How to find out about enforcement proceedings and its termination

In accordance with 229-FZ “On Enforcement Proceedings”, the SPI is obliged to notify the parties about the beginning and termination of enforcement proceedings, and about the activities carried out within its framework. This is done by sending written notifications to the place of residence (or registration) of both parties to the conflict, which entailed a trial and the initiation of enforcement proceedings.

But often this is not enough and debtors, like collectors, remain in the dark about the stages of debt collection and the measures taken by the SPI. Therefore, it is worth periodically checking on your own what is happening with your production facilities.

You can do this in the following ways:

- Through State Services.

In the settings of the portal’s personal account, there is an option to send email notifications when the amount of legal debt changes. Then, when new ones appear or old ones are completed, corresponding letters will be sent to the user’s mail. But this is only in theory - in State Services, information about court debts is often displayed incorrectly, so this method of monitoring collections should be taken as a backup. - At the bailiff's office in person. This method is good when you know which bailiff is or was conducting your enforcement proceedings. Then it is enough to visit him during reception hours - the debtor will be able to find out this information on the website of the territorial department of the FSSP.

- If you do not know the name of your specialist in the SPI, you can clarify information about him and about the penalties in force against you at the reception of the FSSP department.

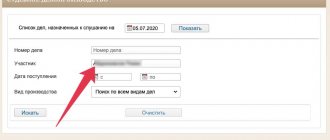

- Through the FSSP website in the “Data Bank of Enforcement Proceedings” section. Everything is simple here - you need to select your region, your full name and date of birth. Then all active and terminated enforcement proceedings for your debts will be displayed on the screen, indicating the amount of debt (but not always), as well as the name and contacts of the bailiff.

- Using mobile applications. You can install applications from the FSSP or State Services on your smartphone, available in the official app stores for Android and iPhone.

In addition, some banks notify their clients via SMS about the seizure or removal of seizure from accounts by bailiffs. For example, you received an SMS from Sberbank from number 900, which states that “collection on the card has been stopped... (followed by the number and date of the bailiff, the name and contacts of the bailiff).” This means that enforcement proceedings against you have been terminated, canceled or suspended.

Nuances of write-off in the presence of a certificate of impossibility of collection

If an organization has a statement about the impossibility of collecting debt, this gives it the right to reflect in its accounting data the fact that such debt is recognized as bad. Accounting does not imply reflection of the reasons why the debt was recognized as uncollectible.

The regulations do not contain the dates on which receivables recognized as uncollectible should be reflected. In this case, you need to be guided by the rules of the Tax Code. In Article 129, amounts of debt that are recognized as uncollectible are recognized as non-operating expenses on the date when documents about the impossibility of collection are drawn up.

That is, when tax reporting is generated, the amounts of debt that are written off due to hopelessness reduce the tax base for income tax in the period when the statement of impossibility of collection is drawn up. At the same time, the tax base for value added tax is not adjusted.

On the date when the act is drawn up, the debt amount is written off from the reserve for debts of dubious origin, if such a reserve has been formed, otherwise - to the financial results accounts.

What does termination of execution mean?

So, you found out that the bailiffs stopped the enforcement proceedings - what does this mean? This means that bailiffs previously took measures against you to forcibly collect the debt.

The reasons for the penalty could be:

- credit debts, including microloans or mortgages;

- payments for taxes, contributions and to the budget;

- alimony;

- fines;

- payments aimed at compensating for damage to property or health.

Termination of enforcement proceedings means the unconditional cancellation of the penalty with the impossibility of its renewal within the framework of this court decision.

In other words, if the collector decides to re-collect money from the debtor, he will again have to go to court for a new decision. This conceals the fundamental difference between the procedure for terminating enforcement proceedings and its return or suspension.

Now let’s figure out what “collection on the card has been stopped” means - this message is sent by the bank at the end of enforcement proceedings. It means that the arrest placed on it by the bailiff has been removed from the card, and all funds on it have been unblocked. From this moment on, the citizen can freely use the bank card - until new enforcement proceedings are initiated based on other court decisions.

Features of withholding the amount of debt from an individual

Repayment of a debt involves the risk of invading the personal space of a citizen who, although he is a debtor, does not thereby become a powerless outcast whose life can be complicated by a certain amount or property. Until recently, the state turned a blind eye to the bandit methods of “collecting” debts that “collectors” used.

There are three directions for collecting debt from an individual:

- Pre-trial dispute resolution.

- Based on the document.

- Sale of debt to third parties.

When is production completed?

In Art. 43 229-FZ contains detailed information on how to close enforcement proceedings. The IPC has the power to revoke it on the following grounds:

- the court decided to terminate the execution of the writ of execution issued by it or another court (official);

- the claimant expressed his refusal to collect funds in court (namely, in court, since if the claimant simply takes away the writ of execution from the bailiffs, he will be able to re-submit it for execution);

- a settlement agreement was concluded between the claimant and the debtor;

- the court canceled the previous writ of execution, on the basis of which the collector could initiate forced collection of debt by bailiffs;

- the executive document within the framework of which the SPI initiated enforcement proceedings was canceled or declared invalid;

- in other cases established by this Federal Law.

The immediate procedure for terminating enforcement proceedings is simple: the bailiff receives information on the basis of which he must close the enforcement proceedings, then he closes it and removes all restrictions from the citizen. Banks, in turn, after receiving information about the termination of an individual entrepreneur, are obliged to unblock the citizen’s accounts.

When an individual entrepreneur is terminated by a court

It is worth highlighting the following grounds for termination of enforcement proceedings:

- The debtor-individual or the collector-individual has died, been declared dead or missing. But only if the right of claim or performance obligations are not transferred to successors or heirs, trustees.

