When an enterprise or businessman can no longer fulfill its financial obligations, that is, it becomes insolvent, it is declared bankrupt. When an arbitration court rules on the bankruptcy of an insolvent business, creditors wonder whether their money is lost forever. In order to try to satisfy the legal claims to creditors at least partially, before the final liquidation of the debtor as an entrepreneur, bankruptcy proceedings (CP) may be opened.

From the article you will learn for what purposes this procedure is being carried out, clarify what steps the appointed bankruptcy manager will take and what documents he will provide at the end of his work. Alternative options for terminating obligations will also be considered.

Why does bankruptcy proceedings exist?

This is the only procedure permitted by law, as a result of which an enterprise, company, LLC declared insolvent is liquidated.

NOTE! The debtor may not cease to exist if, during the bankruptcy proceedings, the business begins to be managed from the outside, or the matter can be resolved through an agreement.

Through the CP, absolutely all property of the debtor enterprise that is of material value must be identified and sold in the manner prescribed by law, and the proceeds must be used to repay all loan obligations (in full or in proportion).

The duration of bankruptcy proceedings is exactly six months from the date of announcement of the decision of the Arbitration Court on the final recognition of the debtor as insolvent. In some cases, this period may be extended for another 6 months (at the request of the bankruptcy trustee).

The goals that the introduction of CP implies:

- discovery of all components of the property of the debtor enterprise or, in other words, accumulation of the bankruptcy estate;

- turning the bankruptcy estate into money;

- through the sale of the bankruptcy estate, fulfillment of obligations to creditors (if full payment is not possible, it must be made proportionately);

- liquidation of a bankrupt as a legal entity or entrepreneur.

Appointment procedure according to law

A bankruptcy application can be filed by both the borrower himself and his creditors (commercial and government organizations). When applying to the court with such a statement, the plaintiff must indicate the candidacy of the arbitration manager to consider the case or the name of the self-governing organization from among whose members the candidate will be selected. Often it is the association that is indicated in the applications. The functions of the arbitration manager are strictly regulated by law and do not differ depending on membership in a particular association.

As soon as the petition to declare the borrower bankrupt is registered by the court, the self-governing association specified in the petition must provide the court with information about the insolvency practitioners who are members of it. In this case, two options are possible. If the plaintiff indicates a specific person whom he wishes to see as an arbitration manager, then the association in which he is a member sends information to the court that the selected candidate complies with the requirements of the law.

If the name of the association is indicated in the application, it submits to the court a list of arbitration managers who are not involved in other processes at the time of consideration of the case, and therefore can be appointed to conduct an analysis of the bankrupt’s activities. From the submitted candidates, the arbitration court selects a suitable specialist.

The bankruptcy proceedings have been announced: what next?

From the moment the opening of the CP is announced in the Arbitration Court, the following natural consequences occur:

- the last opportunity appears to present obligations to the liquidated company;

- all types of sanctions cease to be accrued: penalties, penalties, interest, fines, etc.;

- any information about the debtor’s business ceases to be a trade secret;

- the property of the debtor company, if its quantity exceeds 5%, is prohibited from sale, rental or other alienation;

- all enforcement documents are terminated and returned to the bankruptcy trustee by the bailiffs;

- all restrictions on the use of the bankrupt’s property are removed - arrests, blocking of accounts, etc.;

- the former manager relieves himself of all powers and transfers them to the manager;

- The debtor's patents, permits and licenses are cancelled, and his registration as an individual entrepreneur becomes invalid.

What happens after bankruptcy is declared?

