accepted the inheritance (Article 551 of the Civil Code of the RSFSR). If the only heir refuses the inheritance, the inheritance goes to the state. An application for renunciation of inheritance must be formalized by a notary. Otherwise, if the deadline for submitting it is missed, it will not be accepted, since the six-month period for this type of transaction is preemptive and cannot be extended even in court. An application is submitted to the notary office at the place where the inheritance was opened. Refusal of an inheritance is not permitted if the heir has previously submitted to the notary office at the place where the inheritance was opened an application to accept the inheritance or to issue him a certificate of right to inheritance. On the other hand, if the heir refuses the inheritance, he cannot accept it. Refusal of inheritance can only be declared by a legally capable person. Parents (adoptive parents) can abandon heirs for minor heirs on the basis of Art. 133 CoBS of the RSFSR, but only with the consent of the guardianship and trusteeship authorities (local administration). The law prohibits refusal of inheritance in favor of persons who are not heirs, or who are deprived of the right to inherit by directly indicating this in the will, or by being recognized as unworthy heirs (Article 531 of the Civil Code of the RSFSR). Partial refusal of inheritance is not allowed. It is also not allowed to replace one application for renunciation of inheritance with another. If the refusal of inheritance took place under the influence of deception, violence, delusion, threat or other illegal action, entailing the invalidity of the transaction in accordance with the norms of civil law, then it may be declared invalid in court.

Download the document “Sample. Application for renunciation of inheritance in favor of another heir"

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Sample. Application for renunciation of inheritance in favor of another heir,” and ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

When refusal is not allowed

The legislator limits the rights of certain categories of citizens.

You cannot refuse property in favor of other applicants:

- to heirs under a will, if all property is assigned to a specific person;

- citizens who are entitled to a mandatory portion;

- persons who are designated by the testator as additional heirs. For example, in the event of the death of the main applicant or loss of property rights.

There is also no provision for a waiver with reservations or conditions. If after the death of a person no claimants to the property have been identified, then it is considered escheat and goes to the state. The state's refusal of inheritance is also not provided for.

Comments on the document “Sample. Application for renunciation of inheritance in favor of another heir"

Reply 0

| 5 Ella | 09/17/2018 at 05:58:36 Very good sample with comments. Thank you. |

Reply 0

| 5 Anatoly | 08/03/2019 at 12:16:42 Sample with detailed comments. Thank you. |

Reply 0

| 5 Lina | 08/05/2019 at 23:43:31 Thanks for your help, it was very helpful. |

Reply 0

| 3 years | 10/17/2019 at 11:36:43 it would be more convenient with Word |

Reply 0

| 5 Procopius | 11/07/2019 at 10:22:55 Sample with detailed comments. Thank you |

Reply 0

| Vladimir | 01/23/2020 at 17:40:29 And if the heir lives in another country, how is the refusal of inheritance in favor of another formalized? |

Reply 0

| 1 VZ | 01/23/2020 at 18:42:34 This is a legal scam. |

Reply 0

| 5 Feofan Ivanovich | 07/08/2020 at 10:16:56 Thanks for the sample! helped in court) |

Reply 0

| NM | 09/16/2020 at 17:04:15 It's great that such a service exists! |

Reply 0

| 4 Kay | 03.10.2020 at 20:30:50 The best image I've ever seen. The comments were especially helpful. |

Reply 0

| Elena | 12/19/2020 at 04:18:38 pm reply to Vladimir Similar. But it must be notarized with an apostille or at the consulate. |

Cost of the procedure

For notarial acts, a state tax of 100 rubles is paid. For the services of a legal specialist, you should separately pay an amount of 500 rubles. The price depends on the region where the deceased lived or where his house, business, car, etc. were located. So, in Moscow you will have to pay 1000 rubles for the services of an authorized person. If you use the help of a lawyer, you will be paid additionally for his assistance in accordance with the law firm’s price list.

Found documents on the topic “refusal of inheritance in favor of another person form”

- Sample. Application for renunciation of inheritance in favor of another heir Wills, inheritance documents → Sample.