- The executive document that served as the basis for debt collection has lost its ability to be executed.

- The claimant refused the property seized from the debtor as part of the execution of the executive document, which contained requirements for its transfer to the claimant. In other words, if the subject of the dispute was a car, which the debtor in court is obliged to transfer to the claimant, but after the car was seized, the claimant refused to accept it, then the enforcement proceedings will be terminated.

If there is a compelling reason for the bailiffs to terminate enforcement proceedings, the court issues a ruling, which the Investigative Officer is obliged to execute immediately.

General points

Enforcement of a court decision is a procedure consisting of several sequential actions, as a result of which various measures of influence can be applied to the debtor.

Starting from the seizure and sale of property, ending with the application of administrative or criminal sanctions.

Such measures do not always have a positive effect. In order to enforce a court decision, the bailiff may apply the following measures to the debtor:

- Summons to a bailiff to give explanations and provide information.

- Search for property and accounts, seizure of property, seizure of regular income.

- Foreclosure of the debtor's property with its subsequent sale.

- Ban on travel outside the Russian Federation.

- Application of administrative and criminal liability measures (for example, for intentional damage to an item entrusted for safekeeping or for concealing property).

If collection within the established period is not possible, the bailiff draws up an act, the writ of execution is returned to the creditor, and the case is closed.

What it is

An act of impossibility of collection is a document confirming the fact that the writ of execution cannot be executed in accordance with existing circumstances.

As a rule, an act is drawn up in the following cases:

- The debtor has no property to recover.

- The legislation has changed, so the document cannot be executed.

- The corresponding decision of the government body or court decision has entered into force.

- The debtor organization ceased to exist (was liquidated).

If one of these circumstances exists, enforcement proceedings are subject to termination on the basis of an act issued by the bailiff.

Ways to evade payment

Debtors often use methods to evade paying debts and fulfilling obligations under the sheet.

Most of these methods are not entirely legal, but in fact they are used by unscrupulous citizens and even organizations and individual entrepreneurs:

| Property is registered in the name of third parties | This could be an acquaintance, relatives, and so on. In order to prevent its concealment, the bailiff and the court may impose arrests |

| A citizen switches to a “gray” salary | Formally, the employer pays less; I provide most of the salary “in an envelope.” This option is also an offense on the part of the employer. |

| Actual concealment of property | For example, valuable items that cannot be detected through databases (through a request to Rosreestr, traffic police, banks, etc.) are transported to other places during enforcement actions. |

| A citizen can simply ignore the instructions of the bailiff and even deliberately hide from him | But such actions are punishable by law. |

Other methods may also be used, the purpose of which is one thing - not to pay at all or for a certain period of time due to existing circumstances.

Legal basis

In its work, the bailiff is guided mainly by one legal act - the Federal Law “On Enforcement Proceedings”, which determines the rules of enforcement proceedings, its process and features.

Termination of enforcement proceedings is mentioned in Article 43, and the consequences of this action are mentioned in the following.

The issuance of a judicial act and the subsequent issuance of a writ of execution is carried out on the basis of the Civil Procedure Code or the Arbitration Procedure Code.

Who can terminate enforcement proceedings

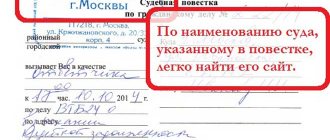

The current edition of the Code of Civil Procedure of the Russian Federation determines that the decision to terminate enforcement proceedings is made by a court of general jurisdiction located in the area of activity of the bailiff performing his duties. That is, in the same locality or area in which the territorial body of the FSSP operates. The basis for the court's decision is the application submitted by one of the parties. The court has 10 days to cancel the execution.

All parties involved in it must be notified of the date and time of the court's consideration of the case: the bailiff, the debtor himself and the collector. Their failure to appear is not an obstacle to the court making a decision. After considering the application, the court issues a ruling sent to the claimant, the bailiff and the debtor.

It is worth noting that in accordance with Art. 440 of the Code of Civil Procedure of the Russian Federation, the parties can file a private complaint against the decision issued by the court.

If the executive document being executed by the bailiff was previously issued by an arbitration court, then its cancellation is carried out by the same court. Or by an arbitration court located in the area where the PPI performs its duties. Arbitration courts are involved if the debtor is a legal entity or an individual registered with the Federal Tax Service as an entrepreneur.

Despite the direct participation of the court, it is the bailiff who puts an end to the enforcement proceedings. He is vested with the following powers:

- terminate the individual entrepreneur due to actually fulfilled requirements;

- return the writ of execution to the claimant at his request or due to the discovery of violations in it, cancellation of the document;

- terminate enforcement proceedings due to the debtor’s lack of funds and property for collection;

- cancel the writ of execution due to the expiration of the statute of limitations of the judicial act.

However, bailiffs rarely take the initiative, so the debtor should independently look for the reasons for the legal annulment of the executive document, and then force the bailiff to close the enforcement proceedings.

Since debtors are not always able to convince bailiffs to close enforcement proceedings, the help of lawyers will be simply invaluable.

Almost any enforcement proceedings regarding credit debts can be terminated - it all depends on the qualifications and experience of the lawyers

We will help you write off credit debts and protect your rights if they are violated by bailiffs.

Time restrictions on document preparation

There are no legislative provisions that would limit the time limits for bailiffs to carry out enforcement proceedings.

Therefore, operations to find facts and investigate the situation can take as long as desired.

As soon as the bailiff collects and provides the bailiff with the necessary evidence about the impossibility of collecting either monetary or property funds from the debtor, an act is drawn up in the prescribed form about the impossibility of carrying out the procedure for returning funds and transfers the writ of execution to the plaintiff.