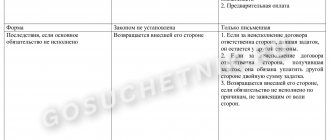

The table presents a step-by-step procedure for bankruptcy proceedings, clarifying the specific deadlines and legislative basis for each action.

| № | Element of the bankruptcy process | Deadlines | Article of the law |

| 1 | An individual entrepreneur or legal entity cannot pay off its obligations; the amount of debt has increased by more than 10 thousand rubles. | More than 3 months after the expiration of the obligation | Article 65 of the Civil Code of the Russian Federation |

| 2 | The arbitration court, considering a bankruptcy case, decides to declare a bankruptcy trustee and approve a bankruptcy trustee | On the day of bankruptcy declaration | Clause 4 art. 72 of Federal Law No. 127 of October 26, 2002 |

| 3 | Notification of the bankruptcy proceedings of the debtor - individual entrepreneur or legal entity, issuance of an order for the transfer of all documents, stamps and remaining property of the newly-made bankrupt to the appointed administrator. | On the same day | Clause 2 art. 126 Federal Law |

| 4 | Transfer of all of the above, activation of this procedure (it is desirable that one of the debtor’s former employees be a member of the inventory commission) | Within 3 days | Clause 2 art. 126 Federal Law |

| 5 | Notification of the Federal Tax Service in the prescribed form about the bankruptcy of an enterprise | Within 3 days after delivery of documentation | P.2. Article 23 of the Tax Code of the Russian Federation |

| 6 | Publication of a message about the introduction of the CP in the media (Kommersant) with notification of the Arbitration Court | 10 days after the appointment of the CP | Art. 28, 126 Federal Law |

| 7 | Transfer by the Federal Bailiff Service of all enforcement documents to the bankruptcy trustee | 10 days after the appointment of the CP | Art. 126 Federal Law |

| 8 | Collecting information about the debtor’s property: sending requests to various organizations where it can be recorded, for example, the land committee. FSS, banks, registration service, etc. | During the entire term of the CP | Art. 126 Federal Law |

| 9 | Notice of impending dismissal is given to the bankrupt’s employees (it does not matter whether the activity is ongoing or not) | Within a month after the start of the procedure | Art. 129 Federal Law |

| 10 | Selecting one bank account (main) on which all accumulated funds will be collected, closing other accounts (if any) | In continuation of KP | Article 133 Federal Law |

| 11 | Drawing up a complete inventory list with the involvement of independent experts to evaluate the property | 30 days from the beginning of the CP | Art. 129-131 Federal Law |

| 12 | Identification of debts to a bankrupt enterprise. If any are discovered, debts are declared for collection, existing contracts are suspended, and transactions are declared invalid. If part of the bankrupt’s property is in the possession of third parties, it must be found and returned. All procedures should be reflected in reports. | Constantly during the CP | Art. 102, 103,129 Federal Law |

| 13 | Formation of the bankruptcy estate, approval of the terms of its implementation at the meeting of creditors. In case of disputes, the Arbitration Court will reconcile everyone | Before 6 months have passed | Art. 131, 132, 139 Federal Law |

| 14 | Open auction for the sale of property with preliminary publication in Rossiyskaya Gazeta and local publications | In accordance with the terms adopted at the meeting of creditors | Art. 139 Federal Law |

| 15 | Settlement with creditors: first, legal costs, repayment of current claims, then - according to the register. If there are not enough funds, the calculation is proportional for each queue | After the sale of the bankruptcy estate | Art. 142 Federal Law |

| 16 | After all payments, the main bank account is subject to closure, of which the tax office is notified along with an application for deregistration of the debtor | 10 days after application | Clause 5 of Article 84 of the Tax Code of the Russian Federation |

| 17 | All documents of the debtor subject to storage are transferred to the archive | It is better to start preparing immediately after the introduction of the CP | Art. 129 Federal Law |

| 18 | Report on the results of the CP to the arbitration court | After settlement with creditors | Art. 147 Federal Law |

| 19 | Publication in the media of a message about the termination of a bankruptcy case (Rossiyskaya Gazeta) with notification to the Arbitration Court | After the decision of the Arbitration Court | Article 28 Federal Law |

| 20 | Exclusion of the debtor enterprise from the Unified State Register of Legal Entities | Until this moment, the bankruptcy trustee exercises his powers | Art. 149 Federal Law |

Peculiarities of appointing a manager when working with state secrets

The declared SRO cannot nominate a manager if he does not have access to state secrets in cases where this is necessary for the bankruptcy of a given enterprise. The presence of such access is a prerequisite for the court to approve the candidacy of the manager.