Application for renunciation of inheritance in favor of another heir (sample) application for renunciation of inheritance in favor of another heir to the notary’s office from (full name) residing at the address... - Sample. Application for refusal from inheritance V benefit separate organization

Wills, inheritance documents → Sample. Application for renunciation of inheritance in favor of a separate organization... my mer (my) (indicate relatives who lived at the address: relationship, full name of the deceased). With this statement renounce my share of the inheritance in favor of (name of organization) located at: . contents with...

- Sample. Will at the place of treatment in benefit legal faces (sub-appointment of an heir, deprivation of the right to inherit, signing of a will others face due to illness of the testator)

Wills, inheritance documents → Sample. A will at the place of treatment in favor of a legal entity (sub-appointment of an heir, deprivation of the right to inherit, signing of a will by another person due to the illness of the testator)... and in the event of her (his) death before mine, I will bequeath the monetary contribution. (name of legal entity ) I am depriving my daughter (son) of inheritance . (last name, first name, patronymic) contents of the article. Art. 534, 535, 536 of the Civil Code of the RSFSR were explained to me by the chief physician. present for...

- Sample. Application for refusal from inheritance

Wills, inheritance documents → Sample. Declaration of renunciation of inheritanceapplication for renunciation of inheritance (sample) to the notary’s office from (full name) residing at the address: declared...

- Application for refusal for a share in inheritance

Wills, inheritance documents → Application for refusal of a share in the inheritanceto the state notary office of the city. (full name) lived (full address at place of residence) application for refusal of a share in the inheritance I, gr. I renounce my share of the inheritance after the deceased (date of death pr...

- Sample. Property insurance contract (the policyholder is an individual face, V benefit beneficiary - legal faces)

Insurance, reinsurance contract → Sample. Property insurance contract (the policyholder is an individual, in favor of the beneficiary - a legal entity)...the insurer's action. 2.12. failure to fulfill the obligation provided for in clause 2.11 of this agreement gives the insurer the right to refuse to pay the corresponding part of the insurance compensation if the insurer did not know and should not have known about the occurrence of fear...

- Sample. Property insurance contract (the policyholder is a legal face, V benefit beneficiary - physical faces)

Insurance, reinsurance contract → Sample. Property insurance contract (the policyholder is a legal entity, in favor of the beneficiary - an individual)...the insurer's action. 2.13. failure to fulfill the obligation provided for in clause 2.12 of this agreement gives the insurer the right to refuse to pay the corresponding part of the insurance compensation if the insurer did not know and should not have known about the occurrence of fear...

- Sample. Property insurance contract (the policyholder is a legal face, V benefit beneficiary - legal faces)

Insurance, reinsurance contract → Sample. Property insurance contract (the policyholder is a legal entity, in favor of the beneficiary - a legal entity)...the insurer's action. 2.12. failure to fulfill the obligation provided for in clause 2.11 of this agreement gives the insurer the right to refuse to pay the corresponding part of the insurance compensation if the insurer did not know and should not have known about the occurrence of fear...

- Sample. Property insurance contract (the policyholder is an individual face, V benefit beneficiary - physical faces)

Insurance, reinsurance contract → Sample. Property insurance contract (the policyholder is an individual, in favor of the beneficiary - an individual)...the insurer's action. 2.13. failure to fulfill the obligation provided for in clause 2.12 of this agreement gives the insurer the right to refuse to pay the corresponding part of the insurance compensation if the insurer did not know and should not have known about the occurrence of fear...

- Sample. Form enterprises to the body carrying out state registration of legal entities persons

Founding agreements, charters → Sample. Form of the enterprise to the body carrying out state registration of legal entitiesform to the body carrying out state registration of legal entities , I hereby notify that in accordance with the decision of the general meeting, protocol no. dated "" 20. (shareholders/account…

- Form to present the issuing bank with a commission and others expenses under an export letter of credit (used when all bank expenses are paid at the expense of a foreign party)

Bank account agreement. Settlement and cash services → Form for presenting to the issuing bank commission and other expenses for an export letter of credit (used in the case when all bank expenses are paid at the expense of the foreign party)THE BANK When replaying please refer to our No. 19 Copy: Dear Sirs, Re: Your Letter(s)o

- Sample. Property insurance contract (in benefit insured - individual or legal faces)

Insurance, reinsurance contract → Sample. Property insurance contract (in favor of the policyholder - an individual or legal entity)...the insurer's action. 2.13. failure to fulfill the obligation provided for in clause 2.12 of this agreement gives the insurer the right to refuse to pay the corresponding part of the insurance compensation if the insurer did not know and should not have known about the occurrence of fear...

- Sample. Savings life insurance contract (the policyholder is an individual face, V benefit insured - physical faces, insured event - survival of the insured until marriage)

Insurance, reinsurance contract → Sample. Savings life insurance contract (the policyholder is an individual, in favor of the insured is an individual, the insured event is the survival of the insured until marriage)... 3.3 of this agreement, the information they provide is considered untrue, and the information they refuse to provide is considered true. 4. responsibility of the parties 4.1. non-performing party...

- Sample. Property insurance contract (the policyholder is an individual or legal entity face; V benefit beneficiary - physical or legal faces; coinsurance)

Insurance, reinsurance contract → Sample. Property insurance contract (policyholder - an individual or legal entity; in favor of the beneficiary - an individual or legal entity; co-insurance)...stupidization of insurers. 2.14. failure to fulfill the obligation provided for in clause 2.13 of this agreement gives the insurers the right to refuse to pay the corresponding part of the insurance compensation if none of the insurers knew or should have known about this...

- Sample. Property insurance contract (the policyholder is an individual or legal entity face, V benefit beneficiary - physical or legal faces)

Insurance, reinsurance contract → Sample. Property insurance contract (the policyholder is an individual or legal entity, in favor of the beneficiary - an individual or legal entity)...the insurer's action. 2.13. failure to fulfill the obligation provided for in clause 2.12 of this agreement gives the insurer the right to refuse to pay the corresponding part of the insurance compensation if the insurer did not know and should not have known about the occurrence of fear...

Procedure for entering into inheritance rights

If a certificate has been issued, it is prohibited to issue a refusal. Until this moment, it is always possible to draw up a document stating the absence of claims. If an individual has written an application to enter into inheritance rights, then you can still contact a notary and cancel the decision to accept the property of the deceased.

After receiving the certificate, you will have to register the assets in your name. To obtain ownership of an apartment, contact Rosreestr. To change the owner of a vehicle, visit the traffic police. When inheriting deposits or shares, they are sent to banking organizations. Only after re-registration of assets in one’s name is one allowed to freely dispose of them.

It is important to remember that the property passes to the heir along with credits, loans, fines, etc. If a person has accepted debt obligations, then it is prohibited to write a waiver. You can try to resolve the issue through court, but such claims are rarely successful. But there are also pleasant moments - the citizen is responsible only for the part that was transferred to him, so he does not need to repay the entire loan himself.

Related documents

- Sample. Application for renunciation of inheritance in favor of a separate organization

- Sample. Application to revoke a will

- Sample. Certificate of right of inheritance by law

- Sample. Certificate for entering into an inheritance for residential premises in housing complexes and residential complexes

- Sample. Inventory act

- Sample. Application for acceptance of inheritance

- Certificate of right to inheritance under a will (option 1)

- Certificate of right to inheritance under a will (option 2)

- Certificate of right to inheritance by law (option 1)

- Certificate of right to inheritance by law (option 2)

- Certificate of right to inheritance by law (option 3)

- Certificate of right to inheritance by law (option 4)

- Certificate of right to inheritance by law (option 5)

- Certificate of right to inheritance by law (option 6)

- Certificate of right to inheritance by law (option 7)

- Inventory act

- Affidavit

- Documents expressing the will of the testator; sample wills

- Application for confirmation of family relationship

- Application for acceptance of inheritance

- Will (option 1)

- Will (option 2)

- Will (option 3)

- Will (option 4)