The debtor and the executive authority, within 2 and 7 days, respectively, after the adoption of the court ruling on acceptance of the application, provide the court and the SRO with information about the form of access to state secrets of the head of the legal entity and the degree of secrecy of the information that the enterprise has.

Provisions on the specifics of appointing a manager, taking into account access to state secrets, appeared in the legislation thanks to amendments to the wording of Article 45 127-FZ in 2015.

Who is he - a bankruptcy trustee

The arbitration court appoints a special person to manage the bankruptcy procedure and exercise the powers provided for by law - a bankruptcy trustee . His activity lasts until the end of all procedures, which consist of collecting the necessary information, systematizing it and filing papers for their intended purpose, that is, to the court. Only on the basis of these reports does the court make a decision on the finalization of bankruptcy proceedings, which it submits to the register to record the liquidation of the company.

The credit manager has the right to dispose of the bankrupt’s property on legal terms, as well as to resolve personnel issues in the organization, up to and including dismissal of management, if he considers this justified.

Responsibilities of the credit manager:

- inventory of the debtor organization's property;

- property valuation with the help of a professional appraiser;

- search and seizure of property belonging to the debtor that is in other hands;

- collect debts in favor of the organization;

- preserve the bankrupt's property;

- inform employees about the upcoming termination of contracts no later than 30 days from the start of bankruptcy proceedings;

- to reasonably object to creditors’ demands that are, in his opinion, inadequate;

- maintain a register of creditor claims;

- ensure the established procedure for storing the debtor's documentation;

- be a representative in concluding transactions approved by the creditors’ committee;

- make claims for subsidiary liability against other persons in favor of the debtor;

- provide any information to the arbitration court upon request.

Remuneration and liability of an arbitration manager in a bankruptcy case

Although the AC is a key figure in insolvency proceedings, its work is not uncontrolled. Creditors and the debtor himself can always report violations in his activities. The manager may be suspended from work or brought to justice - administrative, financial and even criminal. The SRO, in which the AU is a member, strictly controls its work, and if there are violations, it revokes membership.

An external, temporary, bankruptcy trustee, by law, is entitled to a monthly remuneration. Depending on the bankruptcy procedure, it varies from 15,000 to 45,000. A percentage of the remuneration is also provided, the amount of which depends on the book value of the enterprise’s assets. The financial manager's remuneration is 25,000 rubles. A percentage portion is also provided - 7% of the value of the sold property.

Documentation of the bankruptcy trustee

The manager takes part in its preparation and submission to the relevant authorities.

- Inventory statement (when forming the bankruptcy estate), interim and final, as well as the liquidation balance sheet.

- Documents for the sale of the debtor's property.

- Register of creditors' claims.

- Confirmation of repayment of creditor claims.

- Reports on the financial condition of the debtor and on his activities as a manager (submitted at least once every 90 days).

- Certificate for the Arbitration Court regarding the submission of the debtor’s documents for archival storage.

- Application for deregistration of the debtor with the tax office.

- Certificate of no claims from the Pension Fund.

- Minutes of meetings of creditors.

- Application for concluding a settlement agreement (if this happened).

What functions does an arbitration manager perform?

During bankruptcy, the arbitration manager (AM) performs dozens of functions. Some of them are specific to each procedure: supervision, financial recovery, external management or bankruptcy proceedings. Depending on the stage, the manager is called differently - temporary, administrative, external, competitive. In fact, the wording “arbitration manager” is general.

Whatever the capacity of a specialist, he:

- carries out anti-crisis management of a bankrupt enterprise;

- ensures that the rights and interests of bankruptcy participants are not violated;

- works in accordance with the principles of impartiality and independence;

- ensures that the requirements of Federal Law No. 127 and other legal acts in this area are not violated.

The AU in an insolvency case is a central figure, so high demands are placed on it:

- presence of Russian citizenship;

- membership in SRO;

- no criminal record;

- availability of higher education and work experience as an assistant to an administrative assistant;

- completion of the AC training program and successful passing of the exam;

- availability of professional liability insurance.

Another requirement is that the arbitration manager has experience in a managerial position in the sector of the economy in which the debtor company operates. Only in this case will the specialist understand all the internal and external processes in the activities of the bankrupt company.