- Will (several persons, testamentary refusal)

- Will (one person)

- Application for refusal to share in inheritance

- Sample. Act on the impossibility of taking measures to protect inherited property

- Sample. Act on the impossibility of taking measures to protect inherited property

- Sample. Act on the impossibility of taking measures to protect inherited property (option 1)

- Sample. Agreement on division of inherited property

- Sample. Agreement on the division of inherited property with the participation of a representative and on behalf of a minor

- Sample. A will at the place of treatment in favor of a legal entity (sub-appointment of an heir, deprivation of the right to inherit, signing of a will by another person due to the illness of the testator)

- Sample. Will at the place of treatment of all property owned

- Sample. Will at the place of treatment of part of the property

Is it allowed to create a waiver by transferring your share to another person?

The law allows you to renounce your part in favor of another legal successor. However, there are several types of such transactions.

Types of failures:

- undirected (absolute);

- directed.

In the first option, a refusal statement is written, which does not indicate the reason for the decision and the persons to whom the part is assigned. In this case, the individual’s share is distributed in equal parts among the remaining applicants.

For example, a person received a plot of land. But he decides to write a refusal, because the inheritance is far away. After this, the plot is given to subsequent relatives.

When registering a directed variety, an individual independently determines the heir who will take his part. Property is transferred only to the successor who is included in the circle of the main applicants (it is prohibited to select third parties).

Registration of a waiver in favor of another applicant is carried out in compliance with certain rules. Thus, you cannot transfer your share to people who did not figure in any way in the life of the testator (they are not mentioned in the last will and are not included in the circle of relatives). It is also prohibited to give inheritance to citizens who have been deprived of such an opportunity by will or court decision.

Who can you transfer your shares to?

According to the law, an individual can donate his part for the benefit of other claimants to the inheritance who are in the same line of kinship. For example, a spouse writes a waiver to give his savings to his sons, daughters, father or mother.

If the successor dies without having time to accept the property, then part of it is due to first-degree relatives. When the deceased left a will, the order of inheritance changes: the assets are given to those individuals who are on the list of the last will.

Who is prohibited from giving their share?

There are categories of people who are not legally required to transfer assets. Usually these are legal successors who are prohibited from giving any savings of the deceased, or complete strangers who are not related to the deceased.

For whose sake it is prohibited to renounce an inheritance:

- persons who were excluded from the will for various reasons;

- strangers who are in no way connected with the testator and do not appear in the case either by law or by the last order of the deceased;

- unworthy successors who received such status in accordance with current regulations.

You cannot write a refusal by putting forward your own conditions. If only one legitimate candidate claims the property of the deceased, then after his abdication the assets are transferred to the state.

Transfer of inheritance to the state

It is prohibited to draw up a document in favor of the state. But if all applicants renounce the inheritance (for example, if there are large debt obligations), then the savings of the deceased, along with the debts, automatically pass to the state.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Sample.

Statement on renunciation of inheritance in favor of another heir” was useful for you, we ask you to leave a review about it. Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

List of required papers

Before visiting the notary, certain documents are collected. The list of required papers includes a passport, death certificate of the testator (issued by the registry office at the place of residence or death of the individual).

Documents are also prepared confirming the presence of family ties and the authority to claim the inheritance. Additionally, an extract from the passport office is taken from the last place of registration of the deceased (it helps to decide on the notary office to which you need to contact). They may also ask for other documents depending on the conditions of inheritance.

Citizens aged 16 to 18 years bring a decision from the guardianship authorities on their legal capacity (usually these are individuals who officially work or are married). If an intermediary acts on behalf of the applicant, he provides a power of attorney signed and stamped by a notary.

List of documents for an incapacitated person:

- birth certificate and passport;

- conclusion of a judge or doctors on recognition of incapacity;

- parents’ passports, if the applicant is a minor;

- appointment of guardianship authorities to assign a guardian to an incapacitated person;

- documents of the person who is officially responsible for the successor;

- permission from the guardianship and trusteeship service.

To draw up a directed refusal, it is enough to provide identification. The right to claim part of the assets is also documented. Identity is verified by Russian and foreign passports, residence permit, military ID, etc.

It is required to provide a will or proof of relationship with the deceased. Children and parents bring birth certificates. The spouses show their marriage certificate. For a mandatory share, a certificate confirming the incapacity of a man or woman is provided (judicial opinion).

Motivation of “refuseniks”

In addition to the large debts left by the deceased person, they do not want to accept the inheritance for the following reasons:

- it is too far away;

- the property is in poor condition and will require large investments;

- acceptance will entail the payment of a substantial tax;

- the inherited share is very small or cannot be separated in kind from the common property;

- the inherited property has encumbrances that are beyond the strength of the heir.

Whatever the basis for refusing an unwanted inheritance, it is always documented in writing. Failure to appear before the notary within 6 months after the death of the testator is not considered a refusal. Such passivity will be considered as missing the deadline for accepting the inheritance.

Result of failure

The main consequence of writing a document of renunciation is the loss of inheritance rights. But you can transfer your share to another successor. If a person does not make any attempts to refuse or enter into the inheritance, then his part is equally divided among all heirs.

Consequences of refusal:

- loss of rights to claim any property of the testator;

- the process is irreversible;

- the applicant's share is distributed equally among all claimants to the assets of the deceased;

- if the document is sent, then the share of the refuser passes to the person in whose favor such an action was taken;

- the applicant renounces not only the deceased's savings, but also his debts.

The renunciation procedure carries certain risks. To do everything correctly, it is recommended to consult a lawyer.

Cost of refusal from a notary

The cost of paying for notary services consists of 2 parts:

- State duty. It is charged for verifying the authenticity of the signature. Its uniform tariff for all is determined by Art. 333.24 Tax Code of the Russian Federation – 100 rubles.

- Payment for technical and legal services. The cost of such services, without which it is impossible to perform the necessary actions, is established annually by regional notary chambers.

Some categories of citizens are entitled to benefits. In accordance with Art. 333.38 of the Tax Code of the Russian Federation, disabled people of groups I and II pay 50% of the established state duty. The fee for technical services is not charged in full from veterans and disabled people of the Great Patriotic War, former prisoners of fascist camps, in the amount of 50% - from citizens of disability group I.

The specific cost of refusal should be clarified with the notary chamber of the relevant region.

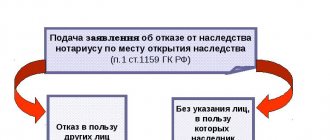

Time and factual framework

According to Art. 1157 of the Civil Code of the Russian Federation, a refusal can be drawn up within six months from the moment of death. If there was actual acceptance of the inheritance or the deadline was missed, then the issue of refusal is resolved only through the court. The plaintiff must provide compelling evidence of his unwillingness to take the property of the deceased.

What does acceptance of inheritance mean:

- living with the deceased for a long time, maintaining a common household;

- paying bills, carrying out repairs, reconstruction;

- contributing your savings to the inheritance, etc.

A striking example from life is a mother and child living together for many years, when the child, along with the parent, contributes his personal funds to improve living conditions. In such a situation, it is difficult to distinguish between the property of the mother and the child.

The arguments for refusal in court will be weighty - a long business trip, illness, sluggishness or obstacles of third parties. In the latter case, it may be a notary who did not proceed with the application and did not formalize the refusal as required by law.

How to refuse correctly

By law, each heir is obliged to respond to the notary's request.

The Civil Code allows 6 months from the date of death to search and identify heirs. If the application is not completed on time, the successor will not be considered to have refused automatically. After 6 months, the property will be distributed among those who entered.

However, a successor who does not relinquish the share on time may later request a review of the distribution through the court. In most cases, the court refuses such citizens.

But there is a risk that everything already formalized by other successors will have to be divided anew.

How to refuse:

- Write an application immediately at the time of opening the inheritance case.

- Do this through any other notary, and then send it by registered mail or transfer it with a trusted person. If registration takes place in another state in a foreign language, of course, a translation (apostille) will be required.